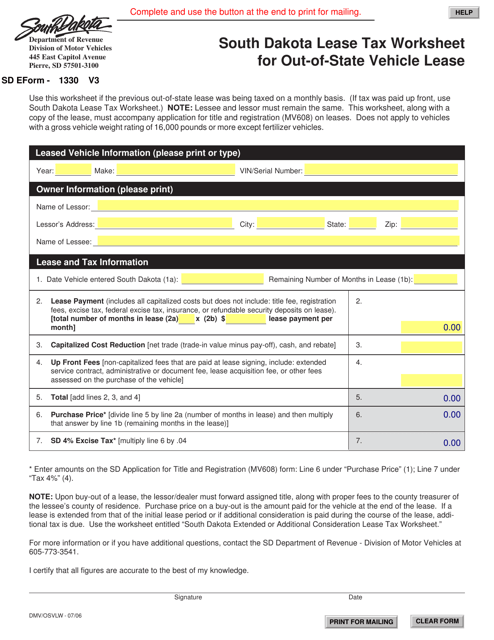

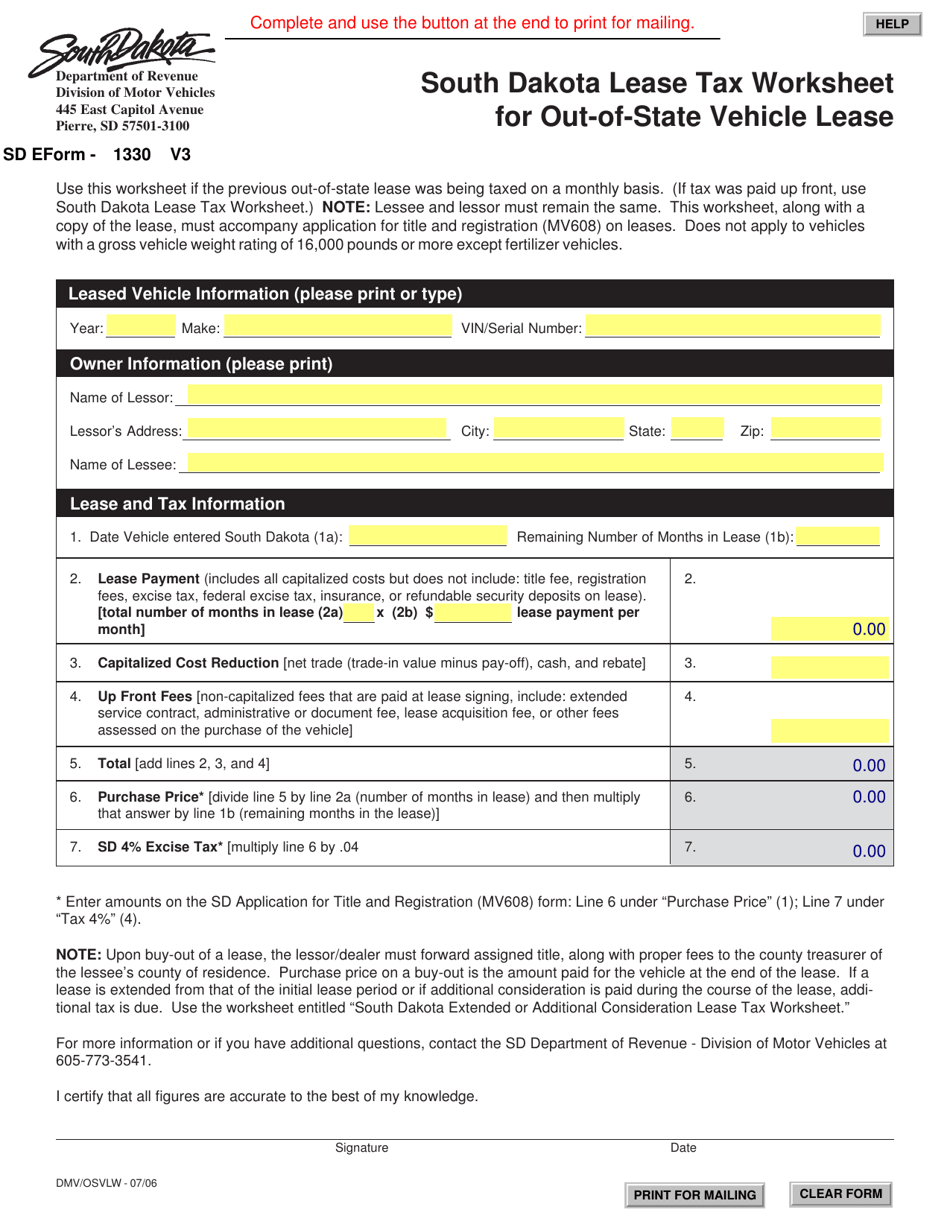

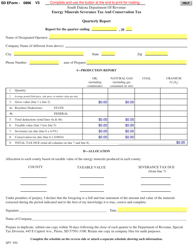

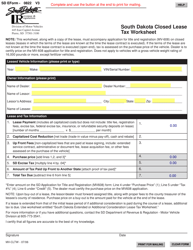

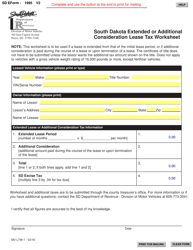

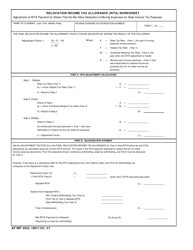

SD Form 1330 South Dakota Lease Tax Worksheet for Out-of-State Vehicle Lease - South Dakota

What Is SD Form 1330?

This is a legal form that was released by the South Dakota Department of Revenue - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SD Form 1330?

A: SD Form 1330 is the South Dakota Lease Tax Worksheet for Out-of-State Vehicle Lease.

Q: What is the purpose of SD Form 1330?

A: The purpose of SD Form 1330 is to calculate the lease tax for out-of-state vehicle leases in South Dakota.

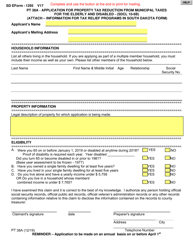

Q: Who needs to use SD Form 1330?

A: SD Form 1330 needs to be used by individuals or businesses who are leasing out-of-state vehicles in South Dakota.

Q: What information is required on SD Form 1330?

A: Some of the information required on SD Form 1330 includes the lessee's information, vehicle details, and lease amount.

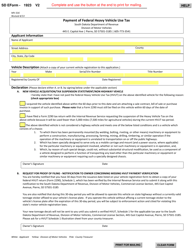

Form Details:

- Released on July 1, 2006;

- The latest edition provided by the South Dakota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SD Form 1330 by clicking the link below or browse more documents and templates provided by the South Dakota Department of Revenue.