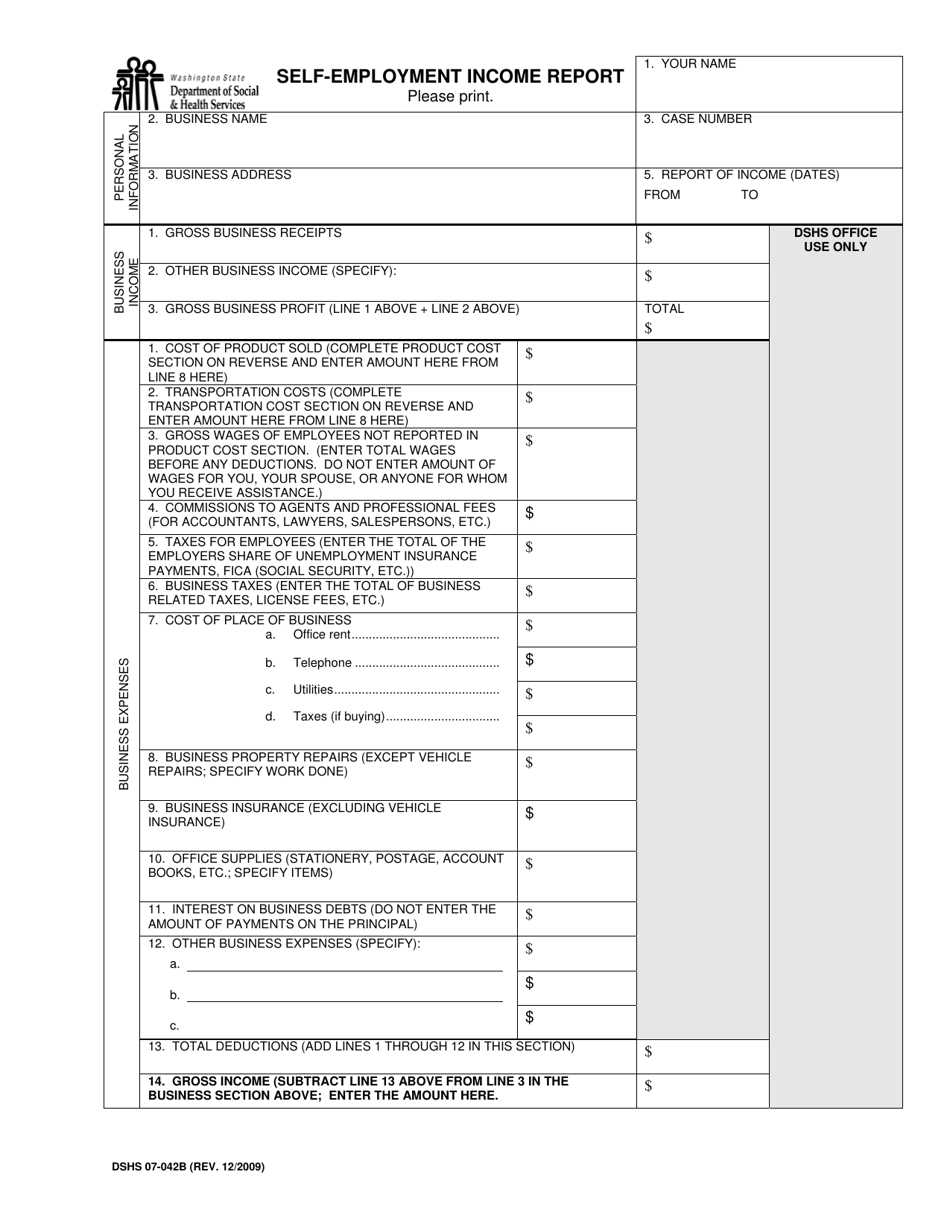

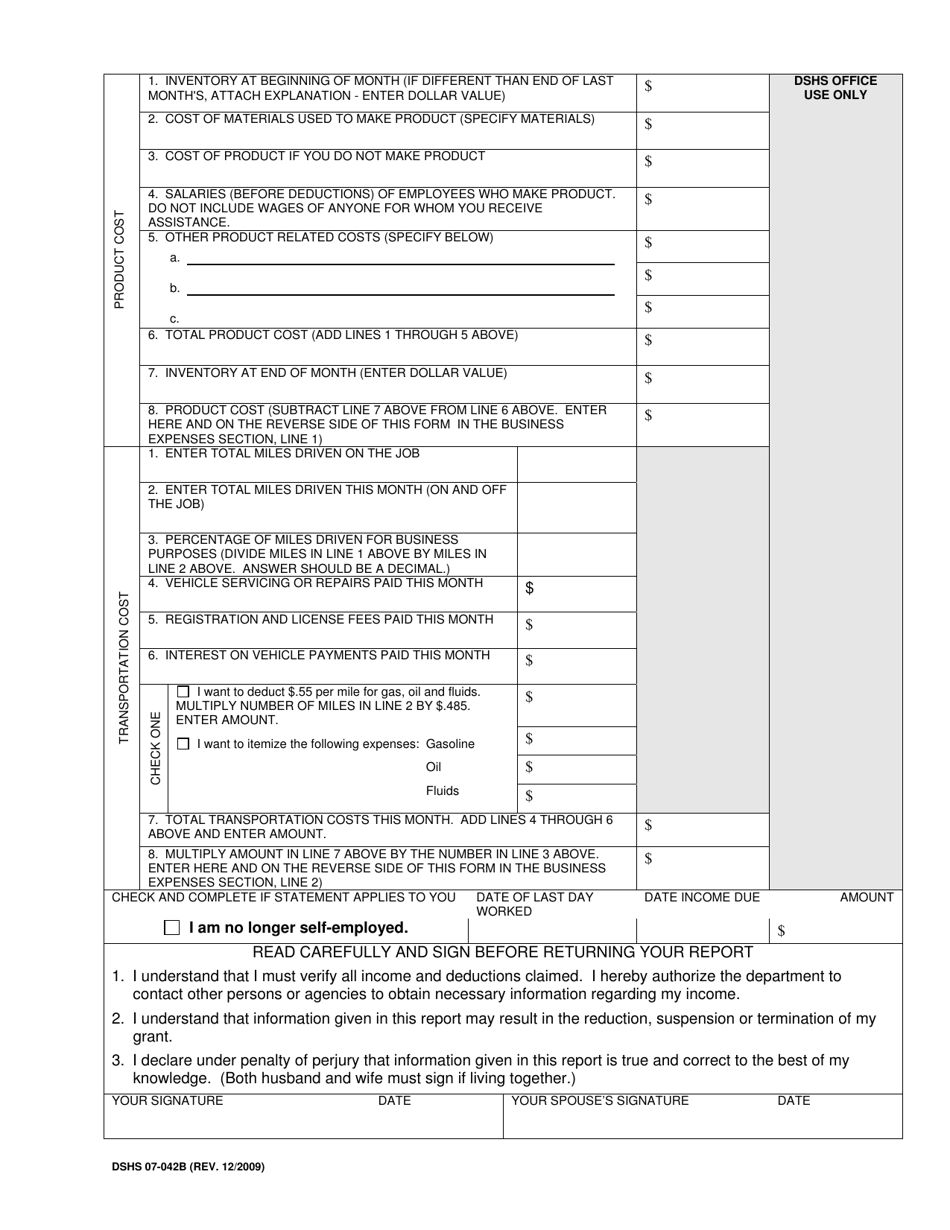

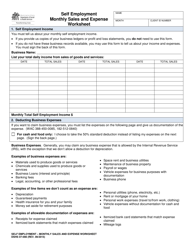

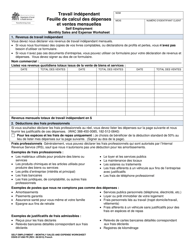

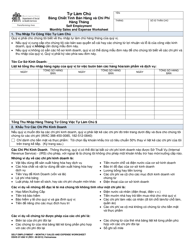

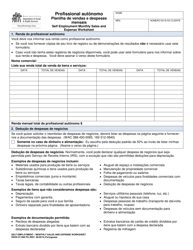

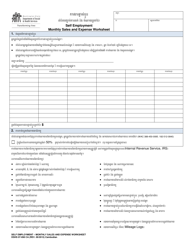

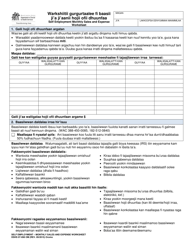

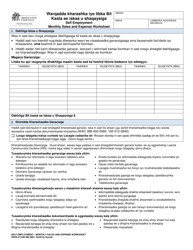

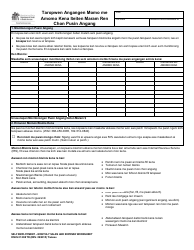

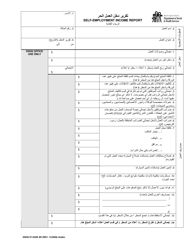

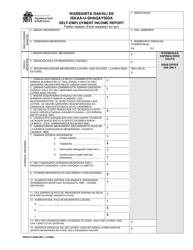

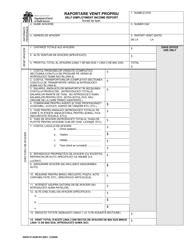

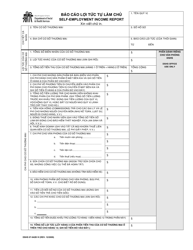

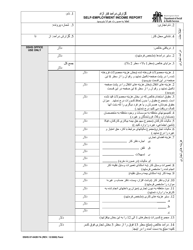

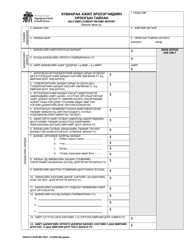

DSHS Form 07-042B Self-employment Income Report - Washington

What Is DSHS Form 07-042B?

This is a legal form that was released by the Washington State Department of Social and Health Services - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DSHS Form 07-042B?

A: DSHS Form 07-042B is a Self-employment Income Report form used in Washington.

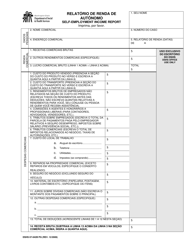

Q: Who can use DSHS Form 07-042B?

A: Any individual who is self-employed in Washington and receives income from self-employment can use this form.

Q: Why do I need to fill out DSHS Form 07-042B?

A: You need to fill out this form to report your self-employment income to the Washington State Department of Social and Health Services (DSHS) for eligibility determination of social and health assistance programs.

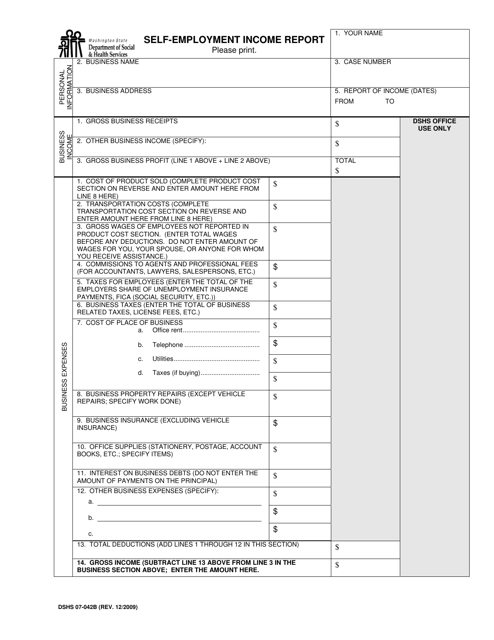

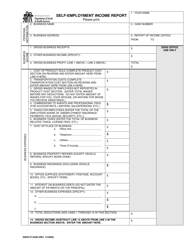

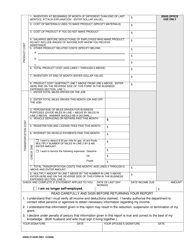

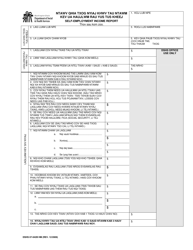

Q: What information do I need to provide on DSHS Form 07-042B?

A: On this form, you will need to provide details about your self-employment income, including gross receipts, allowable deductions, and expenses related to your self-employment.

Form Details:

- Released on December 1, 2009;

- The latest edition provided by the Washington State Department of Social and Health Services;

- Easy to use and ready to print;

- Available in Hmong;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of DSHS Form 07-042B by clicking the link below or browse more documents and templates provided by the Washington State Department of Social and Health Services.