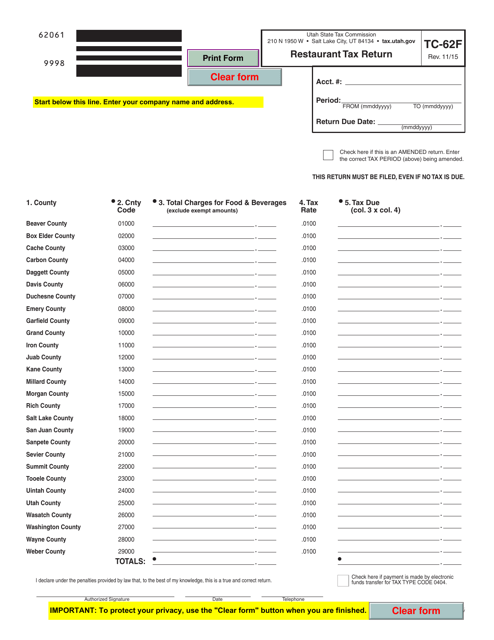

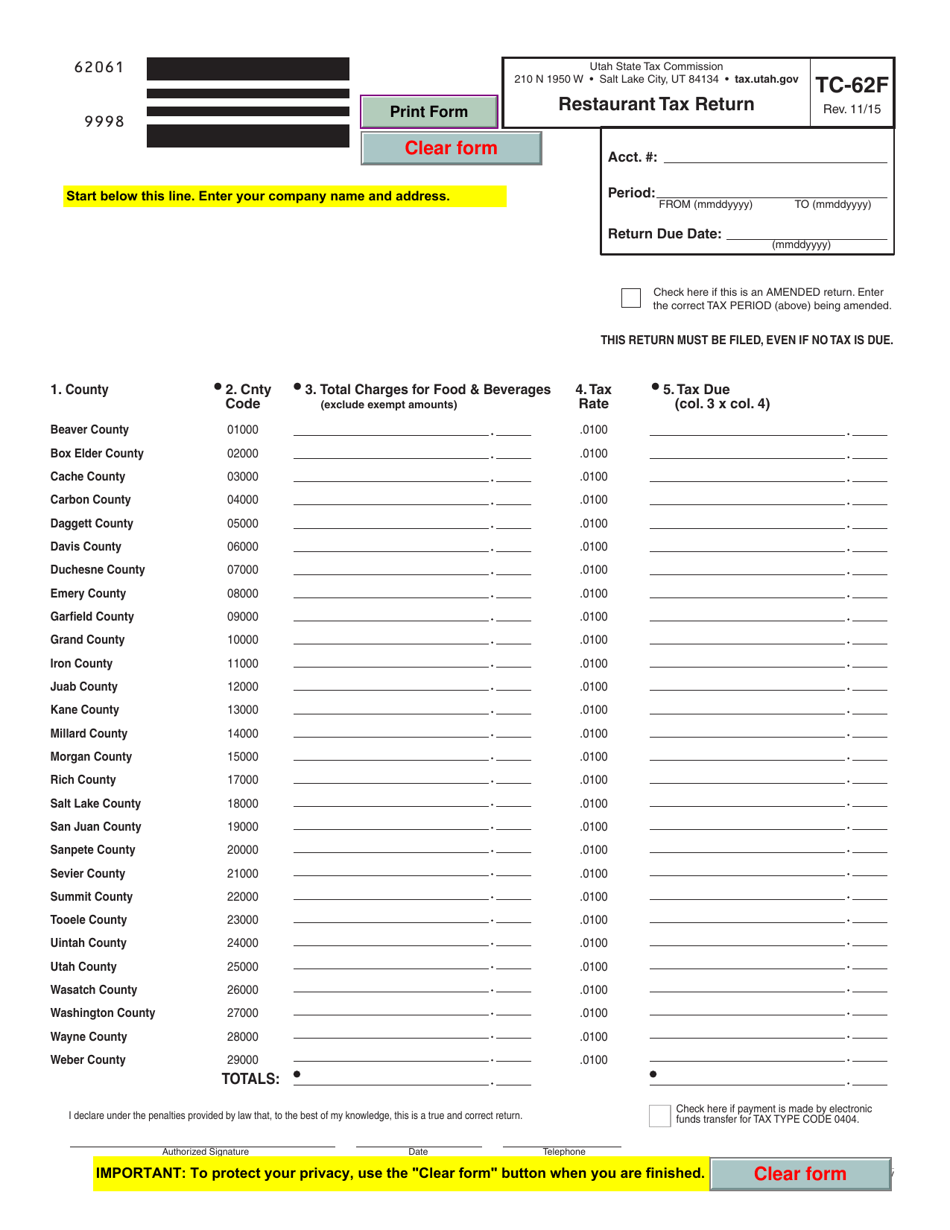

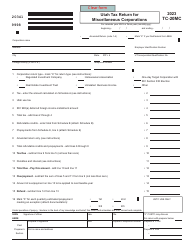

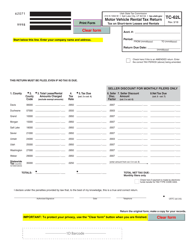

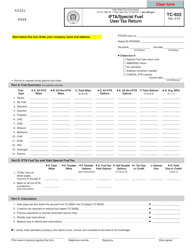

Form TC-62F Restaurant Tax Return - Utah

What Is Form TC-62F?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-62F?

A: Form TC-62F is a tax return specifically for restaurants in Utah.

Q: Who needs to file Form TC-62F?

A: Restaurants in Utah need to file Form TC-62F.

Q: What is the purpose of Form TC-62F?

A: The purpose of Form TC-62F is to report and pay taxes for restaurant sales in Utah.

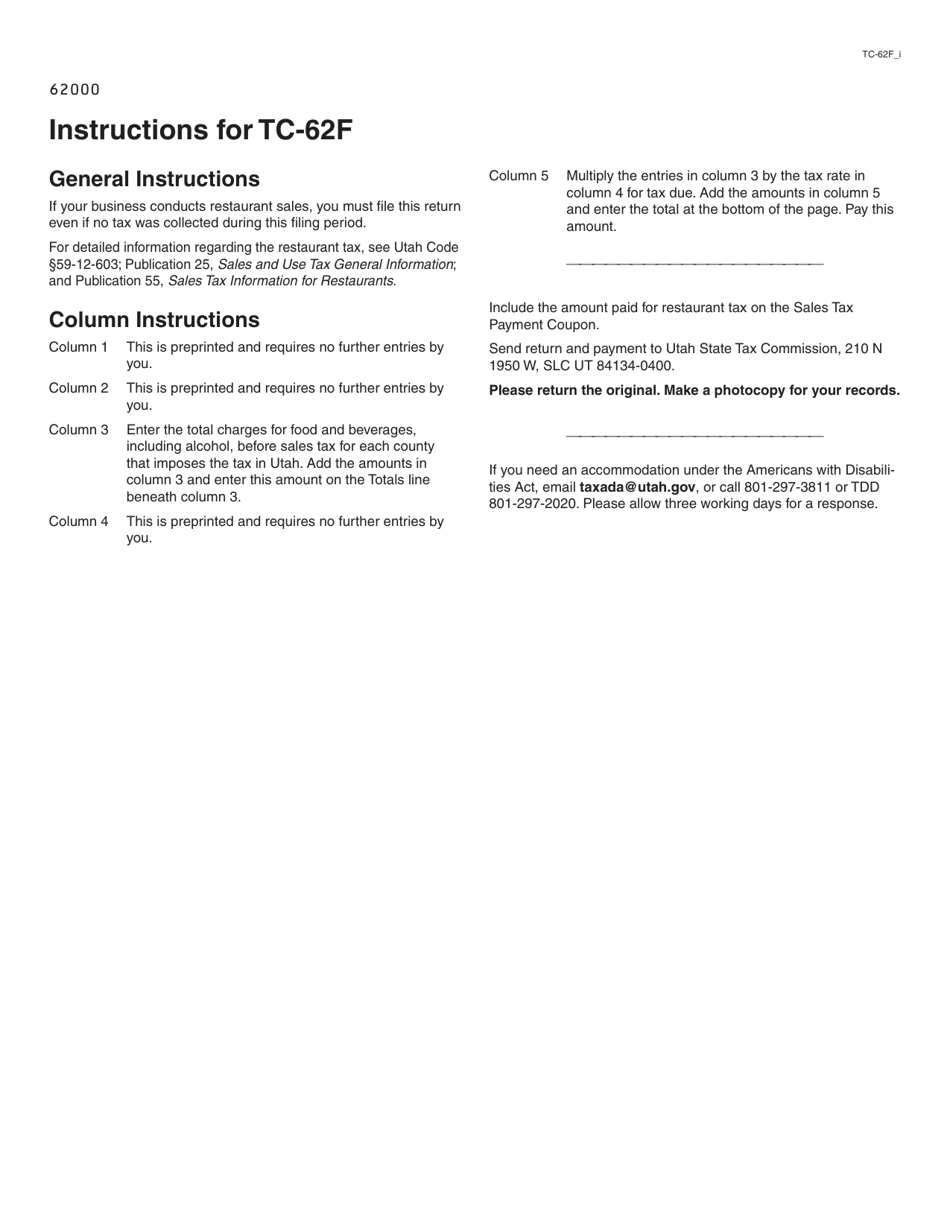

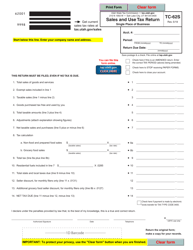

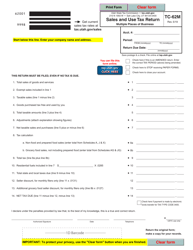

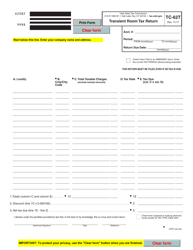

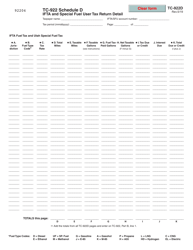

Q: What information is required on Form TC-62F?

A: Form TC-62F requires information such as total sales, taxable sales, and tax due.

Q: When is Form TC-62F due?

A: Form TC-62F is generally due on the last day of the month following the end of the reporting period.

Q: Are there any penalties for not filing Form TC-62F?

A: Yes, there may be penalties for not filing Form TC-62F or for filing it late.

Q: Is Form TC-62F only for restaurants?

A: Yes, Form TC-62F is specifically for restaurants in Utah.

Q: Are there any exemptions for restaurant sales on Form TC-62F?

A: Yes, there are some exemptions for certain types of restaurant sales. Consult the instructions for Form TC-62F for more information.

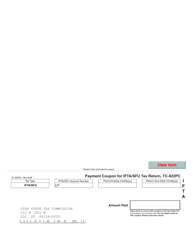

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-62F by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.