This version of the form is not currently in use and is provided for reference only. Download this version of

Form IE (RV-F1406701)

for the current year.

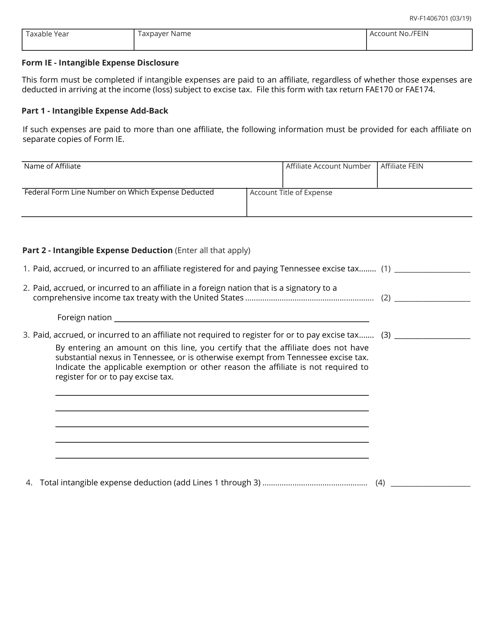

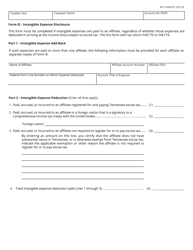

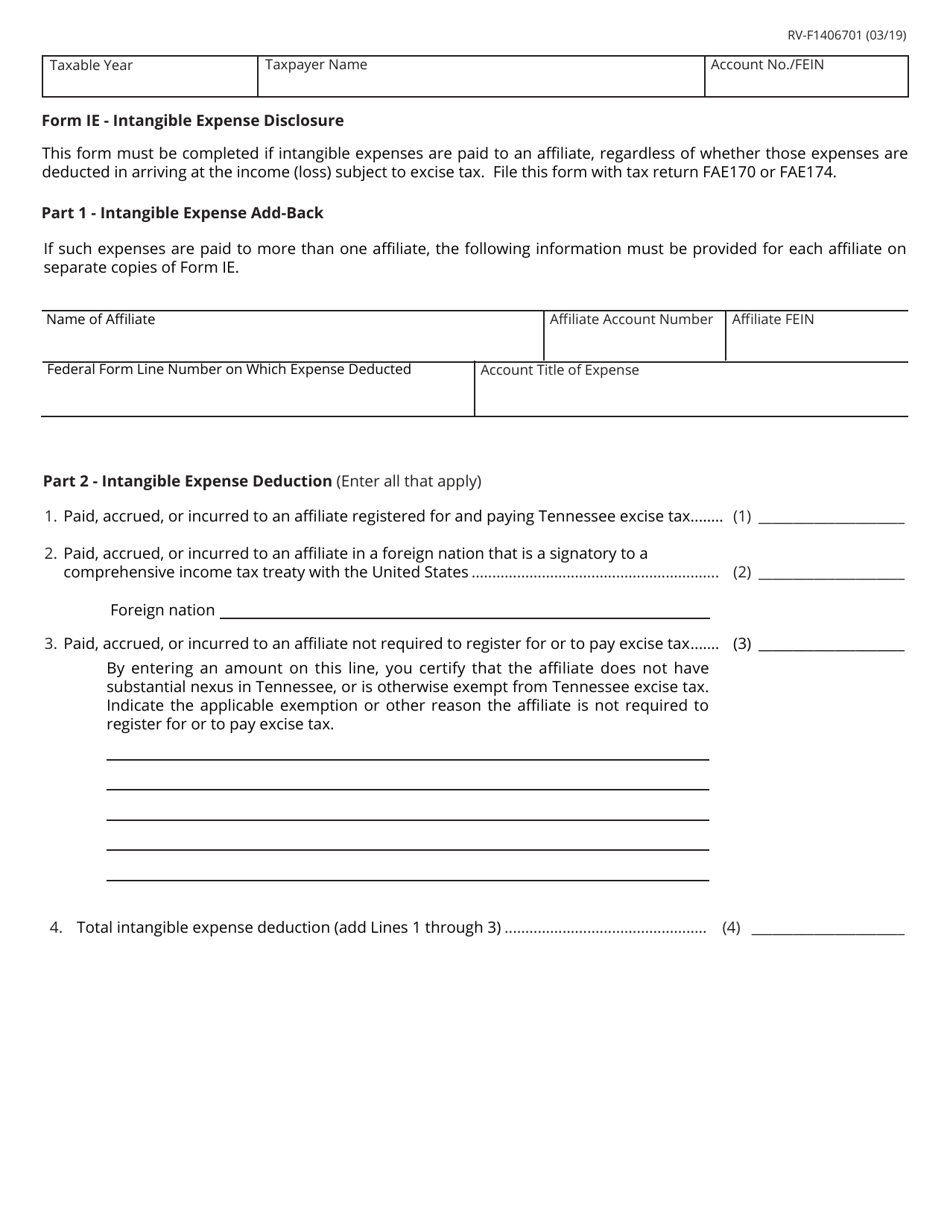

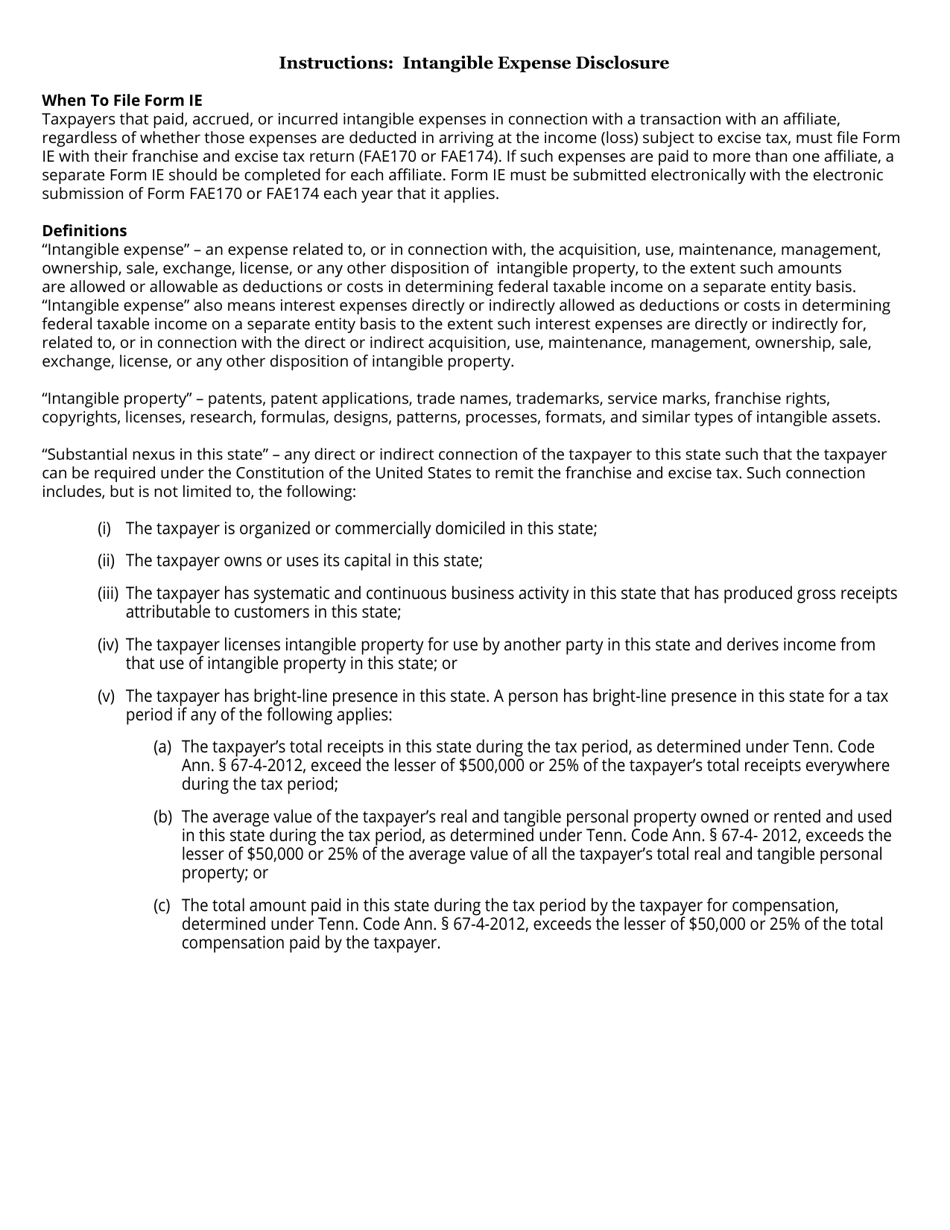

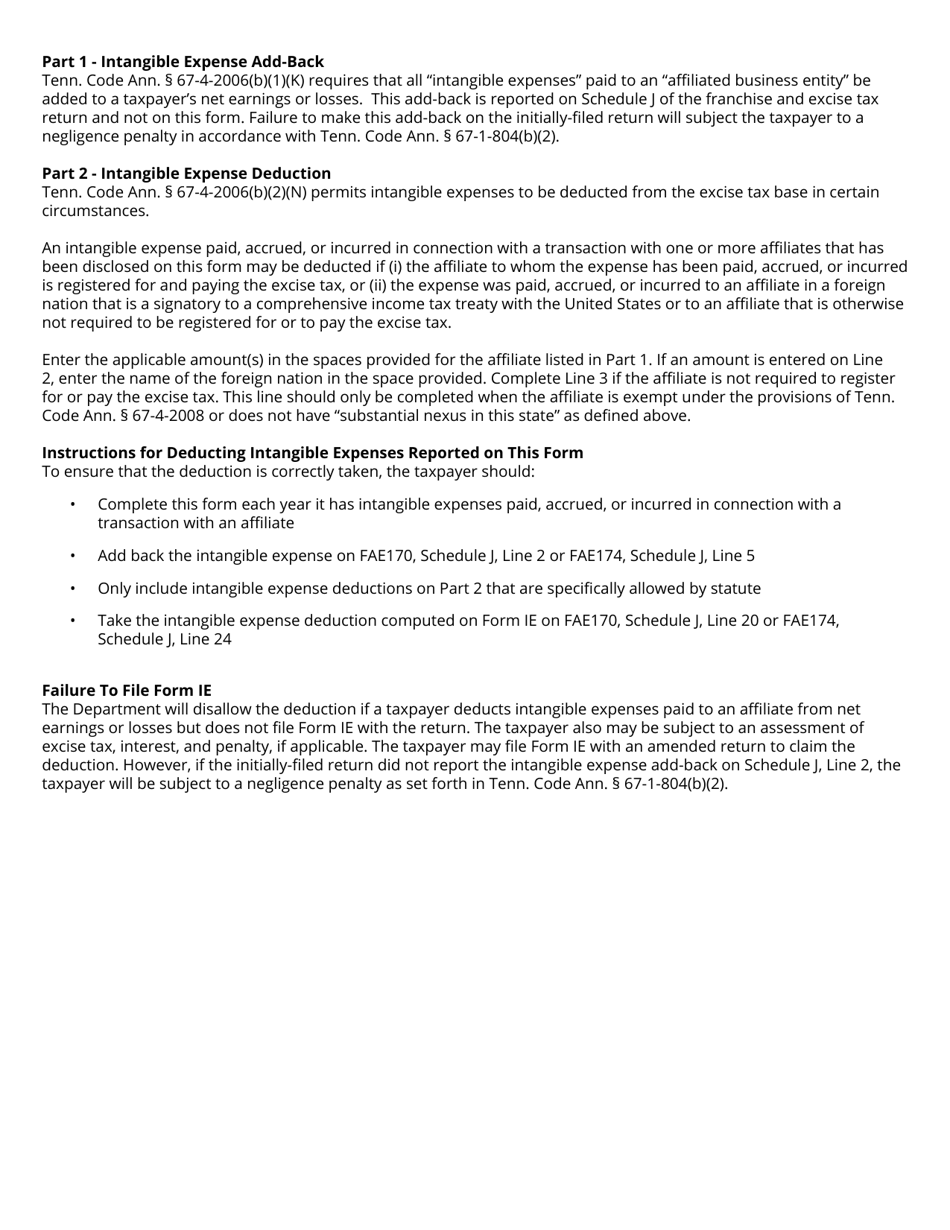

Form IE (RV-F1406701) Intangible Expense Disclosure - Tennessee

What Is Form IE (RV-F1406701)?

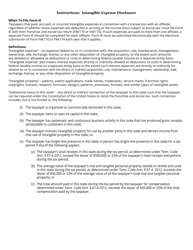

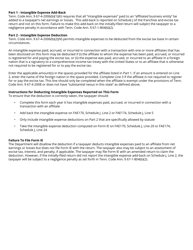

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form IE (RV-F1406701) Intangible Expense Disclosure - Tennessee?

A: The purpose of Form IE (RV-F1406701) Intangible Expense Disclosure - Tennessee is to disclose intangible expenses.

Q: Who needs to file Form IE (RV-F1406701) Intangible Expense Disclosure - Tennessee?

A: Any taxpayer who has intangible expenses in Tennessee needs to file Form IE (RV-F1406701).

Q: What are intangible expenses?

A: Intangible expenses are expenses related to intangible assets, such as patents, copyrights, trademarks, and franchises.

Q: What is the deadline for filing Form IE (RV-F1406701) Intangible Expense Disclosure - Tennessee?

A: The deadline for filing Form IE (RV-F1406701) Intangible Expense Disclosure - Tennessee is usually on or before the 15th day of the fourth month following the close of the taxpayer's taxable year.

Q: Can Form IE (RV-F1406701) be filed electronically?

A: Yes, Form IE (RV-F1406701) can be filed electronically if the taxpayer chooses to do so.

Q: Are there any penalties for not filing Form IE (RV-F1406701) Intangible Expense Disclosure - Tennessee?

A: Yes, there are penalties for not filing Form IE (RV-F1406701) Intangible Expense Disclosure - Tennessee. The penalty amount varies depending on the circumstances.

Q: Are there any other requirements or forms related to intangible expenses in Tennessee?

A: Yes, there may be other requirements or forms related to intangible expenses in Tennessee. Taxpayers should consult the Tennessee Department of Revenue or a tax professional for more information.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IE (RV-F1406701) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.