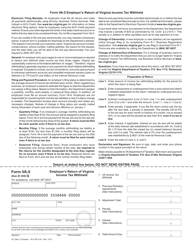

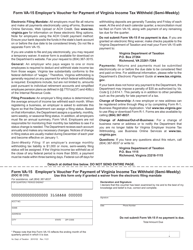

This version of the form is not currently in use and is provided for reference only. Download this version of

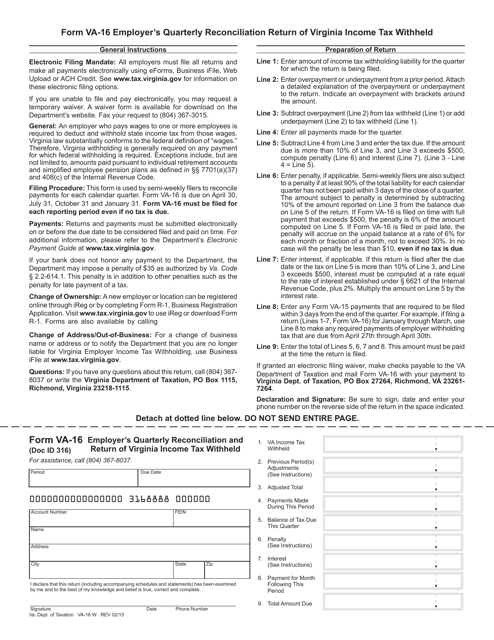

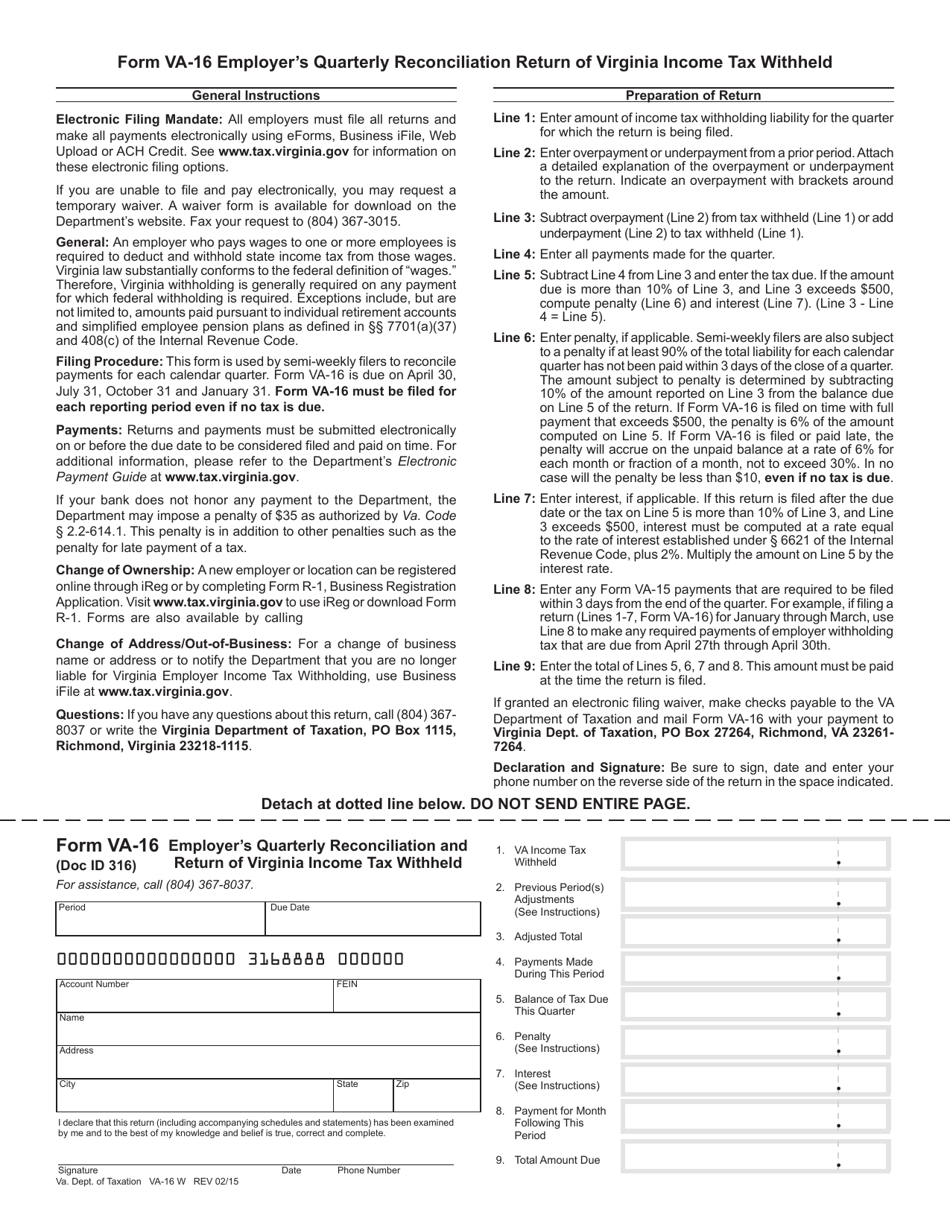

Form VA-16

for the current year.

Form VA-16 Employer's Quarterly Reconciliation and Return of Virginia Income Tax Withheld - Virginia

What Is Form VA-16?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

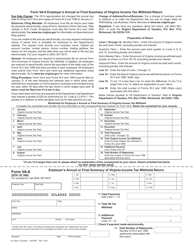

Q: What is form VA-16?

A: Form VA-16 is the Employer's Quarterly Reconciliation and Return of Virginia Income Tax Withheld.

Q: Who is required to file form VA-16?

A: Employers in Virginia who withhold income tax from employee wages are required to file form VA-16.

Q: What is the purpose of form VA-16?

A: The purpose of form VA-16 is to report and reconcile the amount of Virginia income tax withheld from employee wages.

Q: When is form VA-16 due?

A: Form VA-16 is due on a quarterly basis. It must be filed by the last day of the month following the end of each calendar quarter.

Q: What information do I need to complete form VA-16?

A: To complete form VA-16, you will need information about your employees, the amount of income tax withheld from their wages, and other relevant payroll information.

Q: Are there any penalties for not filing form VA-16?

A: Yes, there are penalties for failure to file or late filing of form VA-16. It is important to submit the form by the due date to avoid these penalties.

Form Details:

- Released on February 1, 2015;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VA-16 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.