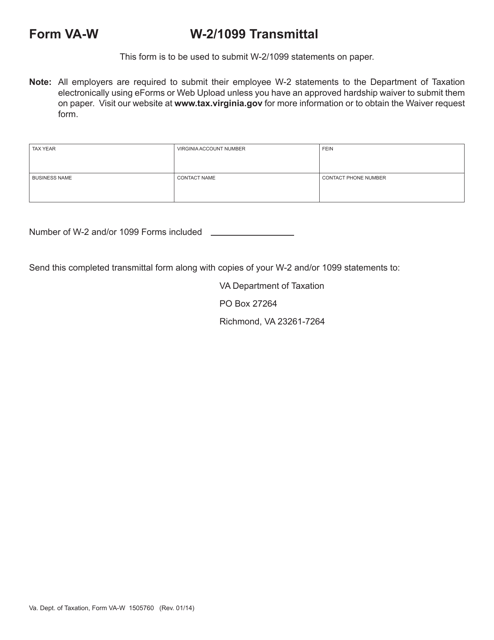

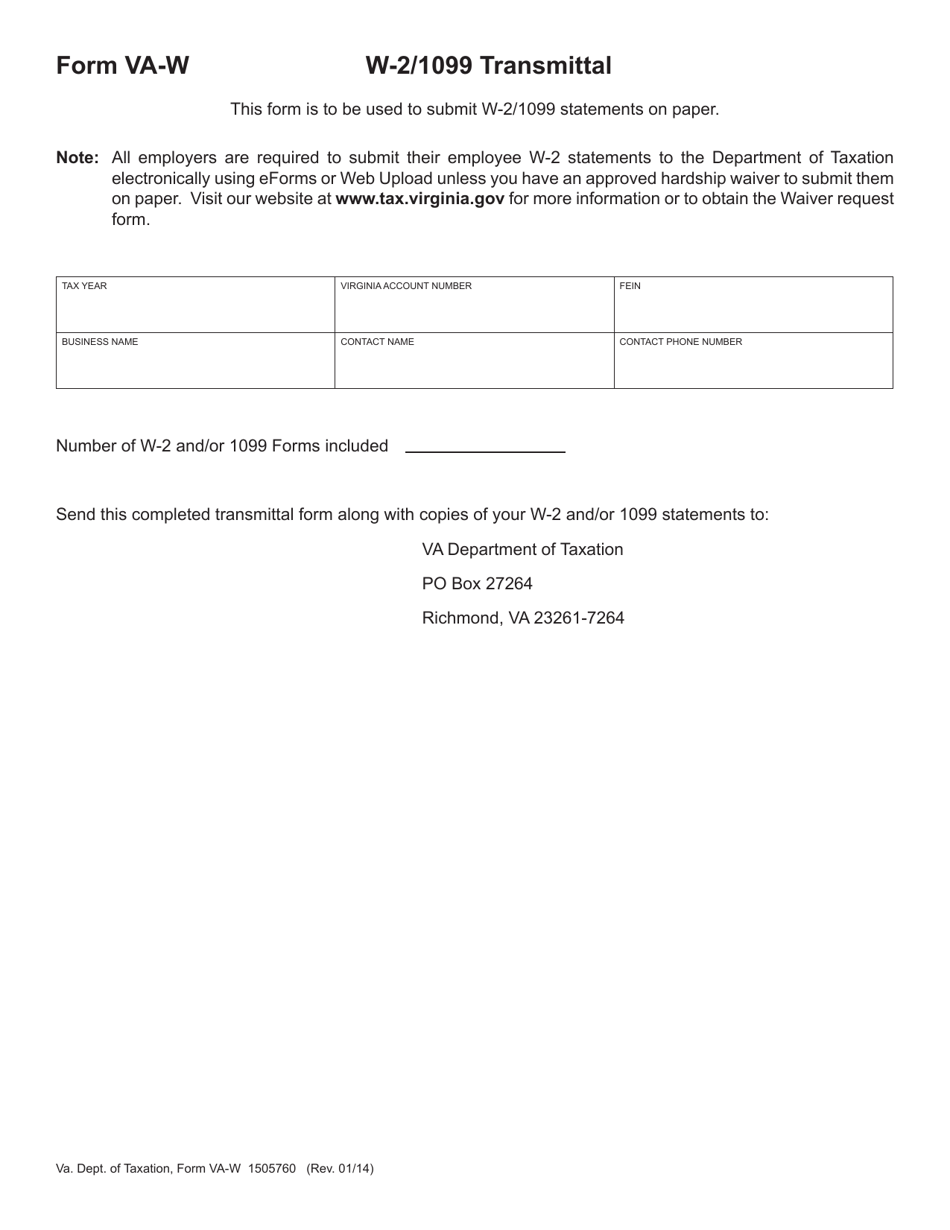

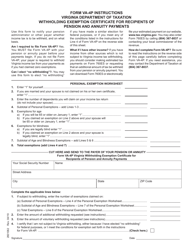

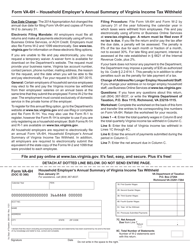

Form VA-W Withholding Transmittal for Submitting Paper W-2 & 1099 Forms - Virginia

What Is Form VA-W?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form VA-W?

A: Form VA-W is a withholding transmittal used in the state of Virginia.

Q: What is the purpose of form VA-W?

A: The purpose of form VA-W is to submit paper W-2 and 1099 forms to the state of Virginia.

Q: Who needs to file form VA-W?

A: Employers who are required to file W-2 and 1099 forms in Virginia.

Q: When is form VA-W due?

A: Form VA-W is due on or before January 31st each year.

Q: Do I need to include payment with form VA-W?

A: No, form VA-W is only used for transmitting paper forms, not for making payments.

Q: Are electronic filings accepted for form VA-W?

A: No, form VA-W is specifically for paper filings.

Q: Are there any penalties for late or incorrect filings of form VA-W?

A: Yes, there are penalties for late or incorrect filings of form VA-W. It is important to file on time and ensure accuracy.

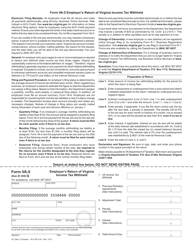

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VA-W by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.