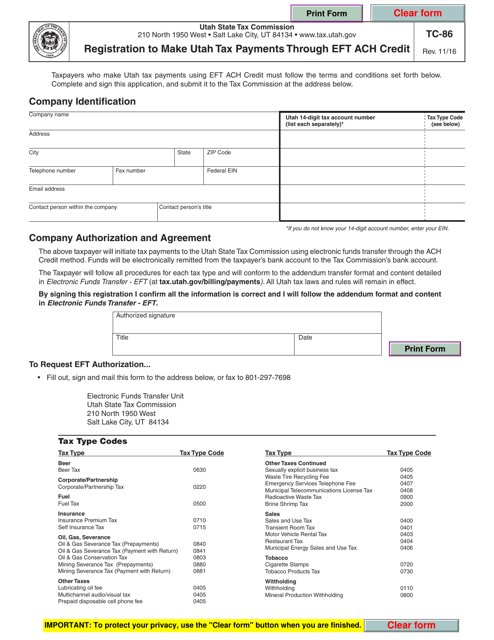

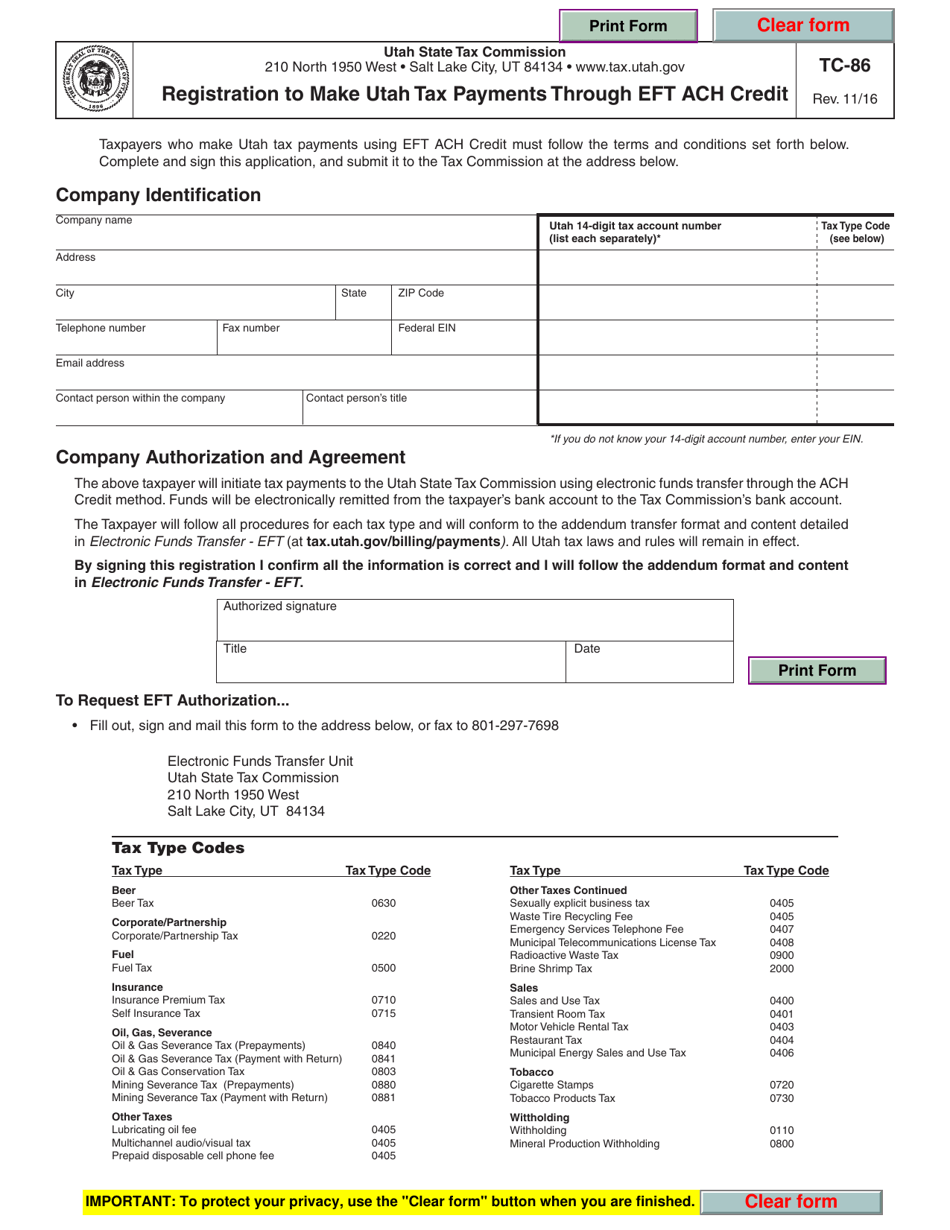

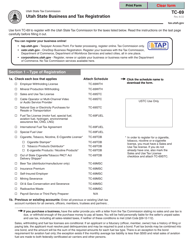

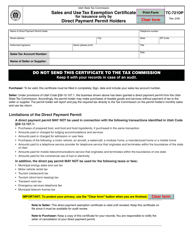

Form TC-86 Registration to Make Utah Tax Payments Through Eft ACH Credit - Utah

What Is Form TC-86?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

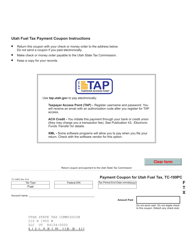

Q: What is Form TC-86?

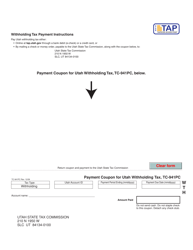

A: Form TC-86 is a registration form used to make Utah tax payments through EFT ACH Credit.

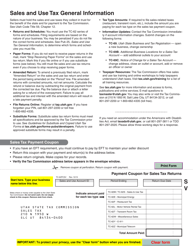

Q: What does EFT ACH Credit mean?

A: EFT ACH Credit stands for Electronic Funds Transfer Automated Clearing House Credit.

Q: Why would I use Form TC-86?

A: You would use Form TC-86 to register for the EFT ACH Credit method of making Utah tax payments.

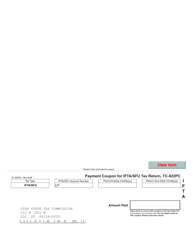

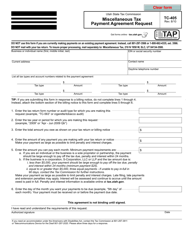

Q: How do I fill out Form TC-86?

A: You can fill out Form TC-86 by providing your business information, bank account details, and tax type information.

Form Details:

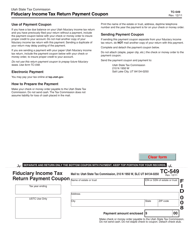

- Released on November 1, 2016;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-86 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.