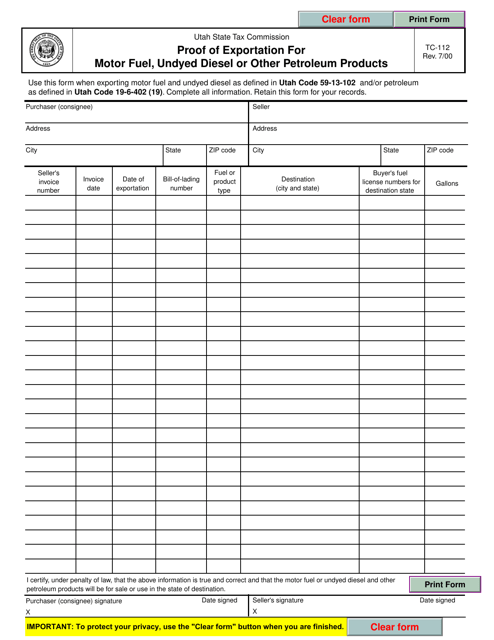

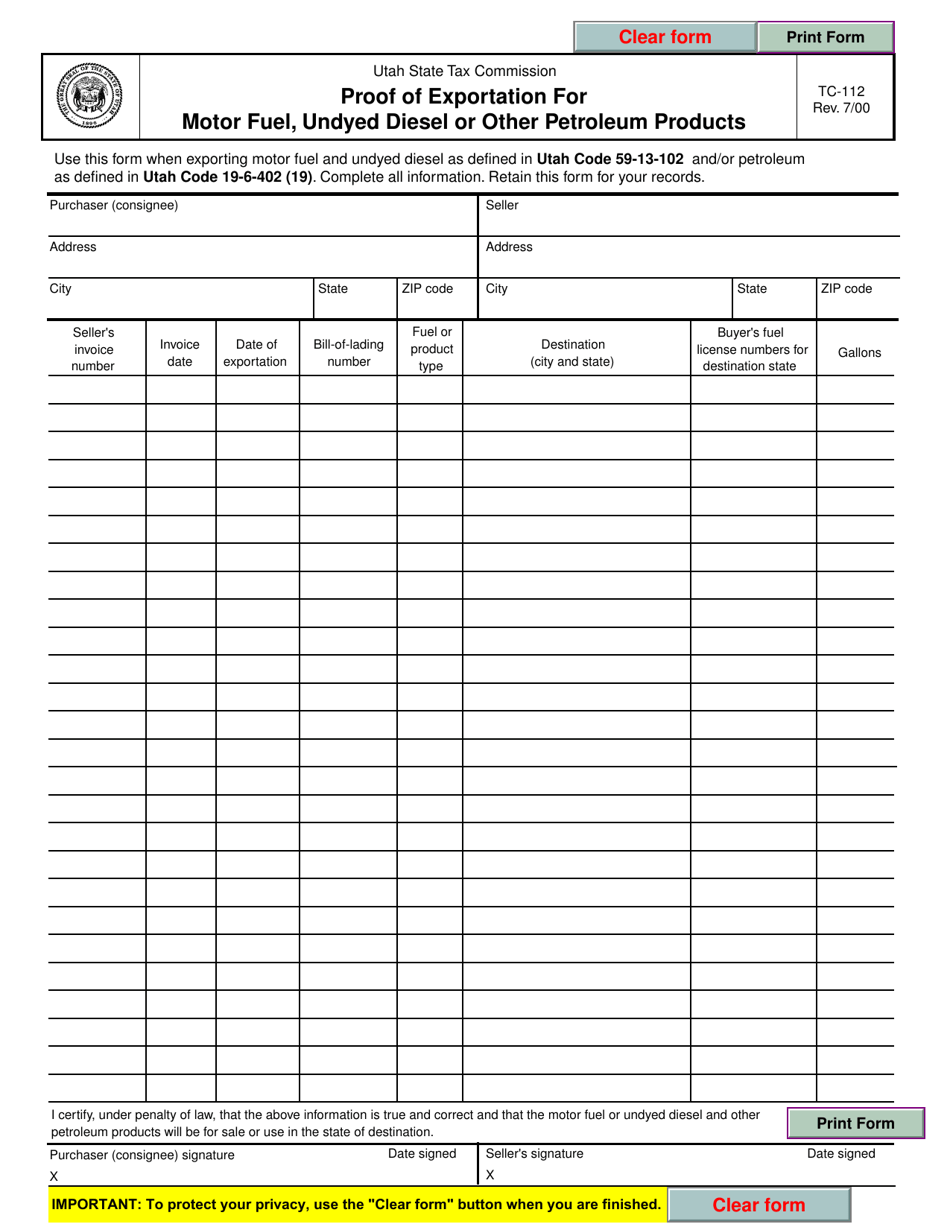

Form TC-112 Proof of Exportation for Motor Fuel, Undyed Diesel or Other Petroleum Products - Utah

What Is Form TC-112?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-112?

A: Form TC-112 is the Proof of Exportation form for motor fuel, undyed diesel, or other petroleum products in Utah.

Q: What is the purpose of Form TC-112?

A: The purpose of Form TC-112 is to provide proof of exportation for motor fuel, undyed diesel, or other petroleum products in Utah.

Q: Who needs to file Form TC-112?

A: Anyone who exports motor fuel, undyed diesel, or other petroleum products in Utah needs to file Form TC-112.

Q: Are there any fees associated with filing Form TC-112?

A: No, there are no fees associated with filing Form TC-112.

Q: What information is required on Form TC-112?

A: Form TC-112 requires information such as the exporter's name, address, and contact information, as well as details about the exported products.

Q: When should Form TC-112 be filed?

A: Form TC-112 should be filed within 10 days of the date of exportation.

Q: Is Form TC-112 required for all types of petroleum products?

A: Yes, Form TC-112 is required for motor fuel, undyed diesel, and other petroleum products.

Q: What happens if I fail to file Form TC-112?

A: Failing to file Form TC-112 may result in penalties and potentially legal consequences.

Form Details:

- Released on July 1, 2000;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-112 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.