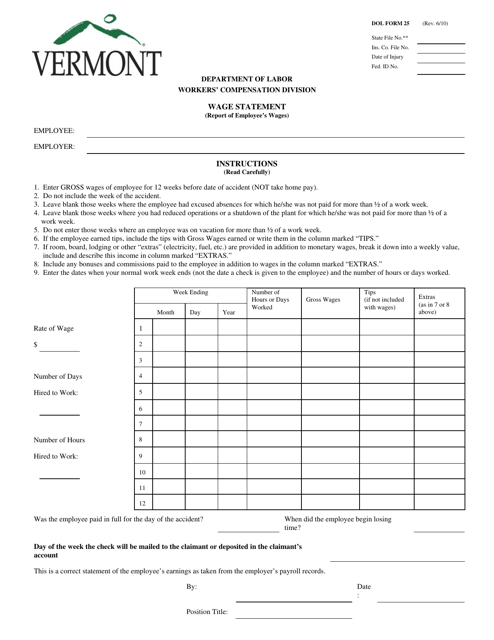

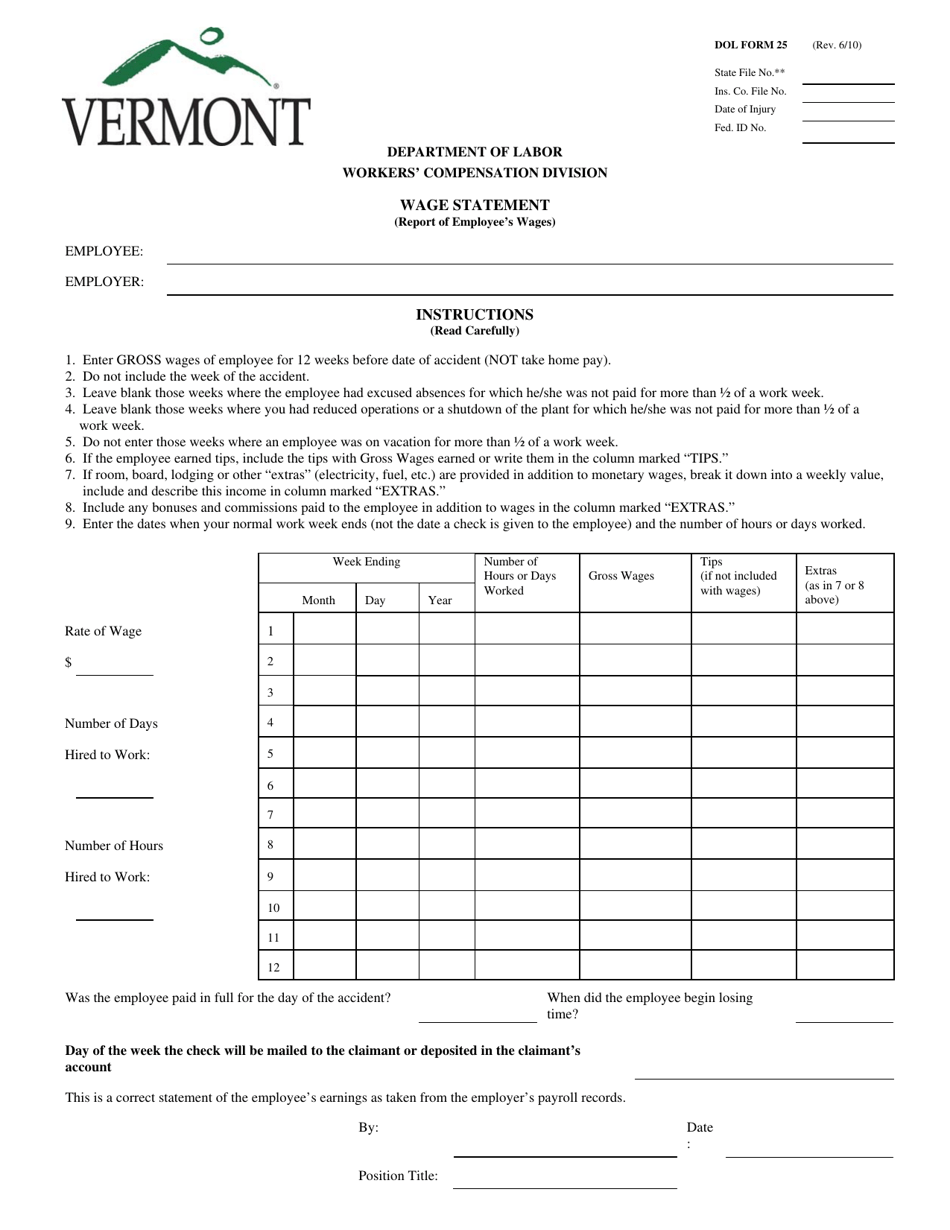

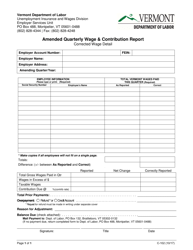

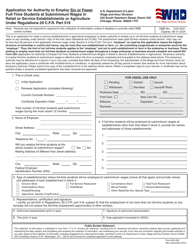

DOL Form 25 Wage Statement - Vermont

What Is DOL Form 25?

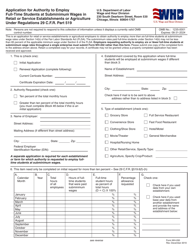

This is a legal form that was released by the Vermont Department of Labor - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DOL Form 25?

A: DOL Form 25 is the Wage Statement form used in Vermont.

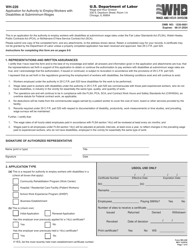

Q: Who needs to fill out DOL Form 25?

A: Employers in Vermont must fill out DOL Form 25 for each employee.

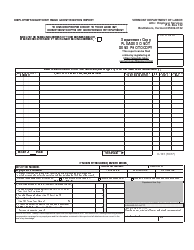

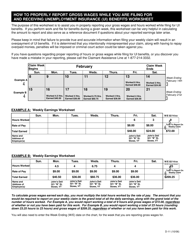

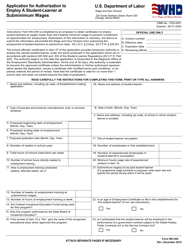

Q: What information is included in DOL Form 25?

A: DOL Form 25 includes information about the employee's wages, deductions, and hours worked.

Q: Is DOL Form 25 mandatory?

A: Yes, employers in Vermont are required to fill out DOL Form 25 for each employee.

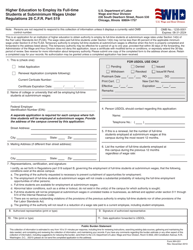

Q: When should DOL Form 25 be filed?

A: DOL Form 25 should be filed each pay period, along with the employee's paycheck.

Q: Are there any penalties for not filing DOL Form 25?

A: Yes, failure to file DOL Form 25 can result in penalties and fines imposed by the Vermont Department of Labor.

Q: Can employees access their DOL Form 25?

A: Yes, employees have the right to access their DOL Form 25 and should be provided a copy with each paycheck.

Q: Can DOL Form 25 be used for federal tax purposes?

A: No, DOL Form 25 is specific to the state of Vermont and cannot be used for federal tax purposes.

Form Details:

- Released on June 1, 2010;

- The latest edition provided by the Vermont Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of DOL Form 25 by clicking the link below or browse more documents and templates provided by the Vermont Department of Labor.