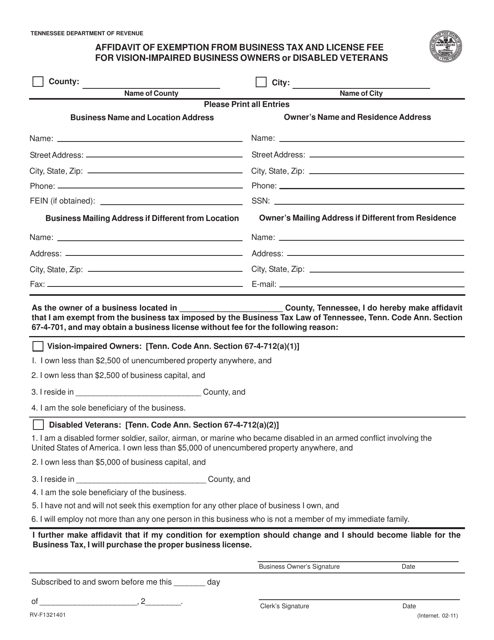

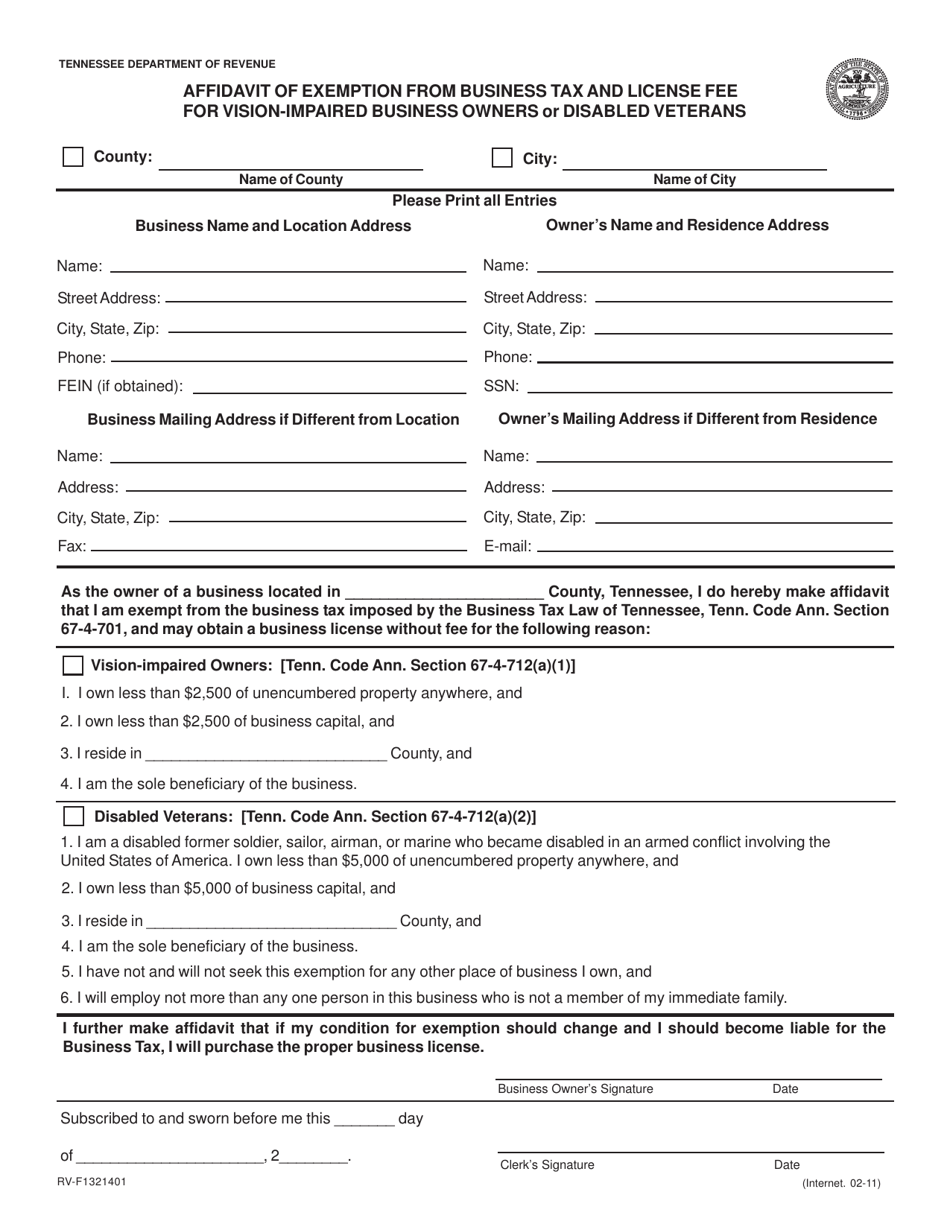

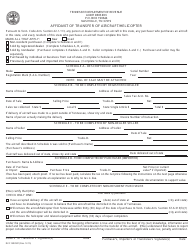

Form RV-F1321401 Affidavit of Exemption From Business Tax and License Fee for Vision-Impaired Business Owners or Disabled Veterans - Tennessee

What Is Form RV-F1321401?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-F1321401?

A: Form RV-F1321401 is an Affidavit of Exemption from Business Tax and License Fee for Vision-Impaired Business Owners or Disabled Veterans in Tennessee.

Q: Who is eligible to use this form?

A: Vision-impaired business owners or disabled veterans in Tennessee are eligible to use this form.

Q: What is the purpose of Form RV-F1321401?

A: The purpose of Form RV-F1321401 is to apply for exemption from business tax and license fees for vision-impaired business owners or disabled veterans in Tennessee.

Q: What information is required on Form RV-F1321401?

A: Form RV-F1321401 requires information such as the business owner's or veteran's name, address, contact information, disability status, and business details.

Q: Are there any supporting documents required with Form RV-F1321401?

A: Yes, supporting documents such as proof of vision impairment or disability may be required when submitting Form RV-F1321401.

Q: What is the deadline for submitting Form RV-F1321401?

A: The deadline for submitting Form RV-F1321401 may vary. It is best to check with the Tennessee Department of Revenue or your local tax office for the specific deadline.

Q: Is there a fee for submitting Form RV-F1321401?

A: No, there is no fee for submitting Form RV-F1321401.

Q: What happens after I submit Form RV-F1321401?

A: After submitting Form RV-F1321401, the Tennessee Department of Revenue will review your application and determine if you are eligible for exemption from business tax and license fees.

Form Details:

- Released on February 1, 2011;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F1321401 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.