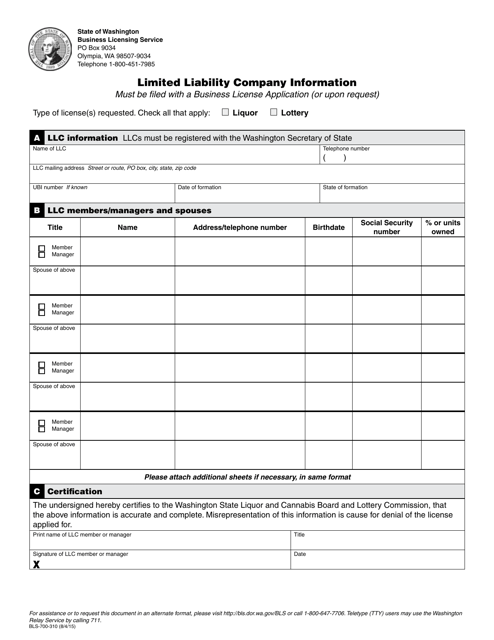

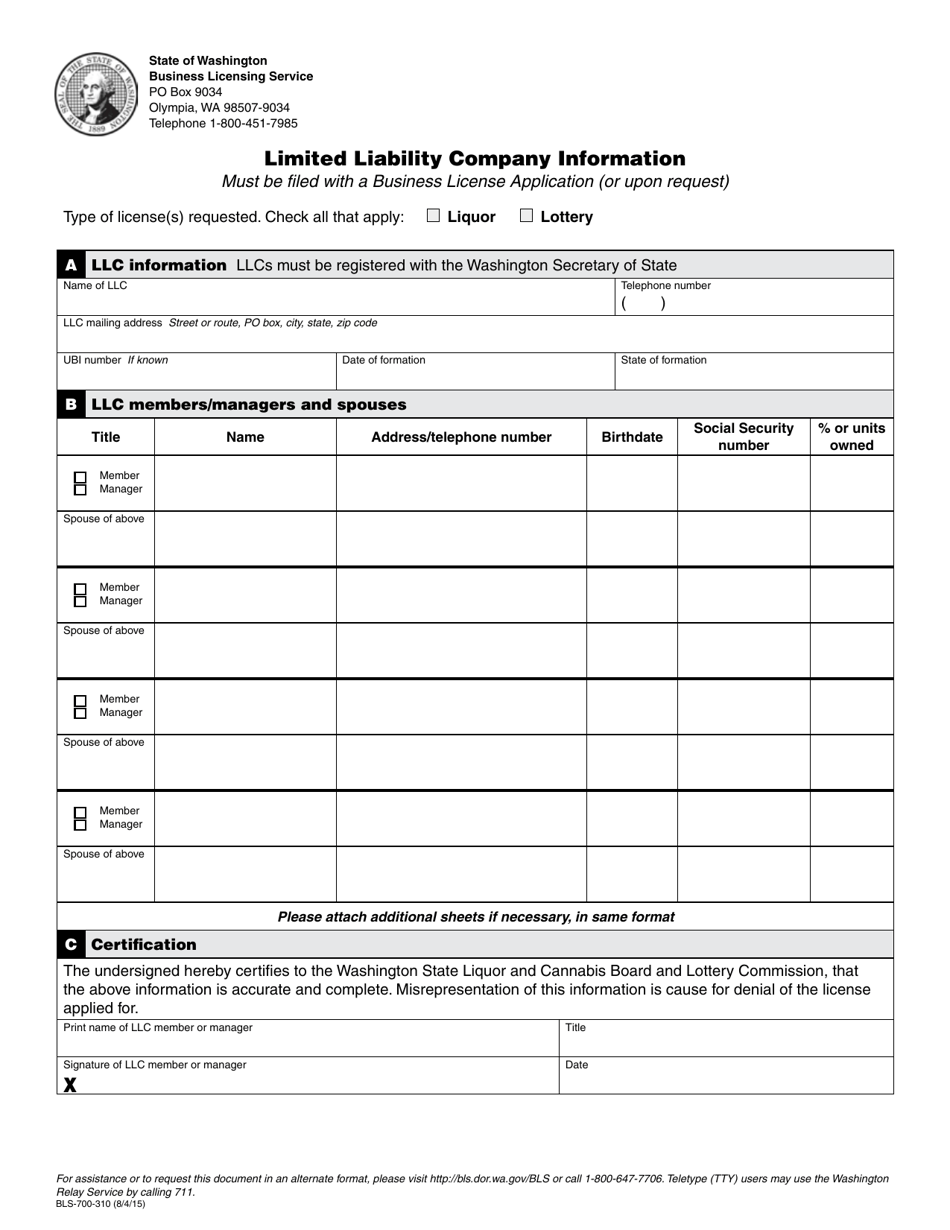

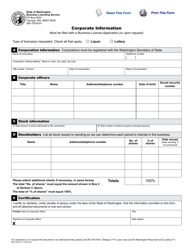

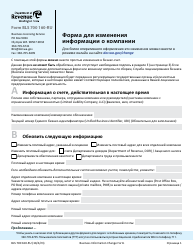

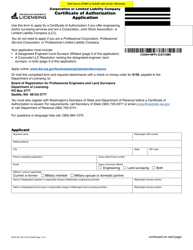

Form BLS-700-310 Limited Liability Company Information - Washington

What Is Form BLS-700-310?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form BLS-700-310?

A: Form BLS-700-310 is the Limited Liability Company Information form for the state of Washington.

Q: What is a Limited Liability Company (LLC)?

A: A Limited Liability Company (LLC) is a type of business structure that offers personal liability protection while allowing for pass-through taxation.

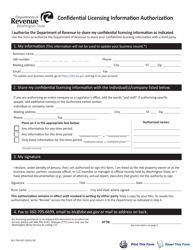

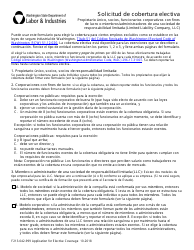

Q: What information is required in form BLS-700-310?

A: Form BLS-700-310 requires information such as the LLC's name, address, registered agent information, members/managers details, and optional email address.

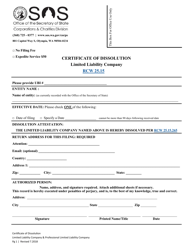

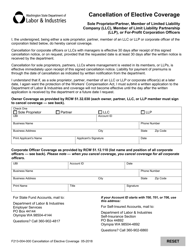

Q: Who needs to file form BLS-700-310?

A: LLCs in Washington need to file form BLS-700-310 to provide or update their information with the Secretary of State.

Q: What is a registered agent?

A: A registered agent is a person or entity designated to receive legal and official documents on behalf of the LLC.

Q: Do all LLCs need a registered agent?

A: Yes, all LLCs in Washington are required to have a registered agent.

Q: Can the registered agent be a member of the LLC?

A: Yes, a member of the LLC can serve as the registered agent, but there are certain requirements that need to be met.

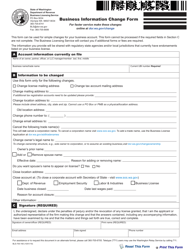

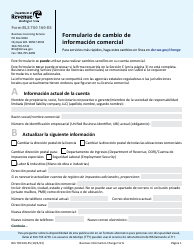

Q: What happens if the LLC's information changes?

A: If the LLC's information changes, an updated form BLS-700-310 must be filed with the Secretary of State to reflect the changes.

Form Details:

- Released on August 4, 2015;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BLS-700-310 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.