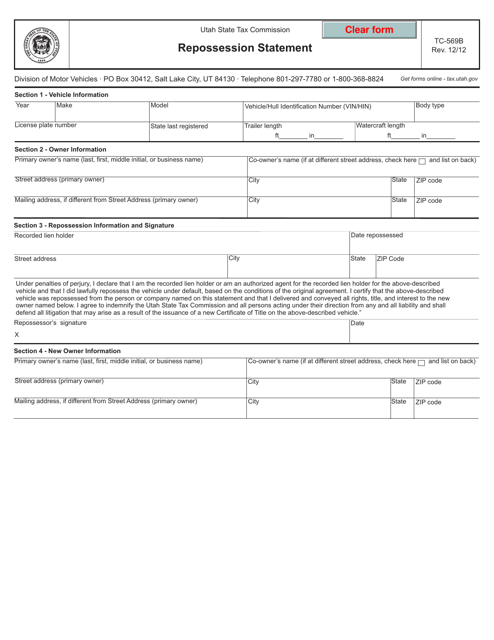

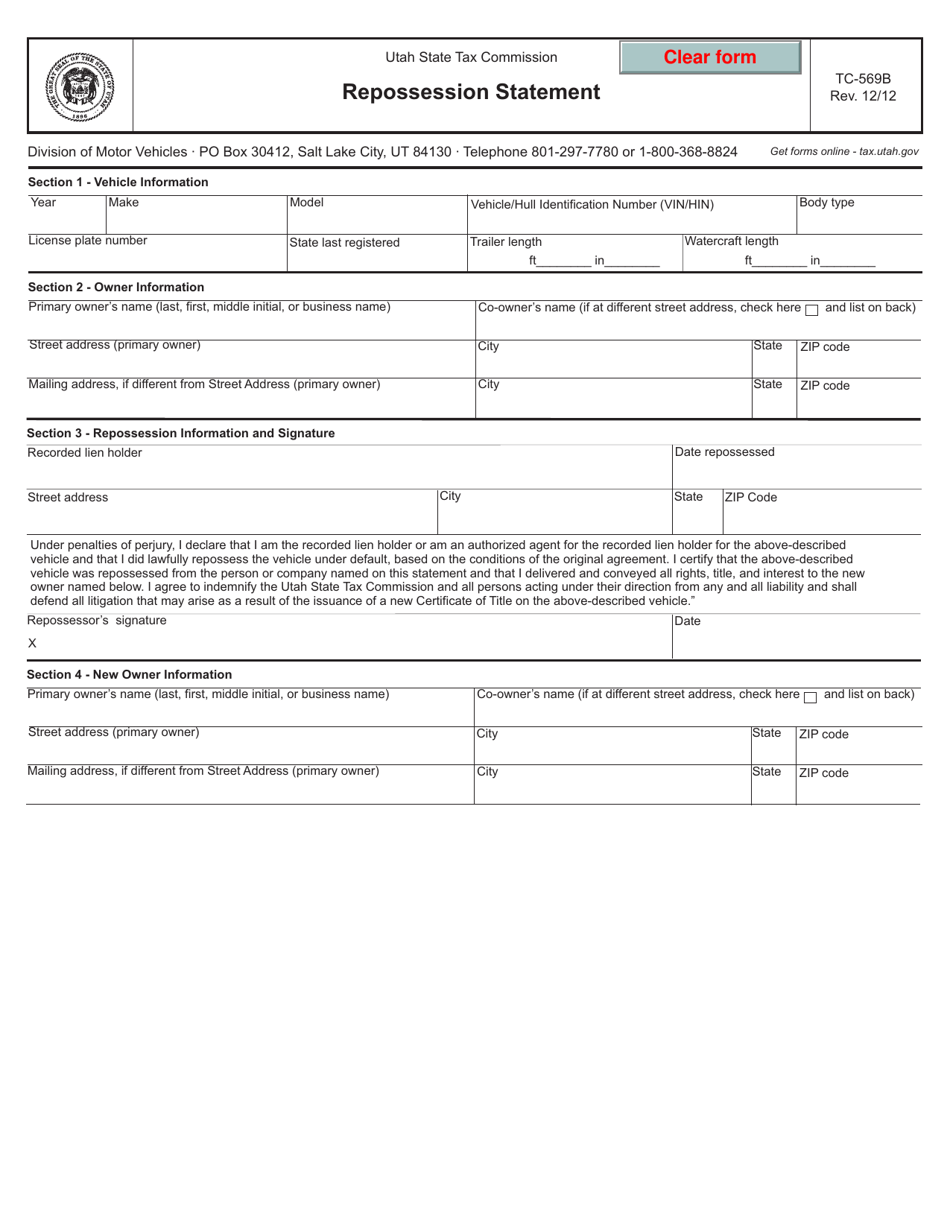

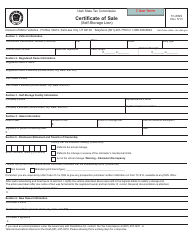

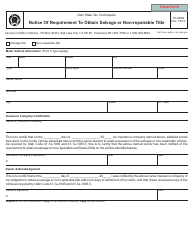

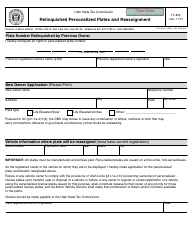

Form TC-569B Repossession Statement - Utah

What Is Form TC-569B?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-569B?

A: Form TC-569B is the Repossession Statement used in the state of Utah.

Q: What is the purpose of Form TC-569B?

A: The purpose of Form TC-569B is to report the repossession of a vehicle to the Utah State Tax Commission.

Q: Who needs to file Form TC-569B?

A: Anyone who has repossessed a vehicle in Utah needs to file Form TC-569B.

Q: Is there a fee for filing Form TC-569B?

A: Yes, there is a $5 fee for filing Form TC-569B.

Q: When is the deadline for filing Form TC-569B?

A: Form TC-569B must be filed within 10 days of the repossession of the vehicle.

Q: What information do I need to provide on Form TC-569B?

A: You will need to provide information about the vehicle, the owner, and the repossession.

Form Details:

- Released on December 1, 2012;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-569B by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.