Tntap Checklist - Tennessee

Tntap Checklist is a legal document that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee.

FAQ

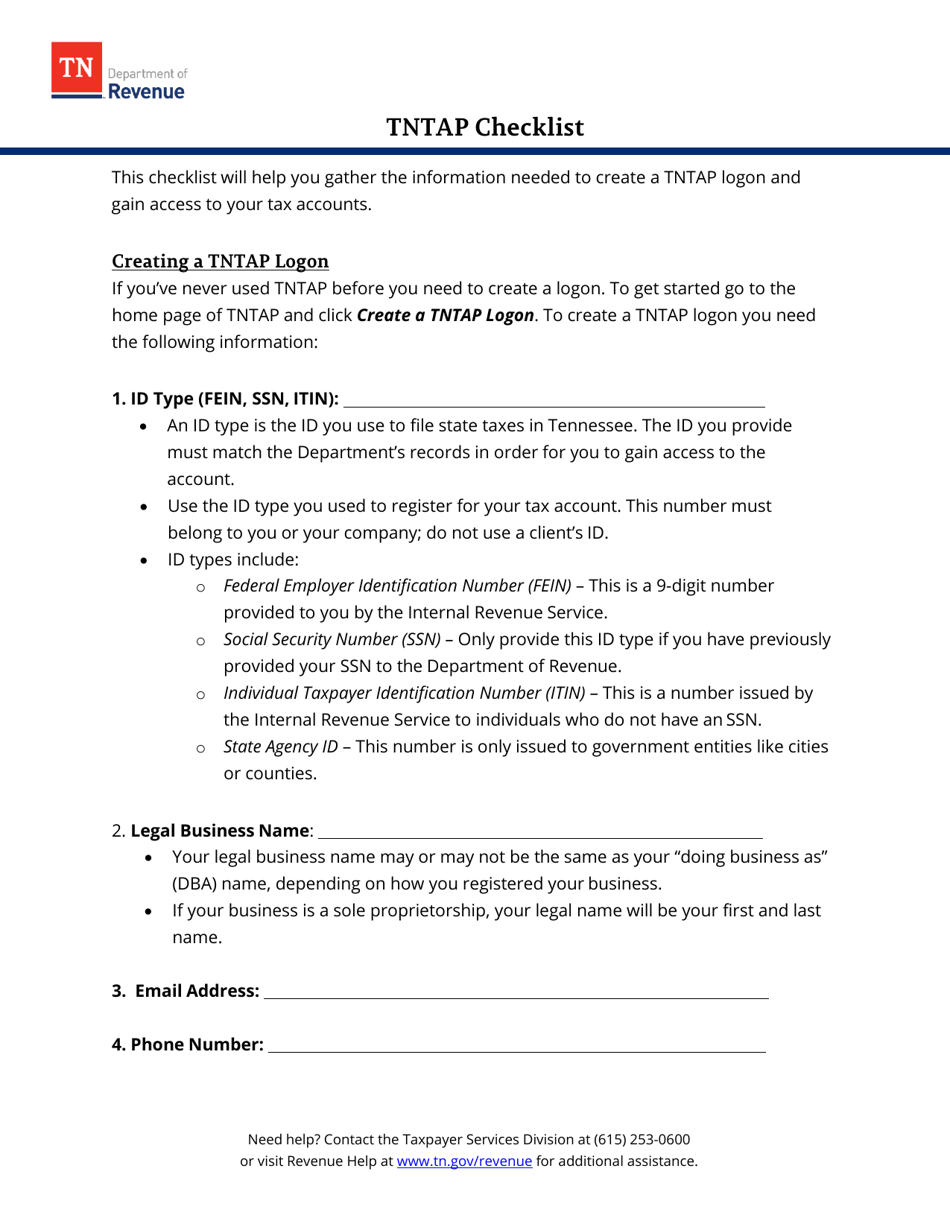

Q: What is the Tntap Checklist?

A: The Tntap Checklist is a tool used in Tennessee for businesses to ensure they have met all requirements for registration and licensing.

Q: Why do I need to use the Tntap Checklist?

A: Using the Tntap Checklist helps businesses make sure they have completed all necessary steps for registration and licensing in Tennessee.

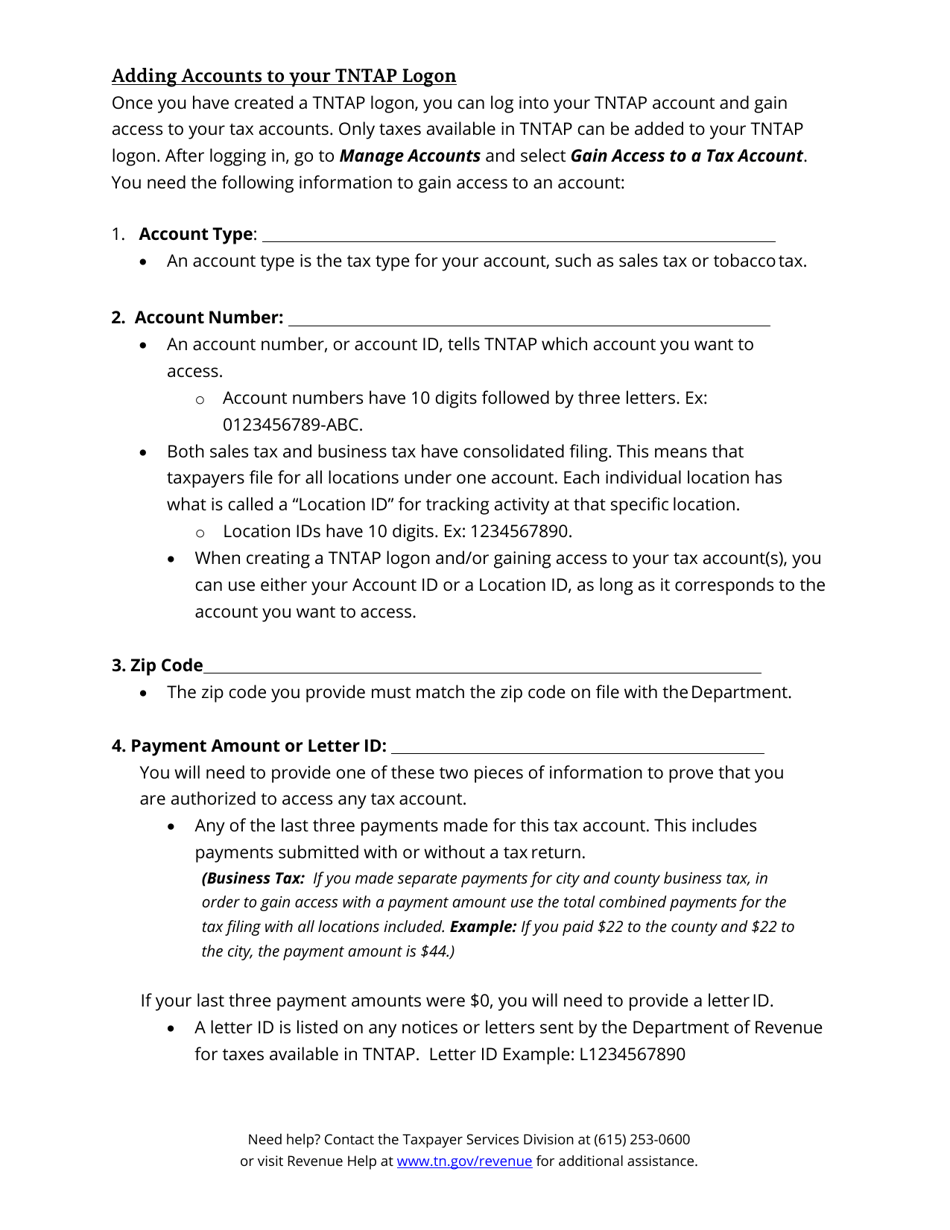

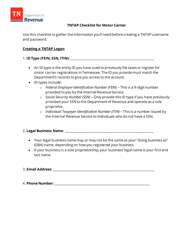

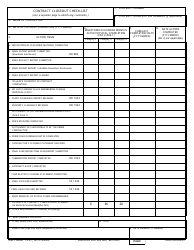

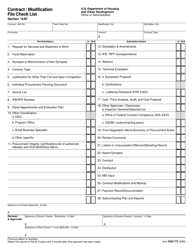

Q: What information is included in the Tntap Checklist?

A: The Tntap Checklist includes information on registration requirements, licensing, permits, and other related tasks for businesses in Tennessee.

Q: Is the Tntap Checklist mandatory?

A: While using the Tntap Checklist is not mandatory, it is highly recommended for businesses to ensure they have completed all necessary requirements.

Q: Can I access the Tntap Checklist if I am not a business owner?

A: The Tntap Checklist is primarily designed for businesses, but individuals can also access it for information on tax requirements and filings in Tennessee.

Q: Are there any fees associated with using the Tntap Checklist?

A: No, accessing and using the Tntap Checklist is free of charge for businesses and individuals in Tennessee.

Q: Is the Tntap Checklist only applicable to Tennessee?

A: Yes, the Tntap Checklist is specific to Tennessee and its tax requirements and regulations.

Q: Is there a helpline available for assistance with the Tntap Checklist?

A: Yes, there is a helpline available for businesses and individuals who need assistance with the Tntap Checklist or any other tax-related inquiries in Tennessee.

Form Details:

- The latest edition currently provided by the Tennessee Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.