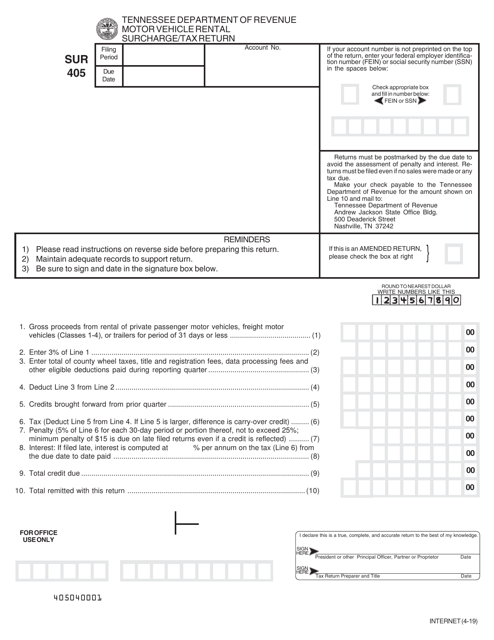

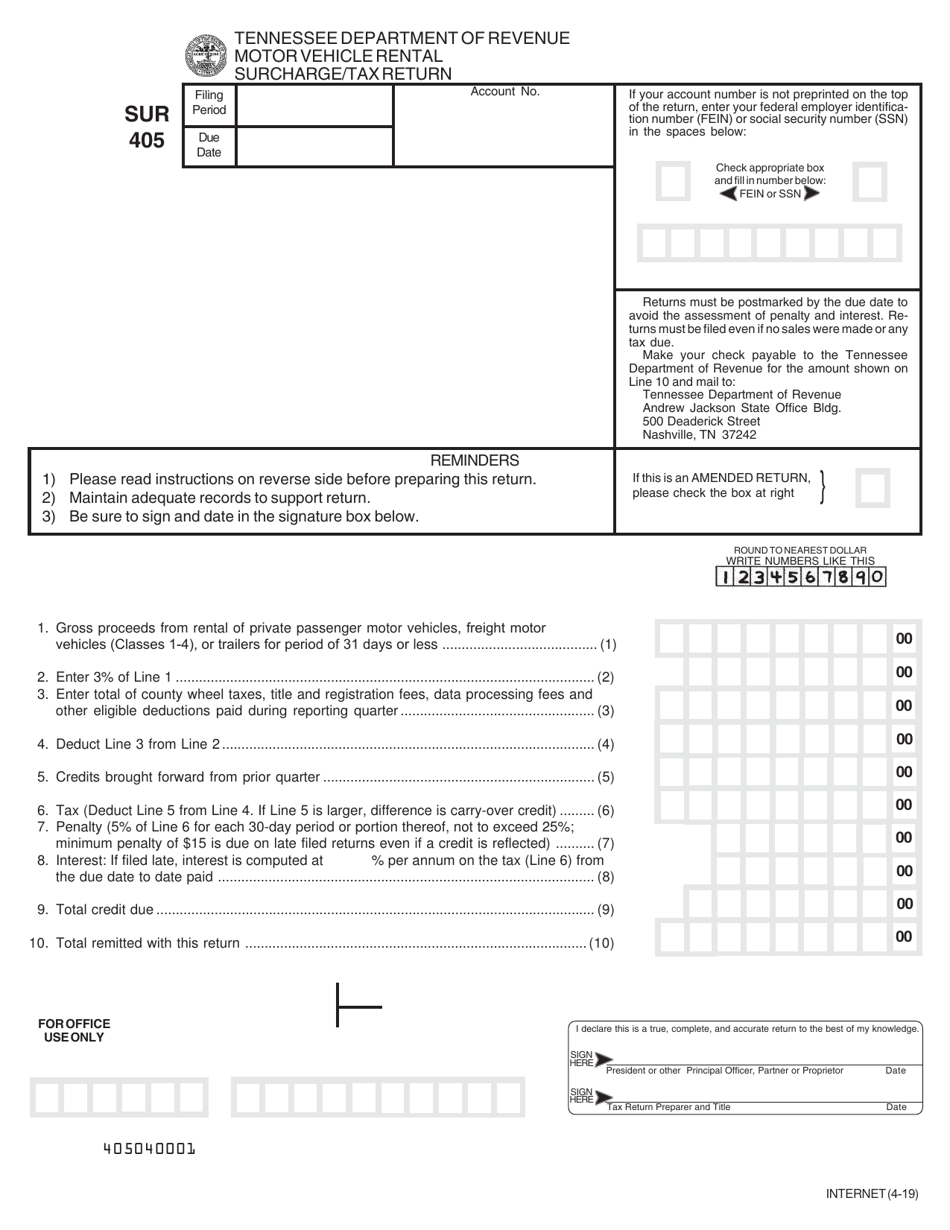

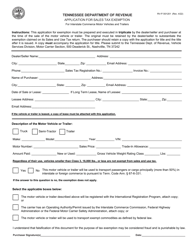

Form SUR-405 Motor Vehicle Rental Surcharge / Tax Return - Tennessee

What Is Form SUR-405?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SUR-405 Motor Vehicle Rental Surcharge/Tax Return?

A: SUR-405 Motor Vehicle Rental Surcharge/Tax Return is a form used in Tennessee to report and pay the motor vehicle rental surcharge or tax.

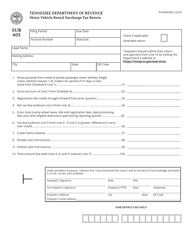

Q: Who needs to file SUR-405 Motor Vehicle Rental Surcharge/Tax Return?

A: Anyone engaged in the business of renting or leasing motor vehicles in Tennessee needs to file the SUR-405 form.

Q: How often do I need to file SUR-405 Motor Vehicle Rental Surcharge/Tax Return?

A: The SUR-405 form needs to be filed monthly, even if no tax is due.

Q: Is there a penalty for late filing of SUR-405 Motor Vehicle Rental Surcharge/Tax Return?

A: Yes, there may be penalties for late filing, depending on the circumstances. It is best to file the form on time to avoid penalties.

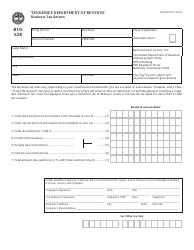

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SUR-405 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.