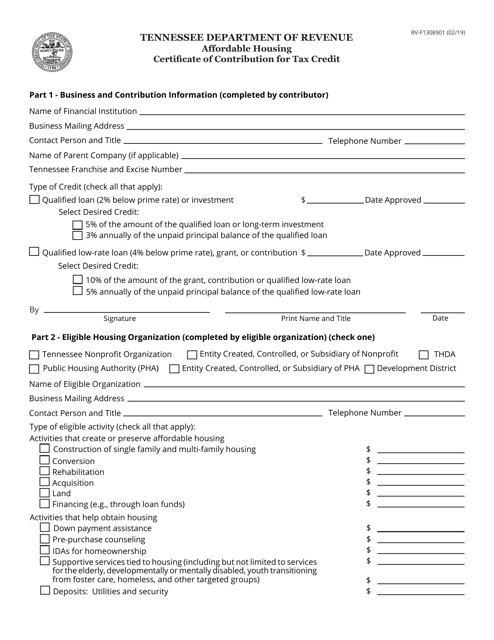

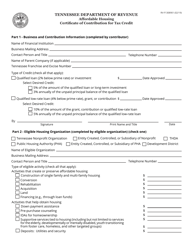

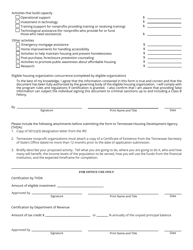

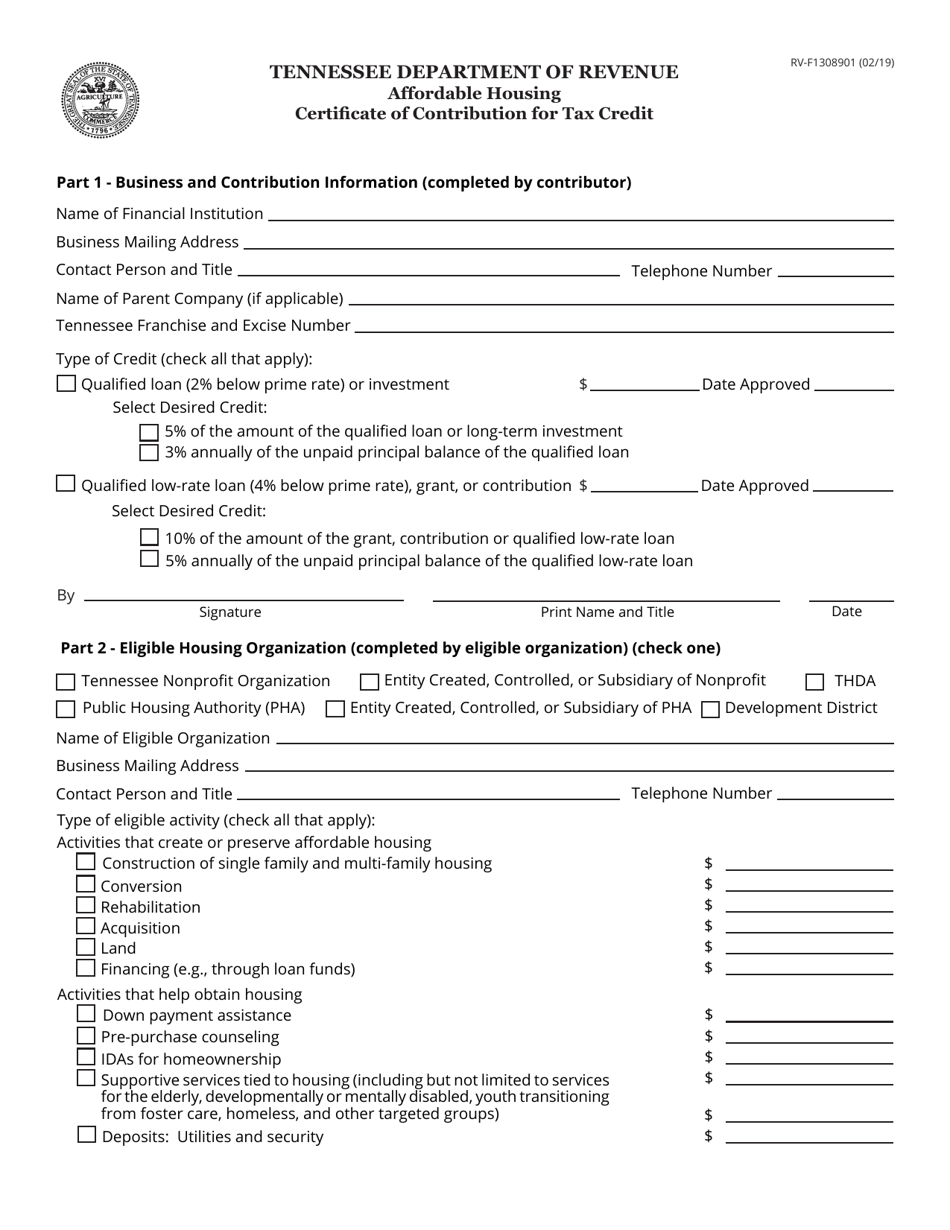

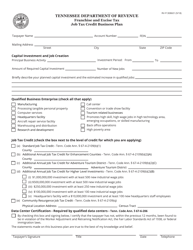

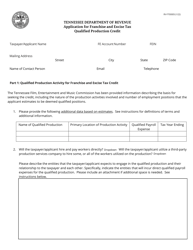

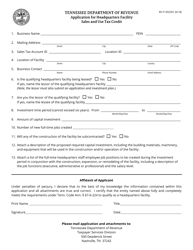

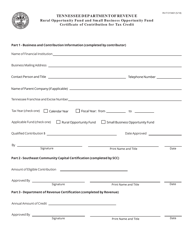

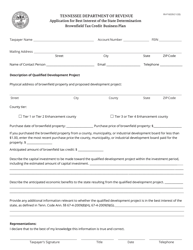

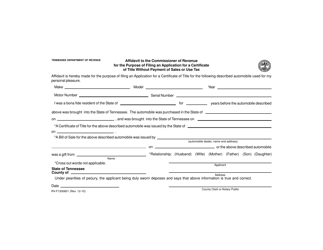

Form RV-F1308901 Affordable Housing Certificate of Contribution for Tax Credit - Tennessee

What Is Form RV-F1308901?

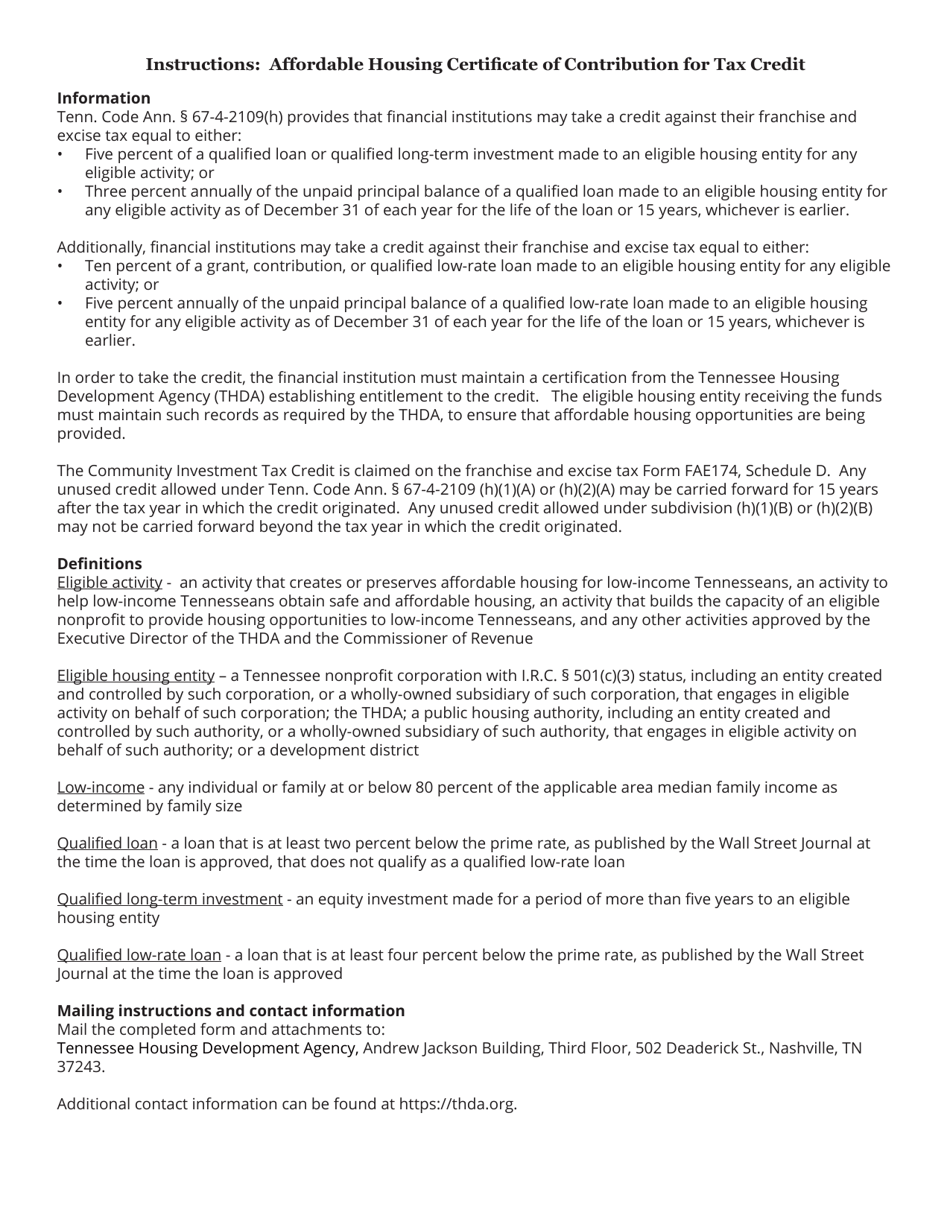

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RV-F1308901?

A: The Form RV-F1308901 is the Affordable Housing Certificate of Contribution for Tax Credit in Tennessee.

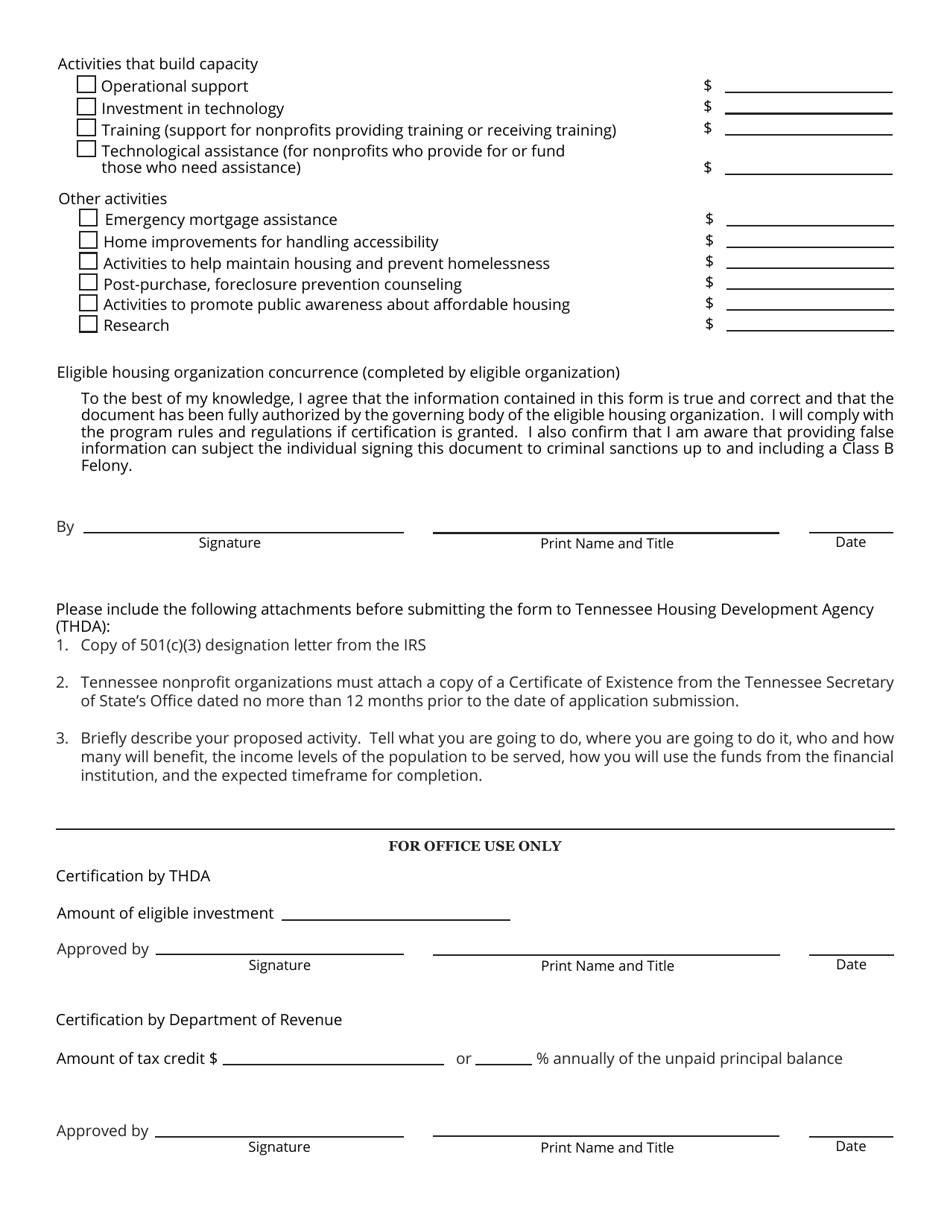

Q: What is the purpose of the Form RV-F1308901?

A: The purpose of the Form RV-F1308901 is to certify the contribution made towards affordable housing that qualifies for tax credits in Tennessee.

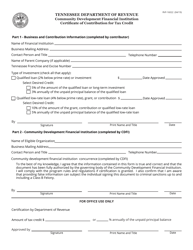

Q: Who needs to file the Form RV-F1308901?

A: The Form RV-F1308901 needs to be filed by individuals or entities who have made contributions towards affordable housing that qualify for tax credits in Tennessee.

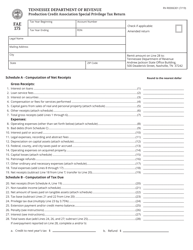

Q: What information is required on the Form RV-F1308901?

A: The Form RV-F1308901 requires information such as the taxpayer's name, address, tax identification number, and details of the contribution made.

Q: Are there any deadlines for filing the Form RV-F1308901?

A: Yes, the Form RV-F1308901 must be filed on or before the tax return due date, including extensions.

Q: What if I made multiple contributions towards affordable housing in Tennessee?

A: If you made multiple contributions, you must attach a separate Form RV-F1308901 for each contribution.

Q: Can I claim tax credits for contributions made in previous years?

A: No, the Form RV-F1308901 is used to claim tax credits for contributions made in the current tax year only.

Q: What should I do with the completed Form RV-F1308901?

A: You should retain a copy of the completed Form RV-F1308901 for your records and submit it along with your tax return to the Tennessee Department of Revenue.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F1308901 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.