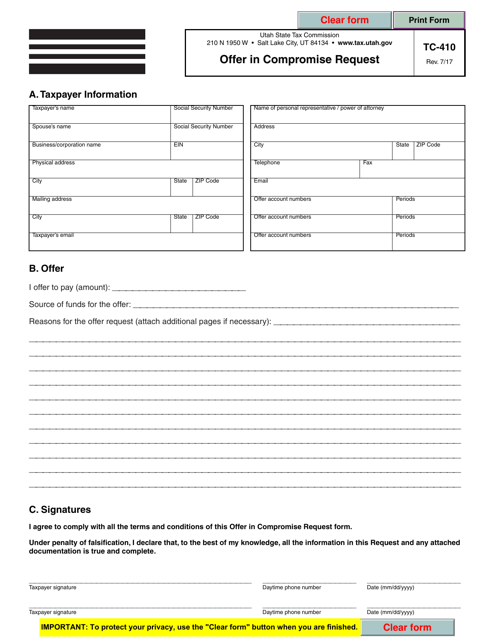

Form TC-410 Offer in Compromise Request - Utah

What Is Form TC-410?

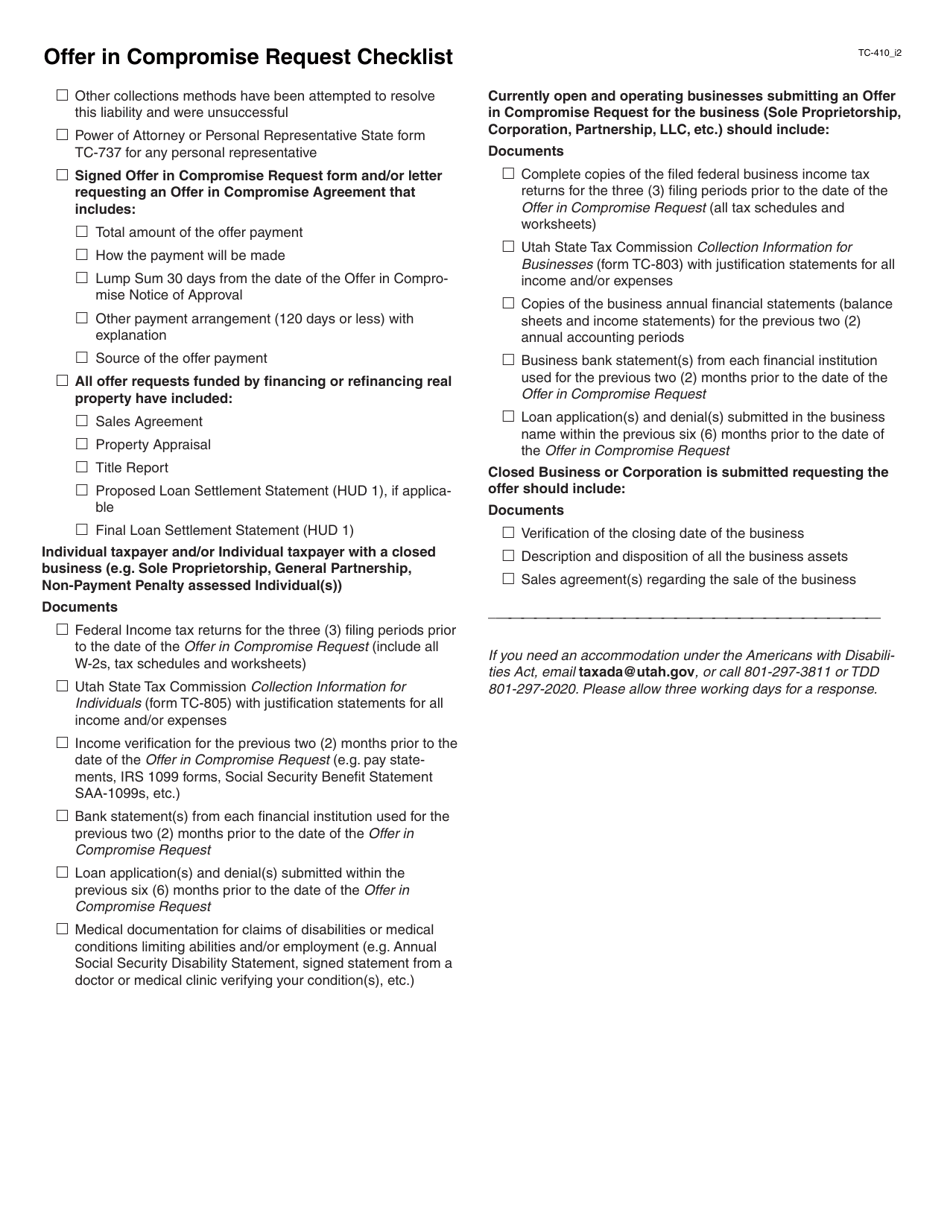

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-410?

A: Form TC-410 is an Offer in Compromise Request form for the state of Utah.

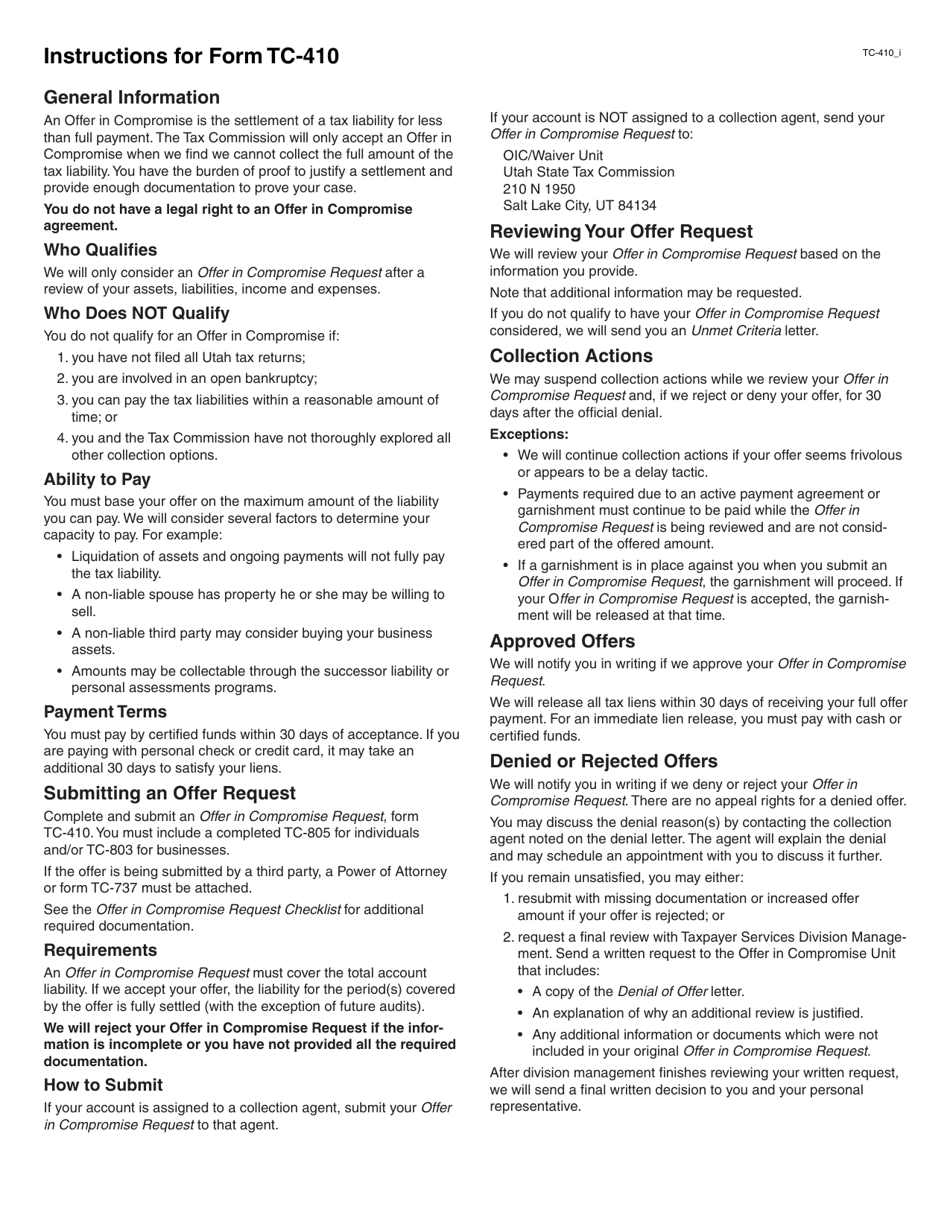

Q: What is an Offer in Compromise?

A: An Offer in Compromise is a program that allows taxpayers to settle their tax debt for less than the full amount owed.

Q: Who is eligible to submit Form TC-410?

A: Individuals and businesses who owe taxes to the state of Utah may be eligible to submit Form TC-410.

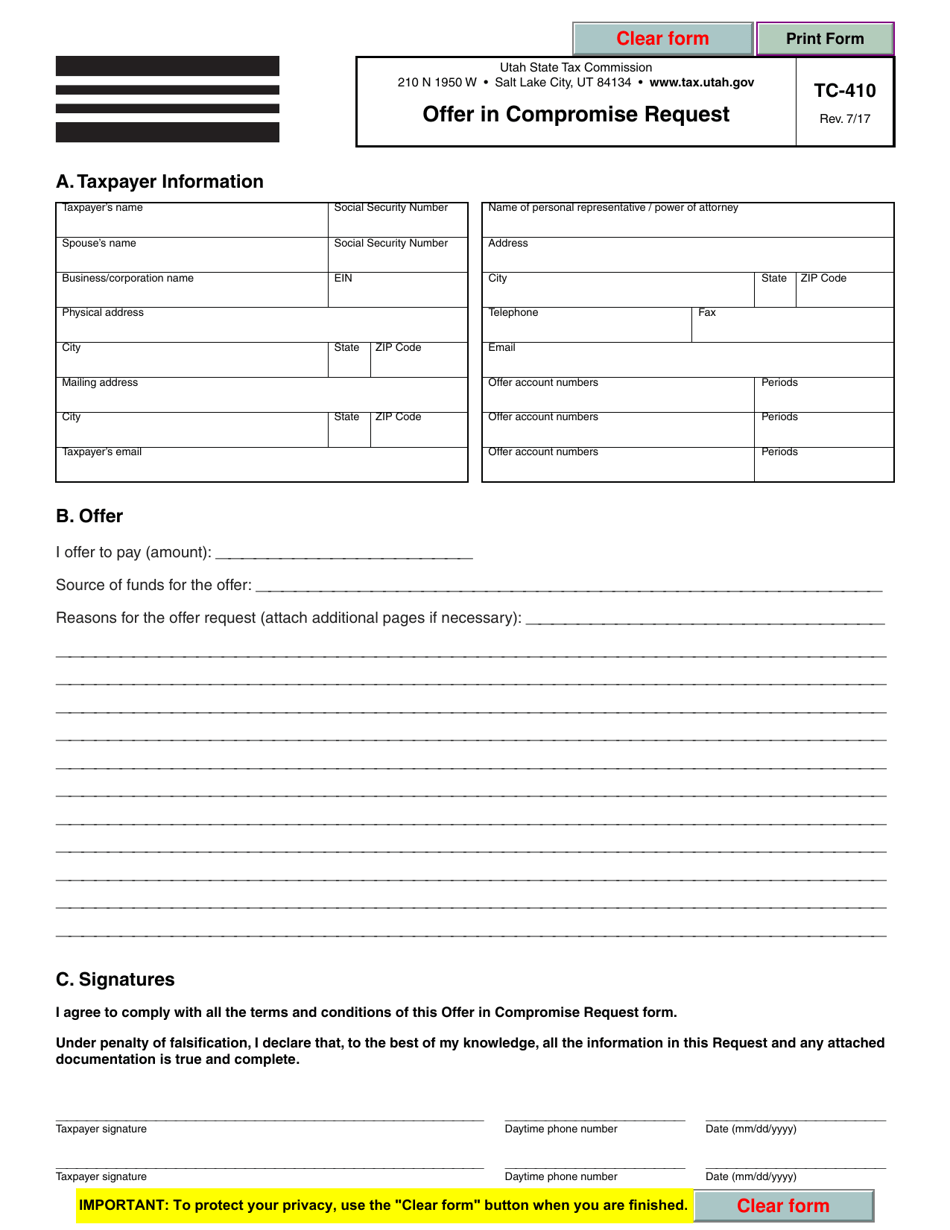

Q: How do I fill out Form TC-410?

A: The form requires information about your financial situation and tax debt. You will need to provide supporting documentation.

Q: What happens after I submit Form TC-410?

A: The Tax Commission will review your offer and may accept, reject, or request additional information before making a decision.

Q: Can I appeal a rejected offer?

A: Yes, you can appeal a rejected offer by following the instructions provided in the rejection letter.

Q: Are there any fees associated with submitting Form TC-410?

A: Yes, there is a non-refundable $100 application fee due at the time of submission.

Q: How long does it take to process an Offer in Compromise?

A: The processing time can vary, but it may take several months for a decision to be made on your offer.

Q: Can I still file my taxes while my offer is being processed?

A: Yes, you should continue to file your taxes while your offer is being processed.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-410 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.