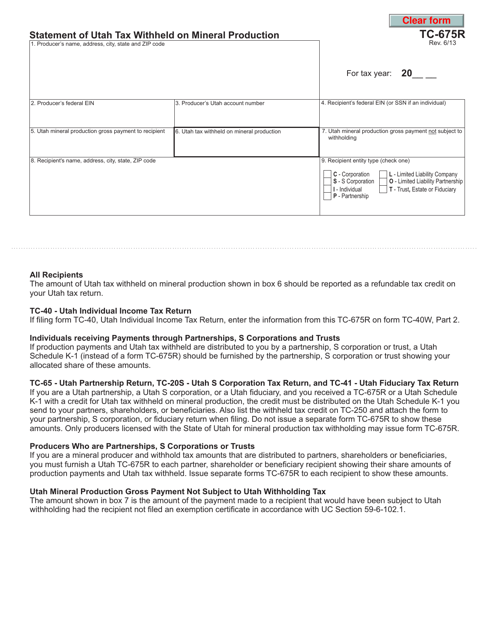

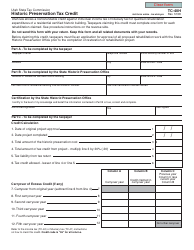

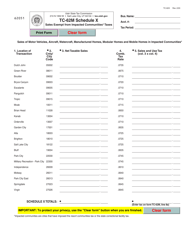

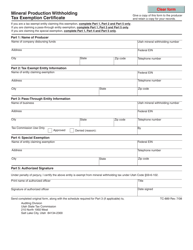

Form TC-675R Statement of Utah Tax Withheld on Mineral Production - Utah

What Is Form TC-675R?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-675R?

A: Form TC-675R is the Statement of Utah Tax Withheld on Mineral Production.

Q: Who needs to file Form TC-675R?

A: Any person or entity who withholds tax on mineral production in Utah needs to file Form TC-675R.

Q: What is the purpose of Form TC-675R?

A: The purpose of Form TC-675R is to report and remit the tax withheld on mineral production in Utah.

Q: When is Form TC-675R due?

A: Form TC-675R is due on or before the last day of the month following the end of the calendar quarter.

Q: Is Form TC-675R mandatory?

A: If you withhold tax on mineral production in Utah, filing Form TC-675R is mandatory.

Q: Are there any penalties for not filing Form TC-675R?

A: Yes, there are penalties for failure to file Form TC-675R or for filing late or incomplete forms.

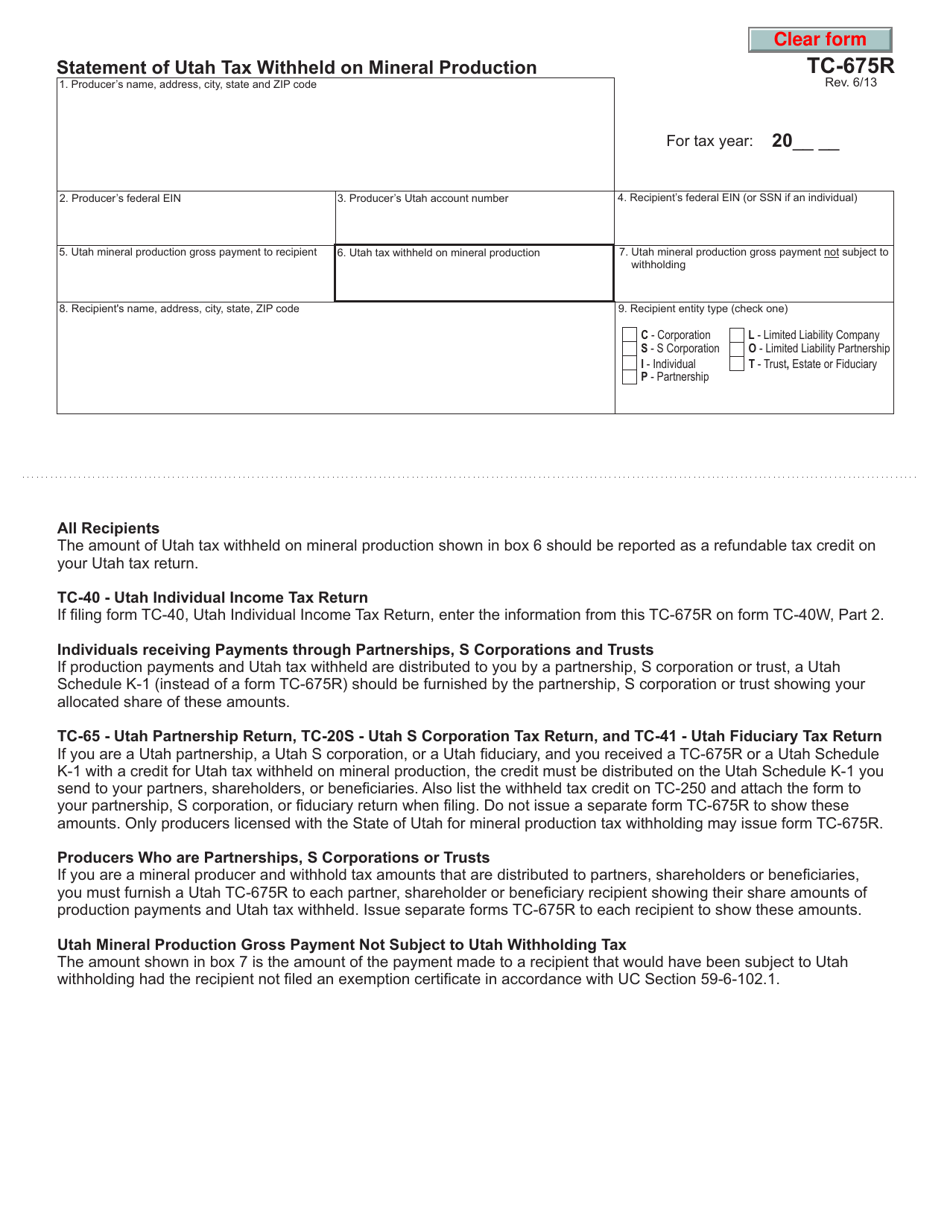

Q: What information is required on Form TC-675R?

A: Form TC-675R requires information such as taxpayer identification number, period covered, total tax withheld, and detailed information about each payee.

Form Details:

- Released on June 1, 2013;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-675R by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.