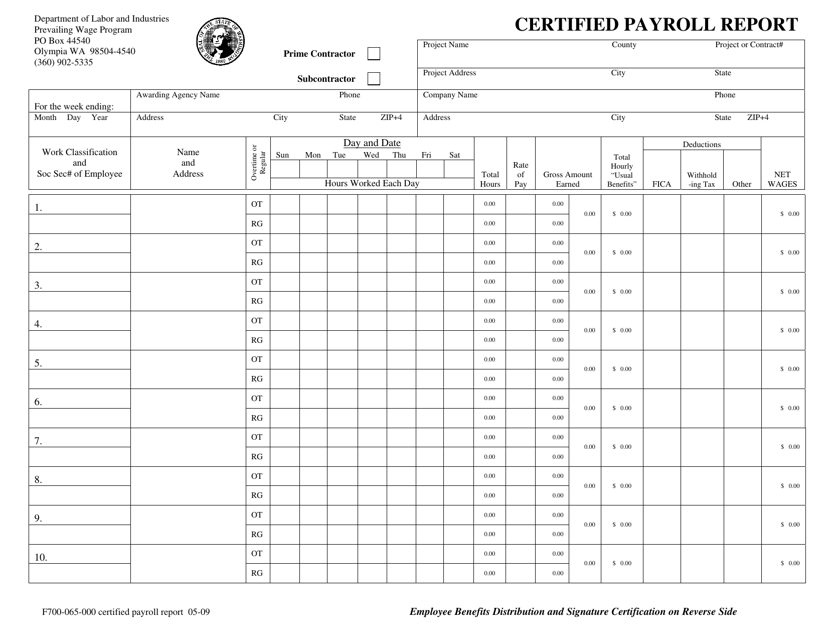

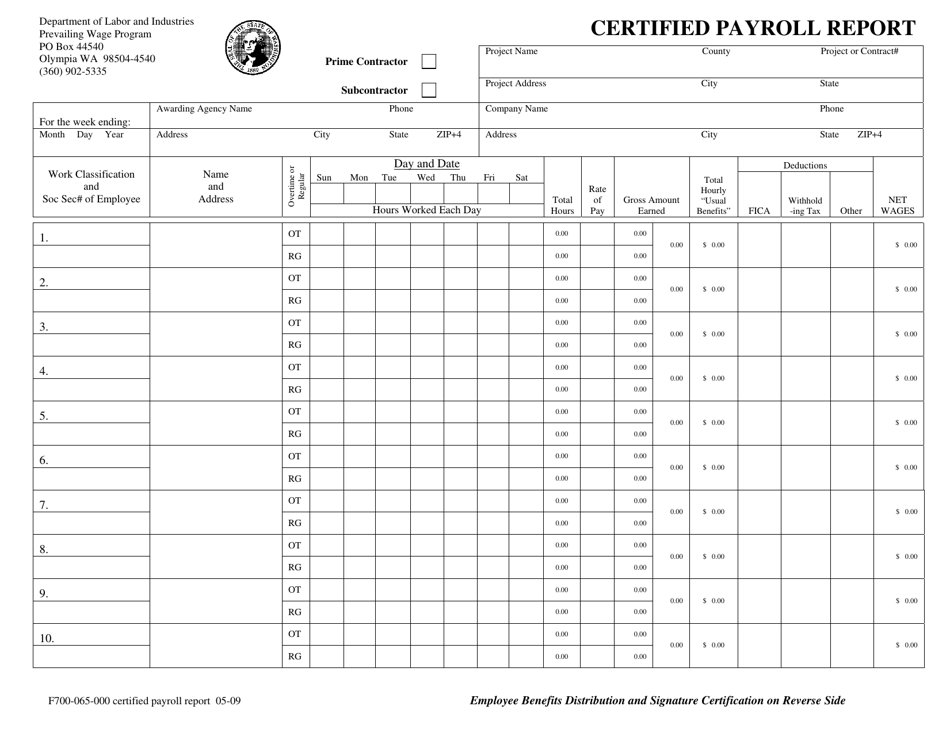

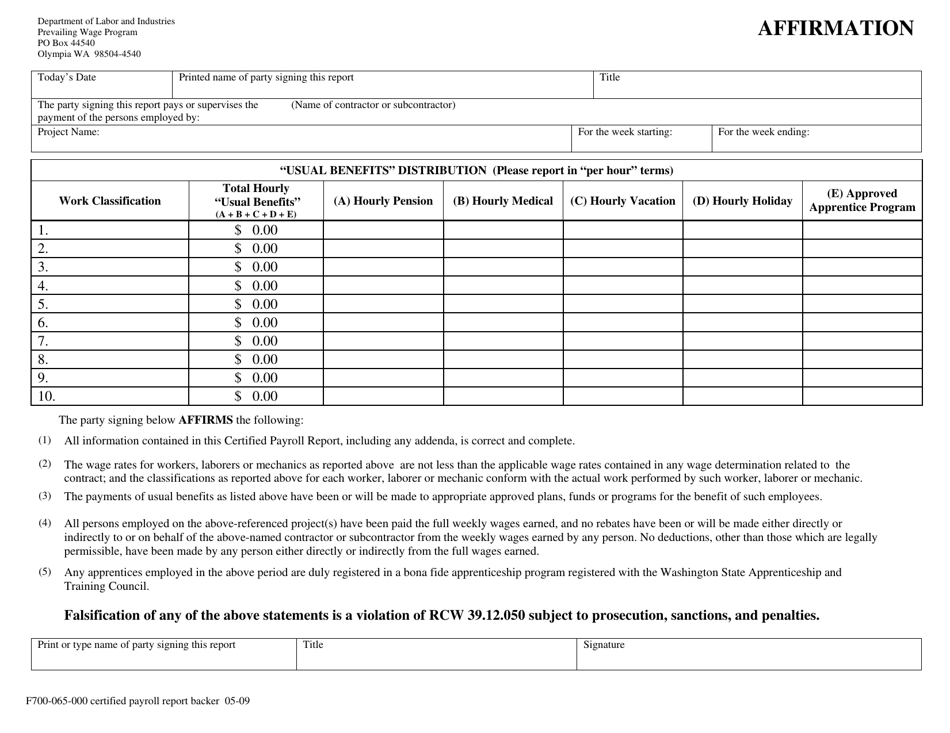

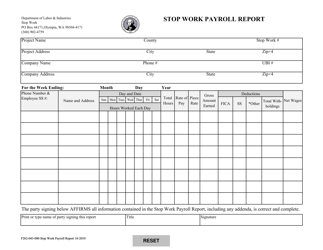

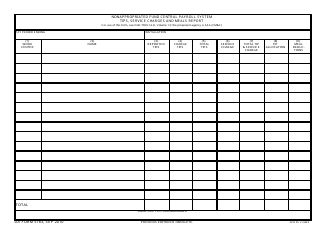

Form F700-065-000 Certified Payroll Report - Washington

What Is Form F700-065-000?

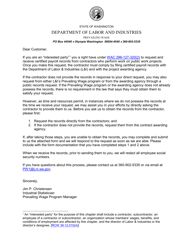

This is a legal form that was released by the Washington State Department of Labor and Industries - a government authority operating within Washington. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form F700-065-000?

A: Form F700-065-000 is a Certified Payroll Report.

Q: What is the purpose of Form F700-065-000?

A: The purpose of Form F700-065-000 is to report and certify the wages paid to workers on a public works project in Washington.

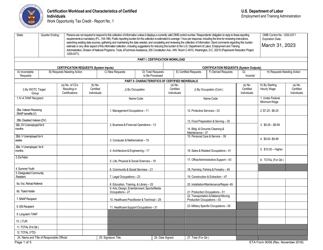

Q: Who is required to submit Form F700-065-000?

A: Contractors and subcontractors who work on public works projects in Washington are required to submit Form F700-065-000.

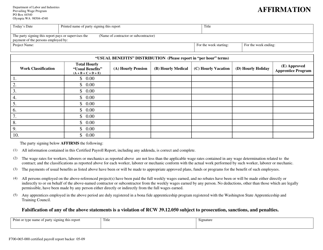

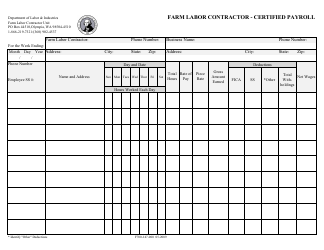

Q: What information is included in Form F700-065-000?

A: Form F700-065-000 includes information such as the names of the workers, their job classifications, hours worked, wages paid, and deductions.

Q: When is Form F700-065-000 due?

A: Form F700-065-000 is typically due on a monthly basis, within seven days after the end of each month.

Q: Is Form F700-065-000 required in other states?

A: No, Form F700-065-000 is specific to Washington and is not required in other states.

Q: What happens if I don't submit Form F700-065-000?

A: Failure to submit Form F700-065-000 can result in penalties and may disqualify contractors from bidding on future public works projects.

Form Details:

- Released on May 1, 2009;

- The latest edition provided by the Washington State Department of Labor and Industries;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F700-065-000 by clicking the link below or browse more documents and templates provided by the Washington State Department of Labor and Industries.