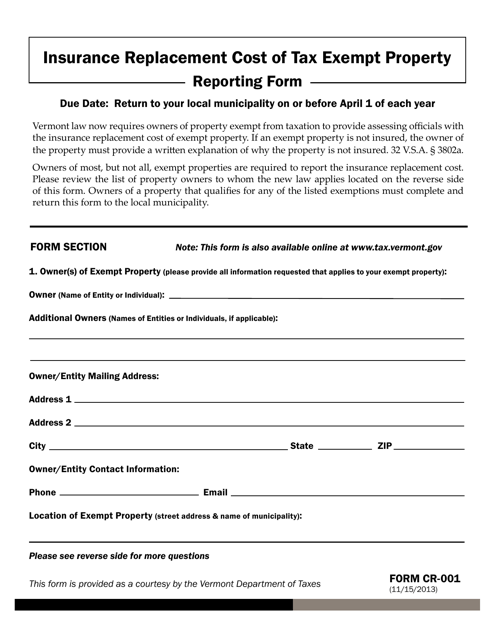

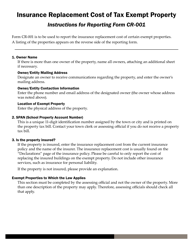

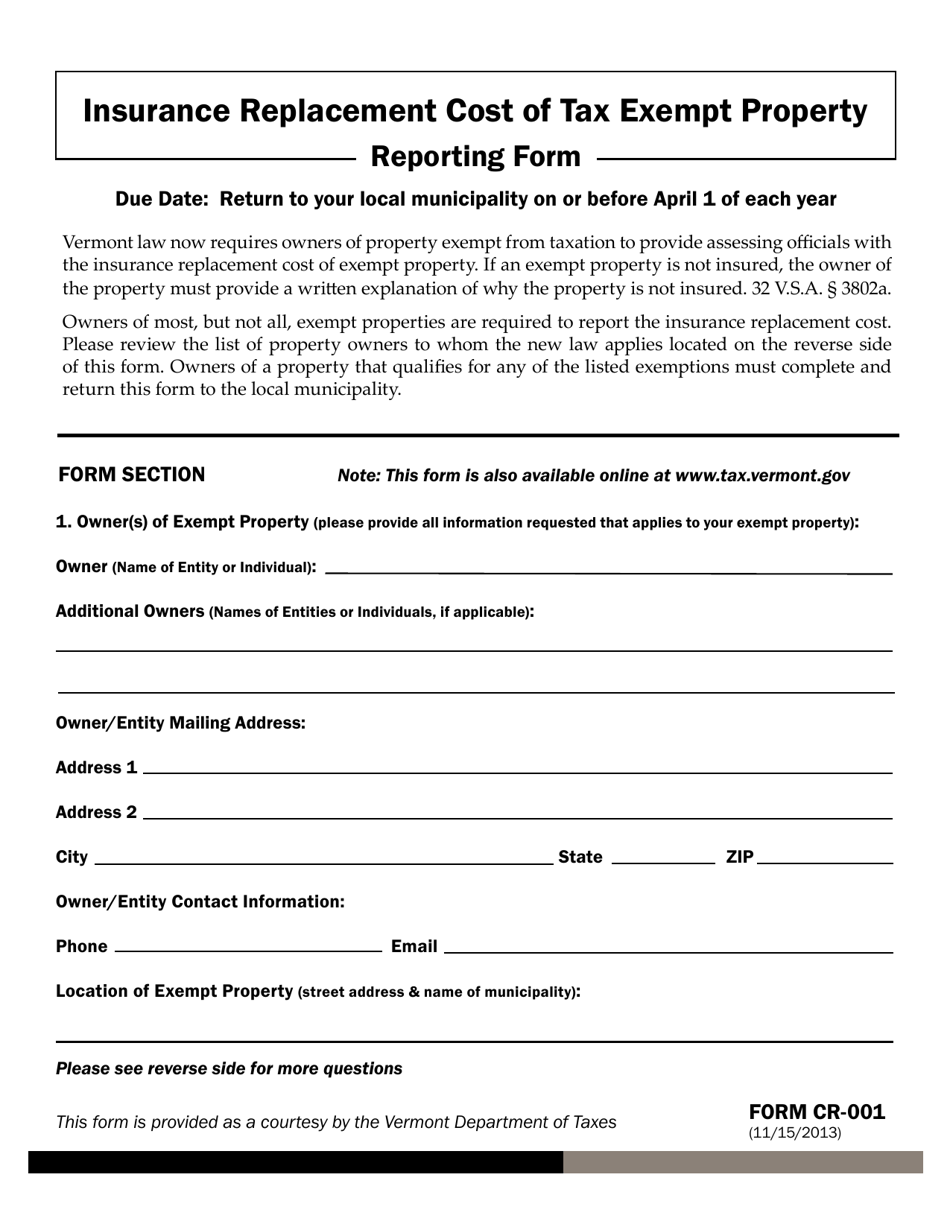

VT Form CR-001 Insurance Replacement Cost of Tax Exempt Property Reporting Form - Vermont

What Is VT Form CR-001?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the VT Form CR-001?

A: The VT Form CR-001 is the Insurance Replacement Cost of Tax Exempt Property Reporting Form in Vermont.

Q: What is the purpose of the VT Form CR-001?

A: The purpose of the VT Form CR-001 is to report the insurance replacement cost of tax-exempt property in Vermont.

Q: Who needs to file the VT Form CR-001?

A: Anyone who has tax-exempt property in Vermont and wants to report the insurance replacement cost needs to file the VT Form CR-001.

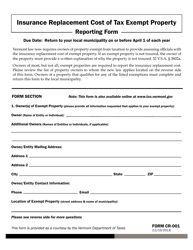

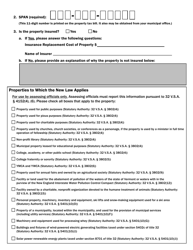

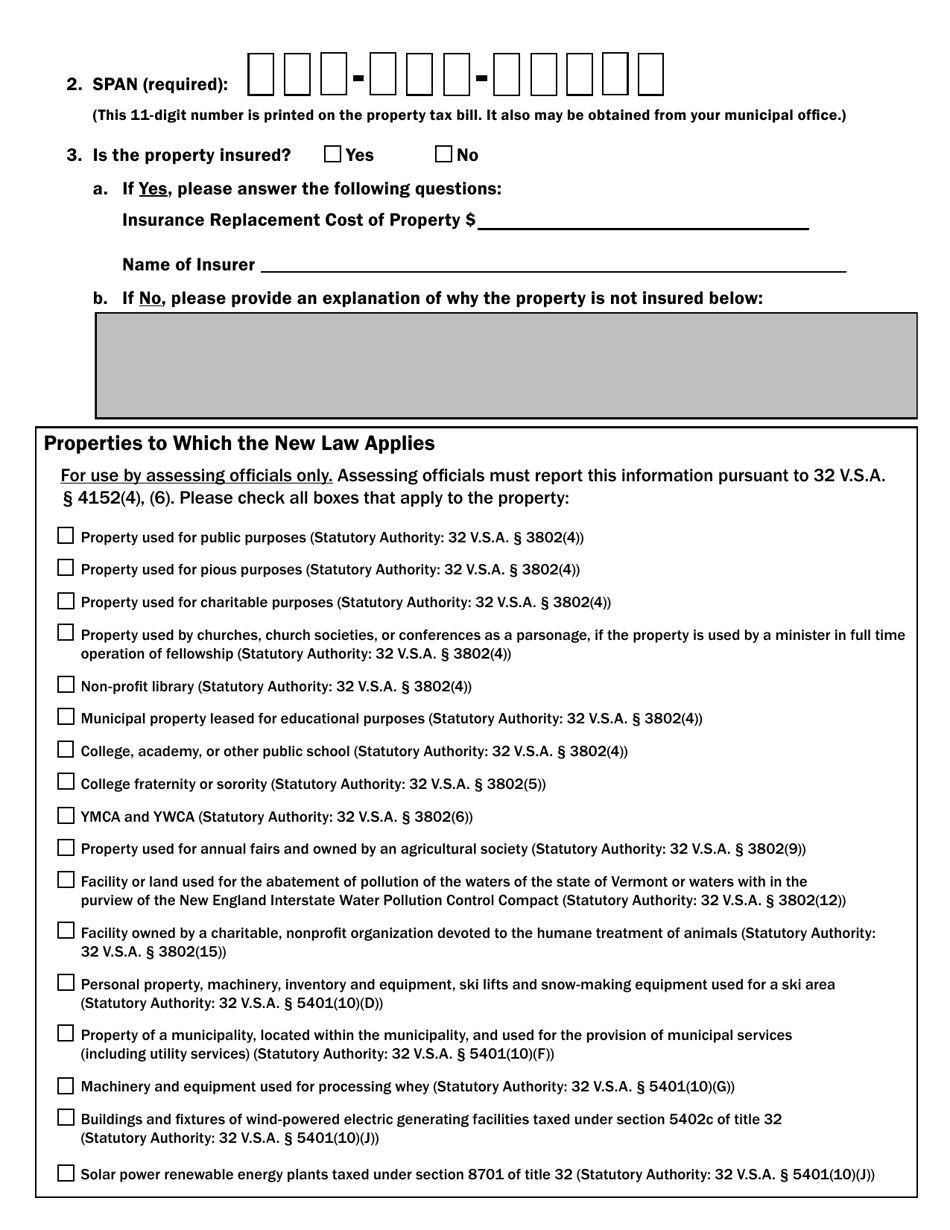

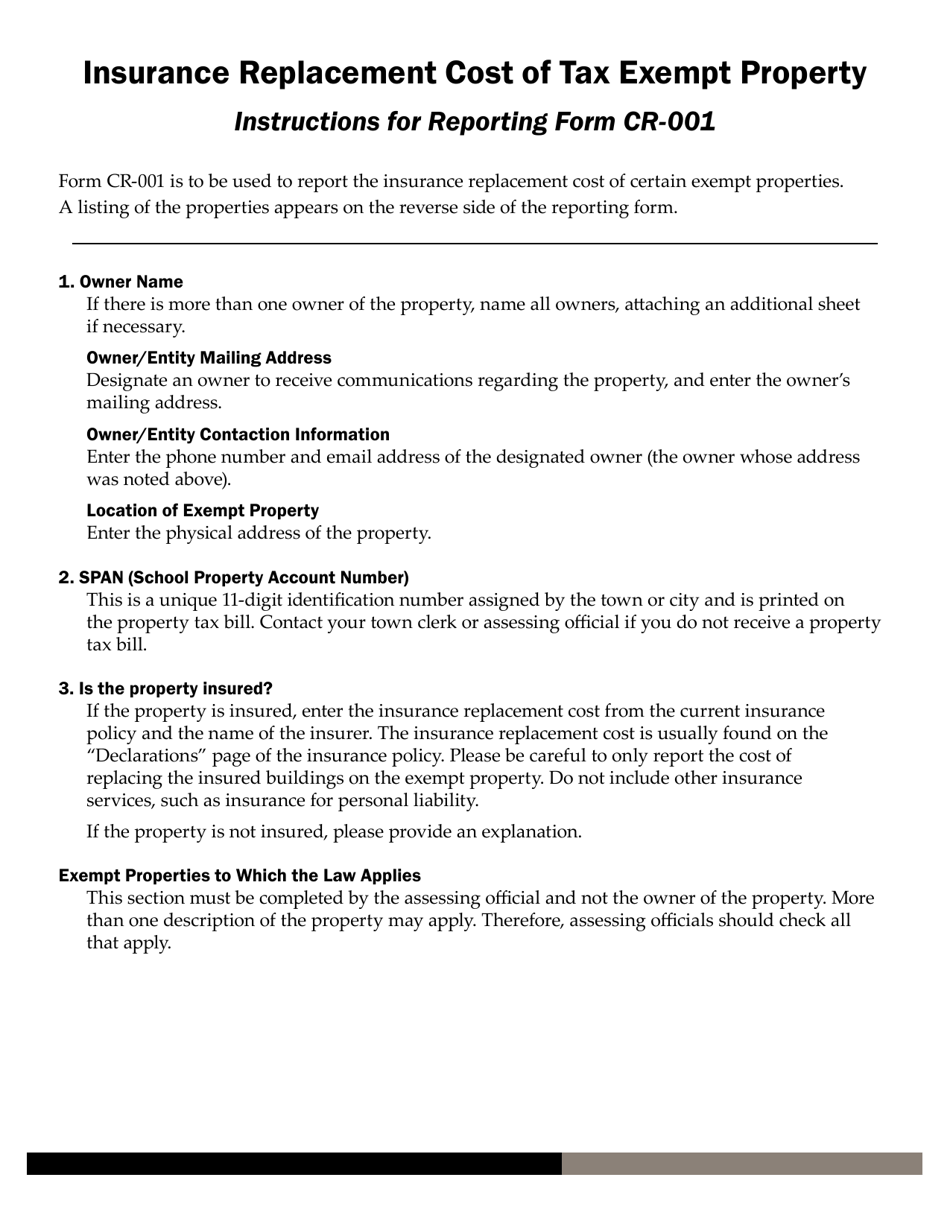

Q: What information is required in the VT Form CR-001?

A: The VT Form CR-001 requires information such as the property description, location, replacement cost, and insurance coverage details.

Q: Are there any deadlines for filing the VT Form CR-001?

A: Yes, the VT Form CR-001 must be filed annually by April 15th.

Q: Is there a fee for filing the VT Form CR-001?

A: No, there is no fee for filing the VT Form CR-001.

Q: What happens if I don't file the VT Form CR-001?

A: Failure to file the VT Form CR-001 may result in penalties or fines imposed by the Vermont Department of Taxes.

Q: Can I amend my VT Form CR-001 if I made a mistake?

A: Yes, you can file an amended VT Form CR-001 if you made a mistake or need to update the information previously submitted.

Form Details:

- Released on November 15, 2013;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form CR-001 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.