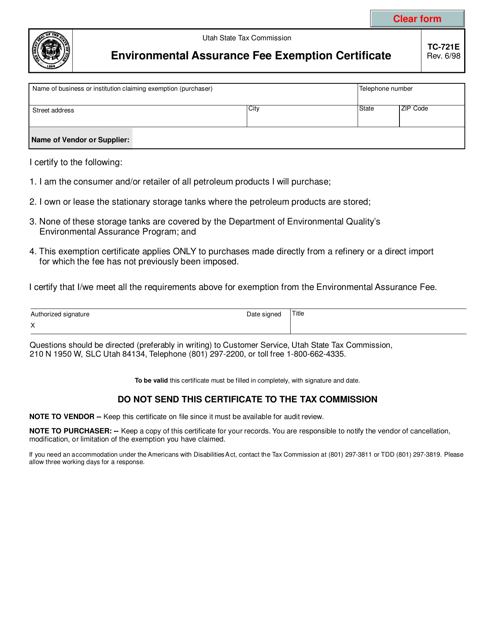

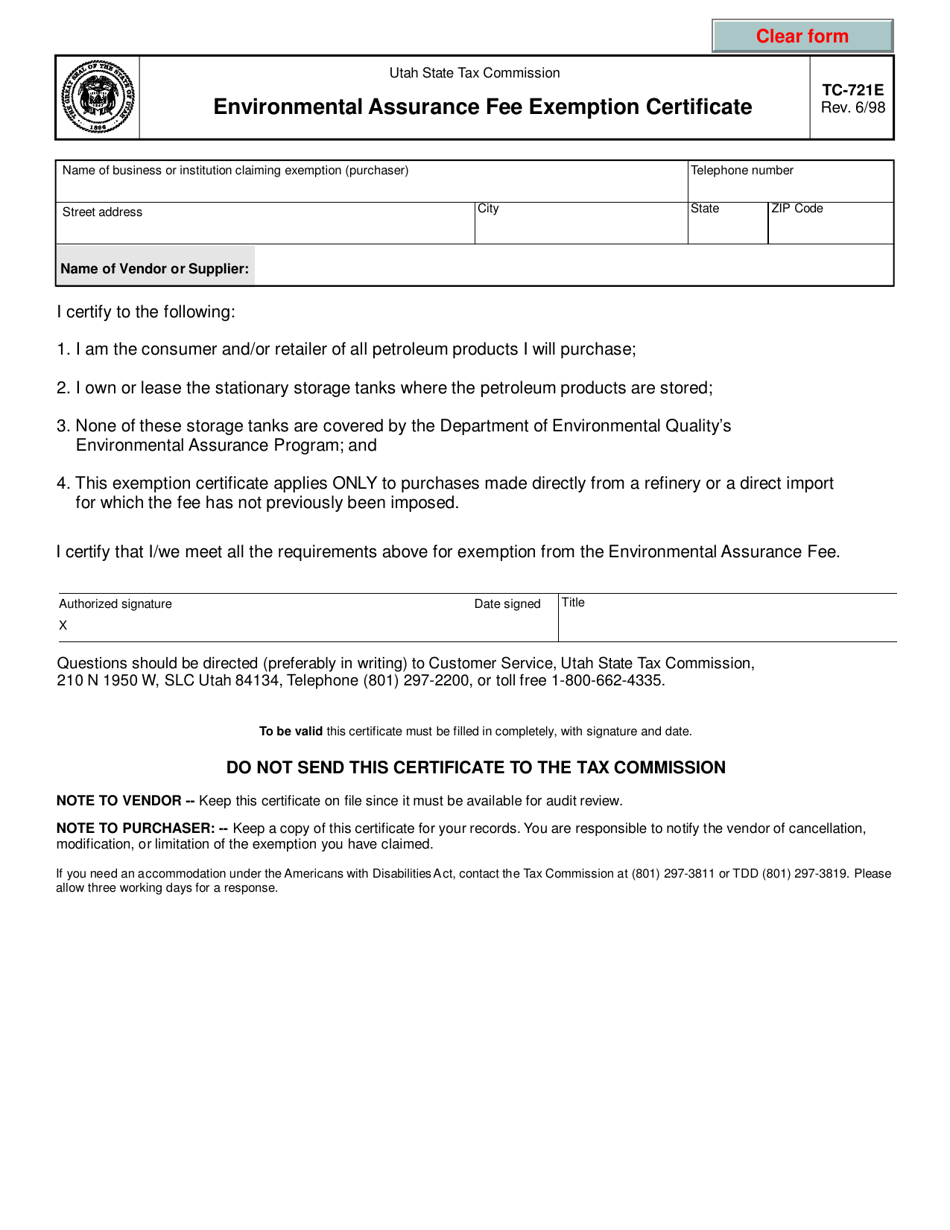

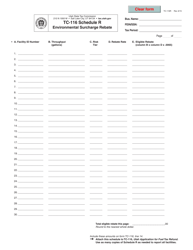

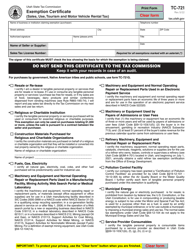

Form TC-721E Environmental Assurance Fee Exemption Certificate - Utah

What Is Form TC-721E?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

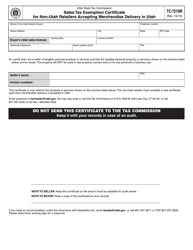

Q: What is the Environmental Assurance Fee Exemption Certificate?

A: The Environmental Assurance Fee Exemption Certificate is a form used in Utah to claim an exemption from paying environmental assurance fees.

Q: Who is eligible to claim an exemption using this form?

A: Individuals or businesses that meet certain criteria, such as being engaged in certain agricultural activities or being a registered nonprofit organization, may be eligible to claim an exemption.

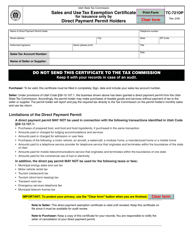

Q: What is the purpose of the environmental assurance fees?

A: The environmental assurance fees help fund the cleanup and restoration of contaminated sites in Utah.

Q: How do I fill out the form?

A: The form requires information about the applicant and the reason for claiming the exemption. Follow the instructions provided with the form to ensure accurate completion.

Q: Is there a deadline to submit the form?

A: The form should be submitted before the due date of the environmental assurance fee payment.

Q: What happens after I submit the form?

A: The Utah State Tax Commission will review your application and inform you of the decision regarding your exemption claim.

Q: Can I use this form for multiple years?

A: No, you need to submit a new form for each year you wish to claim an exemption.

Form Details:

- Released on June 1, 1998;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-721E by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.