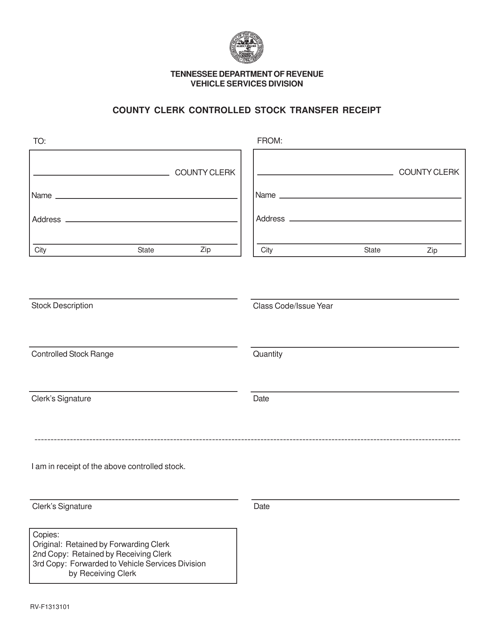

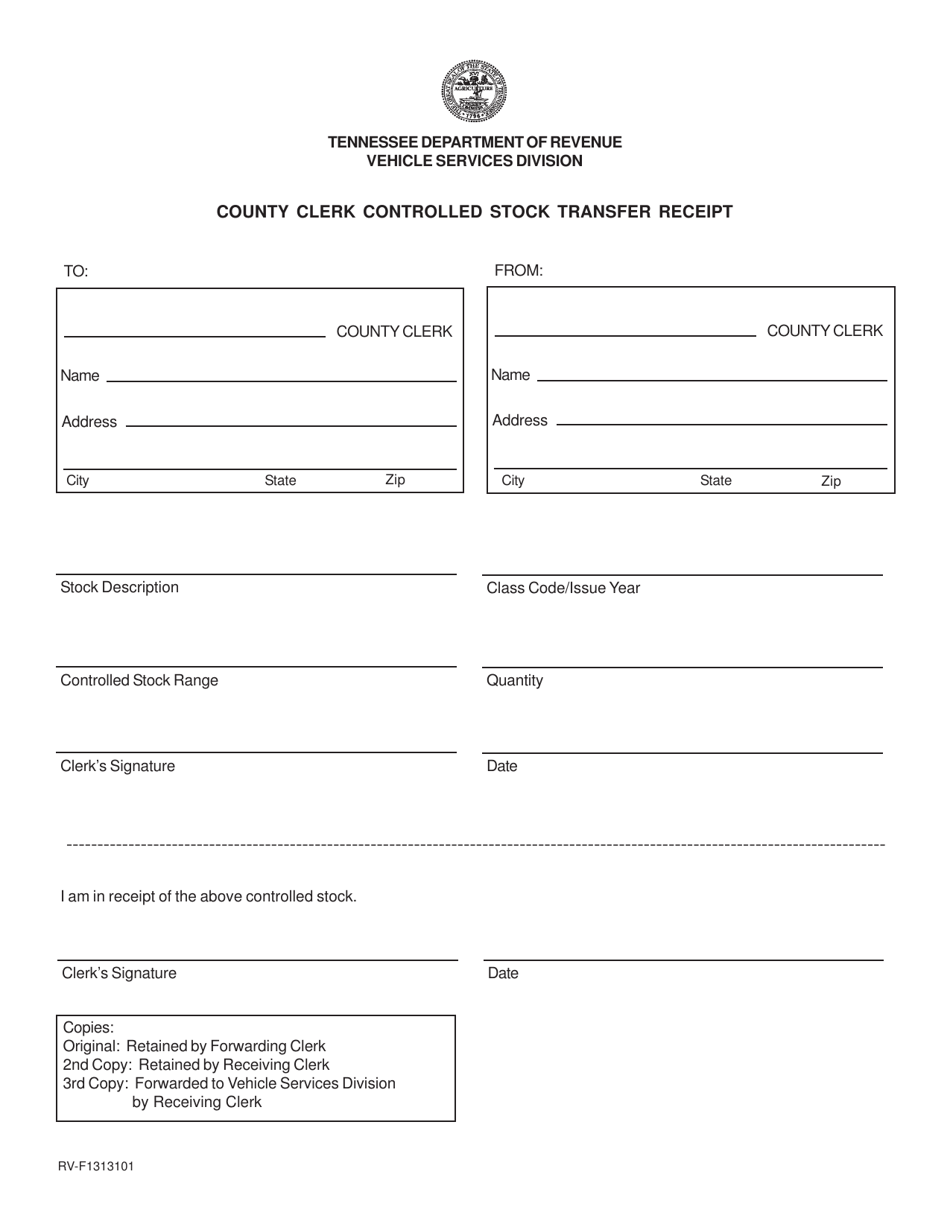

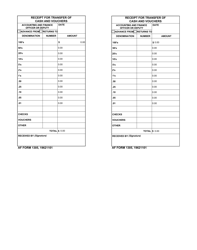

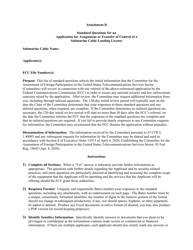

Form RV-F1313101 County Clerk Controlled Stock Transfer Receipt - Tennessee

What Is Form RV-F1313101?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RV-F1313101 County Clerk Controlled Stock Transfer Receipt?

A: The RV-F1313101 County Clerk Controlled Stock Transfer Receipt is a form used in the state of Tennessee to document the transfer of stock ownership between parties.

Q: Who needs to use the RV-F1313101 County Clerk Controlled Stock Transfer Receipt?

A: Both the seller and buyer of the stock need to use this form to record the transfer.

Q: What information is required on the RV-F1313101 County Clerk Controlled Stock Transfer Receipt?

A: The form requires information such as the names and addresses of the seller and buyer, the stock certificate number, and the date of the transfer.

Q: Is there a fee to file the RV-F1313101 County Clerk Controlled Stock Transfer Receipt?

A: Yes, there is typically a fee associated with filing this form.

Q: What should I do after completing the RV-F1313101 County Clerk Controlled Stock Transfer Receipt?

A: After completing the form, you should submit it to the County Clerk's office for processing.

Q: Is the RV-F1313101 County Clerk Controlled Stock Transfer Receipt required for all stock transfers in Tennessee?

A: Yes, this form is required for all stock transfers in Tennessee, as it serves as documentation of the transaction.

Form Details:

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F1313101 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.