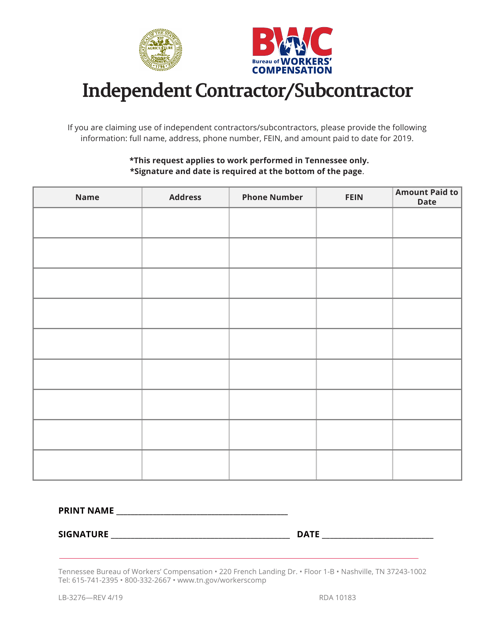

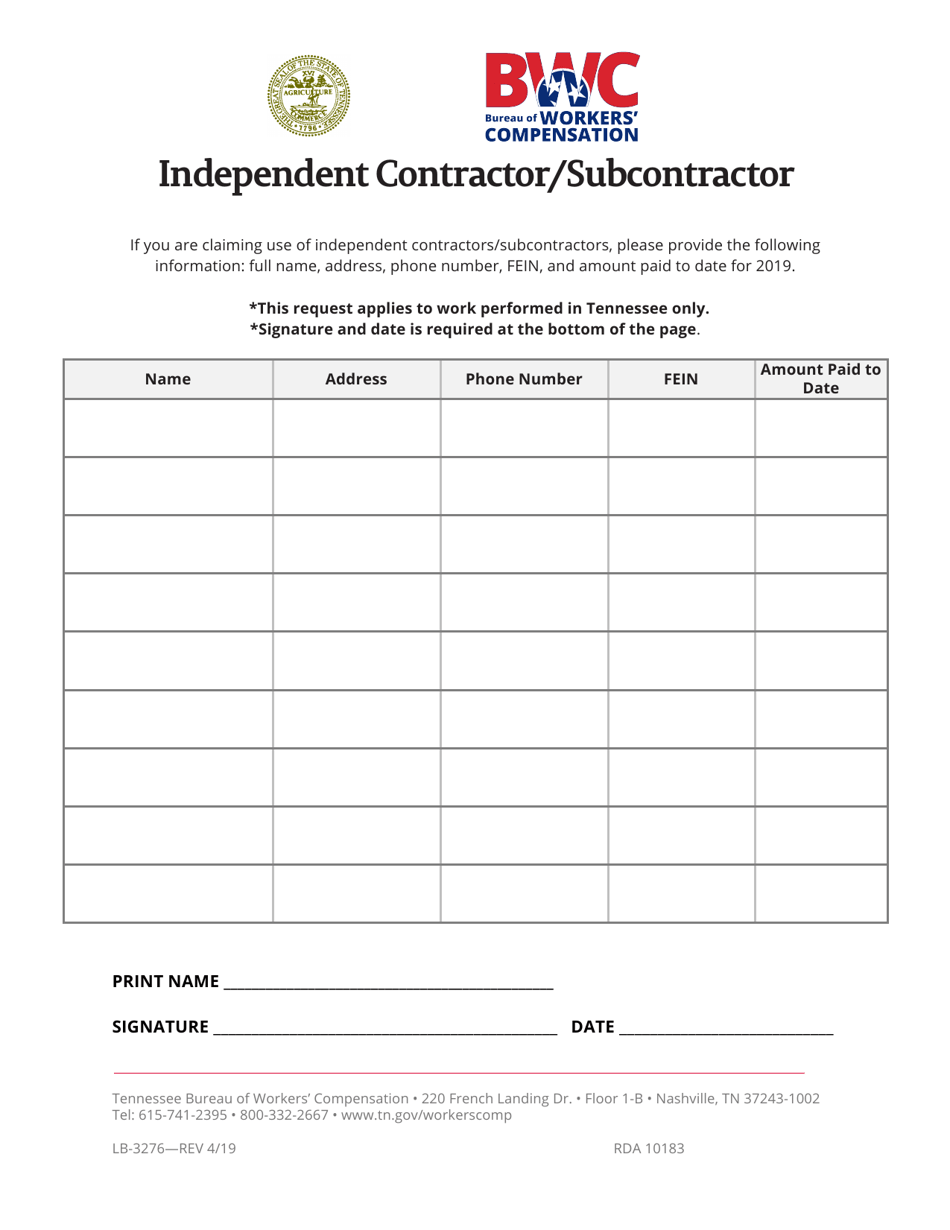

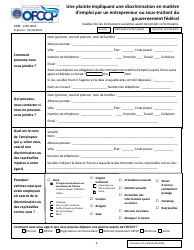

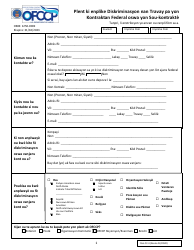

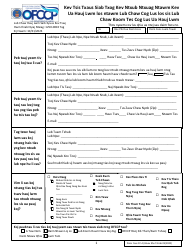

Form LB-3276 Independent Contractor / Subcontractor - Tennessee

What Is Form LB-3276?

This is a legal form that was released by the Tennessee Department of Labor and Workforce Development - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form LB-3276?

A: Form LB-3276 is a document used in Tennessee for reporting independent contractors/subcontractors.

Q: Who should use form LB-3276?

A: Form LB-3276 should be used by individuals or businesses who have hired independent contractors or subcontractors in Tennessee.

Q: What information is required on form LB-3276?

A: Form LB-3276 requires information about the contractor or subcontractor, including their name, address, and taxpayer identification number.

Q: When is form LB-3276 due?

A: Form LB-3276 is due on or before the 20th day of the month following the end of the quarter.

Q: Are there any penalties for not filing form LB-3276?

A: Yes, there are penalties for not filing form LB-3276, including monetary fines and potential legal consequences.

Q: Is form LB-3276 required for all independent contractors and subcontractors in Tennessee?

A: Yes, form LB-3276 is required for all independent contractors and subcontractors hired in Tennessee, regardless of the amount paid.

Q: What should I do if I made a mistake on form LB-3276?

A: If you made a mistake on form LB-3276, you should correct it as soon as possible by filing an amended form with the Tennessee Department of Revenue.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Tennessee Department of Labor and Workforce Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LB-3276 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Labor and Workforce Development.