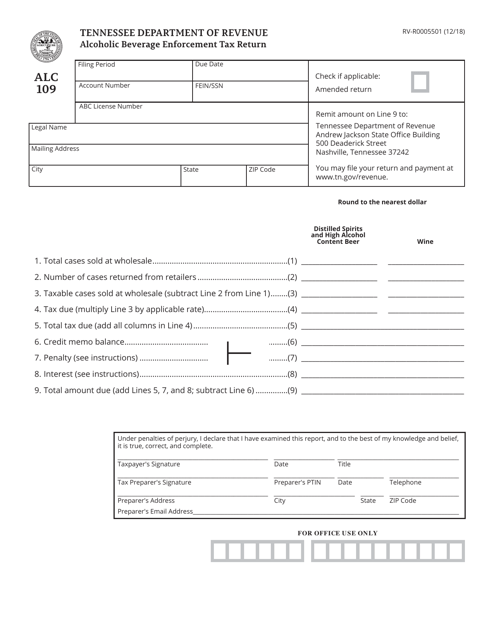

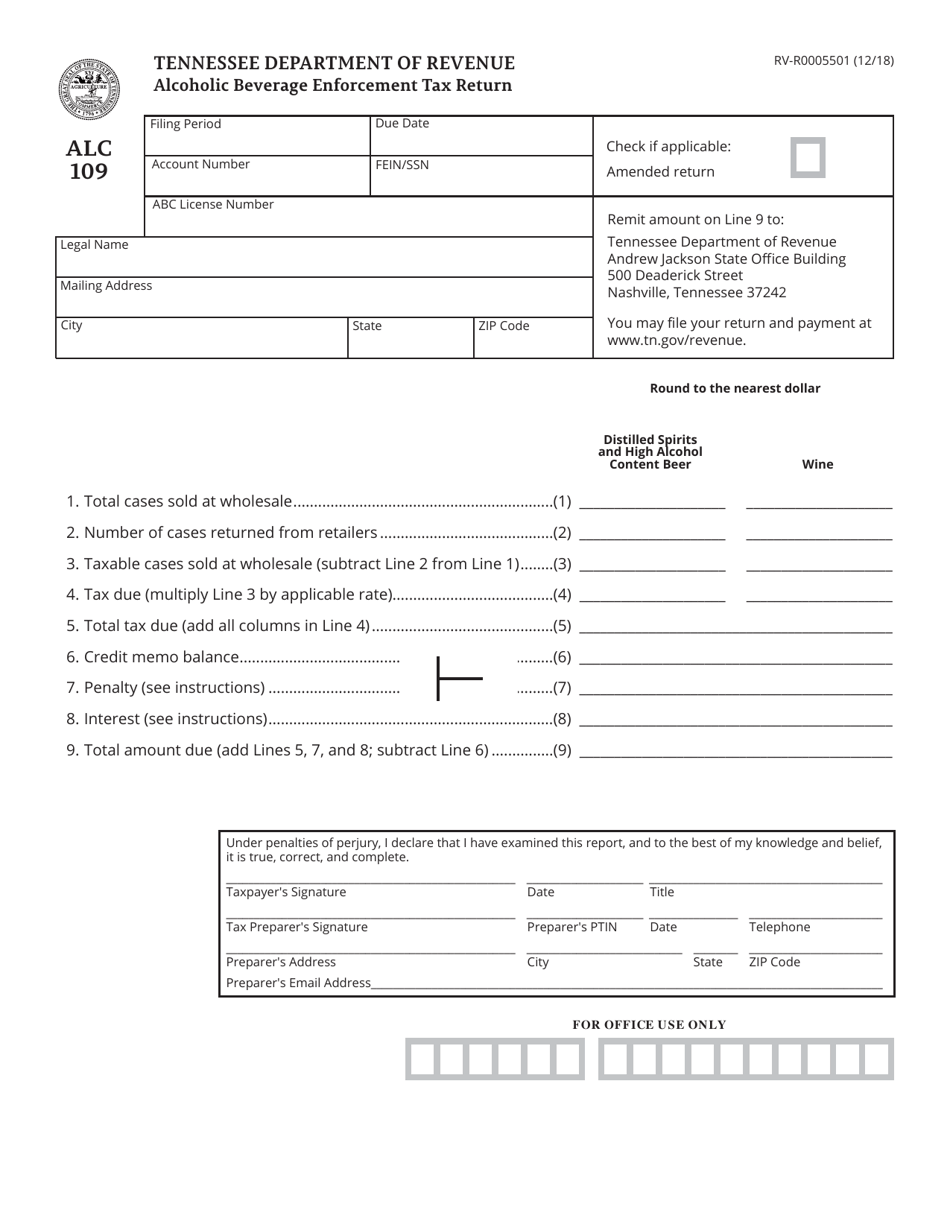

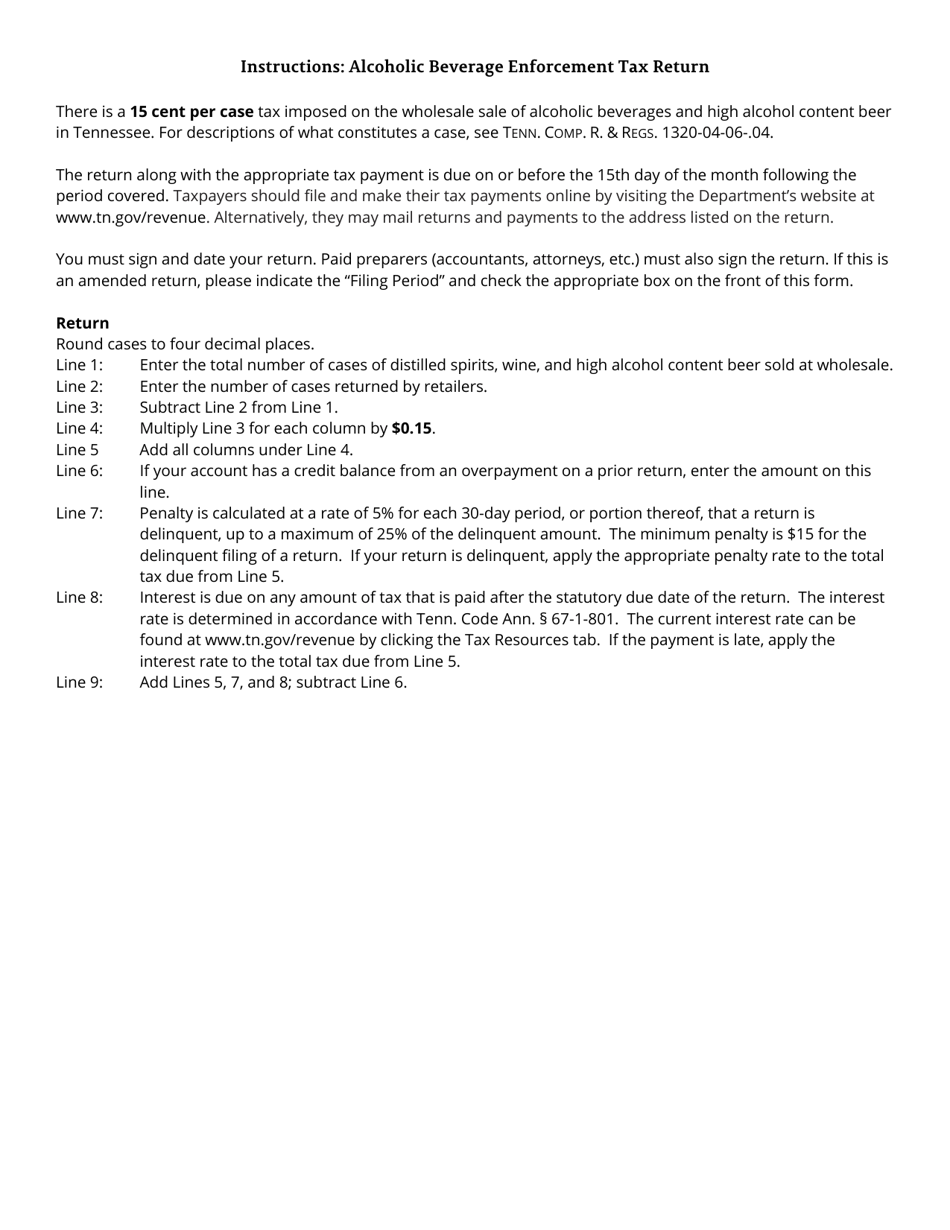

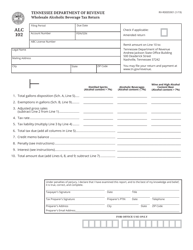

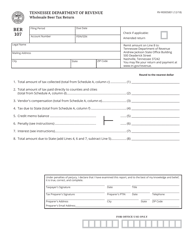

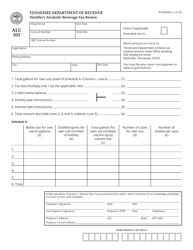

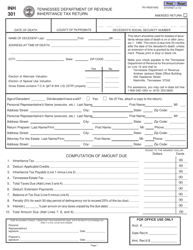

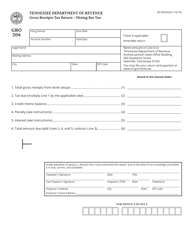

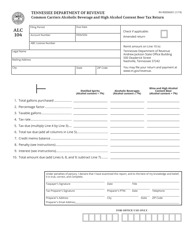

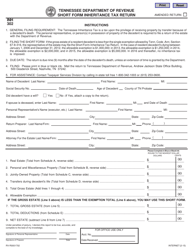

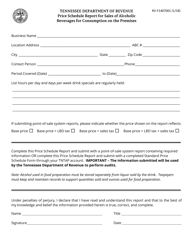

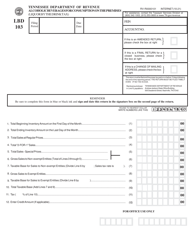

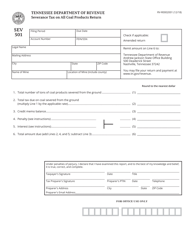

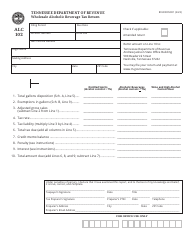

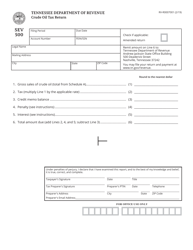

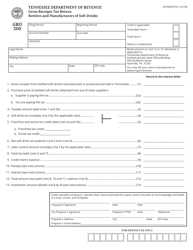

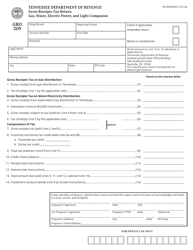

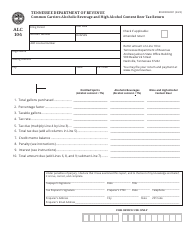

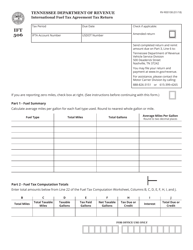

Form RV-R0005501 (ALC109) Alcoholic Beverage Enforcement Tax Return - Tennessee

What Is Form RV-R0005501 (ALC109)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form RV-R0005501 (ALC109)?

A: Form RV-R0005501 (ALC109) is the Alcoholic Beverage Enforcement Tax Return for the state of Tennessee.

Q: What is the purpose of form RV-R0005501 (ALC109)?

A: Form RV-R0005501 (ALC109) is used to report and remit the Alcoholic Beverage Enforcement Tax in Tennessee.

Q: Who needs to file form RV-R0005501 (ALC109)?

A: Businesses engaged in the sale of alcoholic beverages in Tennessee need to file form RV-R0005501 (ALC109).

Q: How often is form RV-R0005501 (ALC109) filed?

A: Form RV-R0005501 (ALC109) is filed quarterly.

Q: What information is required on form RV-R0005501 (ALC109)?

A: Form RV-R0005501 (ALC109) requires information about sales, purchases, and other relevant financial details related to alcoholic beverages.

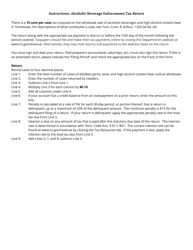

Q: Is there a deadline for filing form RV-R0005501 (ALC109)?

A: Yes, form RV-R0005501 (ALC109) must be filed by the last day of the month following the end of the quarter.

Q: Are there any penalties for late filing of form RV-R0005501 (ALC109)?

A: Yes, there may be penalties for late filing or underpayment of the Alcoholic Beverage Enforcement Tax in Tennessee. It is important to file the form on time.

Q: Is there any additional documentation required to be submitted with form RV-R0005501 (ALC109)?

A: No, there is no additional documentation required to be submitted with form RV-R0005501 (ALC109). However, it is important to keep records of sales and purchases for tax purposes.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-R0005501 (ALC109) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.