This version of the form is not currently in use and is provided for reference only. Download this version of

Form RV-F1320201

for the current year.

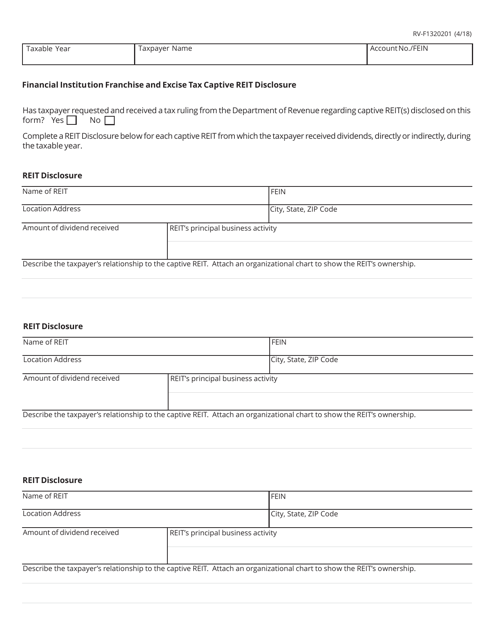

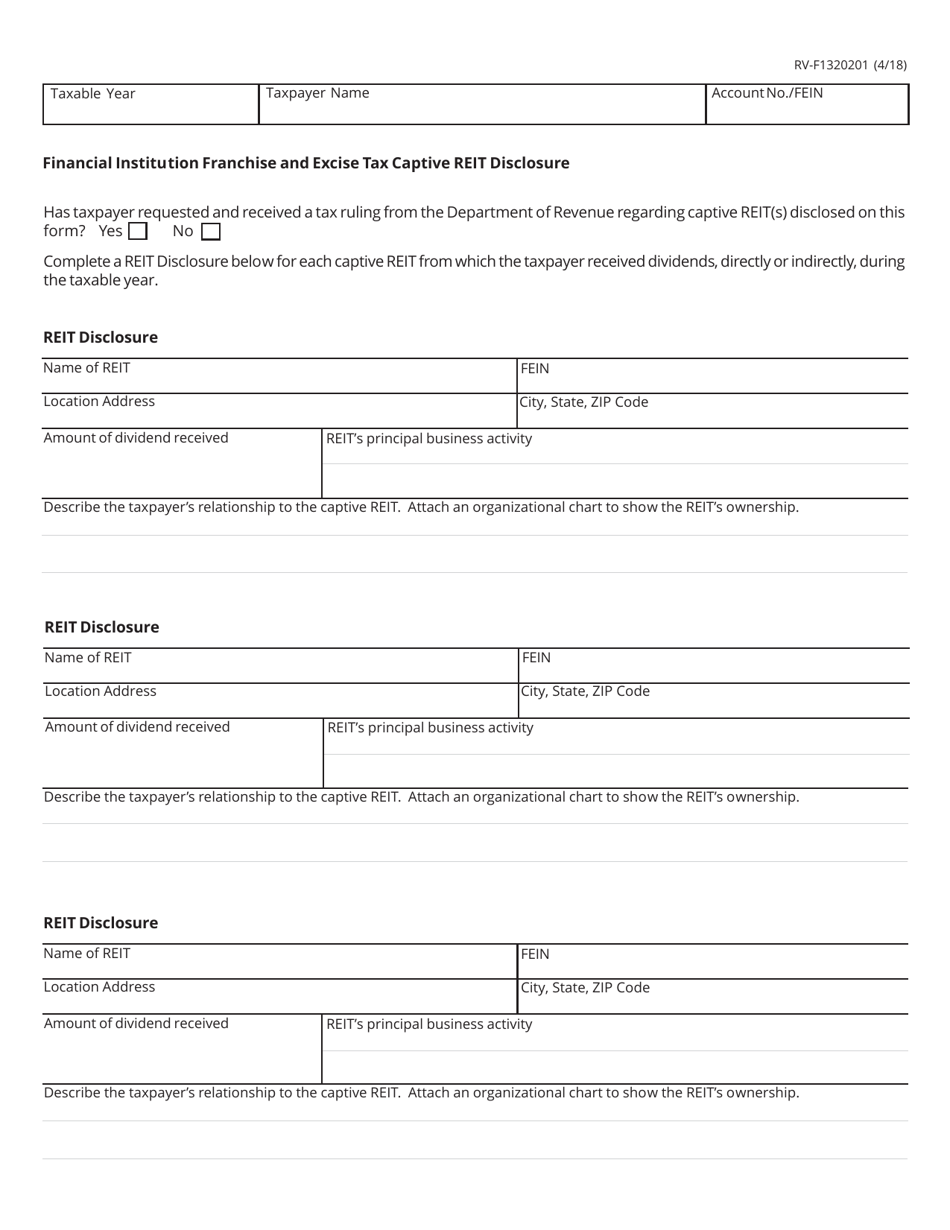

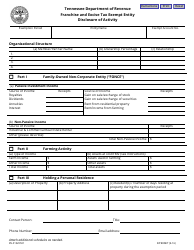

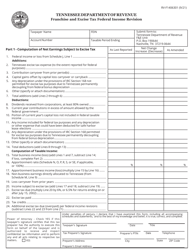

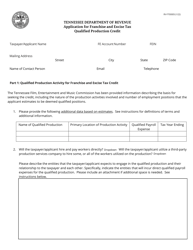

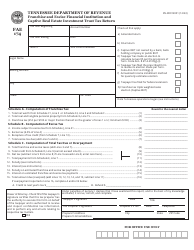

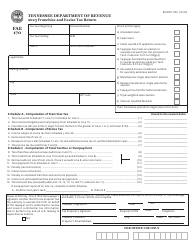

Form RV-F1320201 Financial Institution Franchise and Excise Tax Captive Reit Disclosure - Tennessee

What Is Form RV-F1320201?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RV-F1320201?

A: The RV-F1320201 is a form used for Financial Institution Franchise and Excise Tax Captive REIT Disclosure in Tennessee.

Q: Who needs to file the RV-F1320201 form?

A: Financial institutions that are subject to franchise and excise tax and have captive real estate investment trusts (REITs) need to file this form in Tennessee.

Q: What is the purpose of the RV-F1320201 form?

A: The purpose of this form is to disclose information about captive REITs owned by financial institutions for franchise and excise tax purposes in Tennessee.

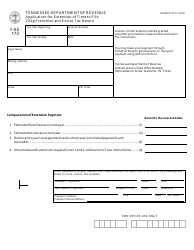

Q: When is the deadline to file the RV-F1320201 form?

A: The deadline to file the RV-F1320201 form is generally the same as the federal incometax due date, which is April 15th.

Q: Are there any penalties for not filing the RV-F1320201 form?

A: Yes, there may be penalties for failing to file the RV-F1320201 form or for filing it incorrectly. It is important to comply with the filing requirements to avoid penalties.

Q: Is the RV-F1320201 form required every year?

A: The RV-F1320201 form is required to be filed annually by financial institutions with captive REITs that are subject to franchise and excise tax in Tennessee.

Q: What information is required on the RV-F1320201 form?

A: The RV-F1320201 form requires information such as the names and identifying numbers of the captive REITs, details about their ownership and activities, and financial information.

Q: Can the RV-F1320201 form be filed electronically?

A: Yes, the RV-F1320201 form can be filed electronically using the Tennessee Taxpayer Access Point (TNTAP) system.

Q: Are there any additional forms or attachments required with the RV-F1320201?

A: Yes, certain additional forms and attachments may be required depending on the specific circumstances of the financial institution and the captive REITs. It is recommended to review the instructions provided with the form for complete guidance.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F1320201 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.