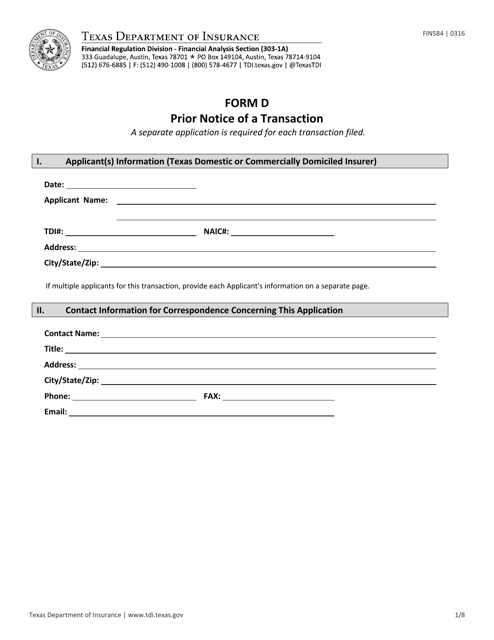

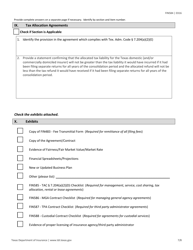

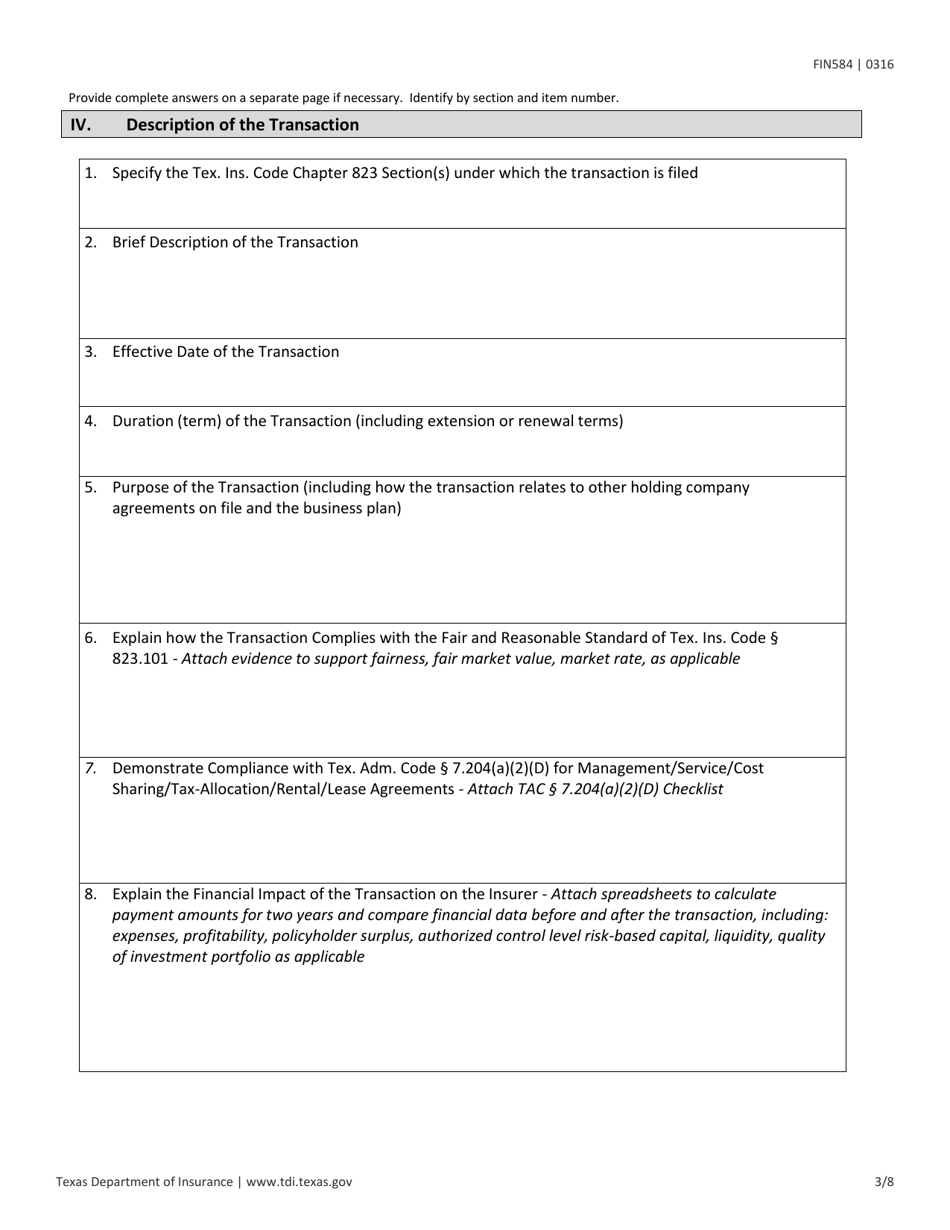

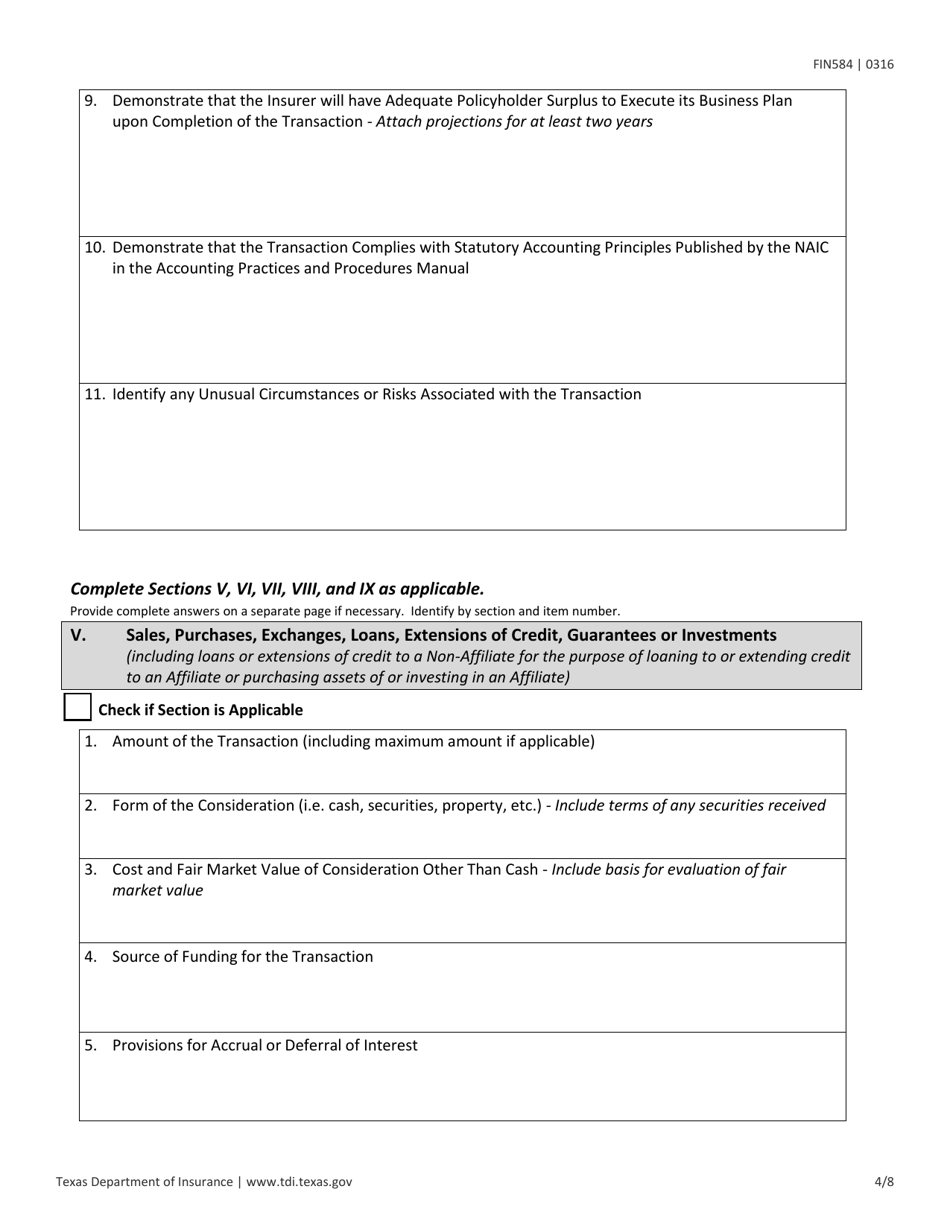

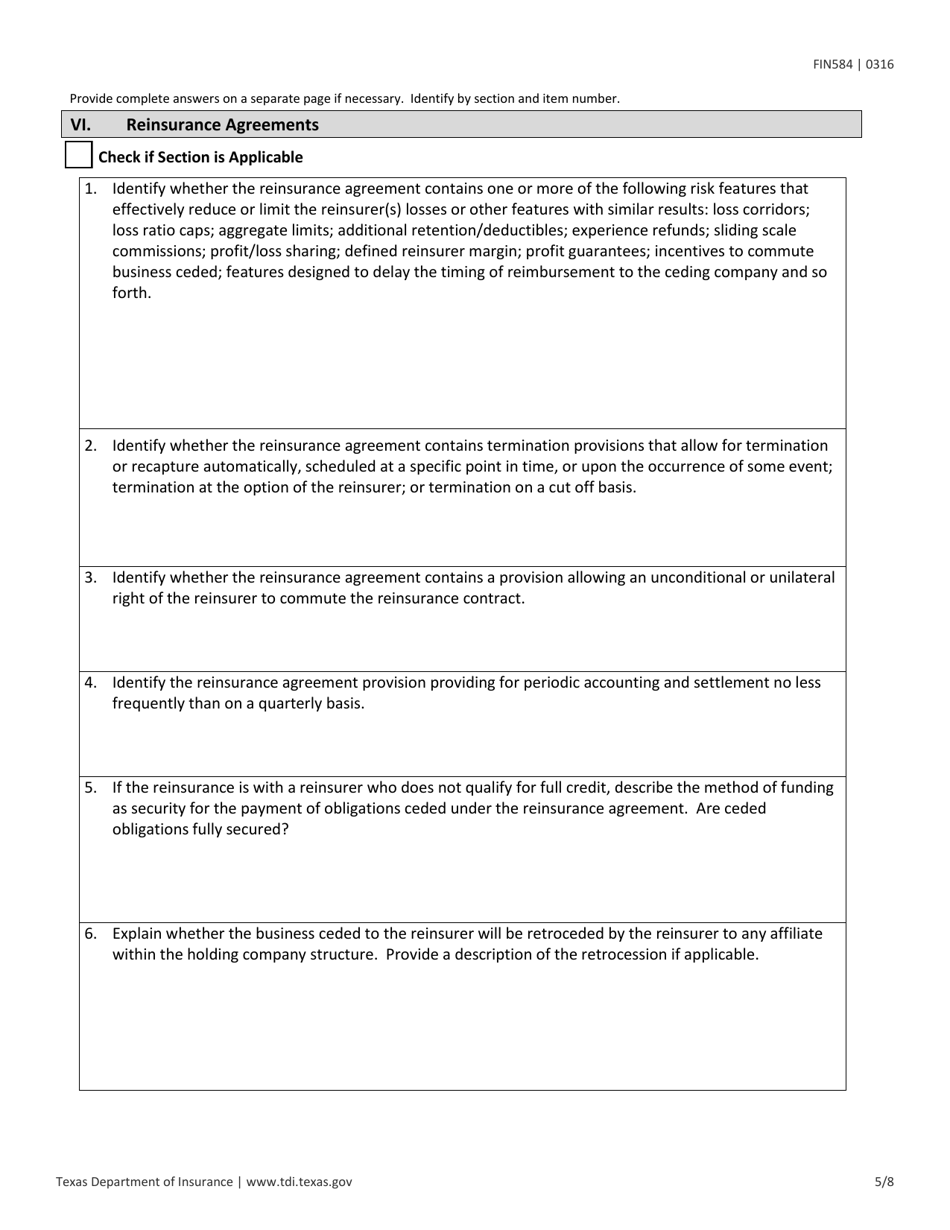

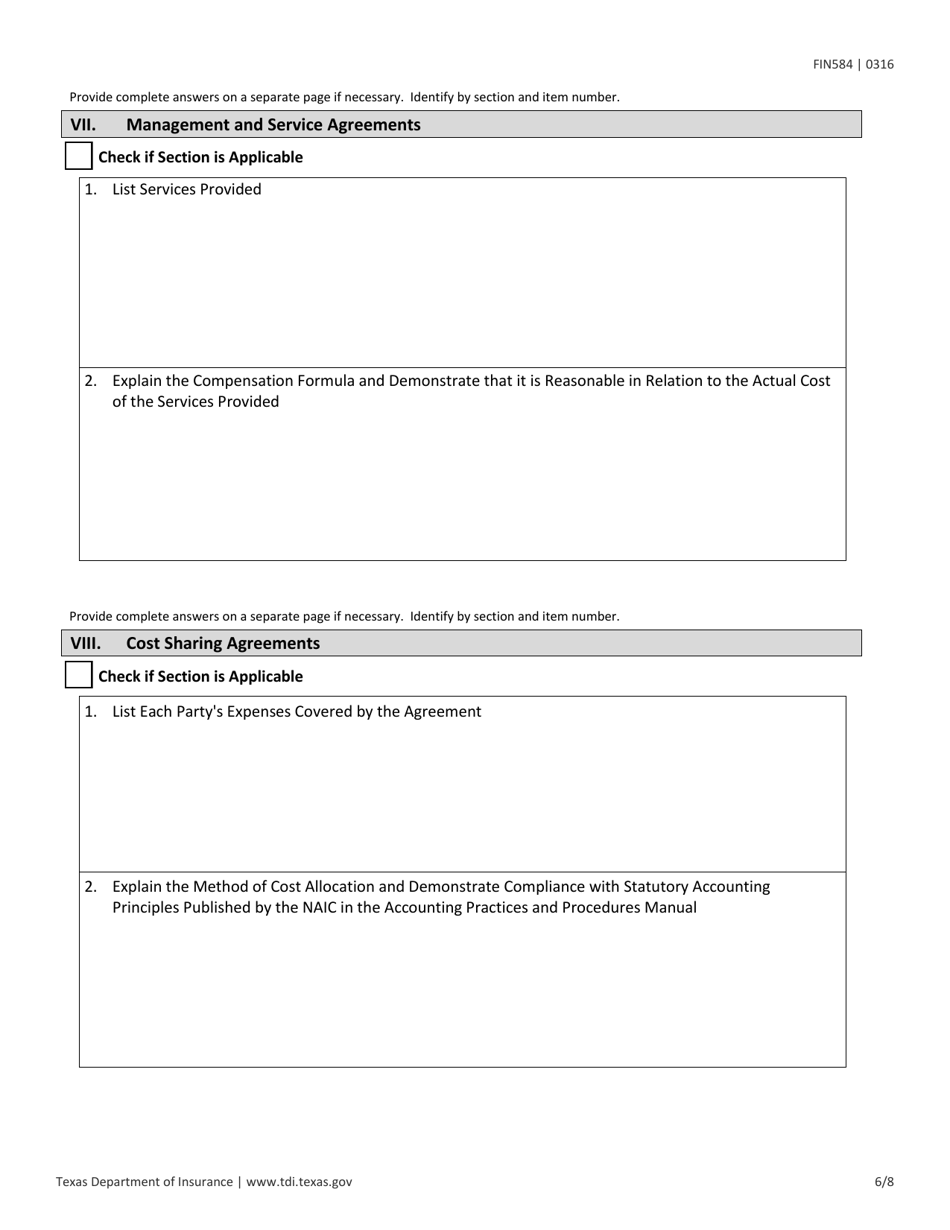

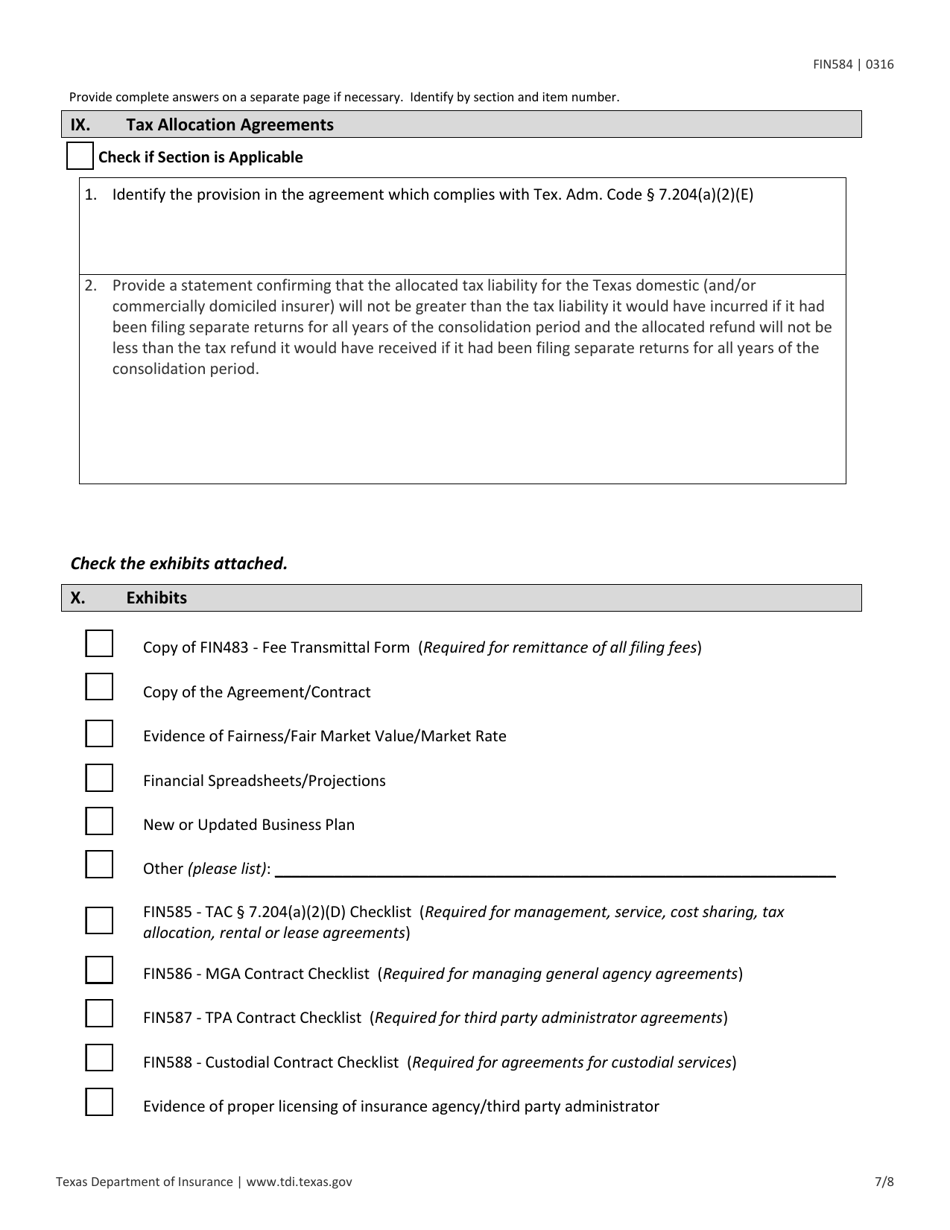

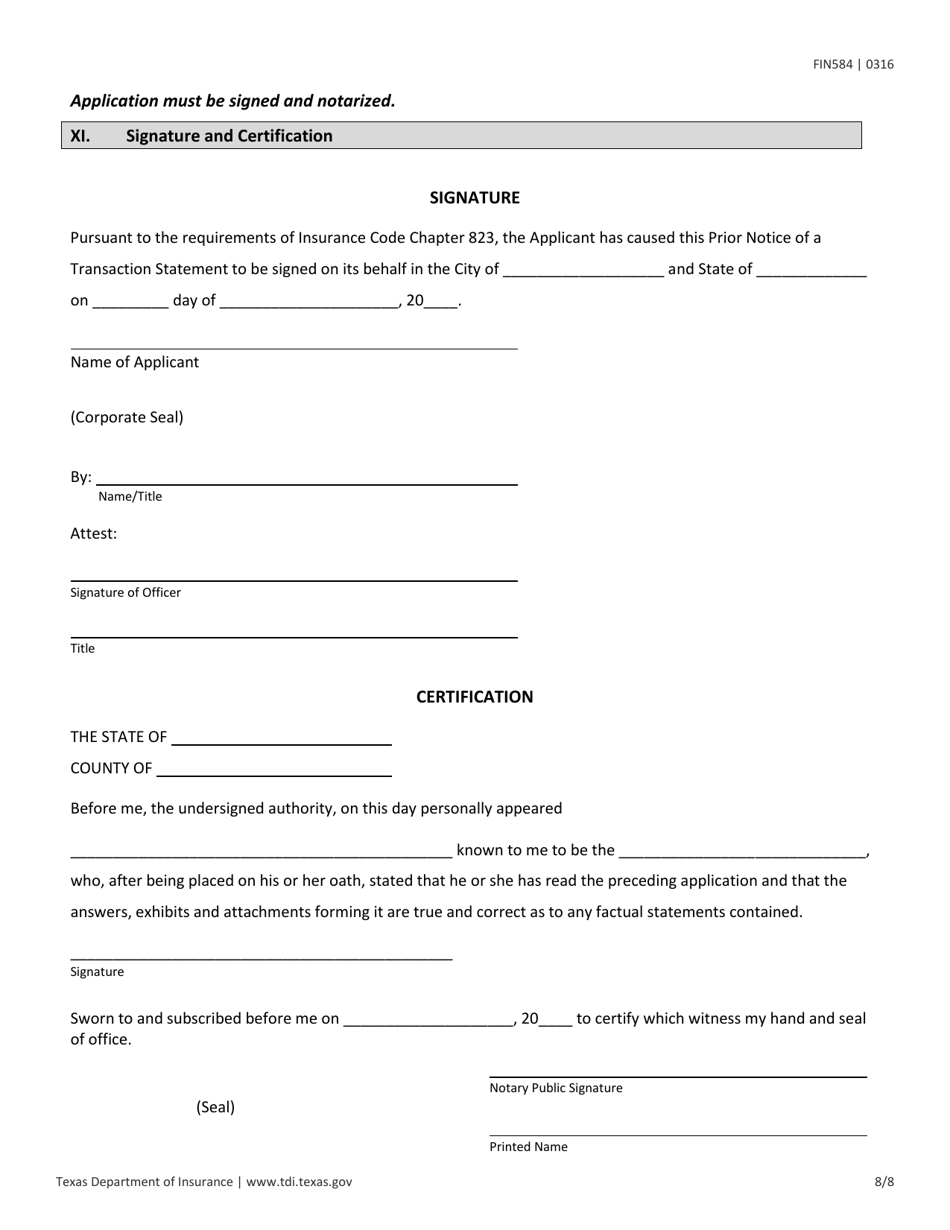

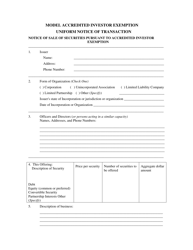

Form FIN584 (D) Prior Notice of a Transaction - Texas

What Is Form FIN584 (D)?

This is a legal form that was released by the Texas Department of Insurance - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FIN584 (D)?

A: Form FIN584 (D) is a form used in Texas to provide prior notice of a transaction.

Q: What is the purpose of Form FIN584 (D)?

A: The purpose of Form FIN584 (D) is to inform the relevant authorities in Texas about a transaction.

Q: Who needs to file Form FIN584 (D)?

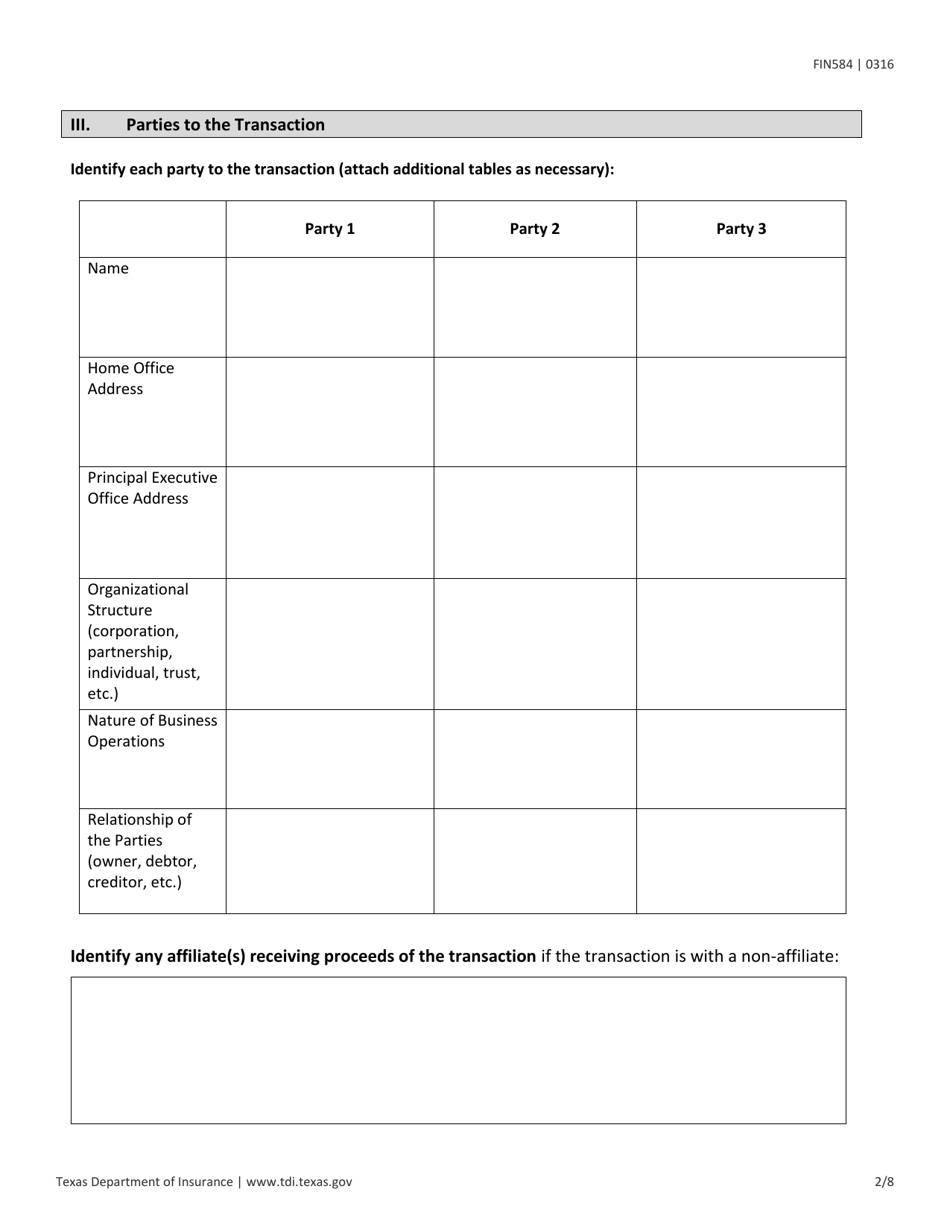

A: The parties involved in the transaction, such as the buyer and seller, are required to file Form FIN584 (D).

Q: When should Form FIN584 (D) be filed?

A: Form FIN584 (D) should be filed at least 15 days before the date of the transaction.

Q: Are there any fees associated with filing Form FIN584 (D)?

A: Yes, there are fees associated with filing Form FIN584 (D). The fees vary depending on the county.

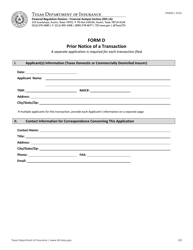

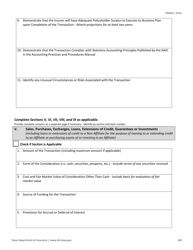

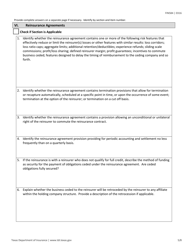

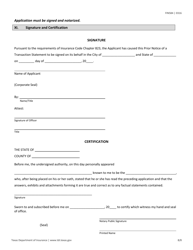

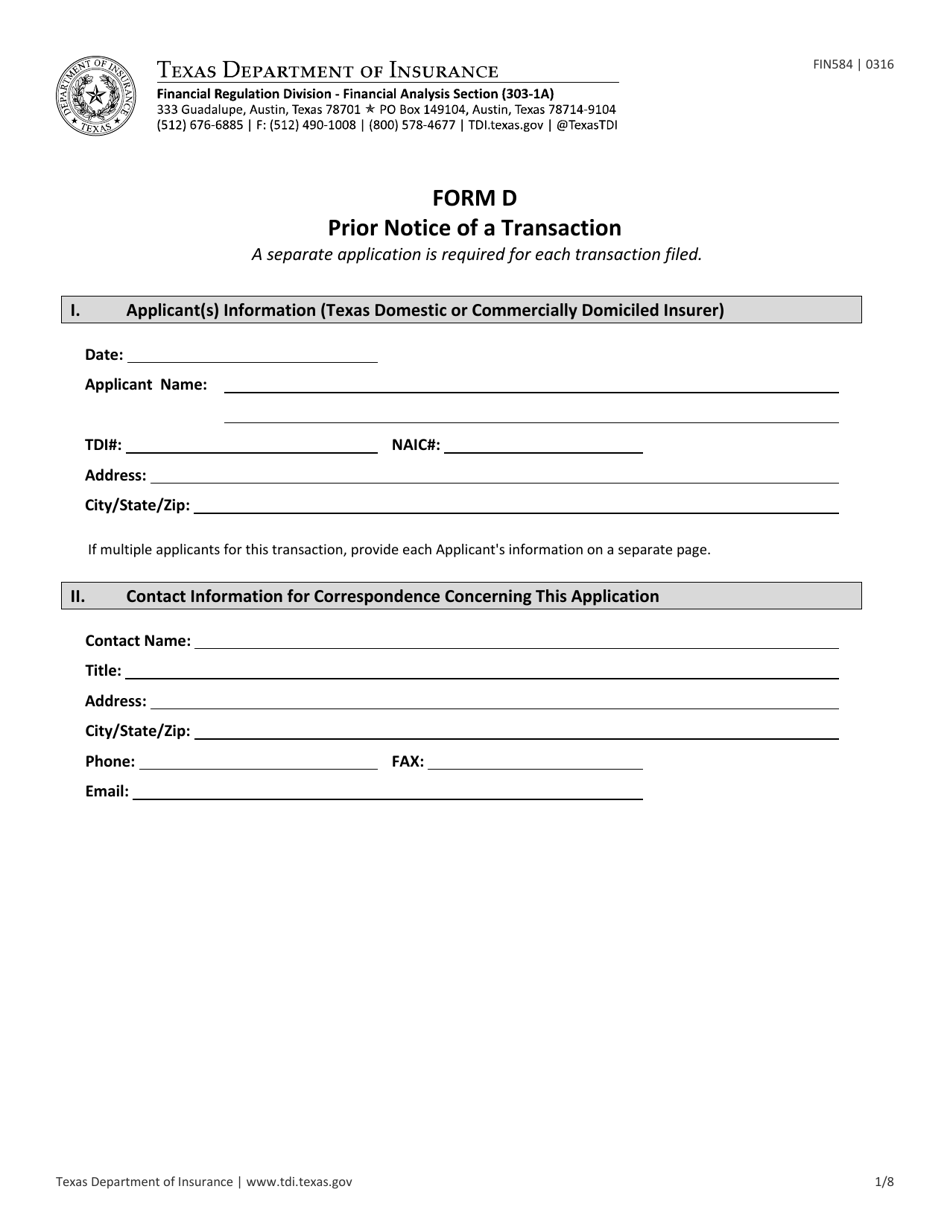

Q: What information is required on Form FIN584 (D)?

A: Form FIN584 (D) requires information about the property being transferred, the parties involved, and the terms of the transaction.

Q: Can Form FIN584 (D) be filed electronically?

A: It depends on the county. Some counties allow for electronic filing, while others require physical submission of the form.

Q: What happens after Form FIN584 (D) is filed?

A: After Form FIN584 (D) is filed, it becomes part of the public record and the transaction can proceed.

Q: Is Form FIN584 (D) specific to Texas?

A: Yes, Form FIN584 (D) is specific to Texas and is used for transactions involving real property in the state.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Texas Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIN584 (D) by clicking the link below or browse more documents and templates provided by the Texas Department of Insurance.