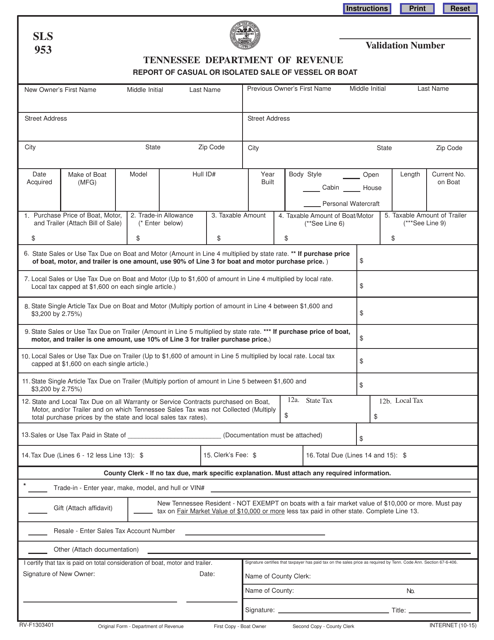

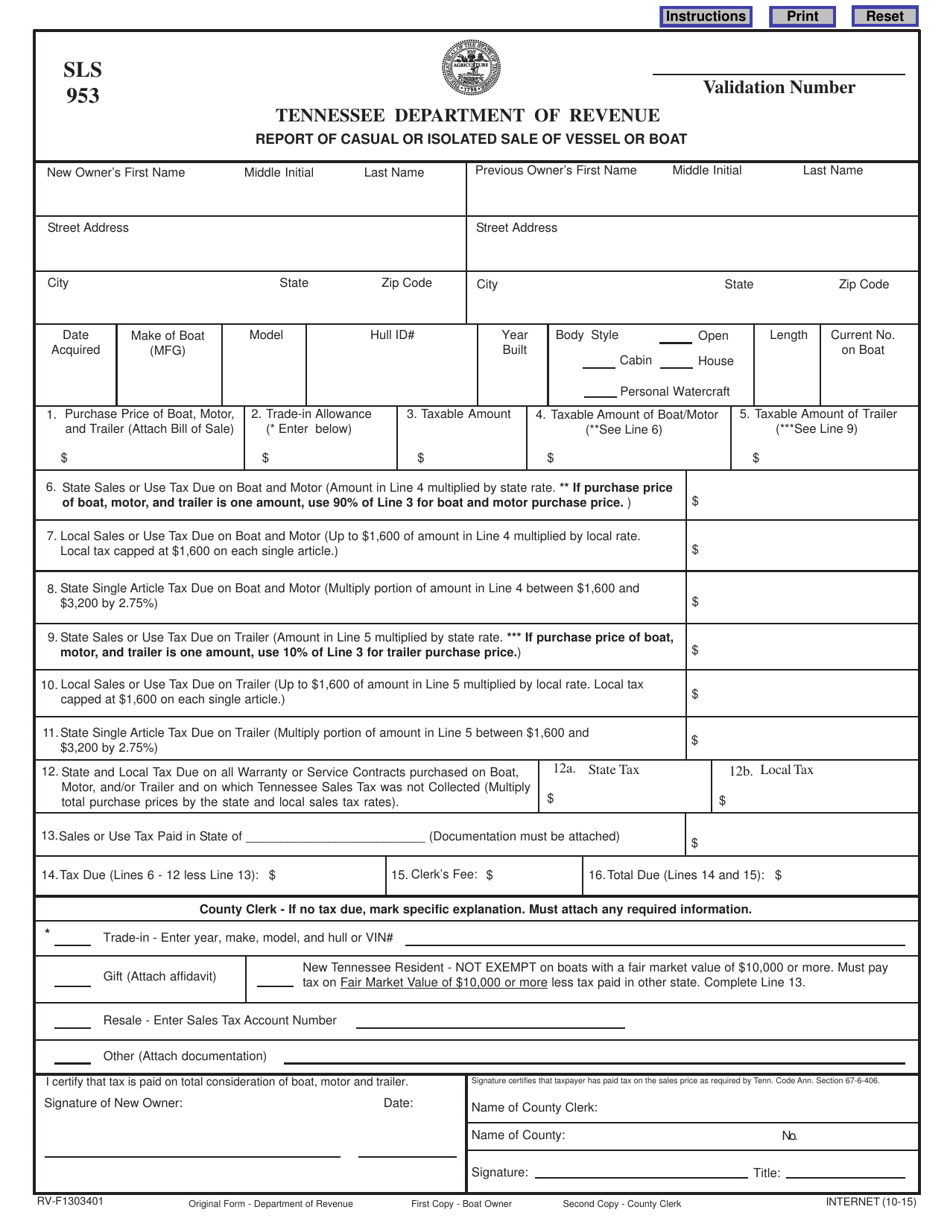

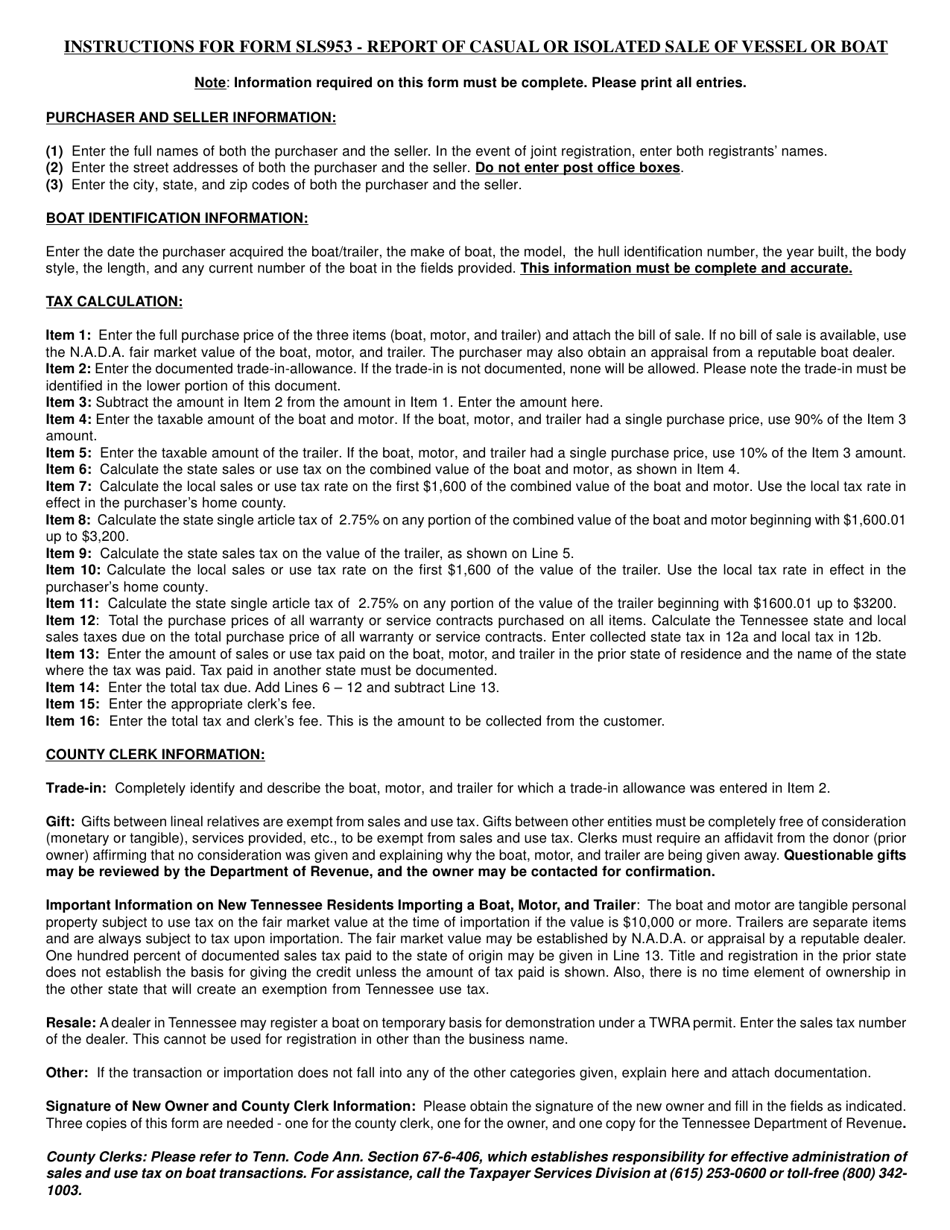

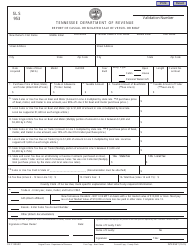

Form RV-F1303401 (SLS953) Report of Casual or Isolated Sale of Vessel or Boat - Tennessee

What Is Form RV-F1303401 (SLS953)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-F1303401?

A: Form RV-F1303401 is the Report of Casual or Isolated Sale of Vessel or Boat in Tennessee.

Q: Who needs to fill out this form?

A: This form needs to be filled out by individuals or businesses who have made a casual or isolated sale of a vessel or boat in Tennessee.

Q: What is considered a casual or isolated sale?

A: A casual or isolated sale refers to the one-time sale of a vessel or boat that is not part of a regular business operation.

Q: Is there a deadline to submit this form?

A: Yes, this form must be submitted within 15 days of the sale or transfer of the vessel or boat.

Q: Are there any fees associated with submitting this form?

A: No, there are no fees associated with submitting Form RV-F1303401.

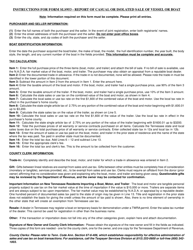

Q: What information is required on this form?

A: The form requires information about the seller, buyer, vessel or boat, and the sale details.

Q: What is the purpose of this form?

A: The purpose of this form is to report and document the sale of a vessel or boat for tax and record-keeping purposes.

Q: Can I submit this form by mail?

A: Yes, this form can be submitted by mail to the Tennessee Department of Revenue.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RV-F1303401 (SLS953) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.