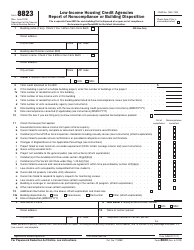

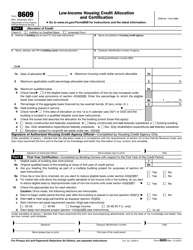

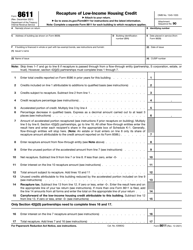

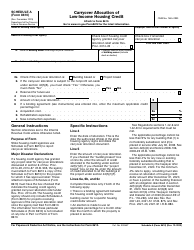

This version of the form is not currently in use and is provided for reference only. Download this version of

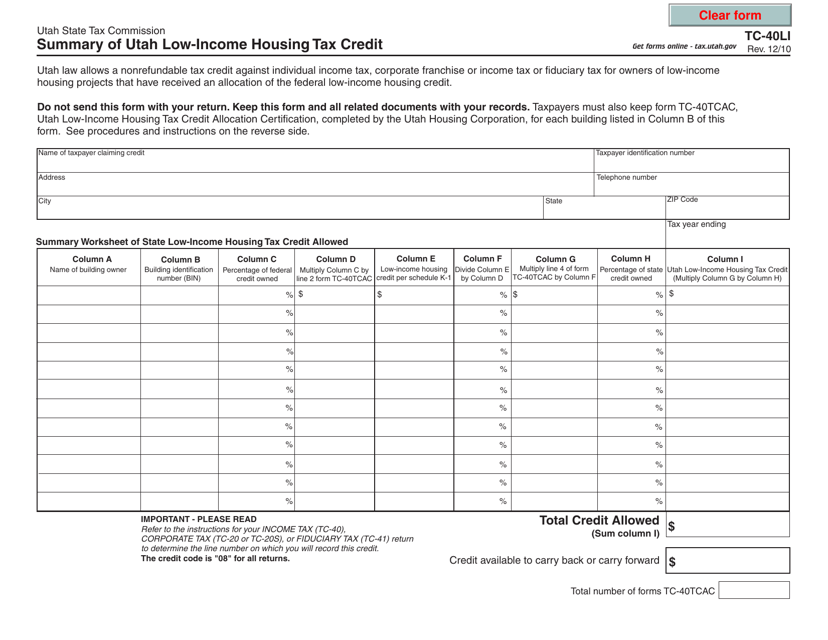

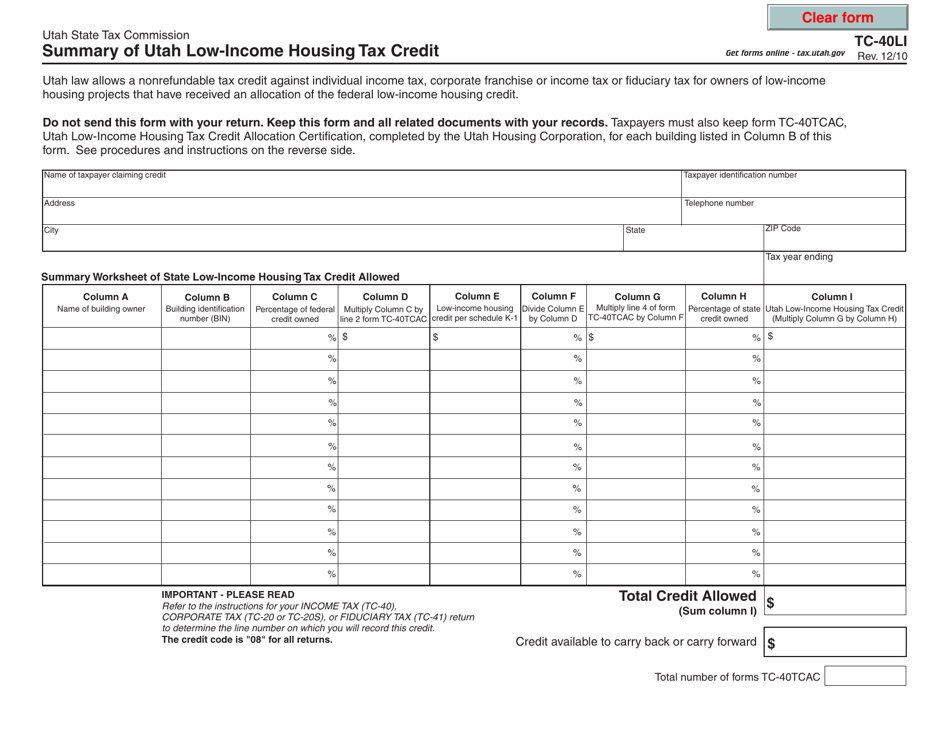

Form TC-40LI

for the current year.

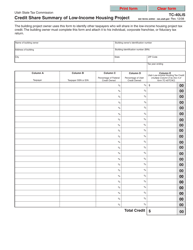

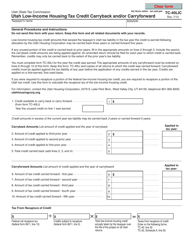

Form TC-40LI Summary of Utah Low-Income Housing Tax Credit - Utah

What Is Form TC-40LI?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the TC-40LI form?

A: The TC-40LI form is the Summary of Utah Low-Income Housing Tax Credit.

Q: What is the purpose of the TC-40LI form?

A: The purpose of the TC-40LI form is to provide a summary of Utah Low-Income Housing Tax Credit.

Q: Who needs to file the TC-40LI form?

A: Individuals or organizations involved in low-income housing projects in Utah may need to file the TC-40LI form.

Q: When is the deadline to file the TC-40LI form?

A: The deadline to file the TC-40LI form is typically the same as the deadline for Utah state income tax returns.

Q: Are there any fees associated with filing the TC-40LI form?

A: There are no specific fees associated with filing the TC-40LI form.

Q: Do I need to attach any supporting documents with the TC-40LI form?

A: You may need to attach supporting documents, such as project financial statements, to the TC-40LI form depending on the requirements of the Utah State Tax Commission.

Q: Who can I contact for more information about the TC-40LI form?

A: For more information about the TC-40LI form, you can contact the Utah State Tax Commission directly.

Q: Can I e-file the TC-40LI form?

A: As of now, e-filing is not available for the TC-40LI form. It must be filed by mail or in person.

Q: What happens if I don't file the TC-40LI form?

A: Failure to file the TC-40LI form and comply with the Utah Low-Income Housing Tax Credit requirements may result in penalties or other legal consequences.

Q: Is the TC-40LI form only for individuals or can organizations also file it?

A: Both individuals and organizations involved in low-income housing projects in Utah can file the TC-40LI form.

Q: Is the TC-40LI form specific to Utah?

A: Yes, the TC-40LI form is specific to Utah and is used to report low-income housing tax credits in the state.

Q: What if I need assistance in completing the TC-40LI form?

A: If you need assistance in completing the TC-40LI form, you can reach out to a tax professional or contact the Utah State Tax Commission for guidance.

Q: Can I amend the TC-40LI form if I make a mistake?

A: Yes, you can file an amended TC-40LI form to correct any mistakes or omissions.

Q: Does the TC-40LI form have any eligibility criteria?

A: The eligibility criteria for the TC-40LI form are determined by the Utah State Tax Commission and may vary based on the specific requirements of low-income housing projects.

Q: Is the TC-40LI form mandatory?

A: If you are involved in low-income housing projects in Utah and have claimed a low-income housing tax credit, filing the TC-40LI form is mandatory.

Q: What other forms or documents may be required along with the TC-40LI form?

A: In addition to the TC-40LI form, you may be required to submit project financial statements or other supporting documents as determined by the Utah State Tax Commission.

Q: Can I file the TC-40LI form electronically?

A: No, currently the TC-40LI form can only be filed by mail or in person.

Q: Are there any penalties for not filing the TC-40LI form?

A: Failure to file the TC-40LI form or comply with the Utah Low-Income Housing Tax Credit requirements may result in penalties or other legal consequences.

Q: What should I do if I have additional questions about the TC-40LI form?

A: If you have additional questions about the TC-40LI form, you can contact the Utah State Tax Commission directly for further assistance.

Q: Is the TC-40LI form applicable to both individuals and businesses?

A: Yes, the TC-40LI form is applicable to both individuals and businesses involved in low-income housing projects in Utah.

Q: Can I file the TC-40LI form at a local Utah State Tax Commission office?

A: Yes, the TC-40LI form can be filed in person at a local Utah State Tax Commission office.

Q: What is the purpose of low-income housing tax credits?

A: The purpose of low-income housing tax credits is to encourage the development of affordable housing for low-income individuals and families.

Q: Are there any income limits for receiving low-income housing tax credits?

A: Yes, there are income limits that determine eligibility for low-income housing tax credits. These limits are set by the Utah State Tax Commission.

Q: Who sets the requirements for low-income housing tax credits in Utah?

A: The requirements for low-income housing tax credits in Utah are set by the Utah State Tax Commission.

Q: What is the role of the Utah State Tax Commission in relation to the TC-40LI form?

A: The Utah State Tax Commission is responsible for administering and enforcing the requirements related to the TC-40LI form and low-income housing tax credits in Utah.

Form Details:

- Released on December 1, 2010;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-40LI by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.