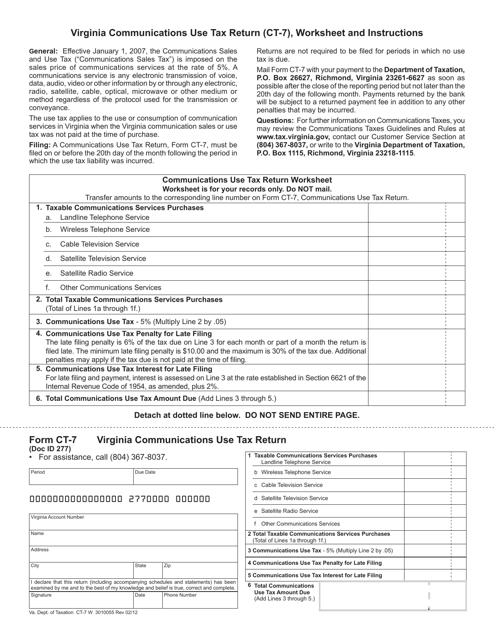

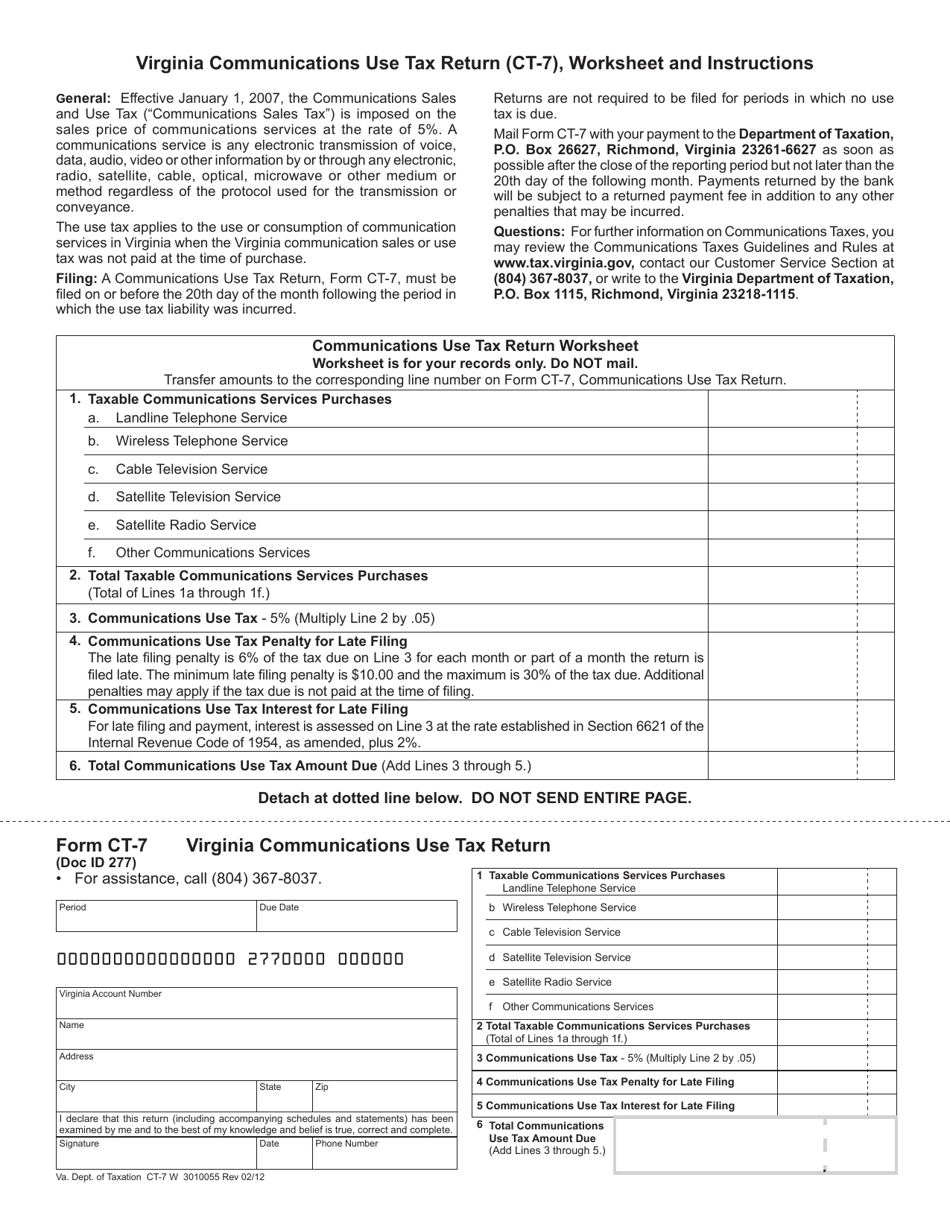

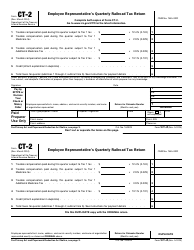

Form CT-7 Virginia Communications Use Tax Return - Virginia

What Is Form CT-7?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-7?

A: Form CT-7 is the Virginia Communications Use Tax Return.

Q: Who needs to file Form CT-7?

A: Anyone who has purchased taxable communications services in Virginia and did not pay sales tax at the time of purchase needs to file Form CT-7.

Q: What is the purpose of filing Form CT-7?

A: The purpose of filing Form CT-7 is to report and pay the use tax on communications services purchased in Virginia.

Q: When is Form CT-7 due?

A: Form CT-7 is due on or before the 20th day of the month following the reporting period.

Q: What is the penalty for not filing Form CT-7?

A: The penalty for not filing Form CT-7 is 6% of the tax due, with a minimum penalty of $10.

Q: Do I need to include payment with Form CT-7?

A: Yes, payment for the use tax owed must be included with the form.

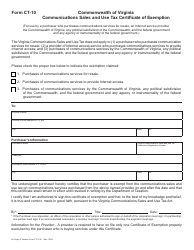

Q: What types of communications services are subject to use tax?

A: Examples of communications services subject to use tax include telephone services, cable television services, and internet access services.

Q: Can I claim a credit for taxes paid to another state?

A: Yes, if you paid use tax on communications services to another state, you can claim a credit on your Virginia return for taxes paid to that state.

Form Details:

- Released on February 1, 2012;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-7 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.