This version of the form is not currently in use and is provided for reference only. Download this version of

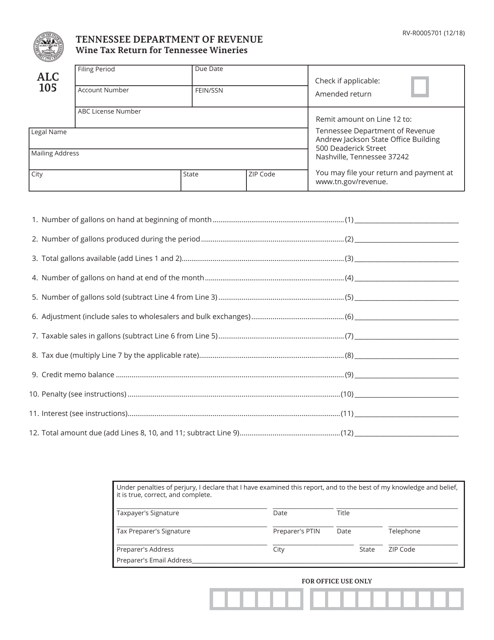

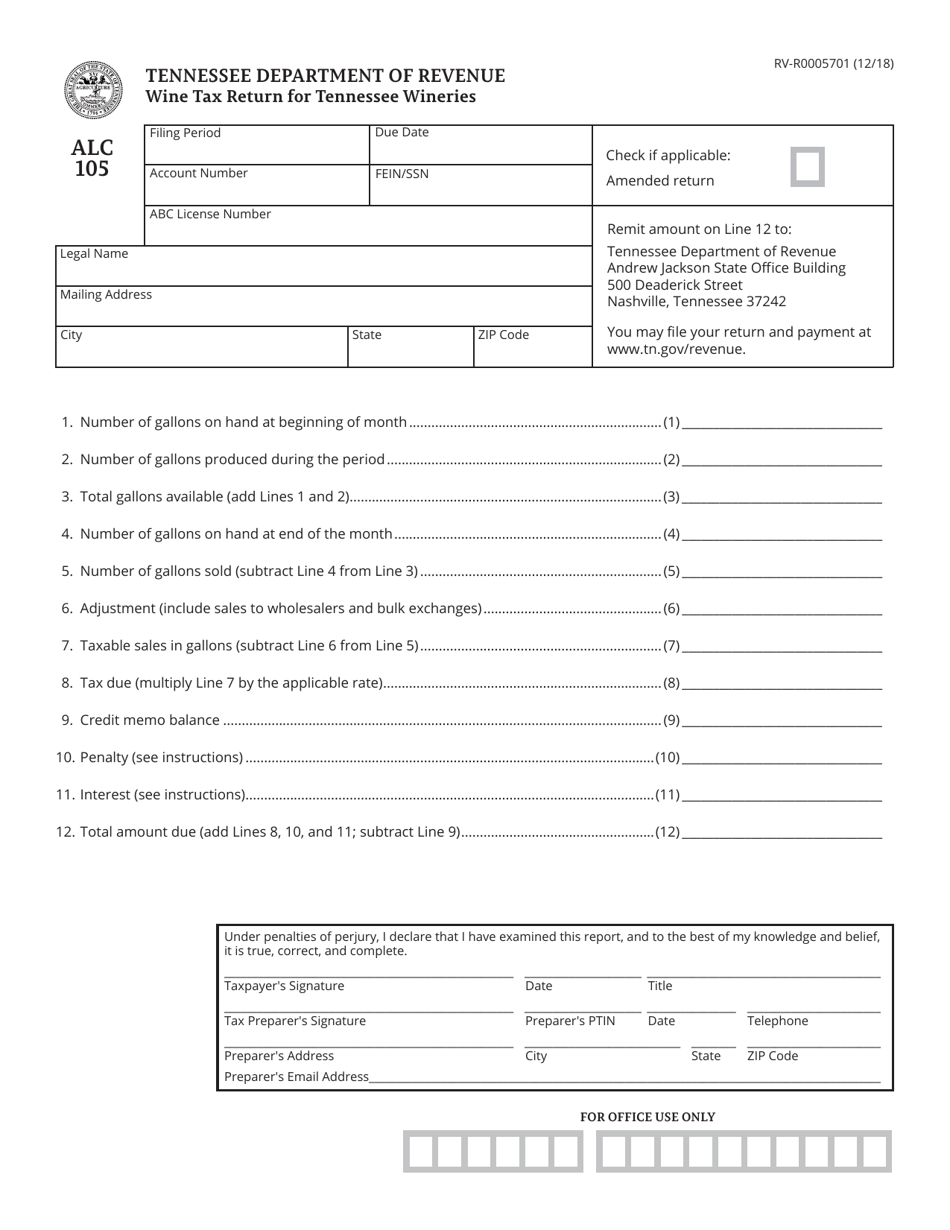

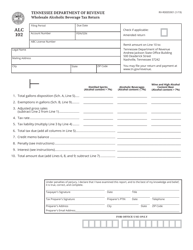

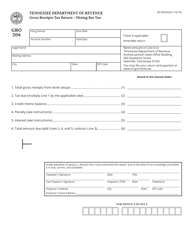

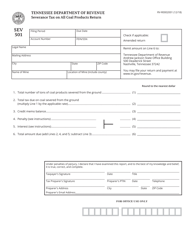

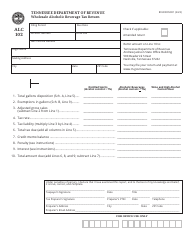

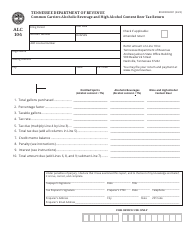

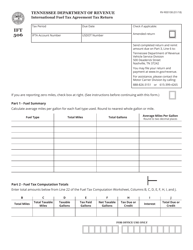

Form RV-R0005701 (ALC105)

for the current year.

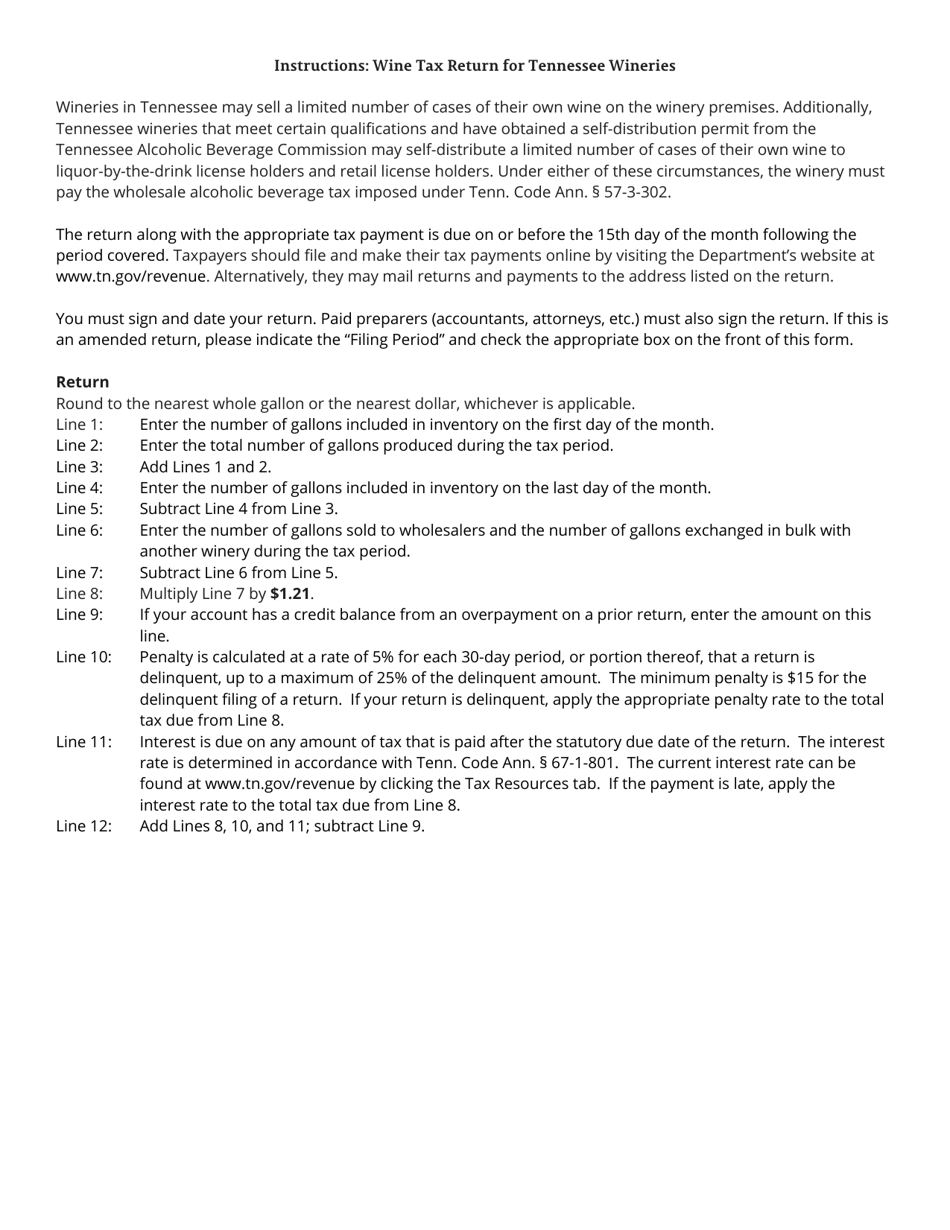

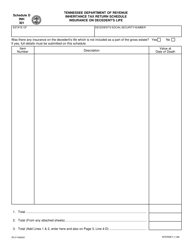

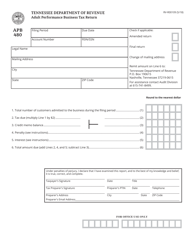

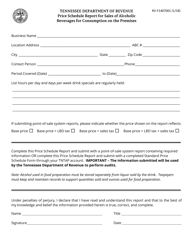

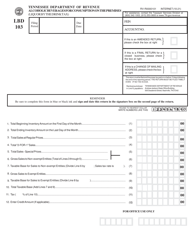

Form RV-R0005701 (ALC105) Wine Tax Return for Tennessee Wineries - Tennessee

What Is Form RV-R0005701 (ALC105)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

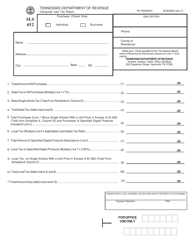

Q: What is Form RV-R0005701?

A: Form RV-R0005701 is the Wine Tax Return for Tennessee Wineries.

Q: Who needs to file Form RV-R0005701?

A: Tennessee wineries need to file Form RV-R0005701.

Q: What is the purpose of Form RV-R0005701?

A: The purpose of Form RV-R0005701 is to report and pay wine tax for Tennessee wineries.

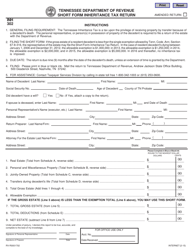

Q: When is Form RV-R0005701 due?

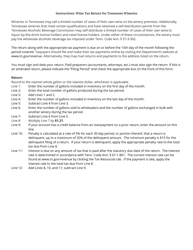

A: Form RV-R0005701 is due on the 20th day of the month following the reporting period.

Q: What information is required on Form RV-R0005701?

A: Form RV-R0005701 requires information such as the winery's name, address, sales information, and tax calculation.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-R0005701 (ALC105) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.