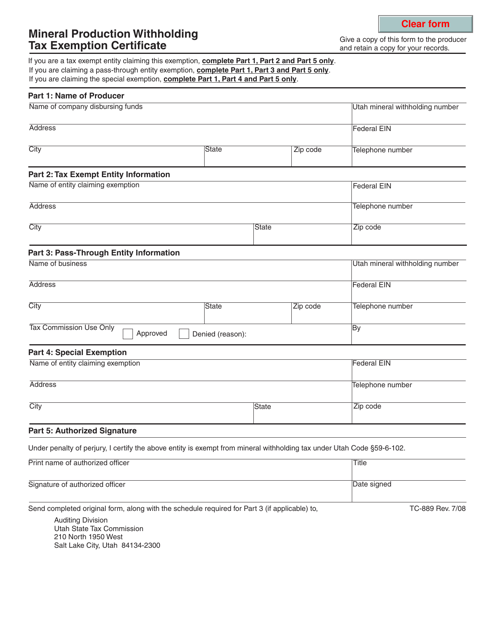

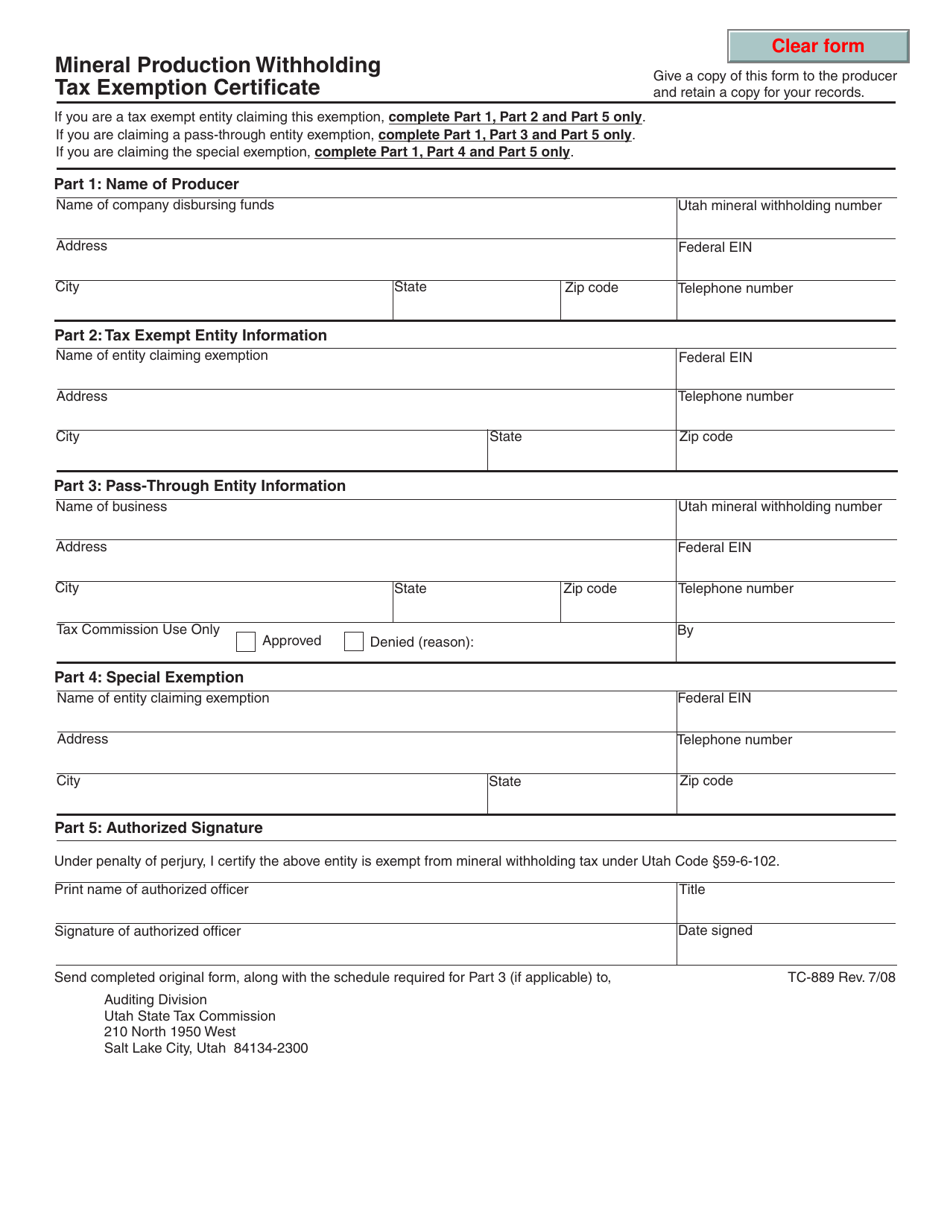

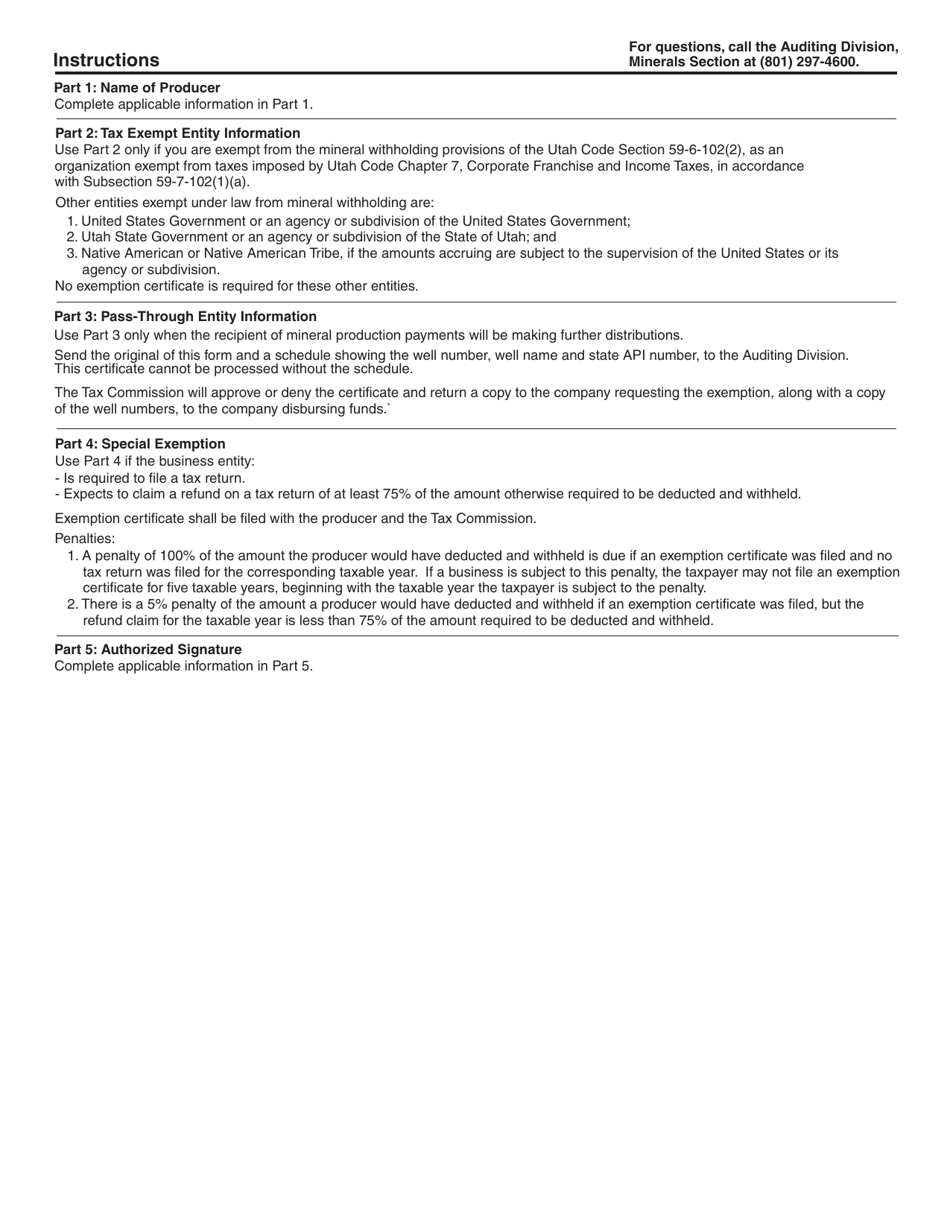

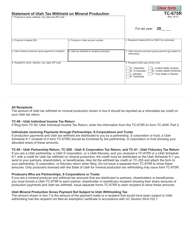

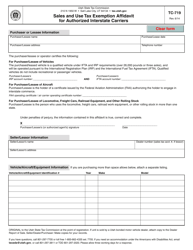

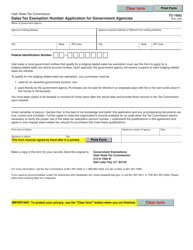

Form TC-889 Mineral Production Withholding Tax Exemption Certificate - Utah

What Is Form TC-889?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-889?

A: Form TC-889 is the Mineral Production Withholding Tax Exemption Certificate for Utah.

Q: What is the purpose of Form TC-889?

A: The purpose of Form TC-889 is to claim an exemption from the Mineral Production Withholding Tax in Utah.

Q: Who should fill out Form TC-889?

A: Form TC-889 should be filled out by individuals or entities who are eligible for an exemption from the Mineral Production Withholding Tax in Utah.

Q: What information is required on Form TC-889?

A: Form TC-889 requires information such as the taxpayer's name, address, social security or taxpayer identification number, and details about the mineral production.

Q: When should Form TC-889 be filed?

A: Form TC-889 should be filed prior to the first payment or withholding of the mineral production proceeds.

Q: Is there a fee for filing Form TC-889?

A: No, there is no fee for filing Form TC-889.

Q: Are there any penalties for not filing Form TC-889?

A: Yes, failure to file Form TC-889 may result in penalties imposed by the Utah State Tax Commission.

Q: How long is Form TC-889 valid?

A: Form TC-889 is valid until revoked or superseded.

Form Details:

- Released on July 1, 2008;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-889 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.