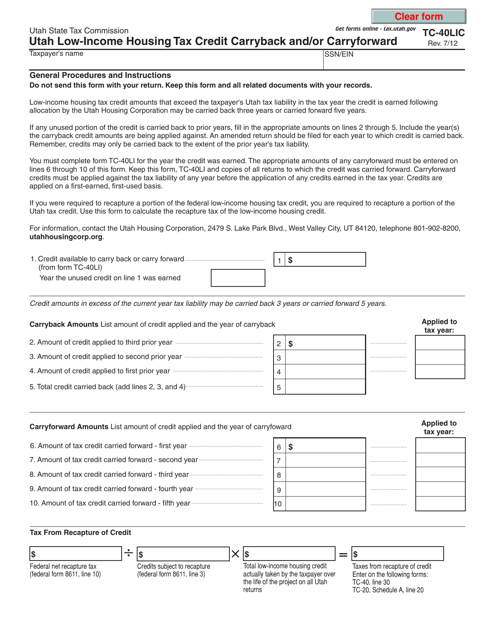

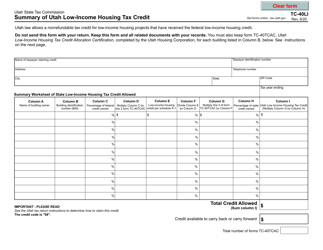

Form TC-40LIC Utah Low-Income Housing Tax Credit Carryback and / or Carryforward - Utah

What Is Form TC-40LIC?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-40LIC?

A: Form TC-40LIC is a tax form in Utah specifically for low-income housing tax credit carryback and/or carryforward.

Q: What is the purpose of Form TC-40LIC?

A: The purpose of Form TC-40LIC is to carry back or carry forward unused low-income housing tax credits in Utah.

Q: Who needs to file Form TC-40LIC?

A: Individuals or businesses that have unused low-income housing tax credits in Utah may need to file Form TC-40LIC.

Q: How do I file Form TC-40LIC?

A: Form TC-40LIC can be filed by completing the form and submitting it to the Utah State Tax Commission.

Q: Is there a deadline for filing Form TC-40LIC?

A: Yes, Form TC-40LIC must be filed by the due date for filing Utah income tax returns.

Q: Are there any penalties for not filing Form TC-40LIC?

A: Failure to file Form TC-40LIC may result in the loss of low-income housing tax credits.

Q: Can I carry back or carry forward low-income housing tax credits in Utah?

A: Yes, you can carry back or carry forward unused low-income housing tax credits in Utah using Form TC-40LIC.

Q: Can I apply low-income housing tax credits to future years' tax liabilities?

A: Yes, you can apply unused low-income housing tax credits to future years' tax liabilities in Utah.

Q: Who can I contact for more information about Form TC-40LIC?

A: For more information about Form TC-40LIC, you can contact the Utah State Tax Commission.

Form Details:

- Released on July 1, 2012;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-40LIC by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.