This version of the form is not currently in use and is provided for reference only. Download this version of

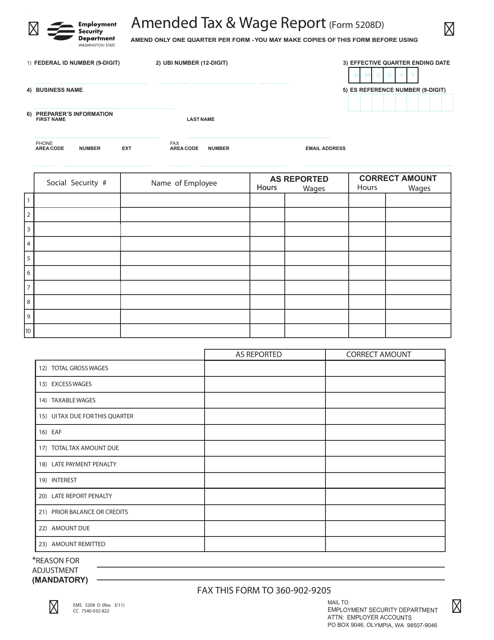

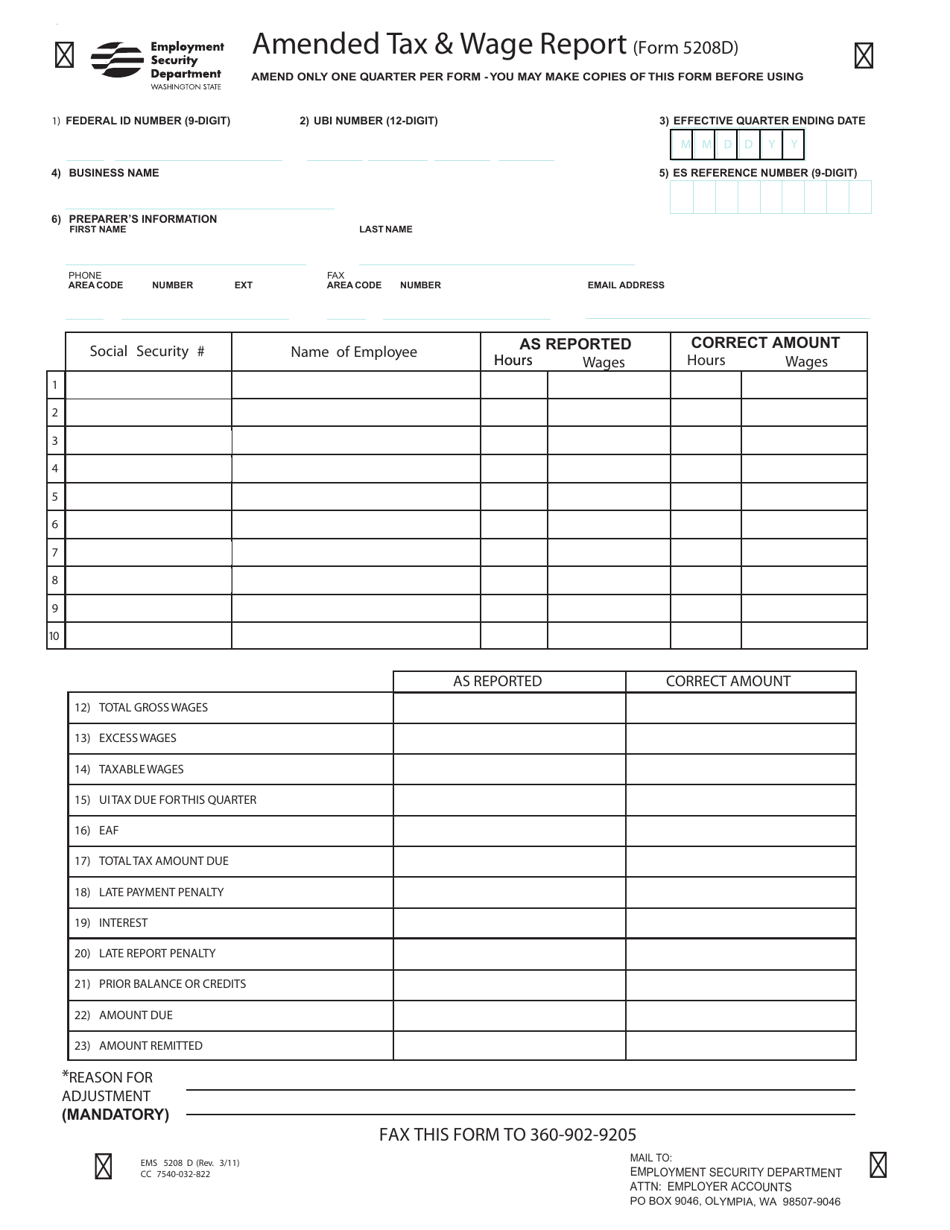

Form 5208D

for the current year.

Form 5208D Amended Tax & Wage Report - Washington

What Is Form 5208D?

This is a legal form that was released by the Washington State Employment Security Department - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5208D?

A: Form 5208D is the Amended Tax & Wage Report for the state of Washington.

Q: Who needs to file Form 5208D?

A: Employers in Washington who need to correct errors on their original Tax & Wage Report must file Form 5208D.

Q: What is the purpose of Form 5208D?

A: The purpose of Form 5208D is to report corrections to previously filed Tax & Wage Reports.

Q: When is Form 5208D due?

A: Form 5208D must be filed by the last day of the month following the end of the quarter in which the error was discovered.

Q: What information is required on Form 5208D?

A: Form 5208D requires information such as the employer's name, address, and social security number, as well as detailed information about the error being corrected.

Q: Are there any penalties for late or incorrect filing of Form 5208D?

A: Yes, there may be penalties for late or incorrect filing of Form 5208D. It is important to submit the form accurately and on time to avoid penalties.

Q: Can I get an extension to file Form 5208D?

A: No, there are no provisions for filing extensions for Form 5208D. It must be filed by the deadline.

Q: Is there a fee for filing Form 5208D?

A: No, there is no fee for filing Form 5208D.

Form Details:

- Released on March 1, 2011;

- The latest edition provided by the Washington State Employment Security Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5208D by clicking the link below or browse more documents and templates provided by the Washington State Employment Security Department.