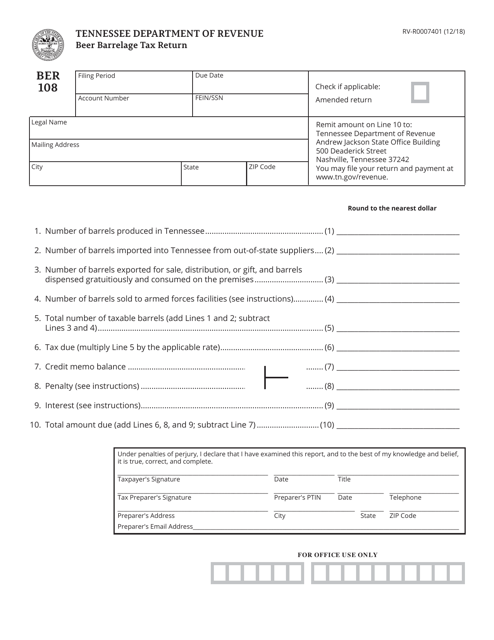

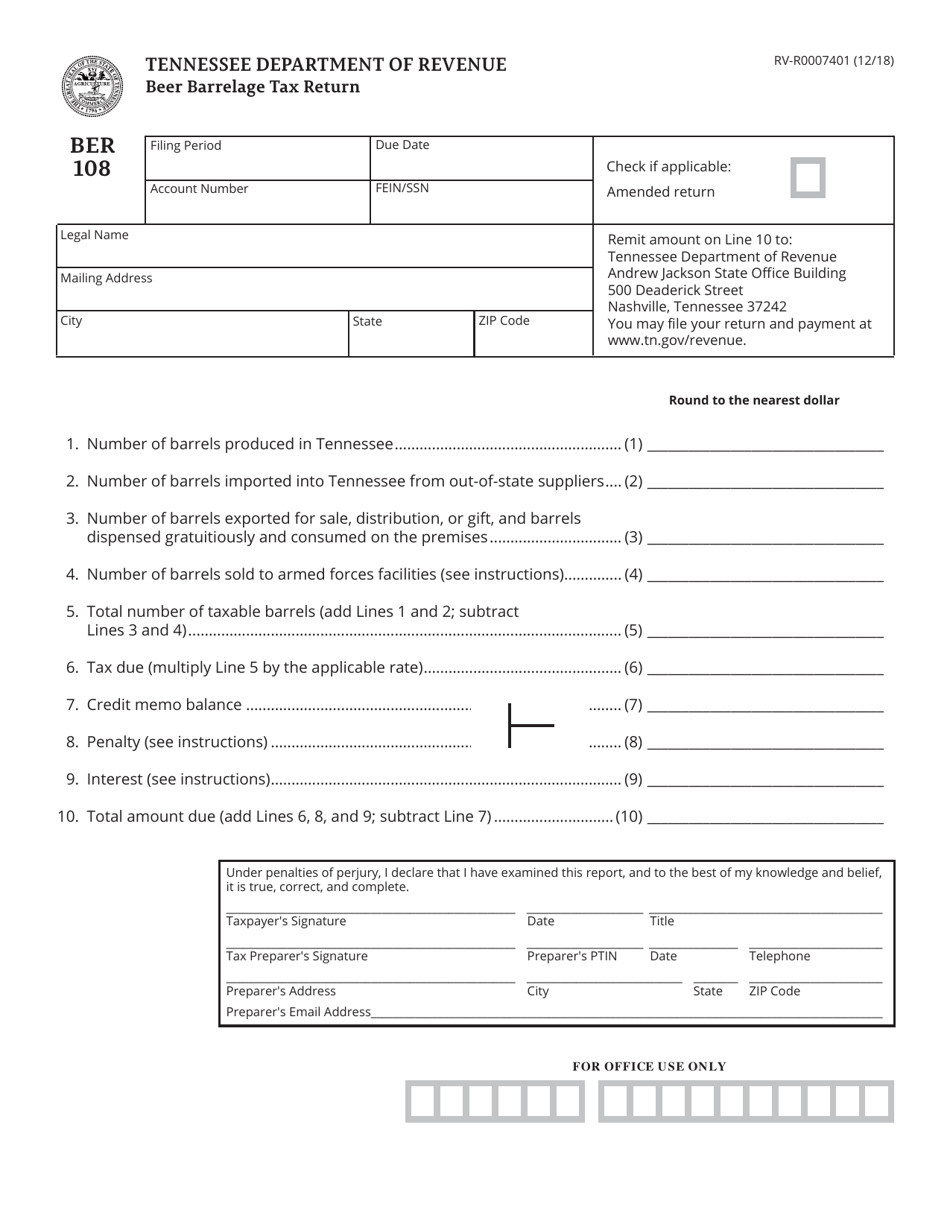

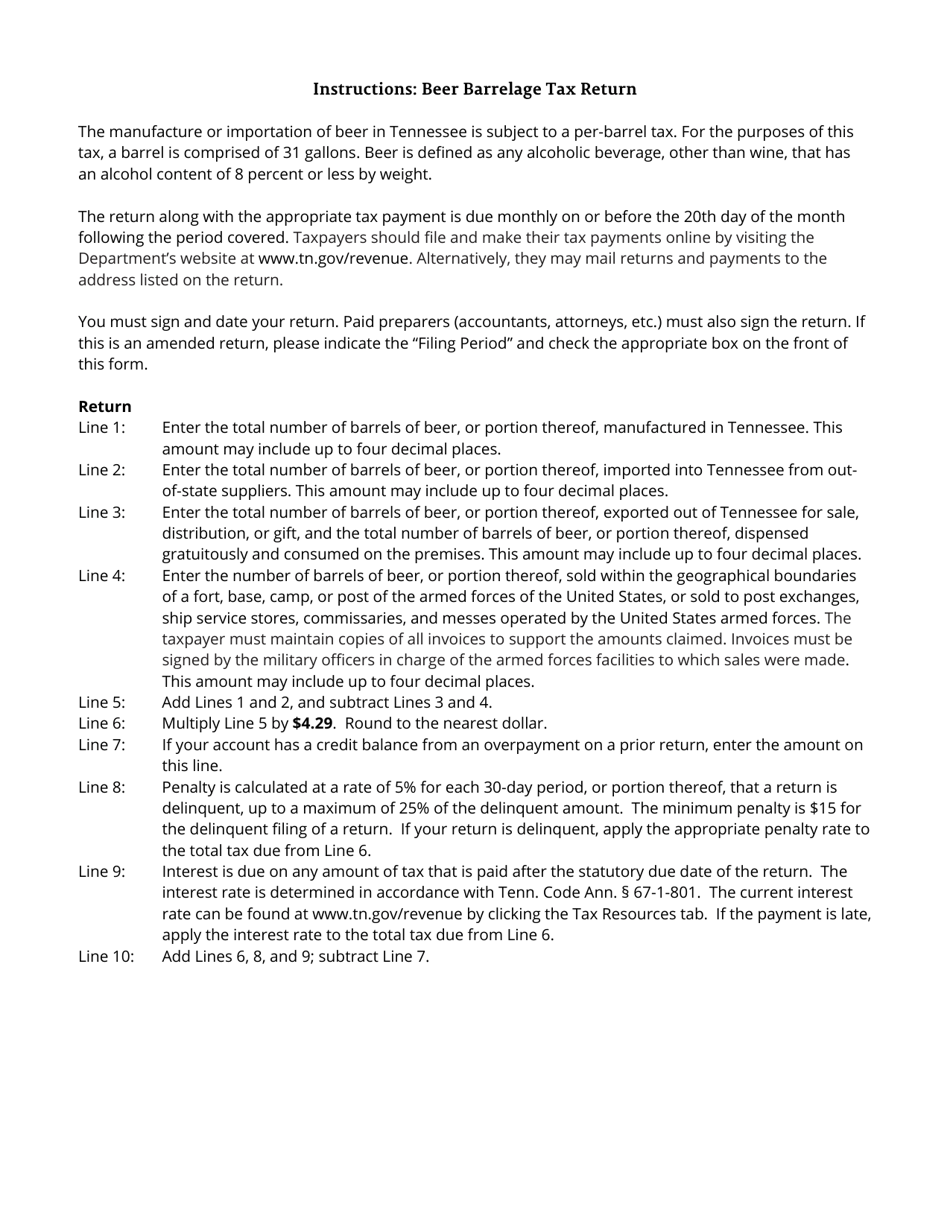

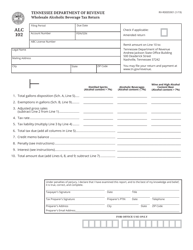

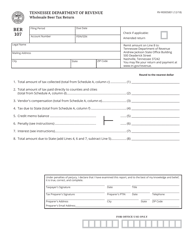

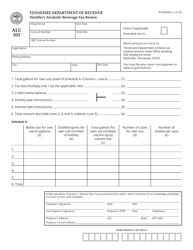

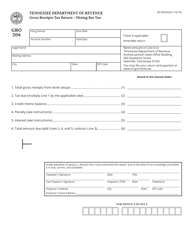

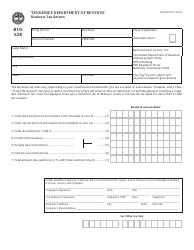

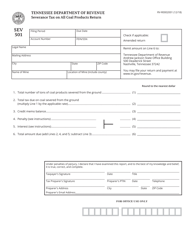

Form RV-R0007401 (BER108) Beer Barrelage Tax Return - Tennessee

What Is Form RV-R0007401 (BER108)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-R0007401 (BER108)?

A: Form RV-R0007401 (BER108) is the Beer Barrelage Tax Return for Tennessee.

Q: Who needs to file Form RV-R0007401 (BER108)?

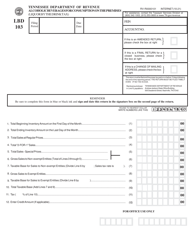

A: Anyone who is engaged in the wholesale distribution or sale of beer in Tennessee needs to file Form RV-R0007401 (BER108).

Q: How often do I need to file Form RV-R0007401 (BER108)?

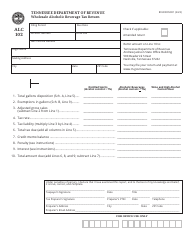

A: Form RV-R0007401 (BER108) must be filed monthly.

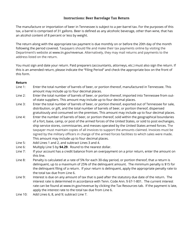

Q: What information do I need to provide on Form RV-R0007401 (BER108)?

A: You need to provide information about the barrels of beer you have received, sold, destroyed, or returned during the reporting period.

Q: What is the deadline for filing Form RV-R0007401 (BER108)?

A: Form RV-R0007401 (BER108) must be filed and paid by the 15th day of the following month.

Q: Are there any penalties for filing Form RV-R0007401 (BER108) late?

A: Yes, there are penalties for late filing and late payment of the beer barrelage tax.

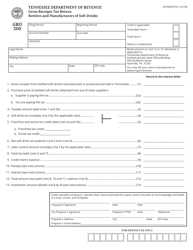

Q: Can I file Form RV-R0007401 (BER108) electronically?

A: Yes, you can file Form RV-R0007401 (BER108) electronically through the Tennessee Taxpayer Access Point (TNTAP).

Q: What should I do if I have questions or need assistance with Form RV-R0007401 (BER108)?

A: If you have questions or need assistance with Form RV-R0007401 (BER108), you can contact the Tennessee Department of Revenue directly.

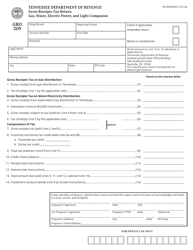

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-R0007401 (BER108) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.