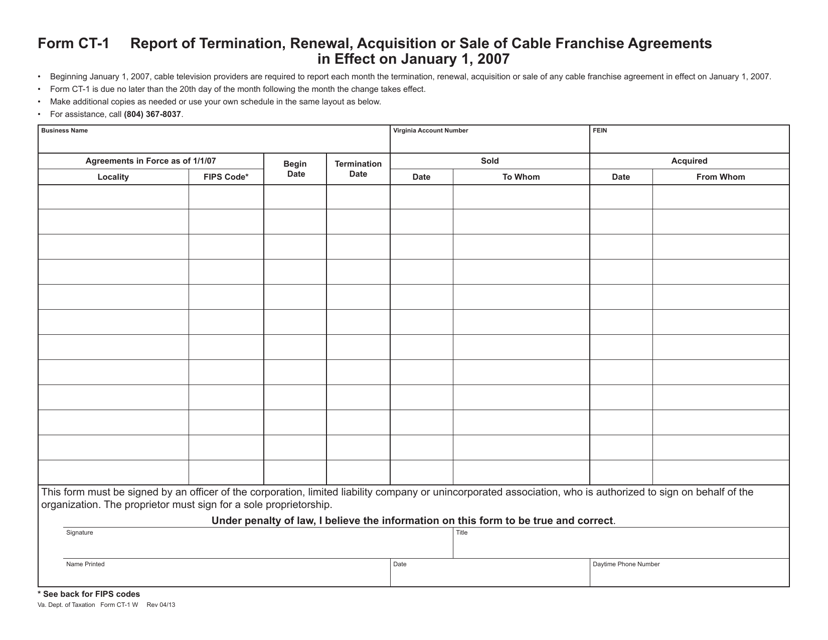

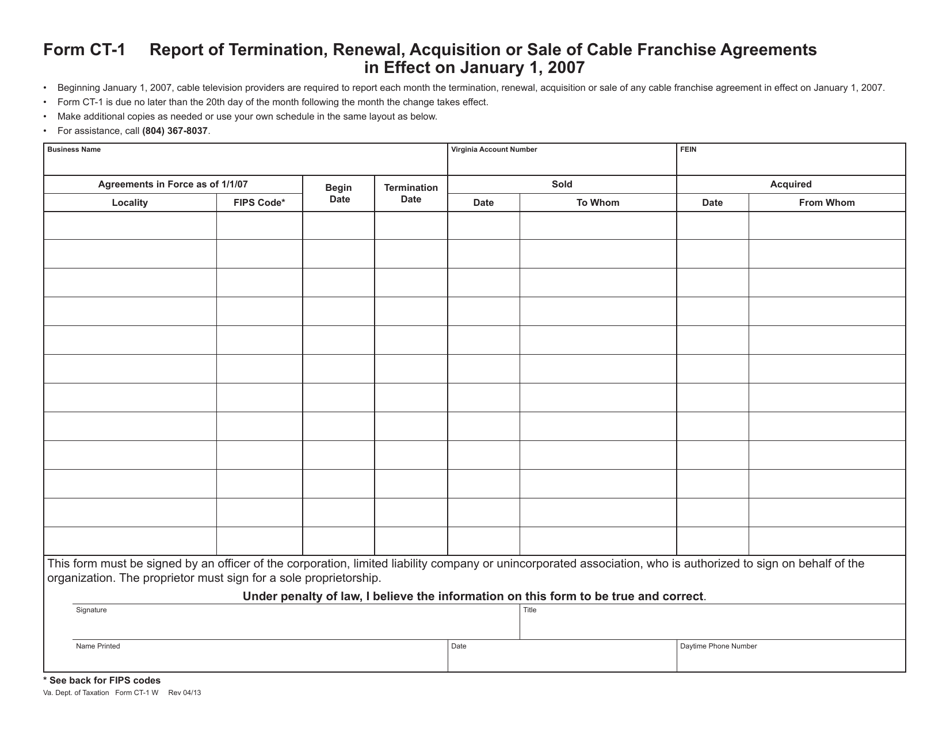

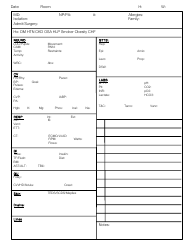

Form CT-1 Report of Termination, Renewal, Acquisition, or Sale of Cable Franchise Agreements - Virginia

What Is Form CT-1?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CT-1?

A: Form CT-1 is the Report of Termination, Renewal, Acquisition, or Sale of Cable Franchise Agreements in Virginia.

Q: What do I need to report on Form CT-1?

A: You need to report any termination, renewal, acquisition, or sale of cable franchise agreements.

Q: Do I need to file Form CT-1?

A: Yes, if you are involved in any termination, renewal, acquisition, or sale of cable franchise agreements in Virginia.

Q: Are there any deadlines for filing Form CT-1?

A: Yes, you must file Form CT-1 within 60 days of the termination, renewal, acquisition, or sale of the cable franchise agreements.

Q: What happens if I don't file Form CT-1?

A: Failure to file Form CT-1 may result in penalties and interest.

Q: Is there a fee for filing Form CT-1?

A: No, there is no fee for filing Form CT-1.

Q: Who should I contact for more information about Form CT-1?

A: You can contact the Virginia Department of Taxation for more information about Form CT-1.

Form Details:

- Released on April 1, 2013;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.