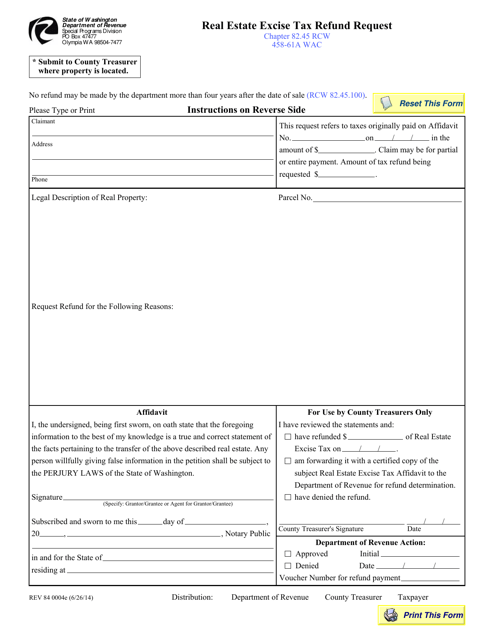

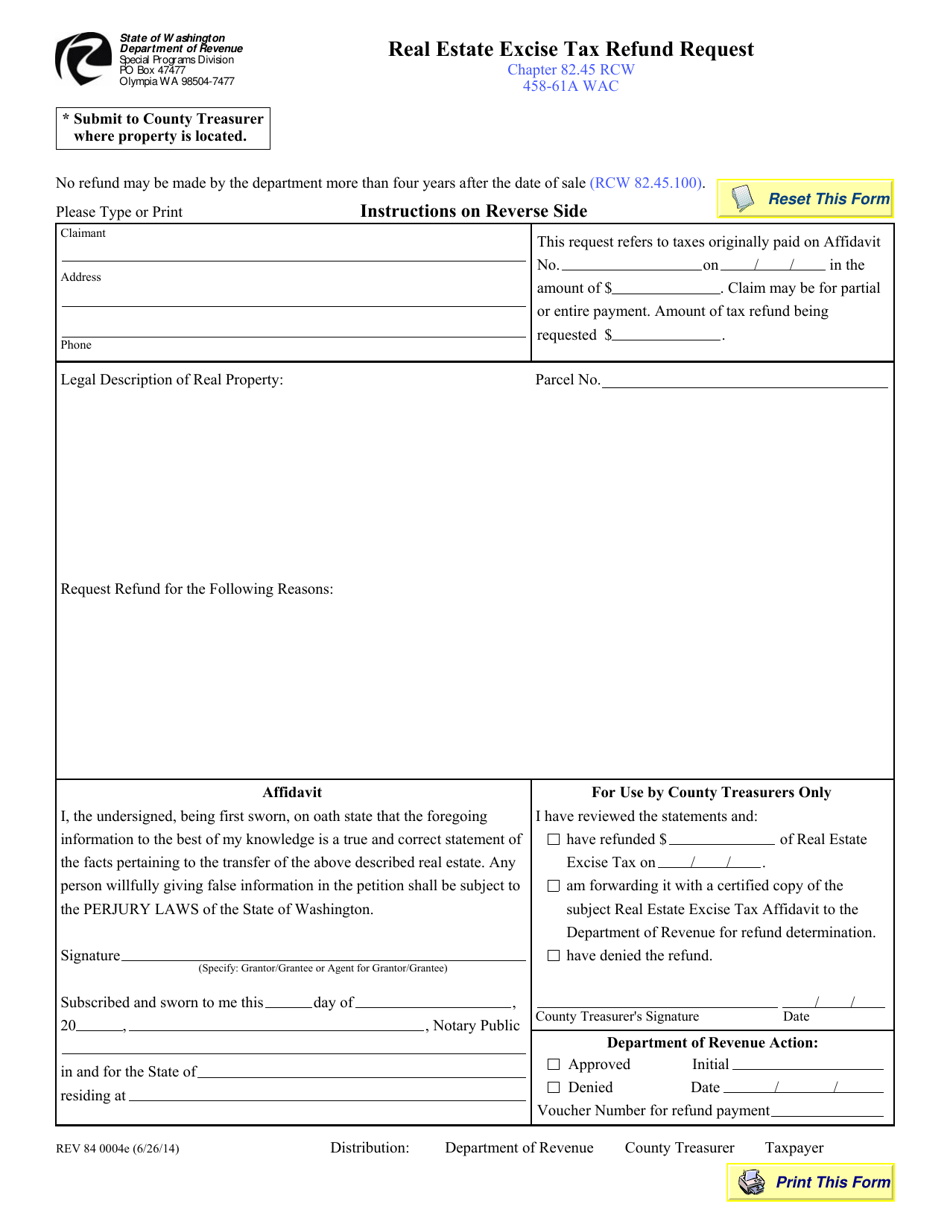

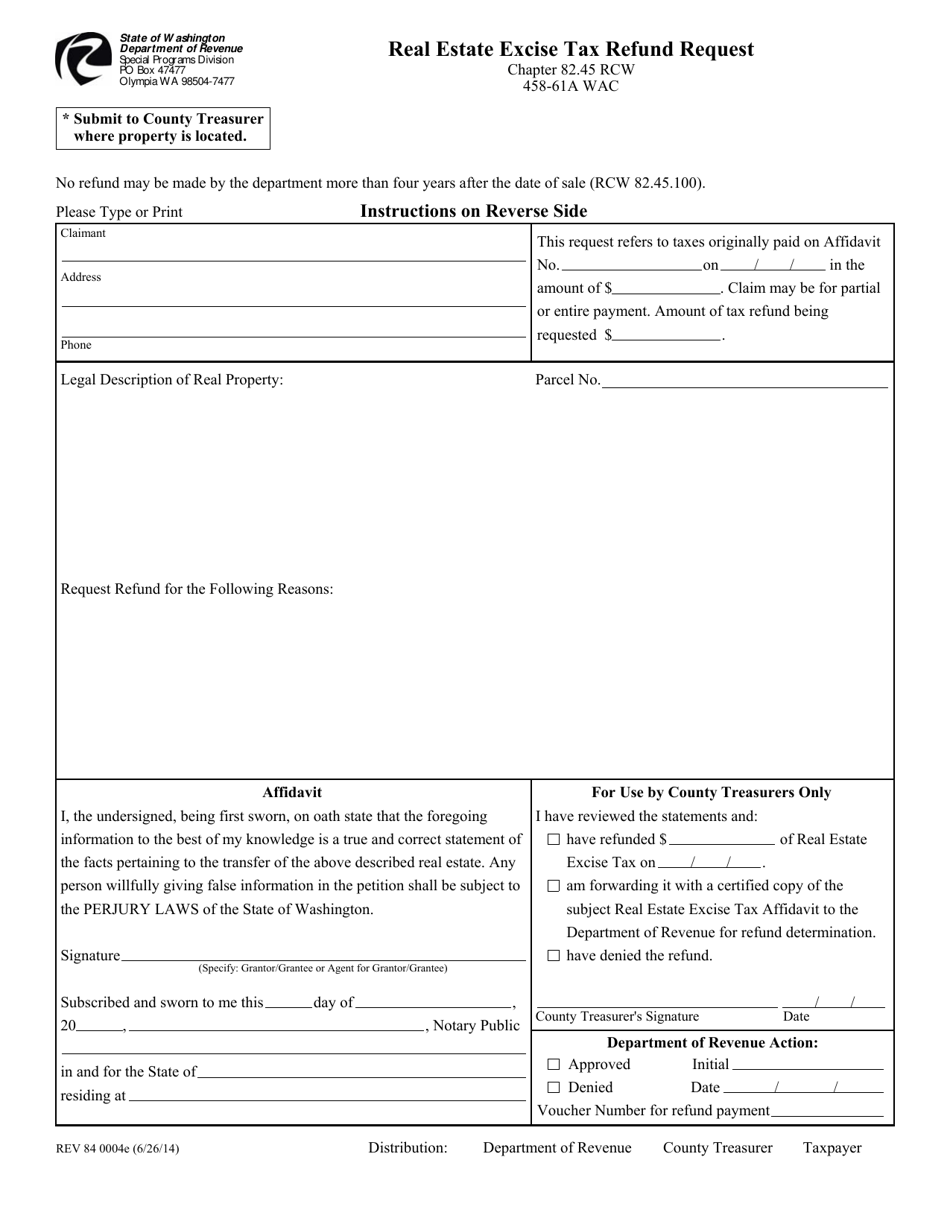

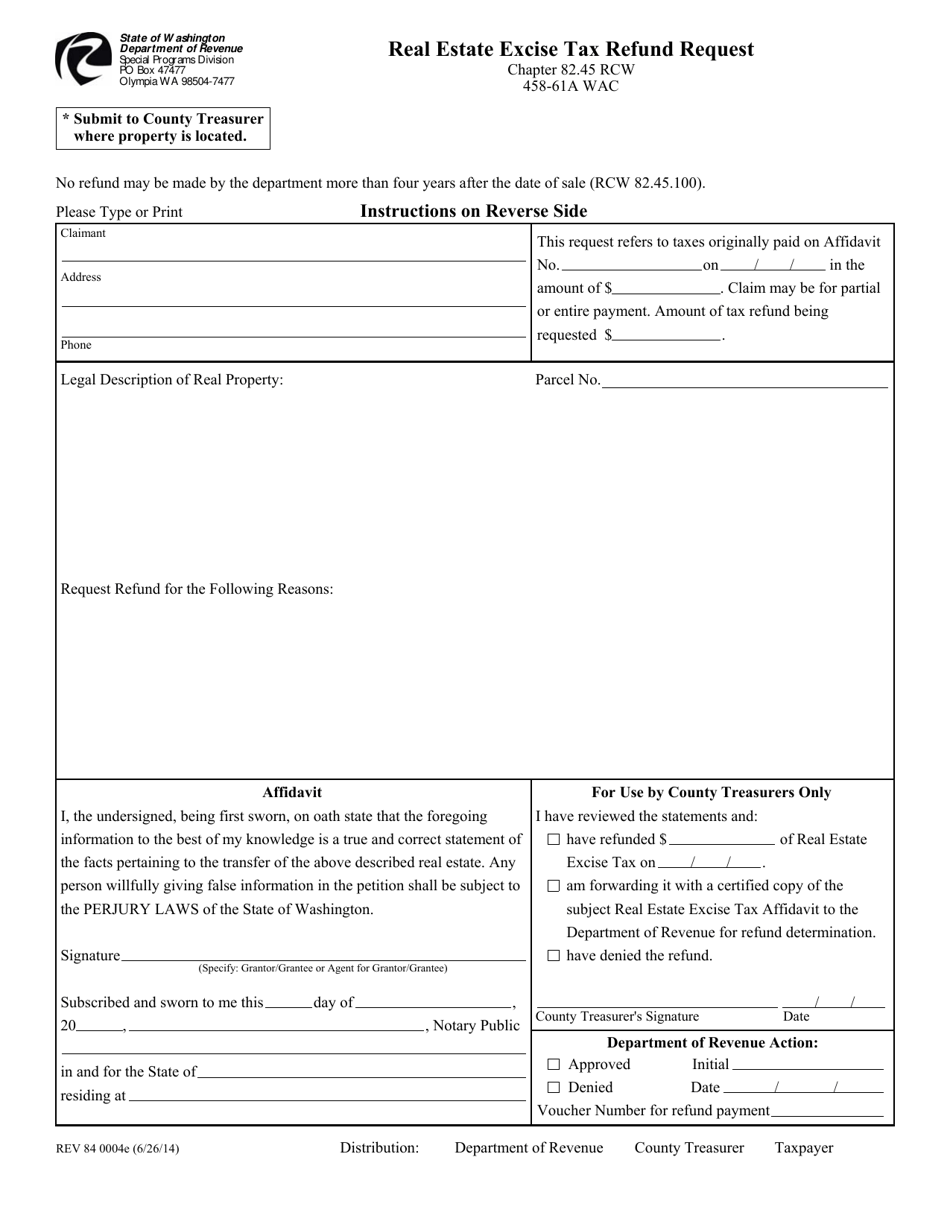

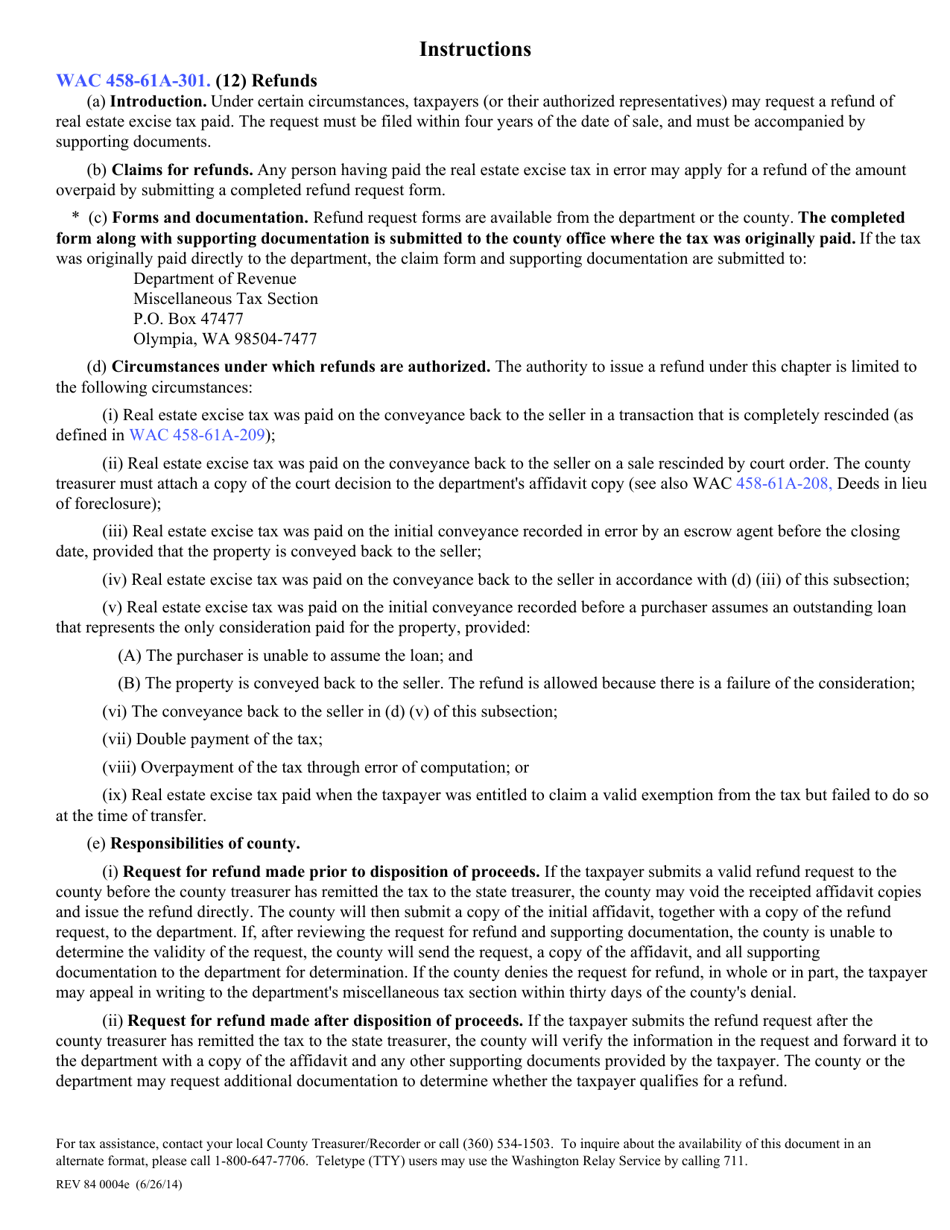

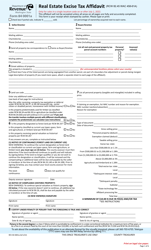

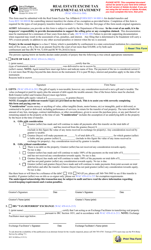

Form REV84 0004E Real Estate Excise Tax Refund Request - Washington

What Is Form REV84 0004E?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV84 0004E?

A: Form REV84 0004E is the Real Estate Excise Tax Refund Request form used in Washington state.

Q: What is the purpose of Form REV84 0004E?

A: The purpose of Form REV84 0004E is to request a refund of the real estate excise tax paid in Washington state.

Q: Who is eligible to use Form REV84 0004E?

A: Individuals or entities who have paid real estate excise tax in Washington state and meet certain eligibility criteria may use Form REV84 0004E to request a refund.

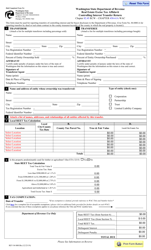

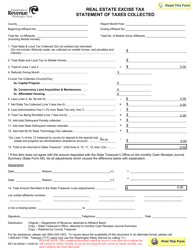

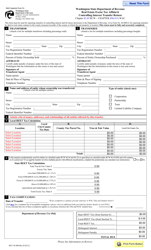

Q: What information is required on Form REV84 0004E?

A: Form REV84 0004E requires information such as the taxpayer's name, contact information, property details, transaction details, and reasons for requesting a refund.

Q: Are there any fees associated with filing Form REV84 0004E?

A: No, there are no fees associated with filing Form REV84 0004E.

Q: How long does it take to process a Real Estate Excise Tax Refund Request?

A: The processing time for a Real Estate Excise Tax Refund Request may vary, but it generally takes several weeks to process.

Q: Can I file Form REV84 0004E electronically?

A: No, Form REV84 0004E cannot be filed electronically. It must be submitted by mail or in person.

Q: What should I do if I have additional questions about Form REV84 0004E?

A: If you have additional questions about Form REV84 0004E, you can contact the Washington State Department of Revenue for assistance.

Form Details:

- Released on June 26, 2014;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV84 0004E by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.