This version of the form is not currently in use and is provided for reference only. Download this version of

Form FIN590

for the current year.

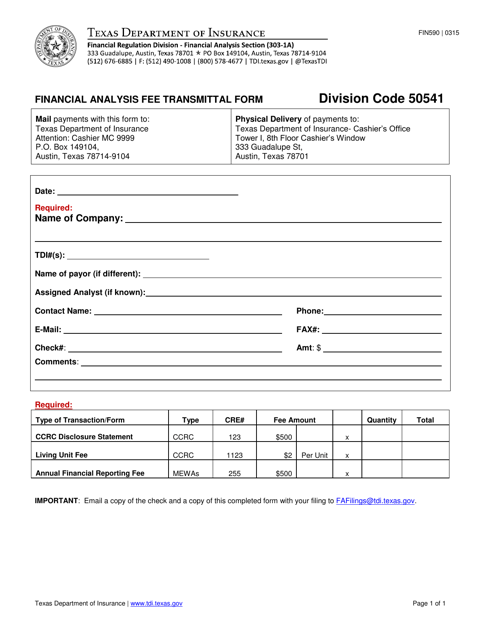

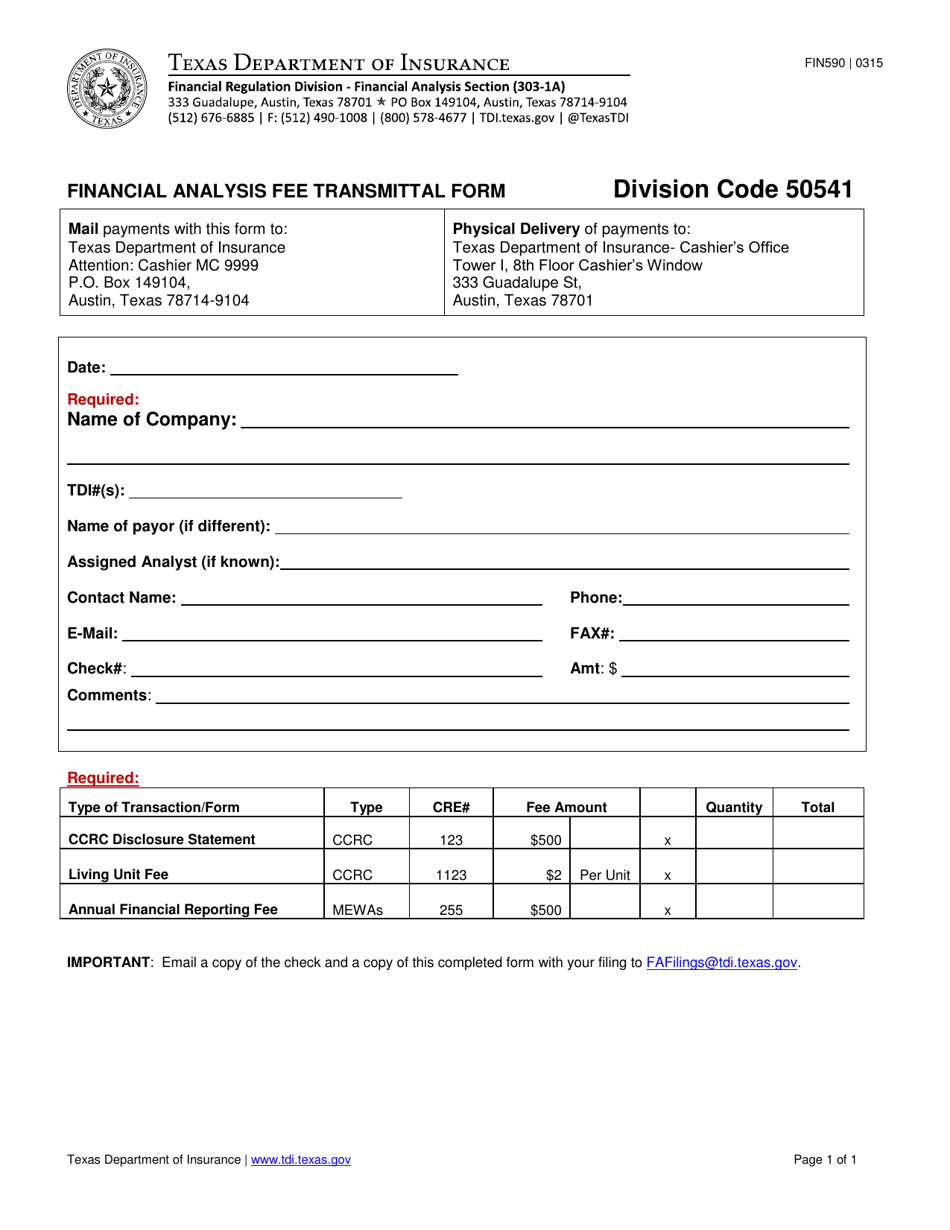

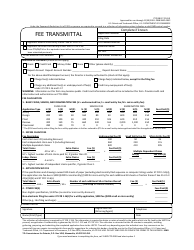

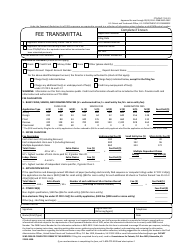

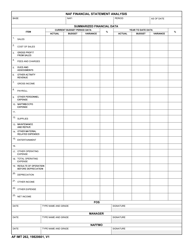

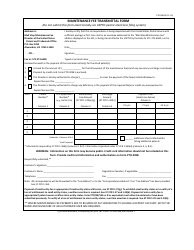

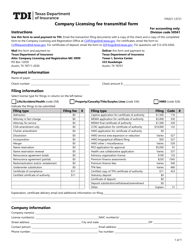

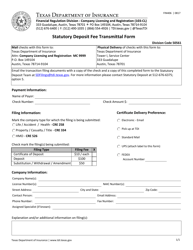

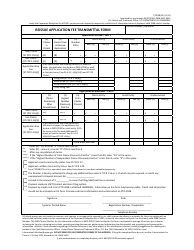

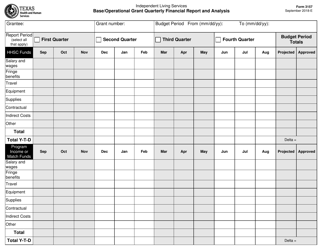

Form FIN590 Financial Analysis Fee Transmittal Form - Texas

What Is Form FIN590?

This is a legal form that was released by the Texas Department of Insurance - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the FIN590 Financial Analysis Fee Transmittal Form?

A: The FIN590 Financial Analysis Fee Transmittal Form is a document used in Texas.

Q: What is the purpose of the FIN590 Financial Analysis Fee Transmittal Form?

A: The purpose of the form is to transmit fees related to financial analysis.

Q: Who needs to use the FIN590 Financial Analysis Fee Transmittal Form?

A: Anyone in Texas who is required to pay fees related to financial analysis.

Q: Are there any filing deadlines for the FIN590 Financial Analysis Fee Transmittal Form?

A: Specific filing deadlines may vary. Please consult the instructions or contact the relevant Texas government agency or department for deadlines.

Q: What information is needed to complete the FIN590 Financial Analysis Fee Transmittal Form?

A: The form typically requires information such as the filer's name, contact information, payment details, and any supporting documentation.

Q: Are there any fees associated with submitting the FIN590 Financial Analysis Fee Transmittal Form?

A: Yes, there are fees associated with financial analysis that need to be paid.

Q: What should I do if I have questions about the FIN590 Financial Analysis Fee Transmittal Form?

A: If you have questions, it is best to reach out to the relevant Texas government agency or department for clarification.

Q: Is the FIN590 Financial Analysis Fee Transmittal Form specific to Texas?

A: Yes, the form is specific to Texas.

Q: Can I use the FIN590 Financial Analysis Fee Transmittal Form for financial analysis in other states?

A: No, the form is only applicable to financial analysis in Texas.

Q: Is the FIN590 Financial Analysis Fee Transmittal Form publicly available?

A: Yes, the form is publicly available.

Q: What should I do if I make an error on the FIN590 Financial Analysis Fee Transmittal Form?

A: If you make an error, it is best to contact the relevant Texas government agency or department for guidance on how to correct it.

Q: Can I submit the FIN590 Financial Analysis Fee Transmittal Form by mail?

A: Yes, mail submission is typically accepted for the form.

Q: Is there a penalty for late submission of the FIN590 Financial Analysis Fee Transmittal Form?

A: Specific penalties for late submission may vary. Please consult the instructions or contact the relevant Texas government agency or department for penalties.

Q: How long does it take to process the FIN590 Financial Analysis Fee Transmittal Form?

A: Processing times will vary depending on the specific Texas government agency or department.

Q: Can I submit the FIN590 Financial Analysis Fee Transmittal Form in person?

A: It depends on the specific Texas government agency or department. In-person submission may be allowed.

Q: Is there a fee waiver available for the FIN590 Financial Analysis Fee Transmittal Form?

A: Fee waivers may be available in certain situations. Contact the relevant Texas government agency or department for more information.

Q: Can I pay the fees associated with the FIN590 Financial Analysis Fee Transmittal Form by check?

A: Yes, check payment is typically accepted for the form.

Q: What happens after I submit the FIN590 Financial Analysis Fee Transmittal Form?

A: After submission, the form will be processed by the relevant Texas government agency or department.

Q: Can I request a refund if I overpaid the fees on the FIN590 Financial Analysis Fee Transmittal Form?

A: Refund policies may vary. Contact the relevant Texas government agency or department for information on refund requests.

Q: Is the FIN590 Financial Analysis Fee Transmittal Form available in languages other than English?

A: It may be available in languages other than English. Check with the relevant Texas government agency or department for language options.

Q: Can an authorized representative complete the FIN590 Financial Analysis Fee Transmittal Form on behalf of an individual?

A: In certain cases, an authorized representative may be able to complete the form on behalf of an individual. Check with the relevant Texas government agency or department for requirements.

Q: How can I check the status of my FIN590 Financial Analysis Fee Transmittal Form?

A: To check the status, contact the relevant Texas government agency or department.

Q: Does the FIN590 Financial Analysis Fee Transmittal Form require notarization?

A: Notarization requirements may vary. Check the instructions or contact the relevant Texas government agency or department for notarization requirements.

Q: Can I fax the FIN590 Financial Analysis Fee Transmittal Form?

A: Fax submission may be allowed, depending on the specific Texas government agency or department.

Q: Is the FIN590 Financial Analysis Fee Transmittal Form available for electronic submission?

A: Electronic submission options may be available. Check with the relevant Texas government agency or department for submission methods.

Q: What types of financial analysis fees are associated with the FIN590 Financial Analysis Fee Transmittal Form?

A: The form may be used to pay various fees related to financial analysis, such as licensing fees, registration fees, or examination fees.

Q: Can I submit multiple FIN590 Financial Analysis Fee Transmittal Forms at once?

A: You may be able to submit multiple forms at once, depending on the specific Texas government agency or department's requirements.

Q: What supporting documentation is required for the FIN590 Financial Analysis Fee Transmittal Form?

A: The required supporting documentation will vary depending on the specific fees being paid. Check the instructions or contact the relevant Texas government agency or department for documentation requirements.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Texas Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIN590 by clicking the link below or browse more documents and templates provided by the Texas Department of Insurance.