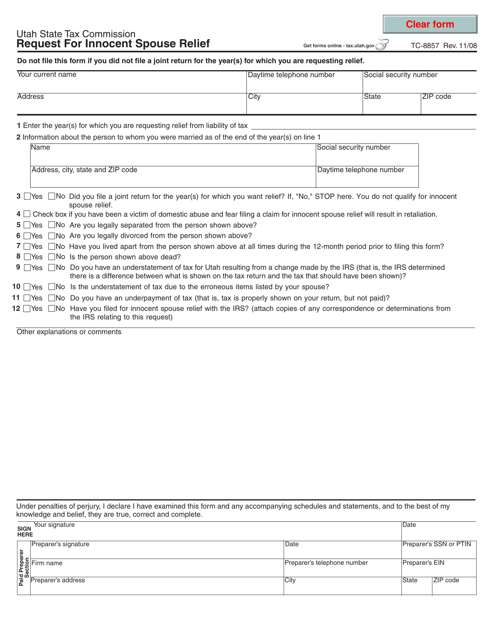

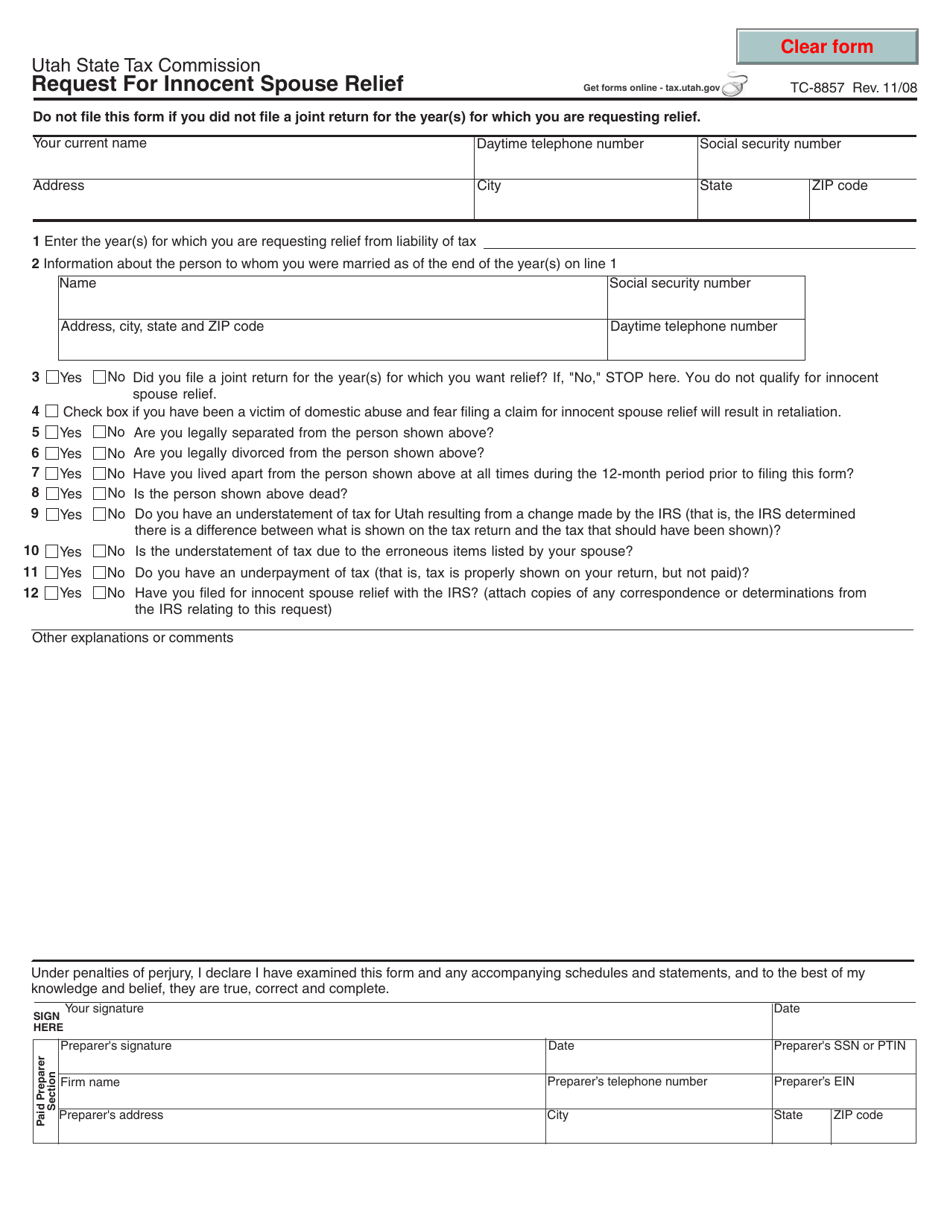

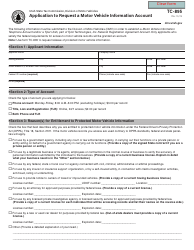

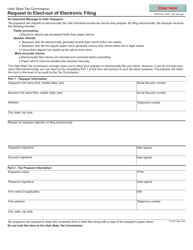

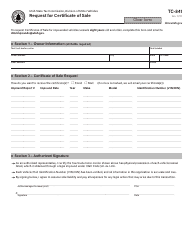

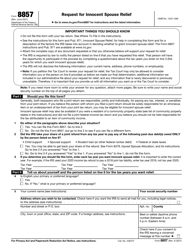

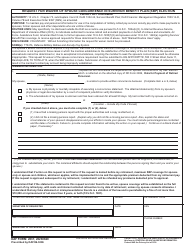

Form TC-8857 Request for Innocent Spouse Relief - Utah

What Is Form TC-8857?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-8857?

A: Form TC-8857 is a document used to request innocent spouse relief in Utah.

Q: What is innocent spouse relief?

A: Innocent spouse relief is a provision in tax law that allows a taxpayer to be relieved of joint tax liabilities if their spouse or former spouse failed to report income, reported income incorrectly, or claimed improper deductions or credits.

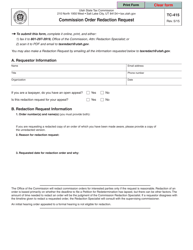

Q: Who can file Form TC-8857?

A: Taxpayers in Utah who believe they qualify for innocent spouse relief can file Form TC-8857.

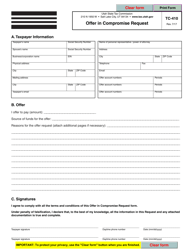

Q: What information is required on Form TC-8857?

A: Form TC-8857 requires personal information about the taxpayer and their spouse, details about the joint tax return in question, and an explanation of why innocent spouse relief is being requested.

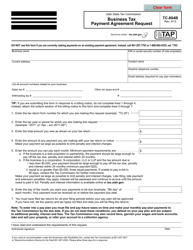

Q: Are there any fees associated with filing Form TC-8857?

A: There are no fees associated with filing Form TC-8857 in Utah.

Q: What should I do after filing Form TC-8857?

A: After filing Form TC-8857, the taxpayer should wait for a response from the Utah State Tax Commission. They may be contacted for additional information or documentation to support their request for innocent spouse relief.

Q: Is innocent spouse relief guaranteed if I file Form TC-8857?

A: The granting of innocent spouse relief is determined by the Utah State Tax Commission based on the facts and circumstances of each individual case. Filing Form TC-8857 does not guarantee that relief will be granted.

Q: Can I file Form TC-8857 electronically?

A: As of now, Utah does not offer electronic filing for Form TC-8857. It must be filed by mail or in person.

Q: Is Form TC-8857 specific to Utah?

A: Yes, Form TC-8857 is specific to Utah. Other states may have their own forms and procedures for requesting innocent spouse relief.

Form Details:

- Released on November 1, 2008;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-8857 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.