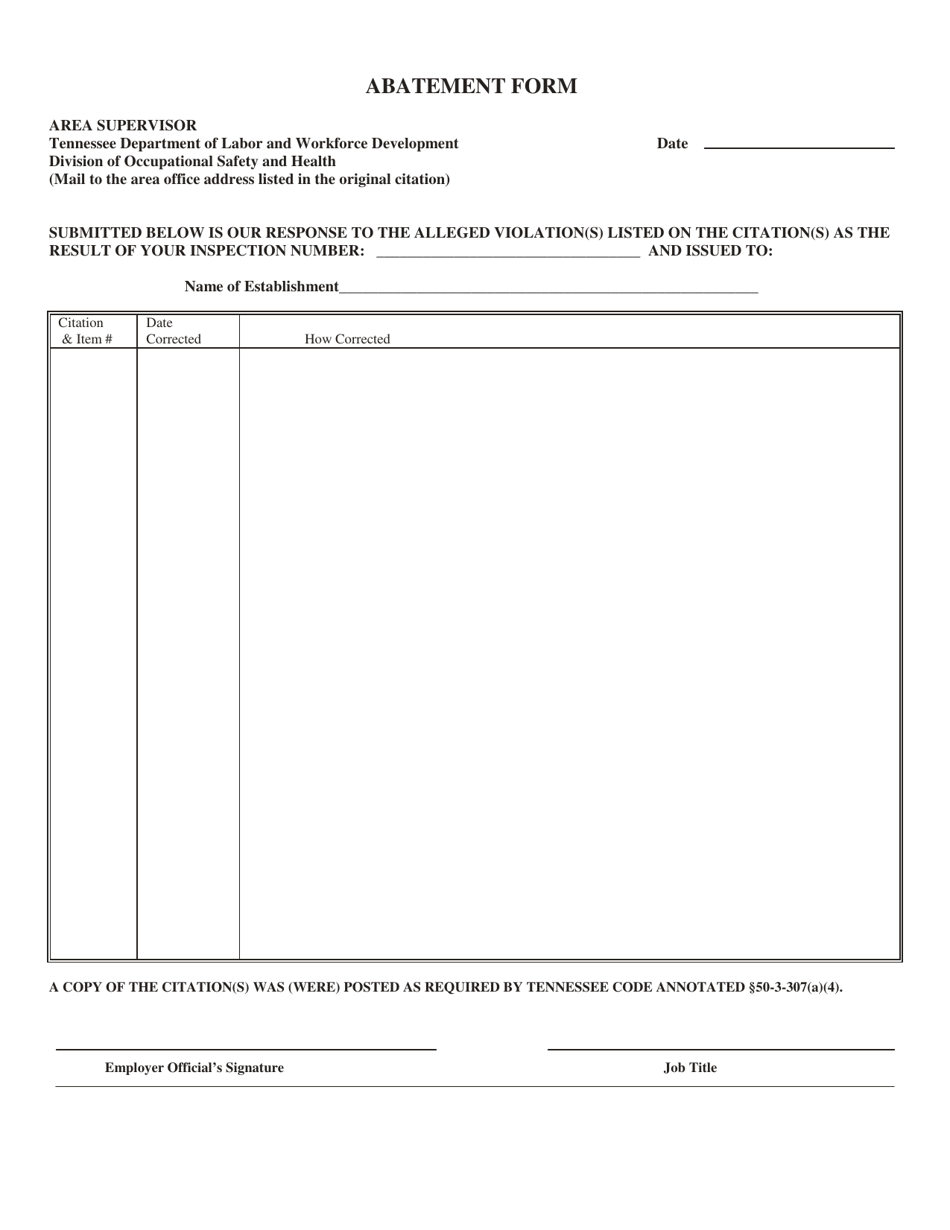

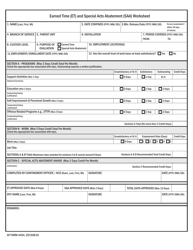

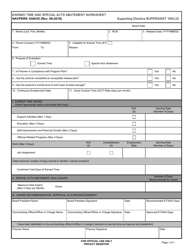

Abatement Form - Tennessee

Abatement Form is a legal document that was released by the Tennessee Department of Labor and Workforce Development - a government authority operating within Tennessee.

FAQ

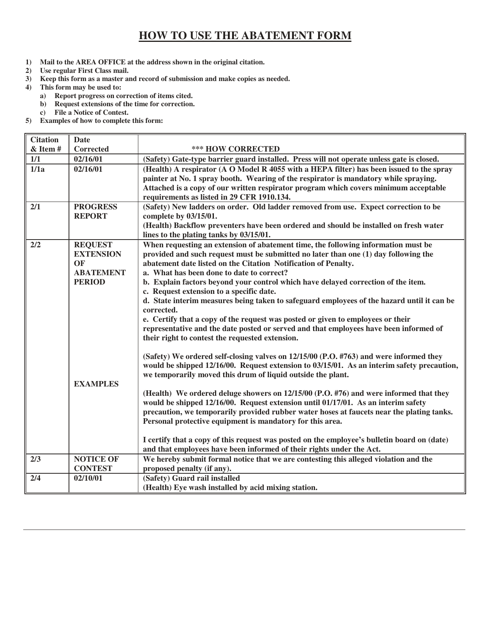

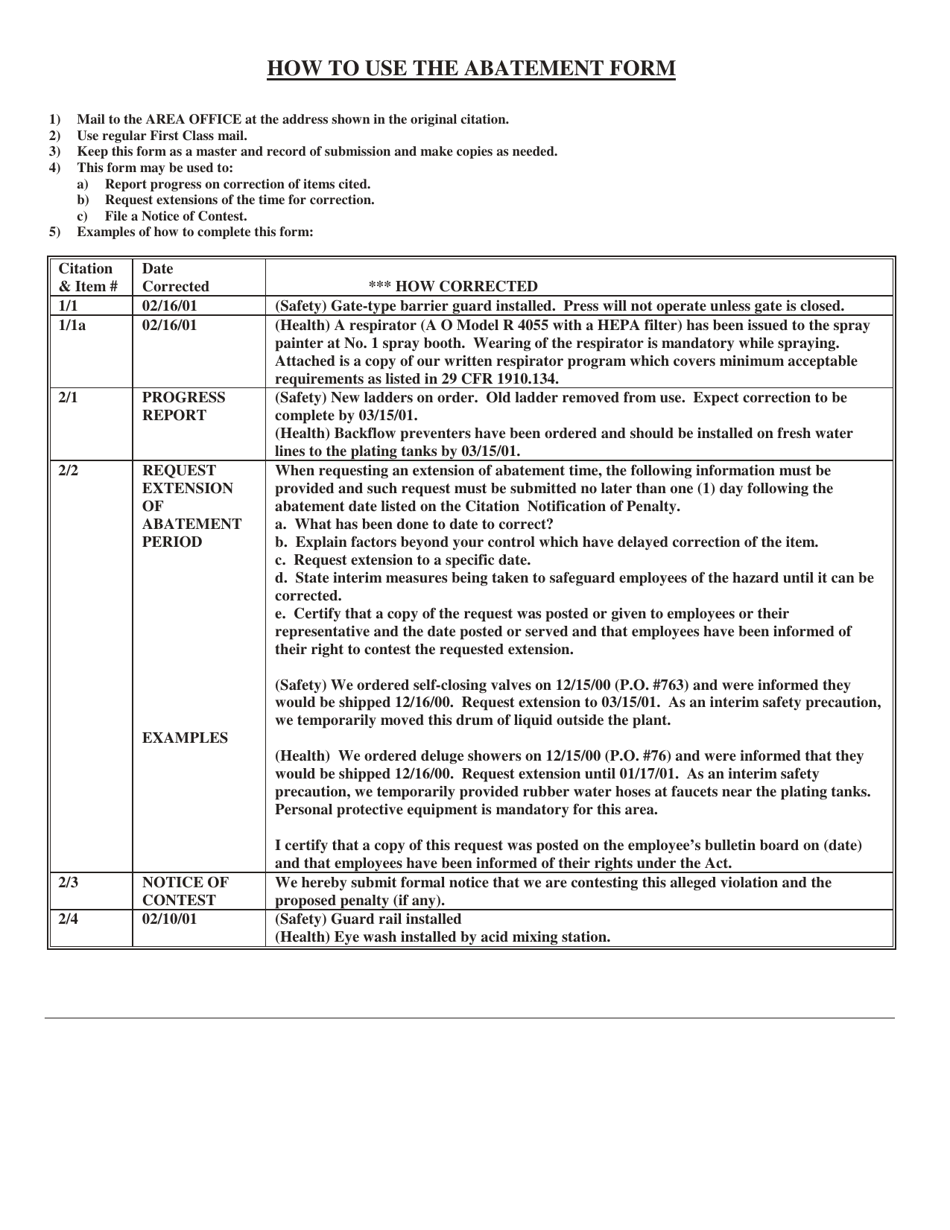

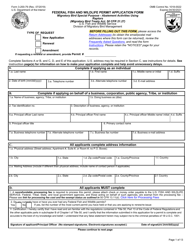

Q: What is an abatement form?

A: An abatement form is a document used in Tennessee for the reduction or elimination of certain taxes or penalties.

Q: What can an abatement form be used for in Tennessee?

A: An abatement form in Tennessee can be used to request a reduction or elimination of taxes, such as property taxes or sales taxes, or penalties associated with these taxes.

Q: What information do I need to provide on an abatement form in Tennessee?

A: The information required on an abatement form in Tennessee may vary depending on the type of tax or penalty you are seeking to abate, but typically includes details about your tax account, the tax period, and the reason for the abatement request.

Q: Can anyone request an abatement in Tennessee?

A: Yes, anyone who meets the eligibility criteria for a specific abatement program in Tennessee can request an abatement.

Q: Are there any deadlines for submitting an abatement form in Tennessee?

A: Yes, there may be specific deadlines for submitting an abatement form in Tennessee, so it is important to check the instructions provided with the form or contact the Tennessee Department of Revenue for more information.

Q: What happens after I submit an abatement form in Tennessee?

A: After submitting an abatement form in Tennessee, your request will be reviewed by the Tennessee Department of Revenue, and you will be notified of the decision.

Q: Can I appeal a denial of my abatement request in Tennessee?

A: Yes, if your abatement request is denied in Tennessee, you can typically appeal the decision to the Tennessee Board of Equalization or another appropriate authority.

Q: Are there any fees associated with filing an abatement form in Tennessee?

A: There may be fees associated with filing an abatement form in Tennessee, such as filing fees or administrative fees, depending on the type of tax or penalty you are seeking to abate. It is important to review the instructions provided with the form or contact the Tennessee Department of Revenue for more information.

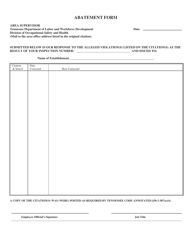

Form Details:

- The latest edition currently provided by the Tennessee Department of Labor and Workforce Development;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Department of Labor and Workforce Development.