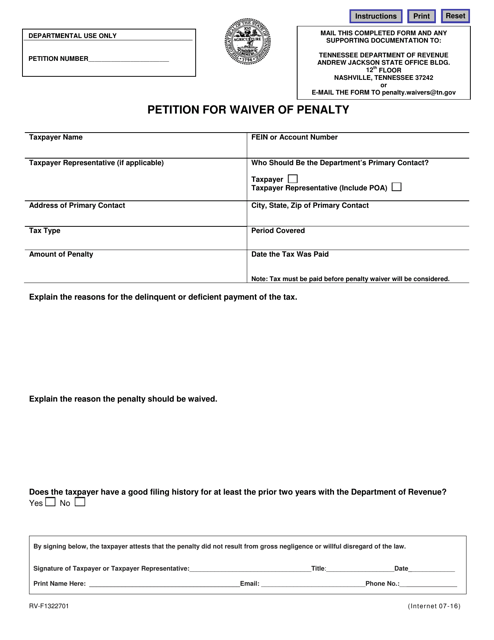

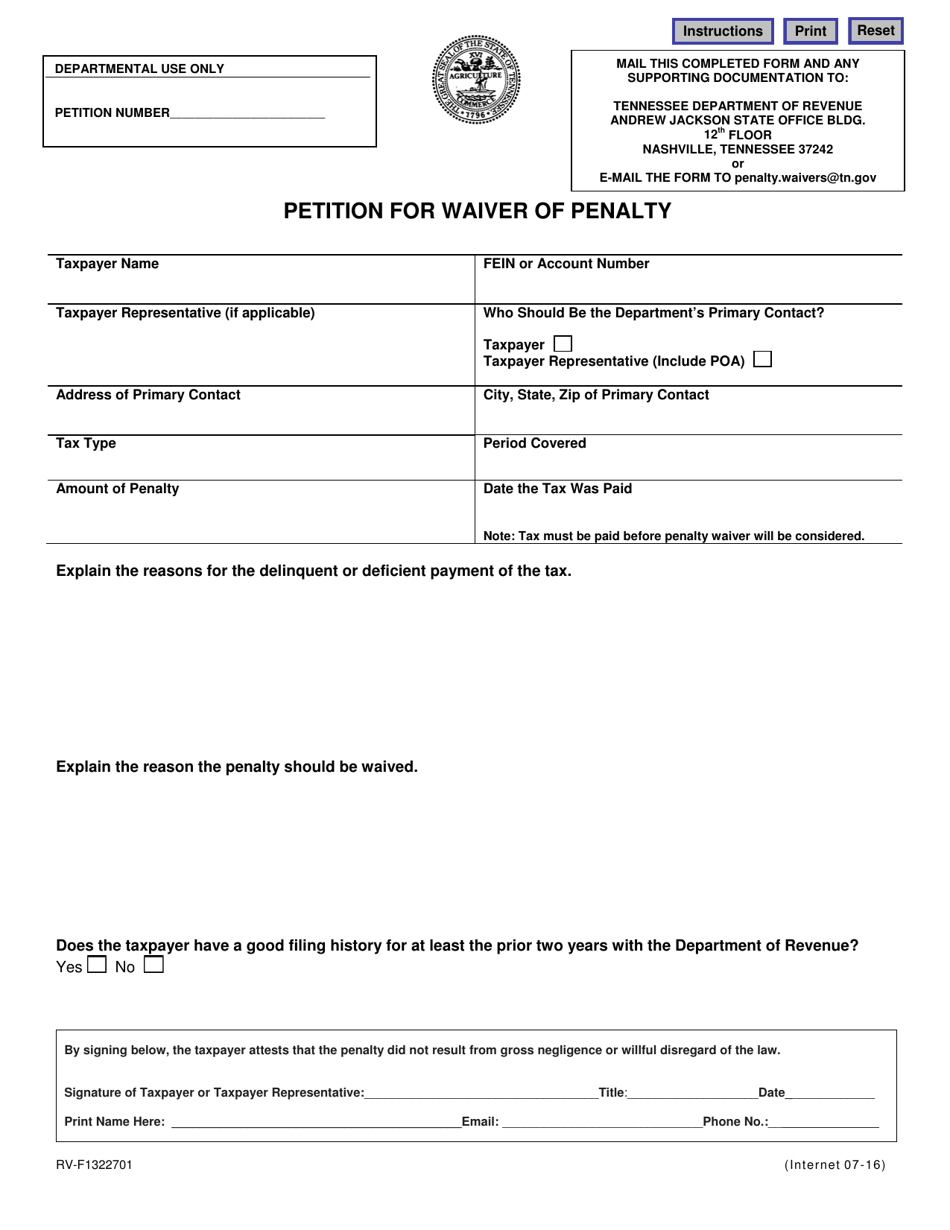

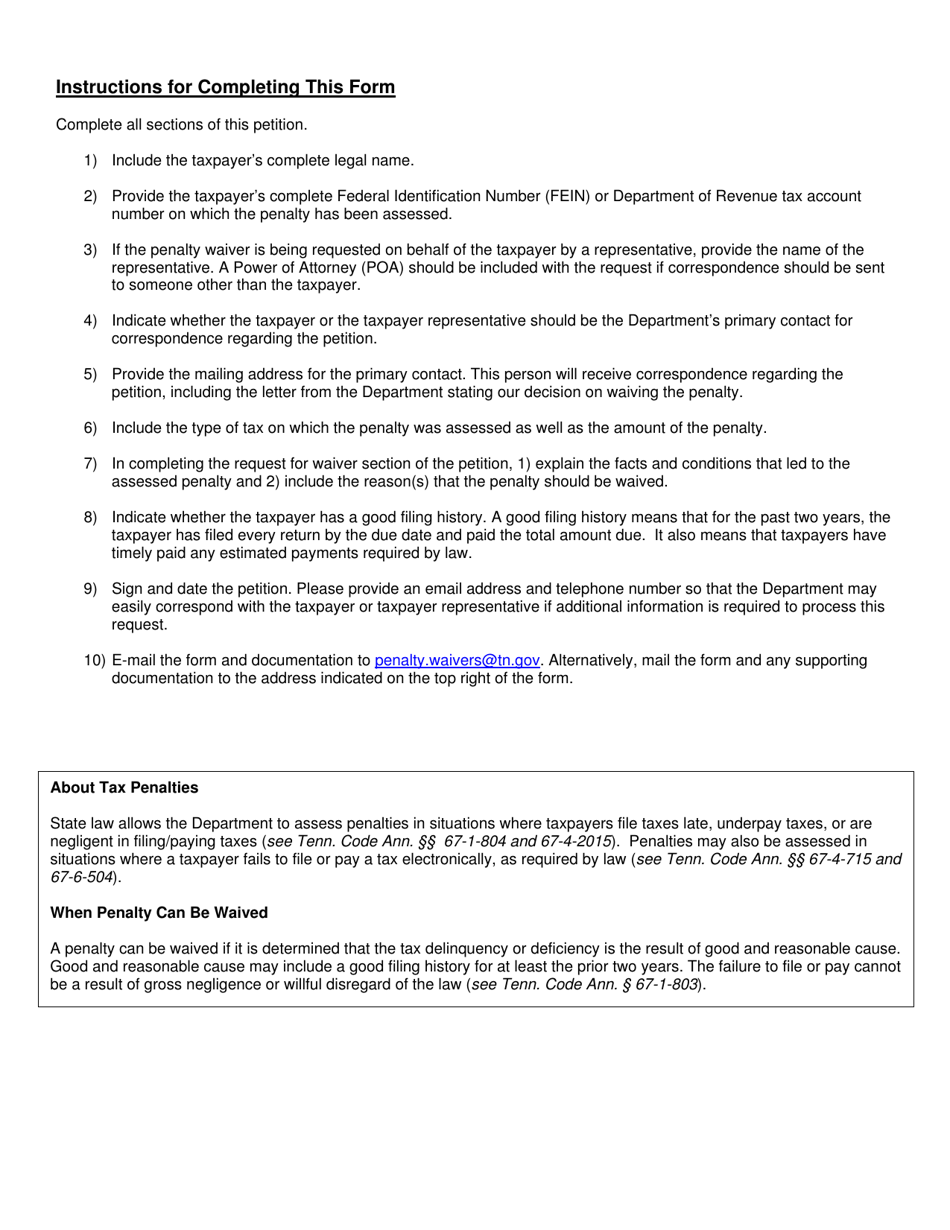

Form RV-F1322701 Petition for Waiver of Penalty - Tennessee

What Is Form RV-F1322701?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the form RV-F1322701?

A: The form RV-F1322701 is a Petition for Waiver of Penalty in Tennessee.

Q: What is a Petition for Waiver of Penalty?

A: A Petition for Waiver of Penalty is a legal document filed to request the waiver of a penalty that has been imposed.

Q: Why would I need to file a Petition for Waiver of Penalty?

A: You may need to file a Petition for Waiver of Penalty if you believe that you have a valid reason for the penalty to be waived.

Q: What information is required on the form RV-F1322701?

A: The form RV-F1322701 requires information about the penalty being contested, the reasons for the waiver request, and supporting evidence.

Q: Is there a fee for filing the form RV-F1322701?

A: There is no fee for filing the form RV-F1322701.

Q: How long does it take to process a Petition for Waiver of Penalty?

A: The processing time for a Petition for Waiver of Penalty may vary, but it typically takes several weeks to receive a decision.

Q: What happens after I file the form RV-F1322701?

A: After you file the form RV-F1322701, the Tennessee Department of Revenue will review your petition and make a decision on whether to grant or deny your request.

Q: Can I appeal the decision on my Petition for Waiver of Penalty?

A: Yes, if your Petition for Waiver of Penalty is denied, you have the right to appeal the decision.

Q: Who can help me with filling out the form RV-F1322701?

A: You may consider seeking assistance from a tax professional or legal advisor to help you fill out the form RV-F1322701 accurately.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RV-F1322701 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.