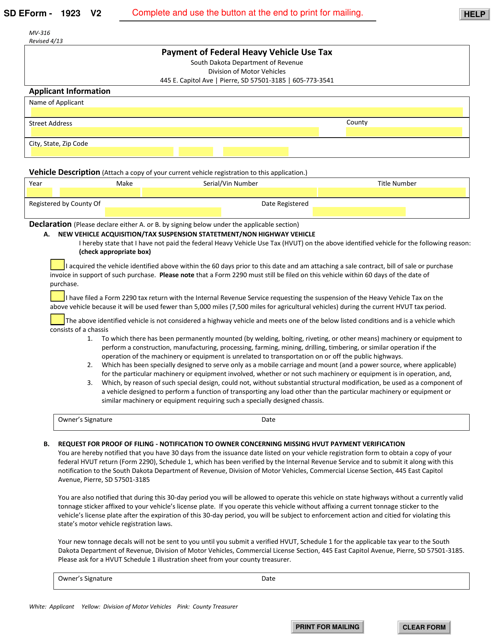

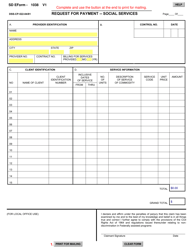

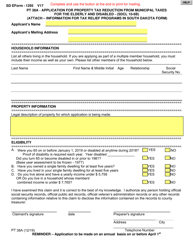

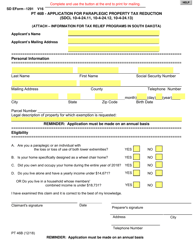

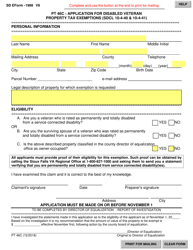

SD Form 1923 (MV-316) Payment of Federal Heavy Vehicle Use Tax - South Dakota

What Is SD Form 1923 (MV-316)?

This is a legal form that was released by the South Dakota Department of Revenue - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SD Form 1923 (MV-316)?

A: SD Form 1923 (MV-316) is a form used for the payment of Federal Heavy Vehicle Use Tax in South Dakota.

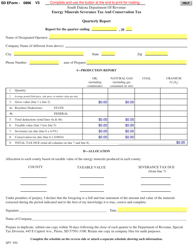

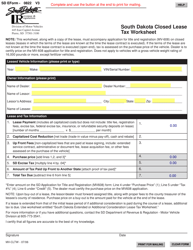

Q: What is Federal Heavy Vehicle Use Tax?

A: Federal Heavy Vehicle Use Tax is a tax imposed on heavy vehicles with a gross weight of 55,000 pounds or more, used on public highways.

Q: Who needs to pay Federal Heavy Vehicle Use Tax?

A: Owners of heavy vehicles with a gross weight of 55,000 pounds or more are required to pay the Federal Heavy Vehicle Use Tax.

Q: What is the purpose of SD Form 1923 (MV-316)?

A: The purpose of SD Form 1923 (MV-316) is to facilitate the payment of Federal Heavy Vehicle Use Tax in South Dakota.

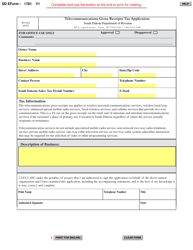

Q: What information is required on SD Form 1923 (MV-316)?

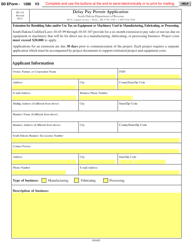

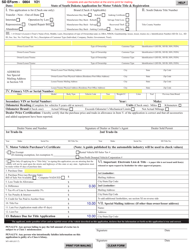

A: SD Form 1923 (MV-316) requires information such as the vehicle identification number, taxable gross weight, and owner information.

Q: How can I submit SD Form 1923 (MV-316)?

A: You can submit SD Form 1923 (MV-316) by mail or in person to the South Dakota Department of Revenue.

Q: When is SD Form 1923 (MV-316) payment due?

A: SD Form 1923 (MV-316) payment is due annually by the last day of the month following the vehicle's first use month.

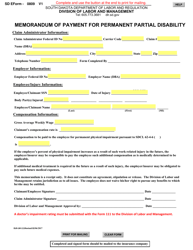

Q: What happens if I don't pay the Federal Heavy Vehicle Use Tax?

A: Failure to pay the Federal Heavy Vehicle Use Tax can result in penalties, fines, and potential suspension of registration.

Q: Can I claim a refund for the Federal Heavy Vehicle Use Tax?

A: Yes, you can claim a refund on the Federal Heavy Vehicle Use Tax if the vehicle is sold, stolen, destroyed, or if the tax was overpaid.

Form Details:

- Released on April 1, 2013;

- The latest edition provided by the South Dakota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SD Form 1923 (MV-316) by clicking the link below or browse more documents and templates provided by the South Dakota Department of Revenue.