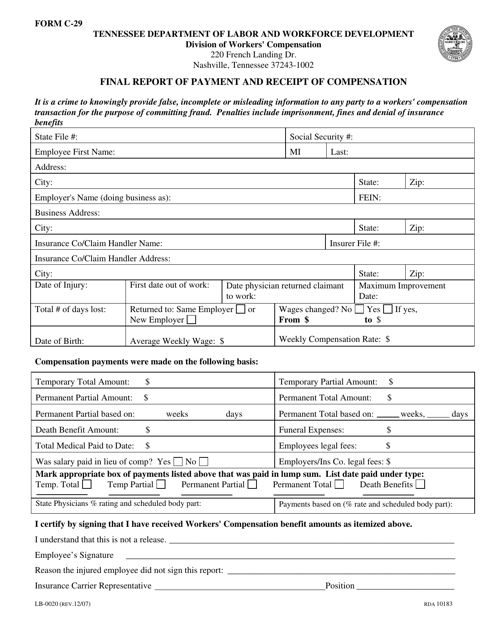

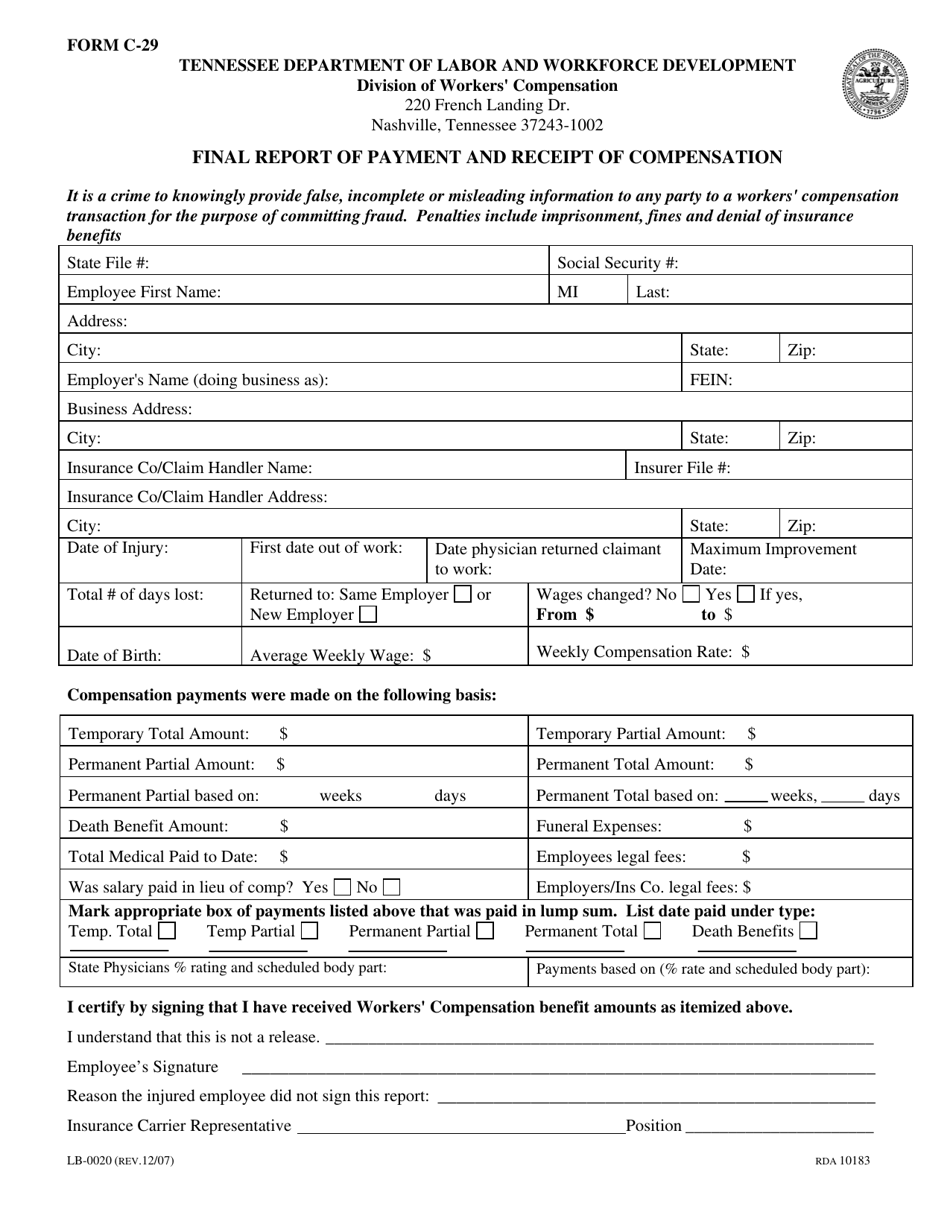

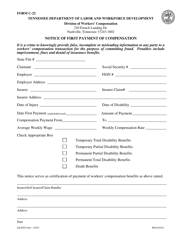

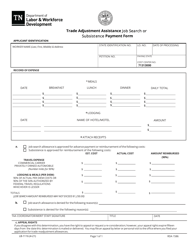

Form LB-0020 (C-29) Final Report of Payment and Receipt of Compensation - Tennessee

What Is Form LB-0020 (C-29)?

This is a legal form that was released by the Tennessee Department of Labor and Workforce Development - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LB-0020 (C-29)?

A: Form LB-0020 (C-29) is the Final Report of Payment and Receipt of Compensation in Tennessee.

Q: What is the purpose of Form LB-0020 (C-29)?

A: The purpose of Form LB-0020 (C-29) is to report the payment and receipt of compensation.

Q: Who needs to file Form LB-0020 (C-29)?

A: Employers or insurance carriers in Tennessee who have made or received payments for compensation must file this form.

Q: When should Form LB-0020 (C-29) be filed?

A: Form LB-0020 (C-29) should be filed within 30 days after the payment or receipt of compensation.

Q: Is there a fee for filing Form LB-0020 (C-29)?

A: No, there is no fee for filing Form LB-0020 (C-29).

Form Details:

- Released on December 1, 2007;

- The latest edition provided by the Tennessee Department of Labor and Workforce Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LB-0020 (C-29) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Labor and Workforce Development.