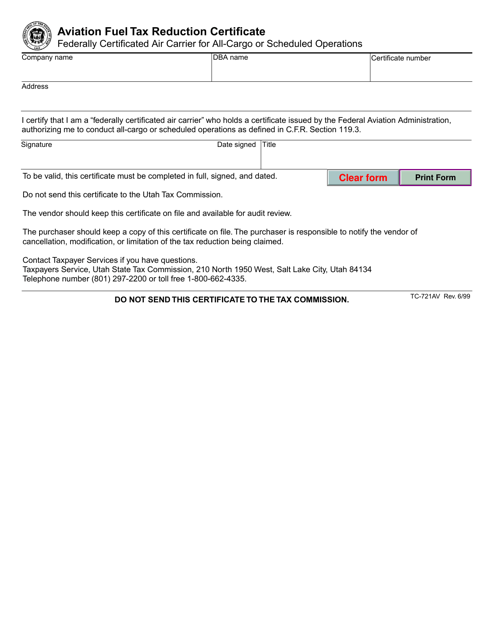

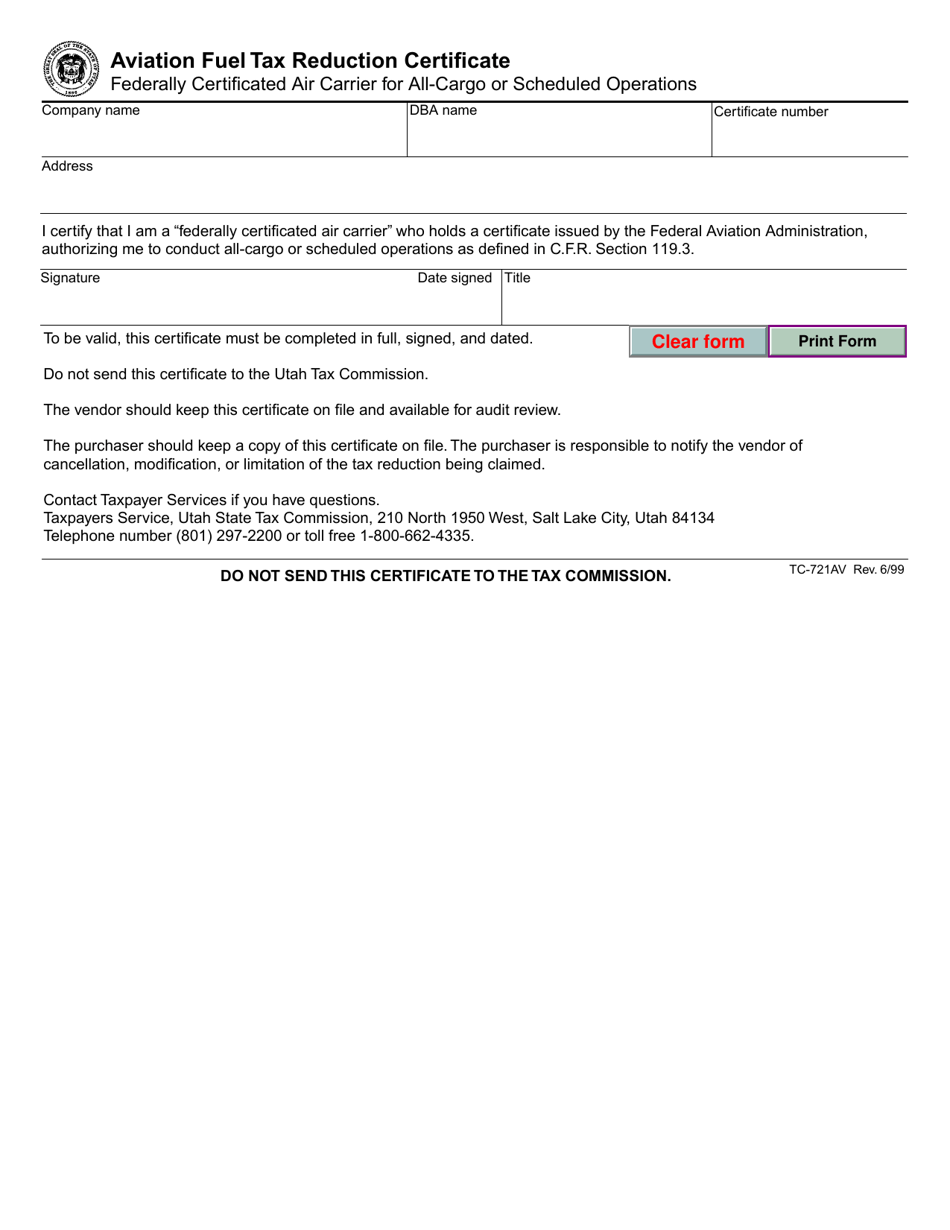

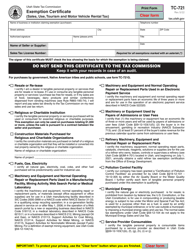

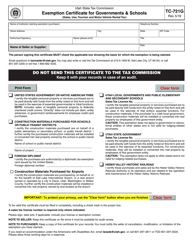

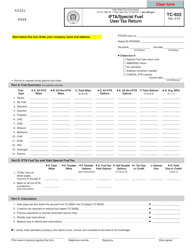

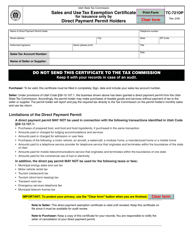

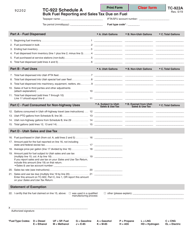

Form TC-721AV Aviation Fuel Tax Reduction Certificate - Utah

What Is Form TC-721AV?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

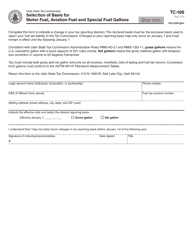

Q: What is TC-721AV?

A: TC-721AV is the abbreviation for the Aviation FuelTax Reduction Certificate form used in Utah.

Q: What is the purpose of TC-721AV?

A: The purpose of TC-721AV is to claim a reduction in aviation fuel tax.

Q: Who can use TC-721AV?

A: The TC-721AV form can be used by individuals or businesses that qualify for a reduction in aviation fuel tax.

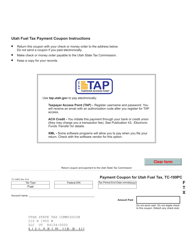

Q: How can I obtain TC-721AV?

A: You can obtain the TC-721AV form from the Utah State Tax Commission.

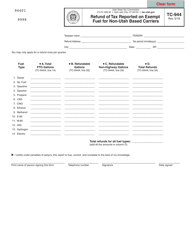

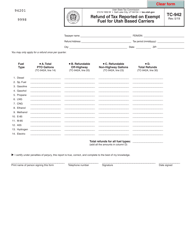

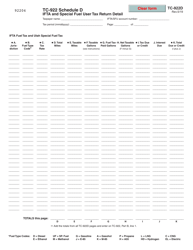

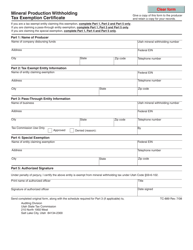

Q: What information is required on TC-721AV?

A: The TC-721AV form requires information such as the taxpayer's name, address, aviation fuel purchases, and supporting documentation.

Q: Is there a deadline for submitting TC-721AV?

A: Yes, TC-721AV must be submitted to the Utah State Tax Commission by the 15th day of the month following the reporting period.

Q: Are there any qualifications for claiming a reduction in aviation fuel tax?

A: Yes, there are specific qualifications and requirements outlined in the Utah tax laws. It's recommended to review the instructions of TC-721AV or consult with a tax professional for guidance.

Q: What are the consequences of submitting an incorrect or incomplete TC-721AV?

A: Submitting an incorrect or incomplete TC-721AV may result in penalties or additional taxes owed to the Utah State Tax Commission.

Form Details:

- Released on June 1, 1999;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-721AV by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.