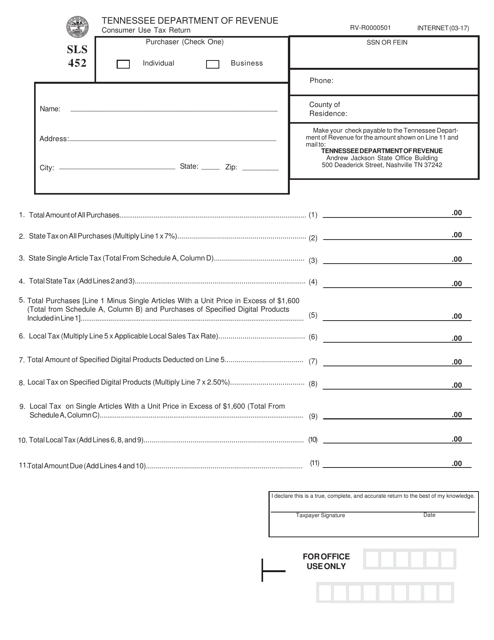

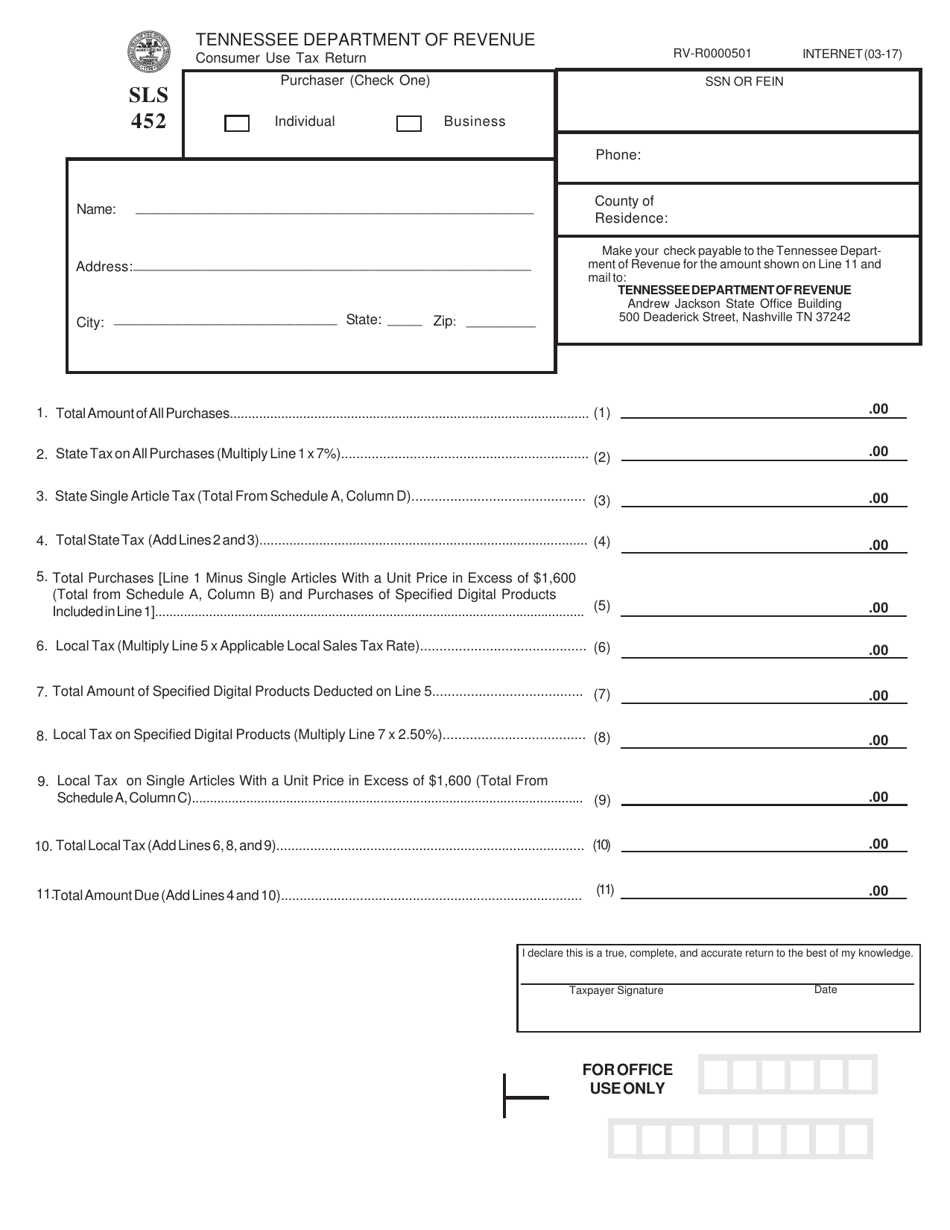

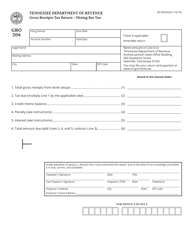

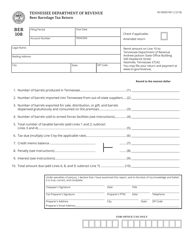

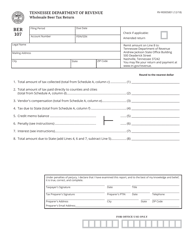

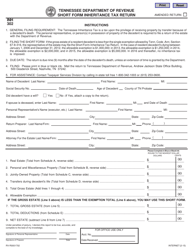

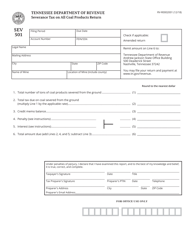

Form RV-R0000501 (SLS452) Consumer Use Tax Return - Tennessee

What Is Form RV-R0000501 (SLS452)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

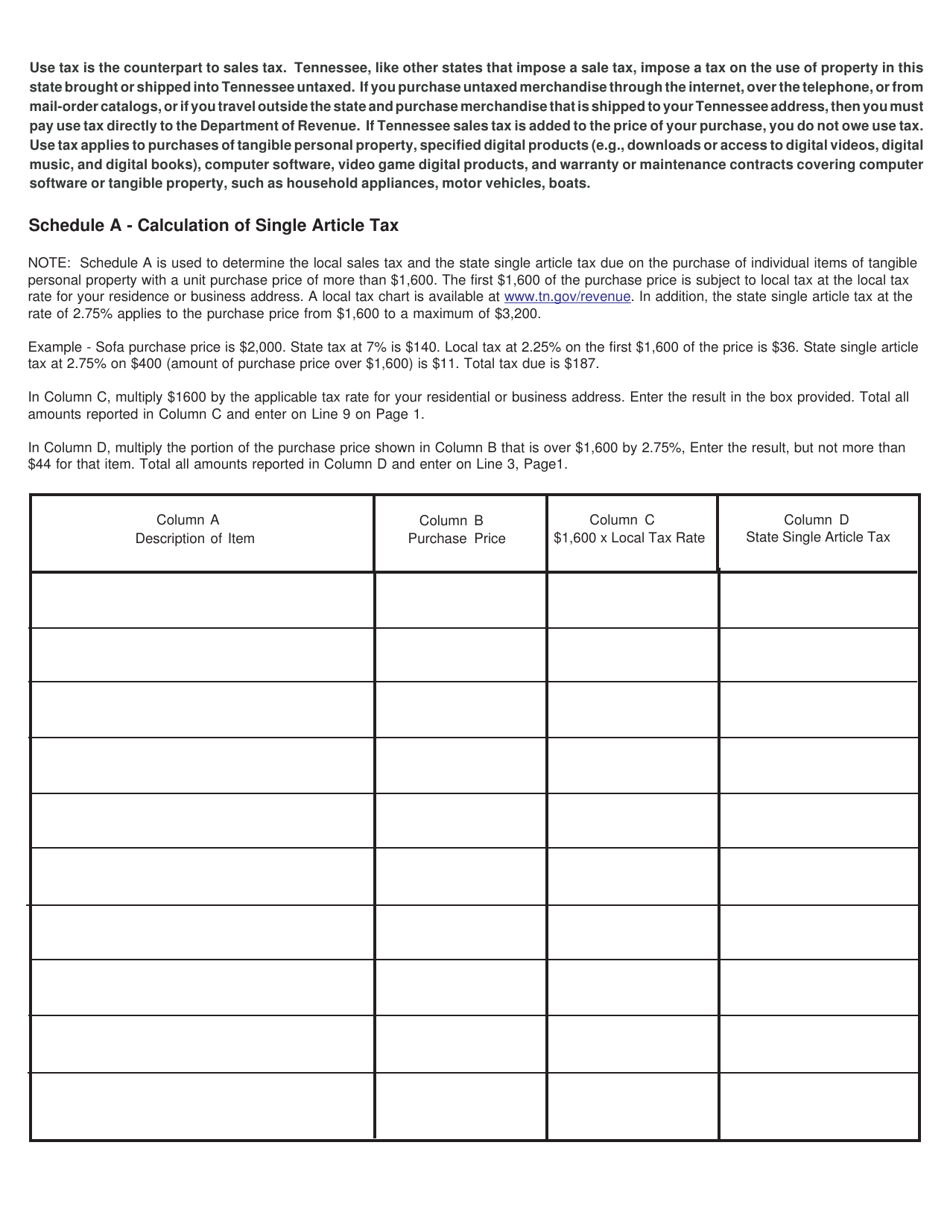

Q: What is Form RV-R0000501?

A: Form RV-R0000501 is the Consumer Use Tax Return for the state of Tennessee.

Q: What is the purpose of Form RV-R0000501?

A: The purpose of Form RV-R0000501 is to report and pay consumer use tax owed by individuals or businesses in Tennessee.

Q: Who needs to file Form RV-R0000501?

A: Any individual or business in Tennessee that has made purchases from out-of-state sellers who did not collect Tennessee sales tax must file Form RV-R0000501.

Q: When is Form RV-R0000501 due?

A: Form RV-R0000501 is due on the 20th day of the month following the end of the reporting period.

Q: How do I fill out Form RV-R0000501?

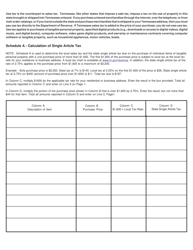

A: You will need to provide your name, address, and contact information, as well as details about your purchases and the amount of consumer use tax owed.

Q: What should I do if I am unable to pay the full amount of consumer use tax owed?

A: If you are unable to pay the full amount, you should still file Form RV-R0000501 and contact the Tennessee Department of Revenue to discuss payment options.

Q: Are there any penalties for late filing or non-payment?

A: Yes, there are penalties for late filing or non-payment of consumer use tax. It is important to file and pay on time to avoid these penalties.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-R0000501 (SLS452) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.