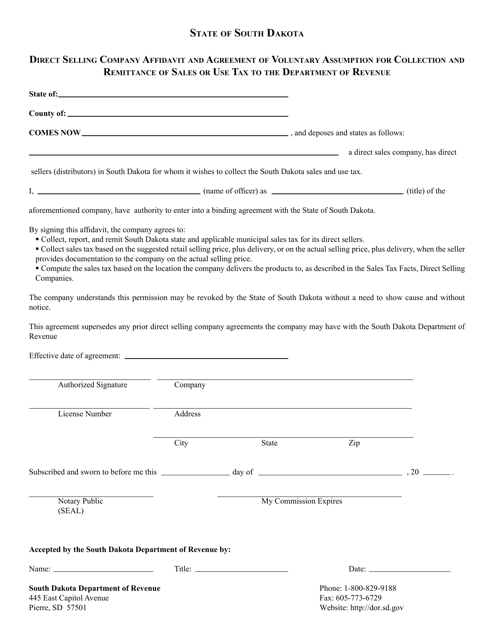

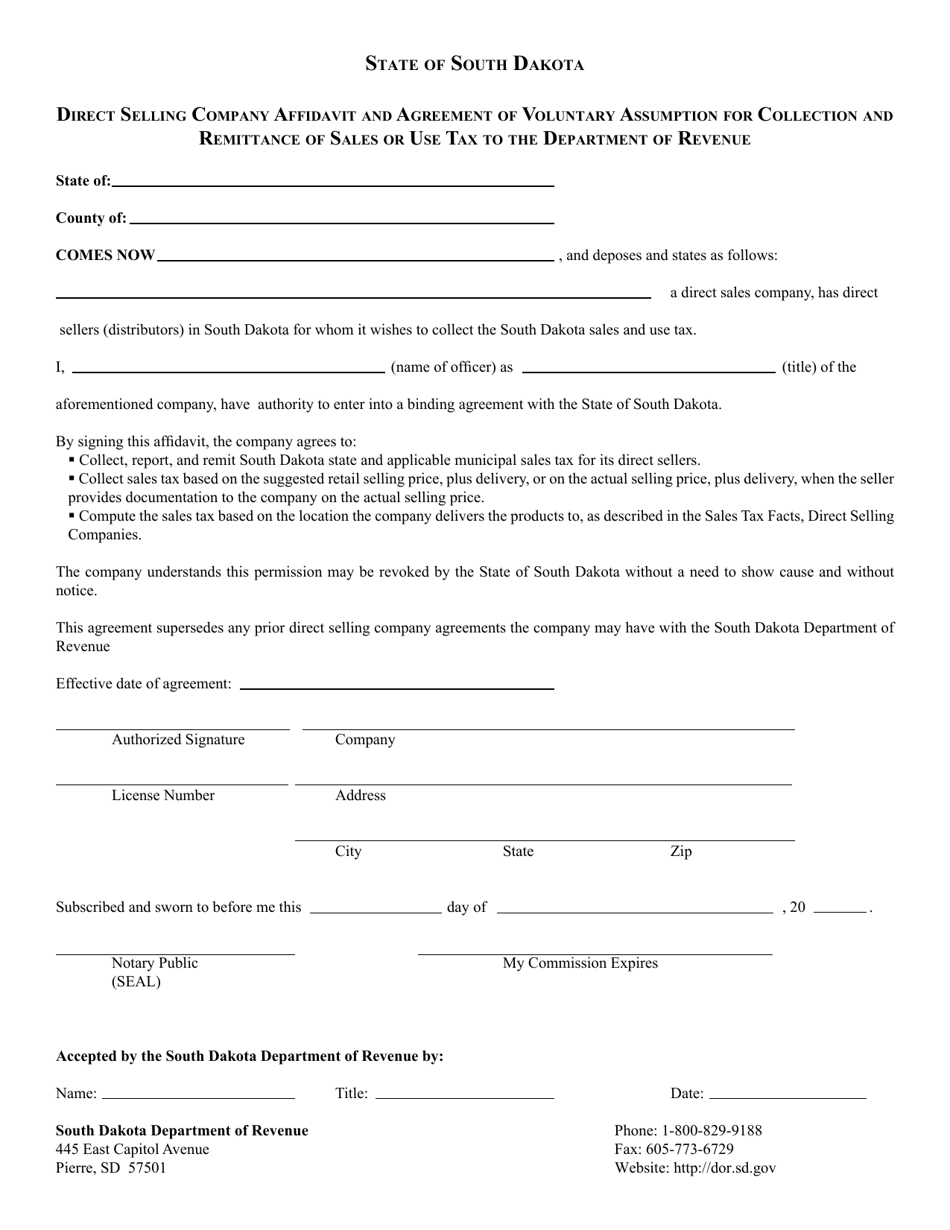

Direct Selling Company Affidavit and Agreement of Voluntary Assumption for Collection and Remittance of Sales or Use Tax to the Department of Revenue - South Dakota

Direct Selling Company Affidavit and Agreement of Voluntary Assumption for Collection and Remittance of Sales or Use Tax to the Department of Revenue is a legal document that was released by the South Dakota Department of Revenue - a government authority operating within South Dakota.

FAQ

Q: What is a Direct Selling Company Affidavit?

A: A Direct Selling Company Affidavit is a document used by companies engaged in direct selling to acknowledge their responsibility for collecting and remitting sales or use tax to the Department of Revenue - South Dakota.

Q: What is the purpose of the Agreement of Voluntary Assumption?

A: The purpose of the Agreement of Voluntary Assumption is to confirm the company's commitment to comply with the sales or use tax collection and remittance requirements set by the Department of Revenue - South Dakota.

Q: Who needs to file a Direct Selling Company Affidavit and Agreement of Voluntary Assumption?

A: Companies engaged in direct selling in South Dakota need to file the Direct Selling Company Affidavit and Agreement of Voluntary Assumption.

Q: What is the responsibility of a direct selling company regarding sales or use tax?

A: A direct selling company is responsible for collecting sales or use tax from its customers and remitting the tax to the Department of Revenue - South Dakota.

Q: What happens if a direct selling company fails to comply with the tax requirements?

A: Non-compliance with the tax requirements can result in penalties and fines for the direct selling company.

Form Details:

- The latest edition currently provided by the South Dakota Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Department of Revenue.