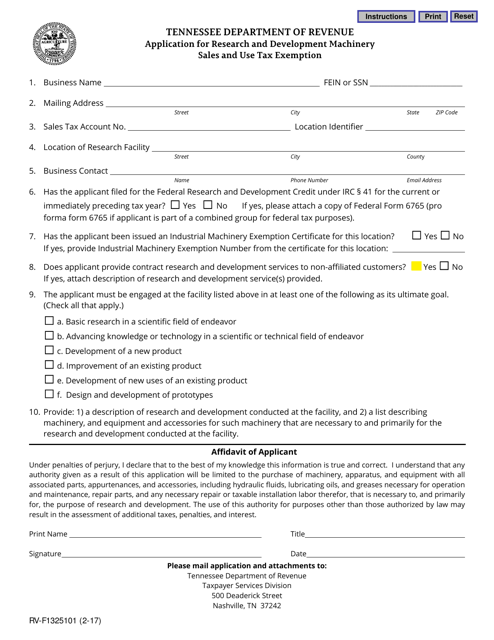

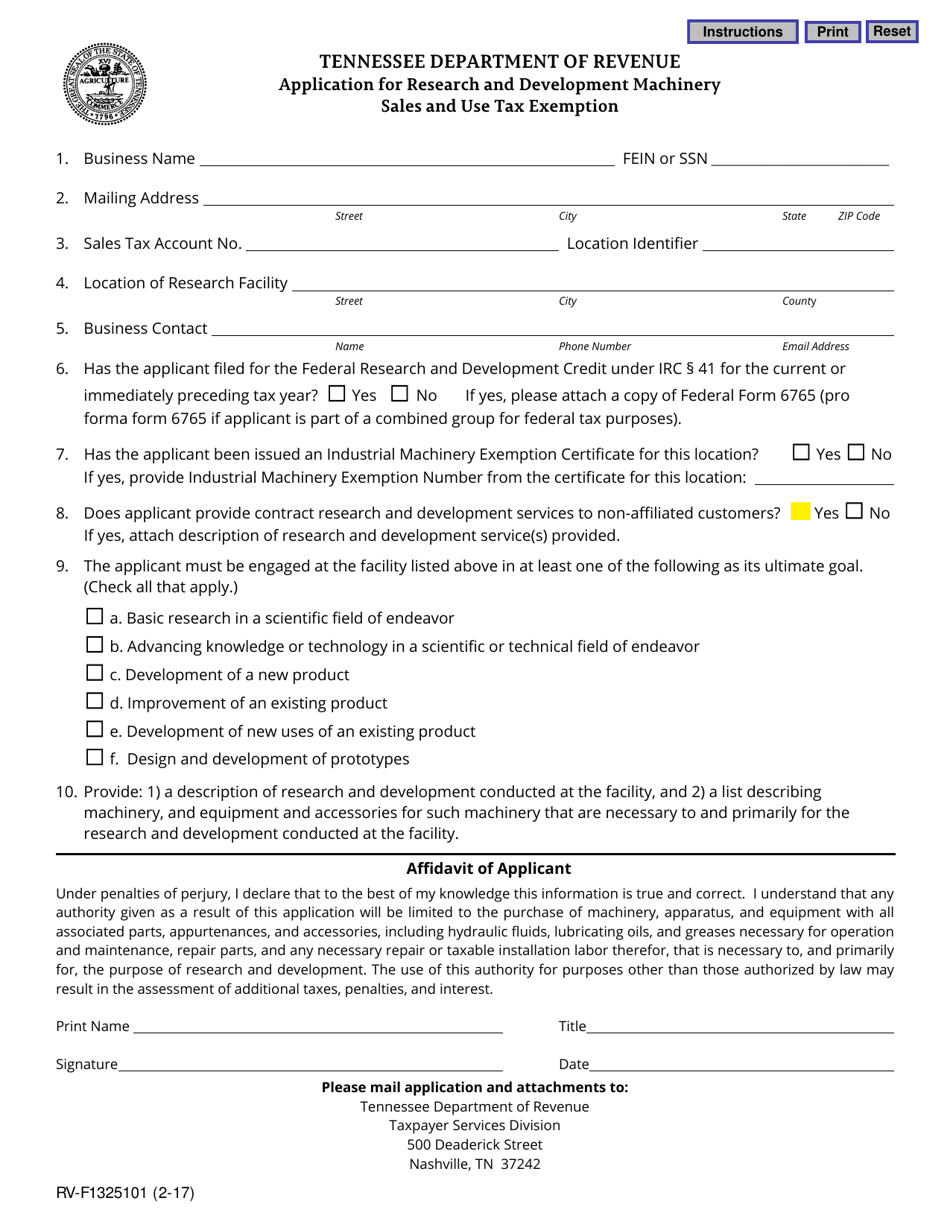

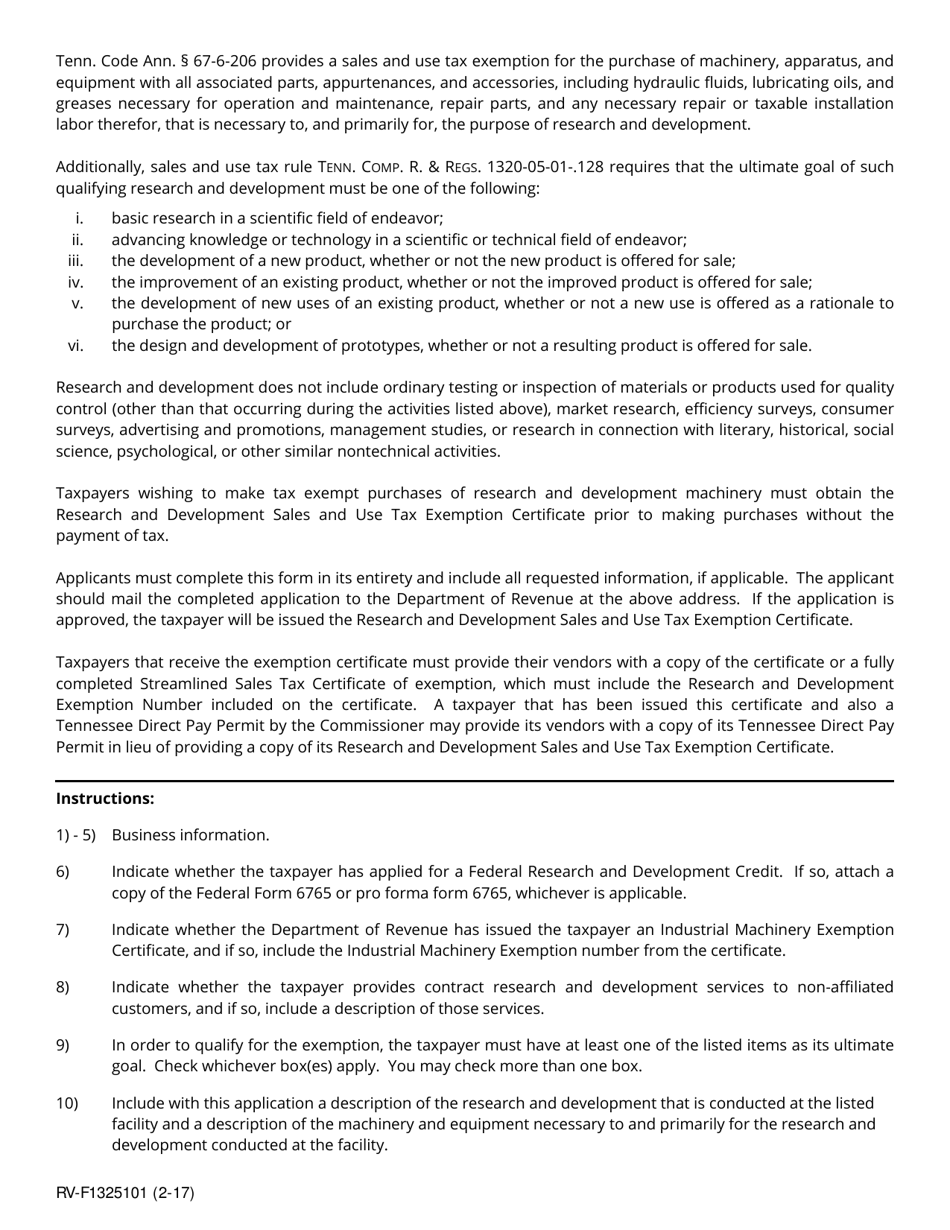

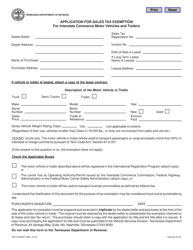

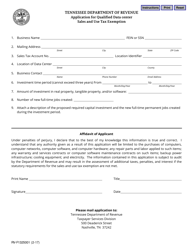

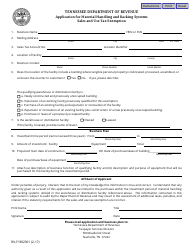

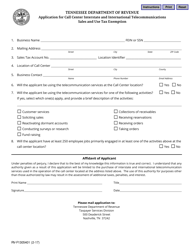

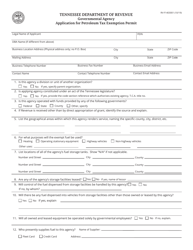

Form RV-F1325101 Application for Research and Development Machinery Sales and Use Tax Exemption - Tennessee

What Is Form RV-F1325101?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RV-F1325101 form?

A: The RV-F1325101 form is the Application for Research and Development Machinery Sales and Use Tax Exemption in Tennessee.

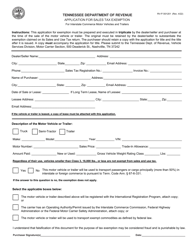

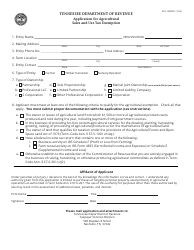

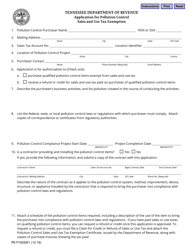

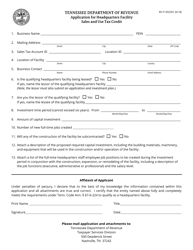

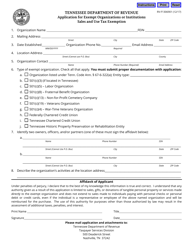

Q: Who can use the RV-F1325101 form?

A: This form can be used by businesses or individuals engaged in research and development activities and seeking sales and use tax exemption on machinery used for such purposes.

Q: What is the purpose of the RV-F1325101 form?

A: The purpose of this form is to apply for exemption from sales and use tax on machinery used for research and development activities in Tennessee.

Q: Are there any eligibility requirements for the tax exemption?

A: Yes, there are eligibility requirements that need to be met in order to qualify for the tax exemption. These requirements are outlined in the form instructions.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RV-F1325101 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.