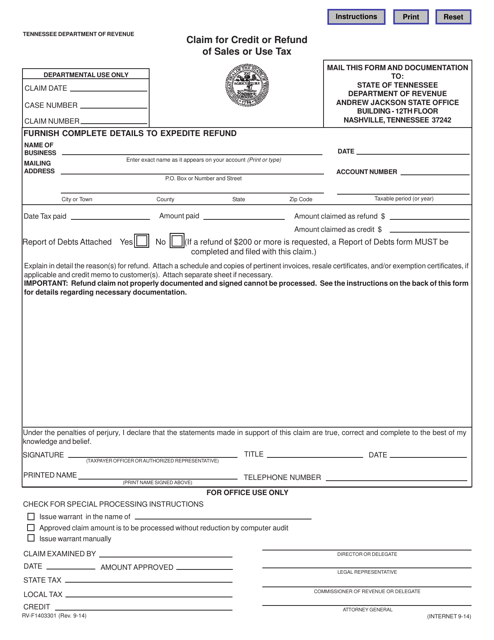

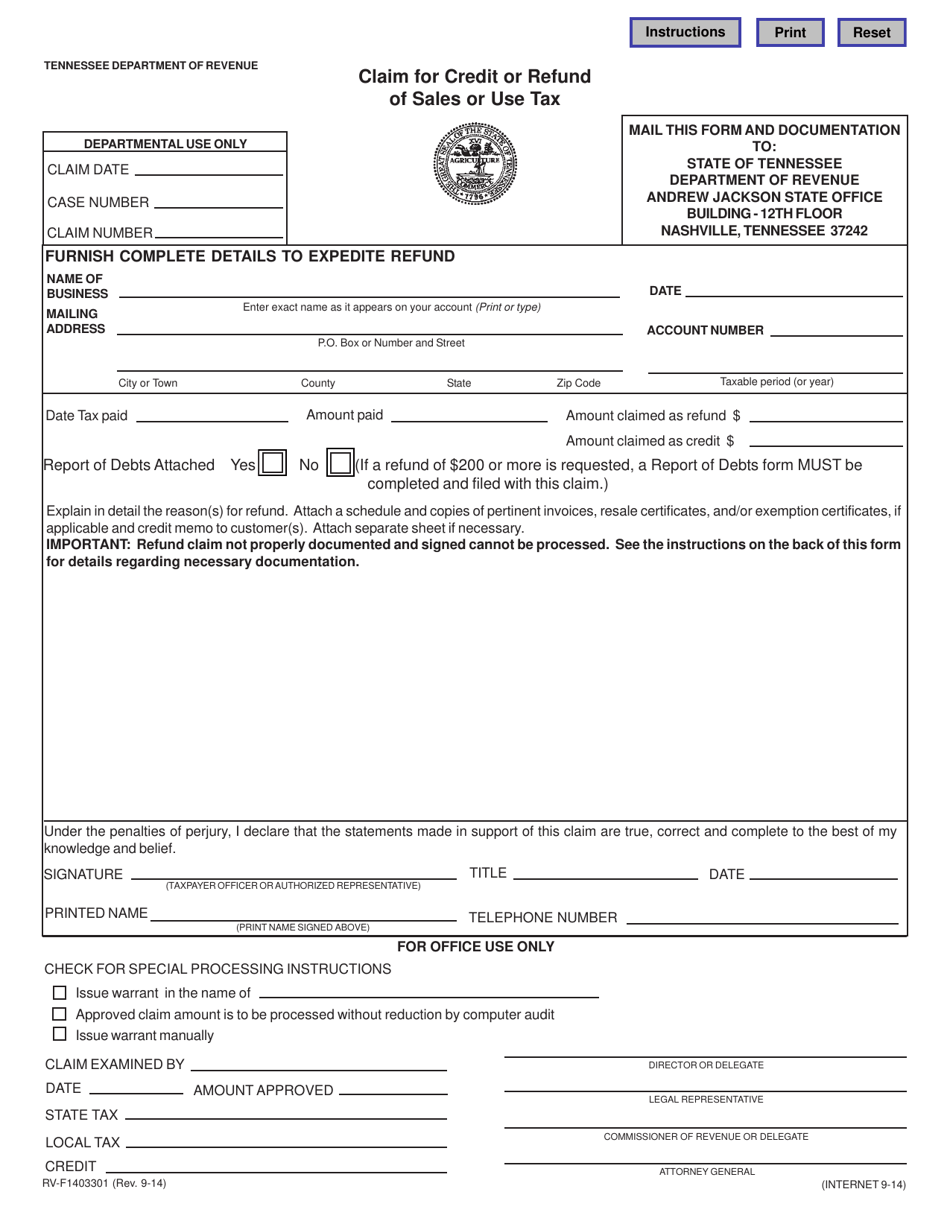

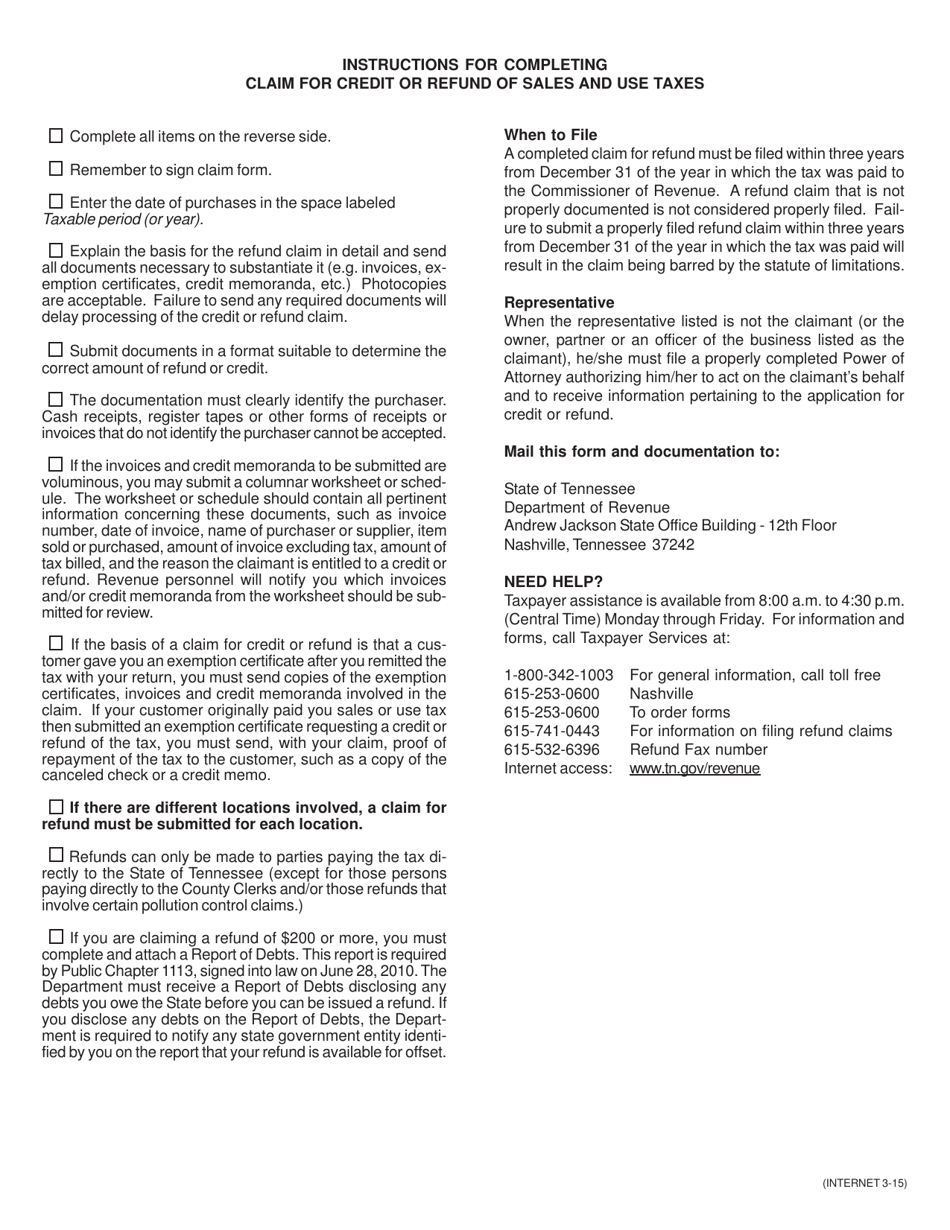

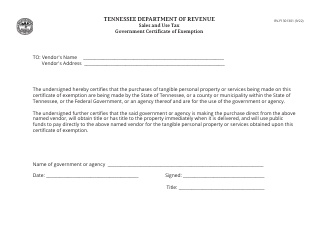

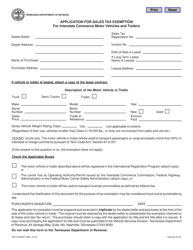

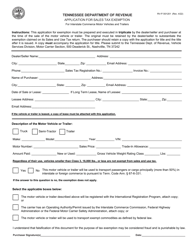

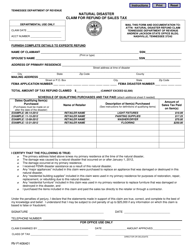

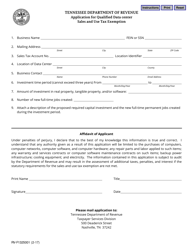

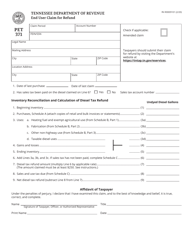

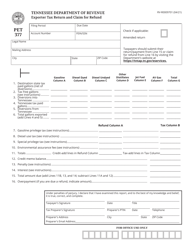

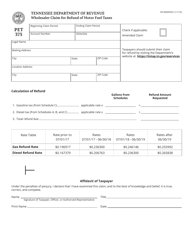

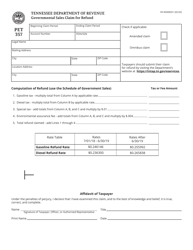

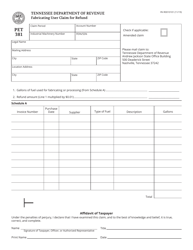

Form RV-F1403301 Claim for Credit or Refund of Sales or Use Tax - Tennessee

What Is Form RV-F1403301?

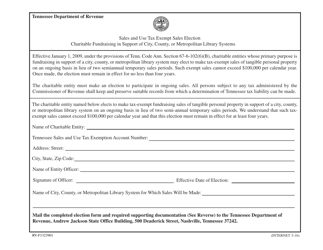

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form RV-F1403301?

A: Form RV-F1403301 is the official document used in Tennessee to claim a credit or refund for sales or use tax.

Q: Who can use form RV-F1403301?

A: Any individual or business that has paid sales or use tax in Tennessee can use form RV-F1403301 to claim a credit or refund.

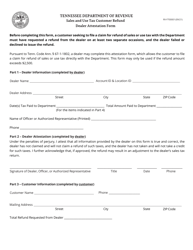

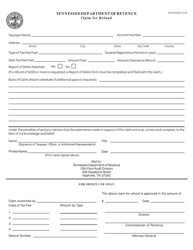

Q: What information do I need to provide on form RV-F1403301?

A: You will need to provide your contact information, details of the tax being claimed, and any supporting documentation.

Q: What is the deadline for filing form RV-F1403301?

A: Form RV-F1403301 must be filed within three years from the date the sales or use tax was paid.

Q: How long does it take to receive a refund after filing form RV-F1403301?

A: The processing time for refunds can vary, but it typically takes about six to eight weeks to receive a refund after filing form RV-F1403301.

Form Details:

- Released on September 1, 2014;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RV-F1403301 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.