This version of the form is not currently in use and is provided for reference only. Download this version of

Form FIN586

for the current year.

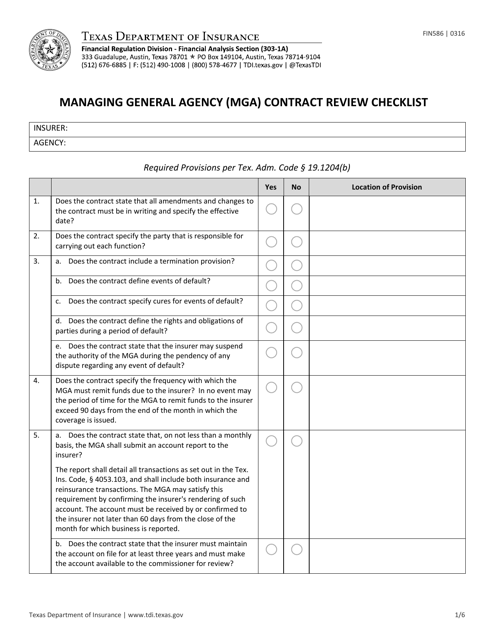

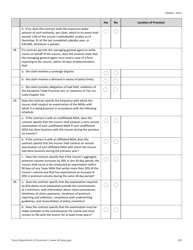

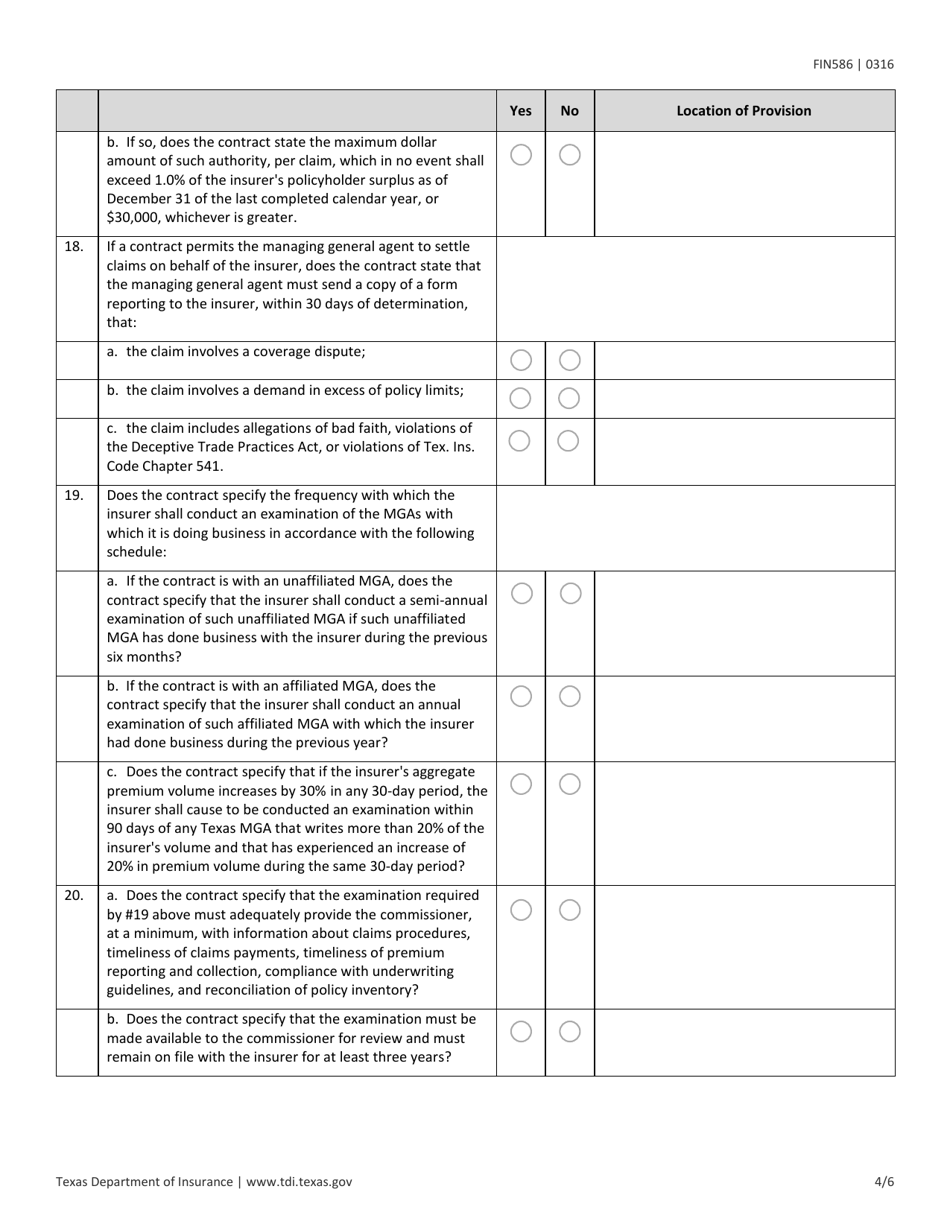

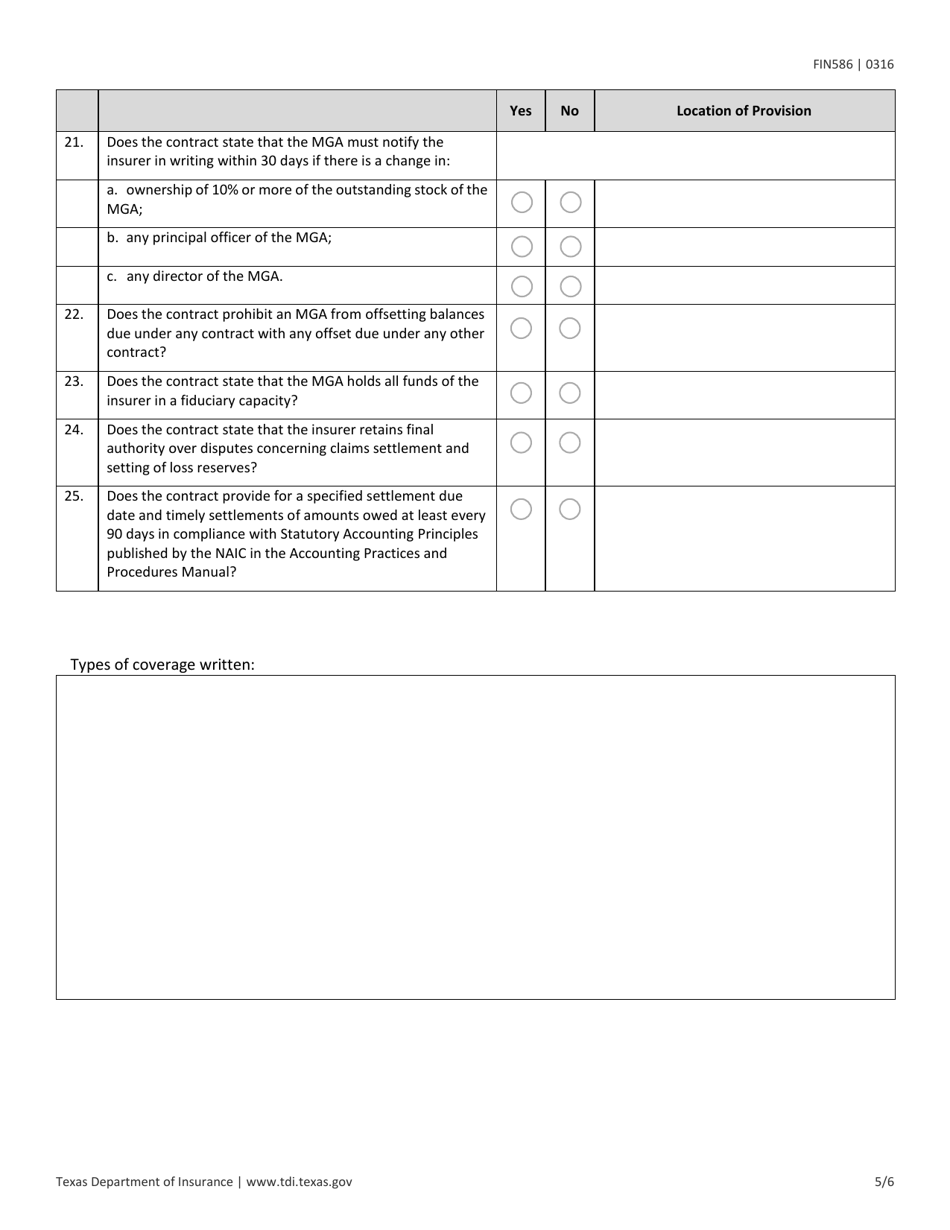

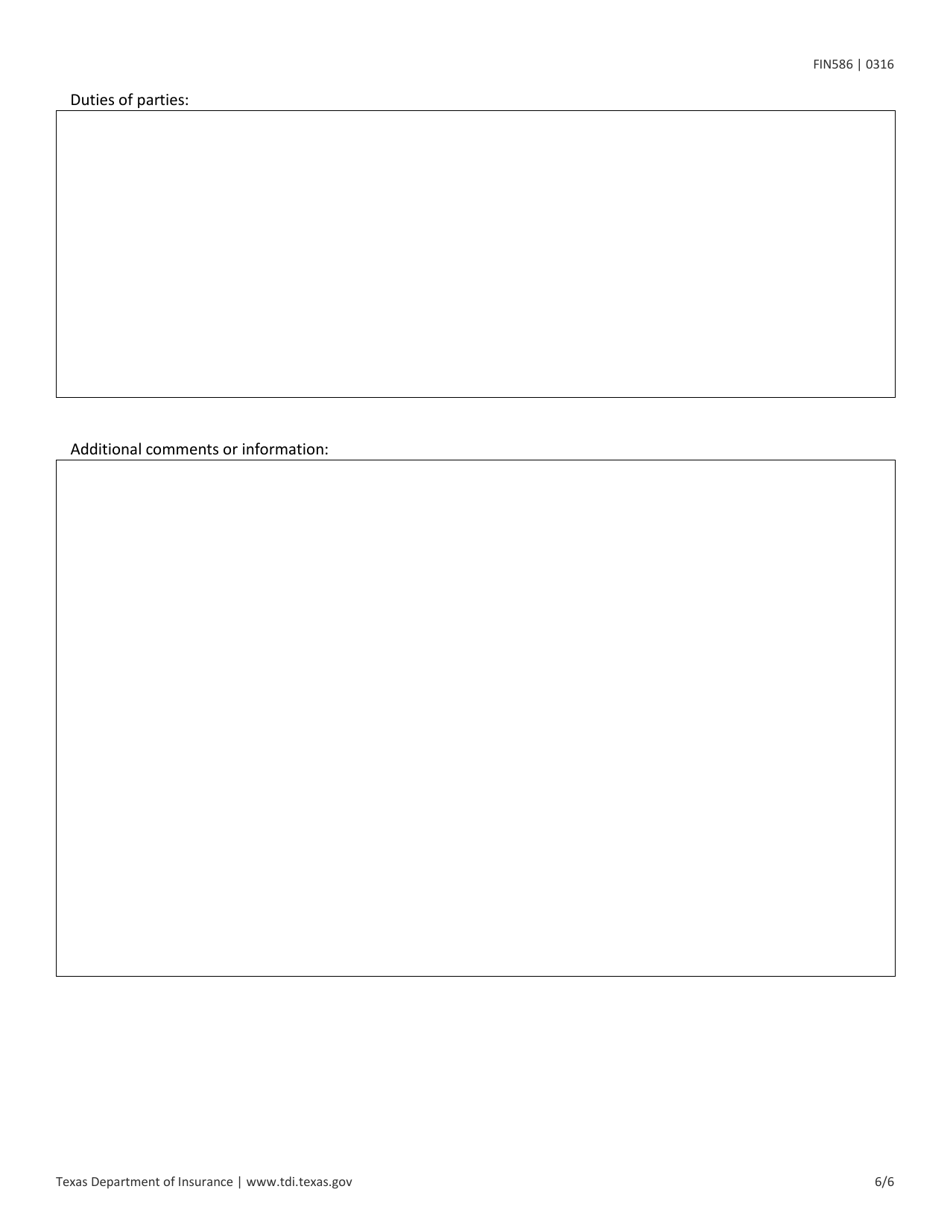

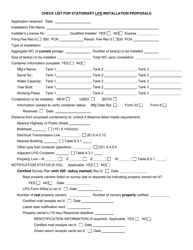

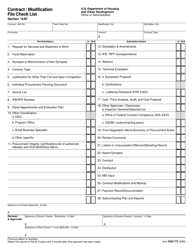

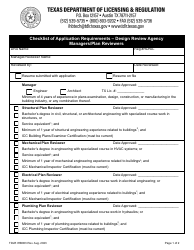

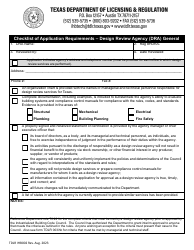

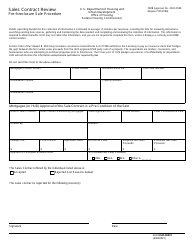

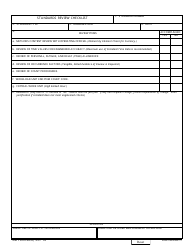

Form FIN586 Managing General Agency (Mga) Contract Review Checklist - Texas

What Is Form FIN586?

This is a legal form that was released by the Texas Department of Insurance - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

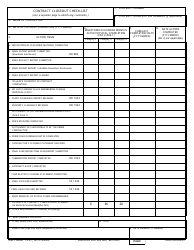

Q: What is a Managing General Agency (MGA) contract?

A: A Managing General Agency (MGA) contract is an agreement between an insurance company and a managing general agent, who acts as an intermediary between the insurance company and insurance agents or brokers.

Q: What is the purpose of a MGA contract review?

A: The purpose of a MGA contract review is to ensure that the terms and conditions of the contract are fair and comply with applicable laws and regulations.

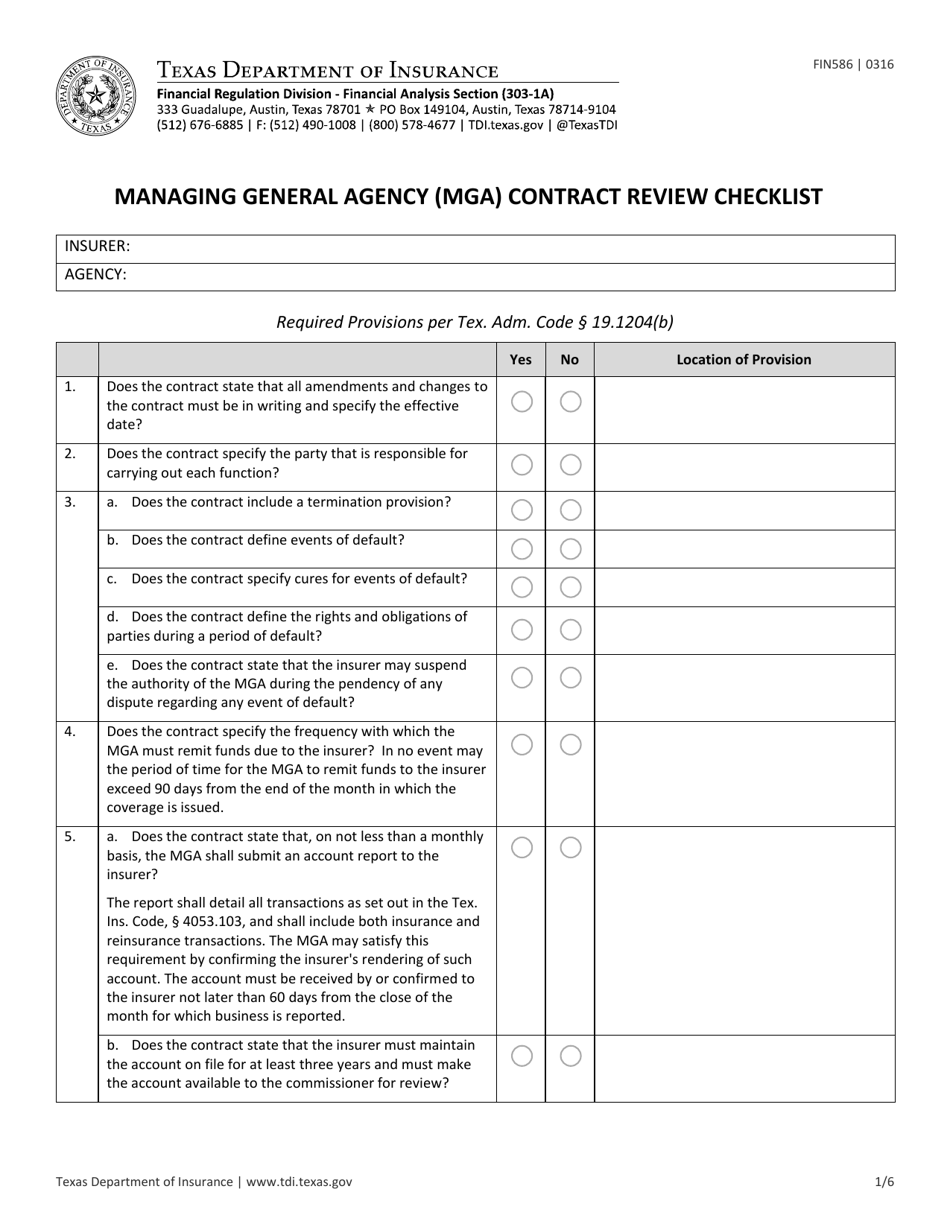

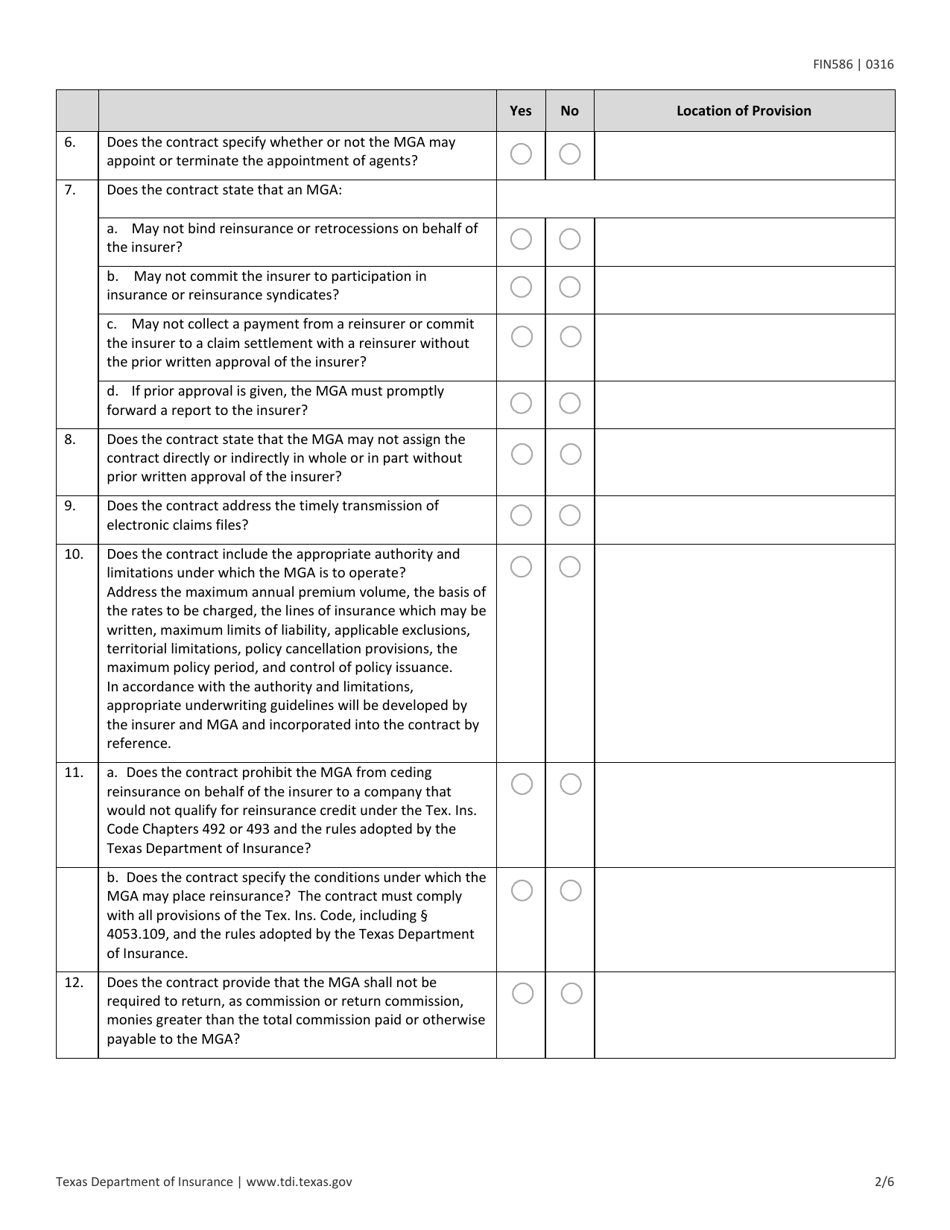

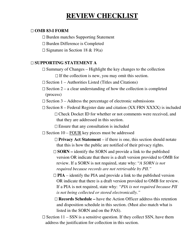

Q: What should be reviewed in a MGA contract?

A: Key areas to review in a MGA contract include the scope of authority, commission structure, termination provisions, compliance requirements, and any indemnification clauses.

Q: Why is it important to review the scope of authority in a MGA contract?

A: Reviewing the scope of authority in a MGA contract is important to clarify the extent of authority granted to the managing general agent and to ensure that it aligns with the insurance company's expectations.

Q: What should be considered when reviewing the commission structure in a MGA contract?

A: When reviewing the commission structure in a MGA contract, factors such as the percentage of commission, payment terms, and any additional fees should be carefully evaluated.

Q: What are some important termination provisions to look for in a MGA contract?

A: Important termination provisions to look for in a MGA contract include provisions related to notice periods, grounds for termination, and any financial implications of termination.

Q: Why is it important to review compliance requirements in a MGA contract?

A: Reviewing compliance requirements in a MGA contract is important to ensure that the managing general agent is responsible for maintaining compliance with applicable laws and regulations.

Q: What are indemnification clauses in a MGA contract?

A: Indemnification clauses in a MGA contract specify the responsibilities of each party regarding indemnification for losses, damages, or liabilities.

Q: Who should review a MGA contract?

A: A MGA contract should be reviewed by legal counsel or someone with expertise in insurance contract review.

Q: Is a MGA contract review required by law in Texas?

A: There is no specific legal requirement for a MGA contract review in Texas, but it is highly recommended to ensure compliance and protect the interests of both parties.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Texas Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIN586 by clicking the link below or browse more documents and templates provided by the Texas Department of Insurance.