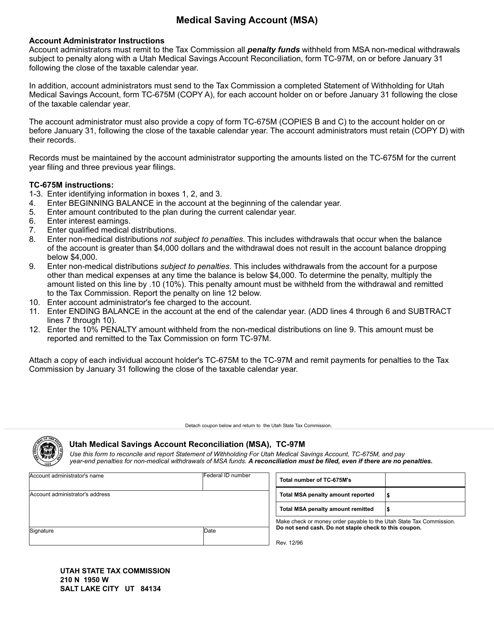

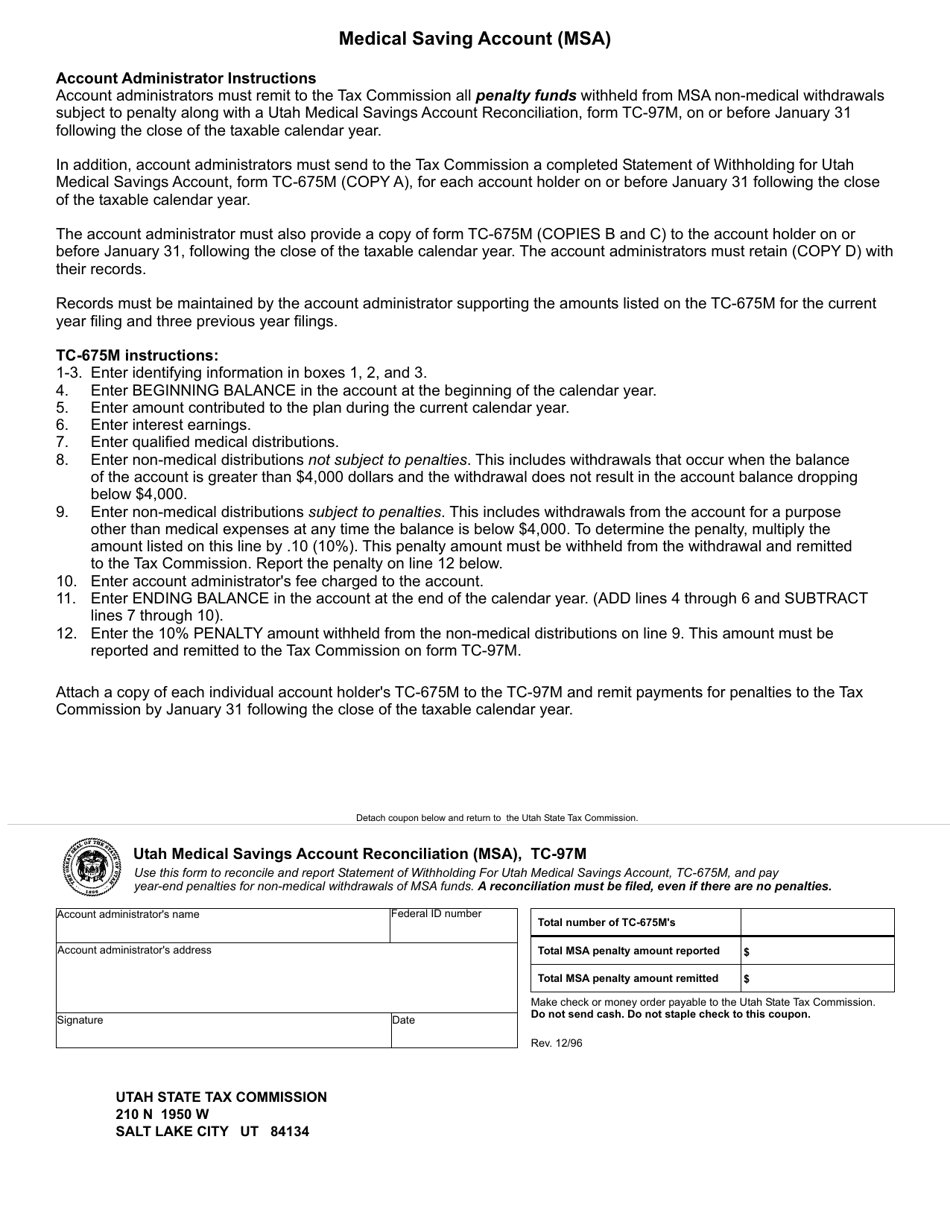

Form TC-97M Utah Medical Savings Account Reconciliation (Msa) - Utah

What Is Form TC-97M?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the TC-97M form?

A: The TC-97M is the Utah Medical Savings Account Reconciliation (MSA) form.

Q: What is a Medical Savings Account (MSA)?

A: A Medical Savings Account (MSA) is a type of savings account that allows individuals to set aside money for medical expenses.

Q: What is the purpose of the TC-97M form?

A: The purpose of the TC-97M form is to reconcile the medical savings account contributions and distributions made by an individual.

Q: Who needs to file the TC-97M form?

A: Any individual who has a medical savings account in Utah needs to file the TC-97M form.

Q: When is the TC-97M form due?

A: The TC-97M form is due on April 15th of the following year.

Q: What information do I need to complete the TC-97M form?

A: You will need information about your medical savings account contributions and distributions made during the tax year.

Q: Are there any penalties for not filing the TC-97M form?

A: Yes, there may be penalties for not filing the TC-97M form or for underreporting your medical savings account activity.

Q: Who can I contact for help with the TC-97M form?

A: You can contact the Utah State Tax Commission for assistance with the TC-97M form.

Form Details:

- Released on December 1, 1996;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TC-97M by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.