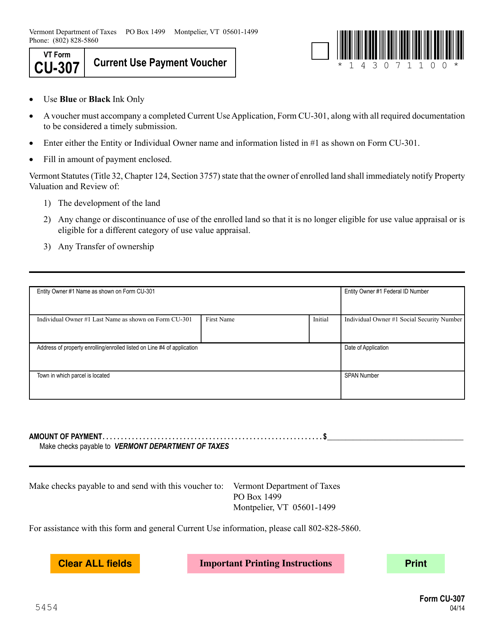

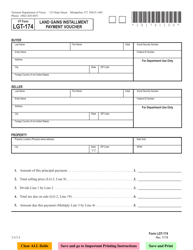

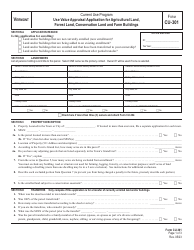

VT Form CU-307 Current Use Payment Voucher - Vermont

What Is VT Form CU-307?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form CU-307?

A: VT Form CU-307 is a Current Use Payment Voucher used in Vermont.

Q: What is Current Use?

A: Current Use is a program in Vermont that encourages landowners to keep their forestland and other open space lands undeveloped.

Q: What is the purpose of VT Form CU-307?

A: The purpose of VT Form CU-307 is to make payments for participating in the Current Use program.

Q: Who uses VT Form CU-307?

A: Landowners who are enrolled in the Current Use program in Vermont use VT Form CU-307.

Q: Is there a deadline for submitting VT Form CU-307?

A: Yes, VT Form CU-307 must be submitted by a specific due date, which can be found on the form.

Q: What happens if I don't submit VT Form CU-307 on time?

A: If VT Form CU-307 is not submitted on time, there may be penalties or consequences for the landowner.

Q: Are there any fees associated with VT Form CU-307?

A: There may be fees associated with VT Form CU-307, such as processing fees or late payment fees.

Q: What information is required on VT Form CU-307?

A: VT Form CU-307 requires information such as the landowner's name, address, parcel ID, and payment amount.

Q: Can I submit VT Form CU-307 electronically?

A: It is recommended to submit VT Form CU-307 by mail, but electronic submission may be allowed.

Q: Who can I contact for more information or assistance with VT Form CU-307?

A: For more information or assistance with VT Form CU-307, you can contact the Vermont Department of Taxes.

Form Details:

- Released on April 1, 2014;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form CU-307 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.