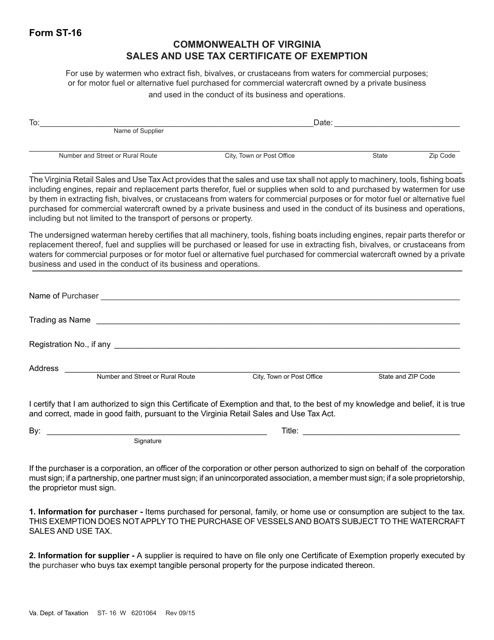

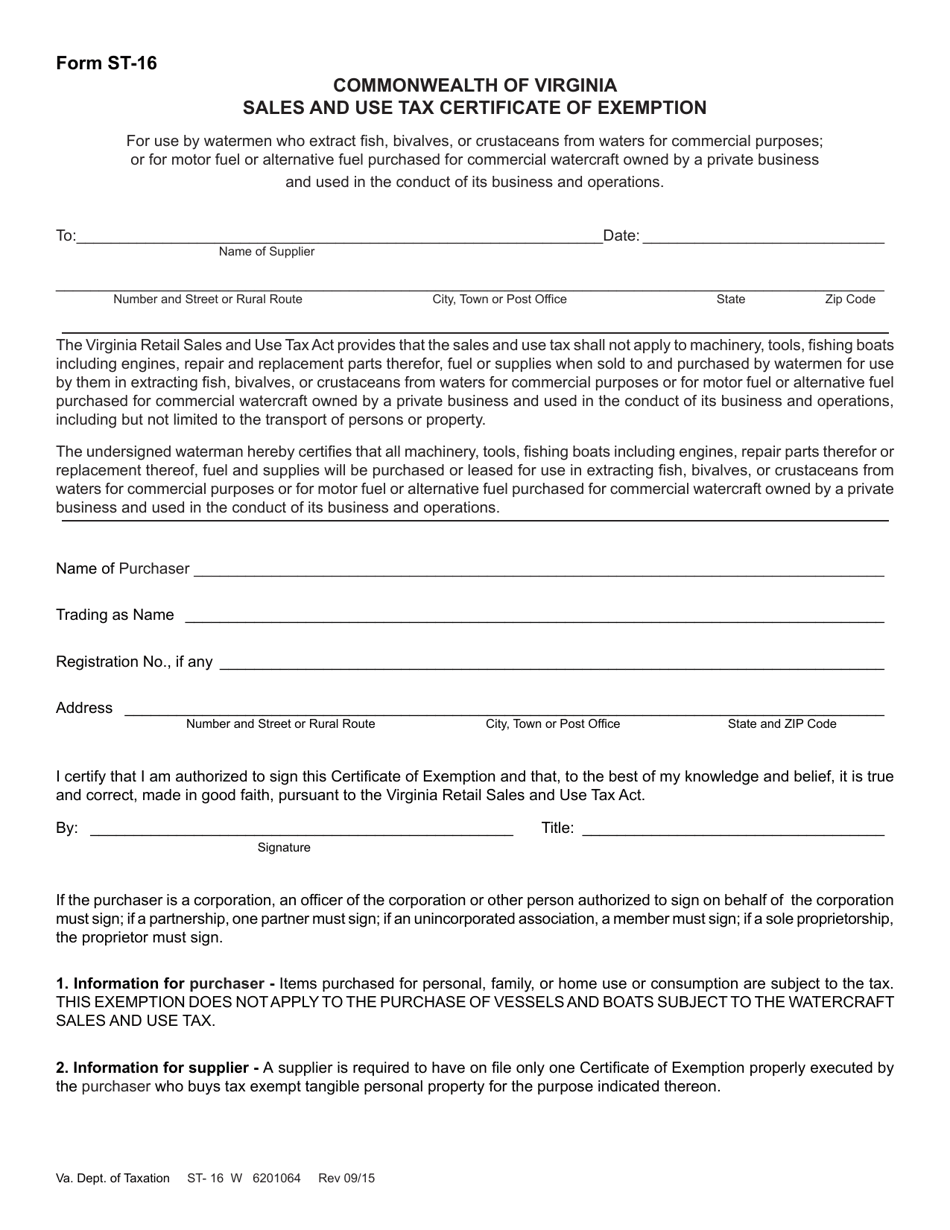

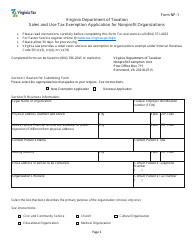

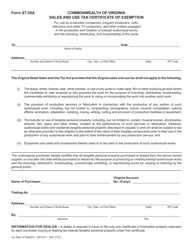

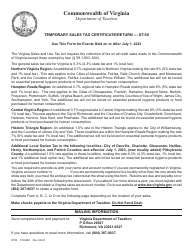

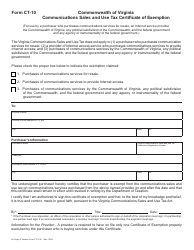

Form ST-16 Sales and Use Tax Certificate of Exemption - Virginia

What Is Form ST-16?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ST-16?

A: The Form ST-16 is the Sales and Use Tax Certificate of Exemption specific to Virginia.

Q: What is the purpose of Form ST-16?

A: The purpose of Form ST-16 is to claim exemption from sales and use tax in Virginia.

Q: Who should use Form ST-16?

A: Form ST-16 should be used by individuals or businesses who are eligible for sales and use tax exemptions in Virginia.

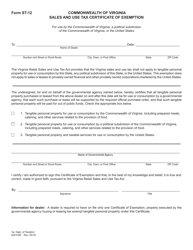

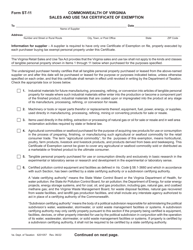

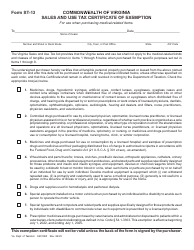

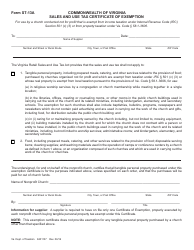

Q: What types of exemptions can be claimed using Form ST-16?

A: Form ST-16 can be used to claim exemptions such as resale, government, agriculture, manufacturing, and more.

Q: How do I fill out Form ST-16?

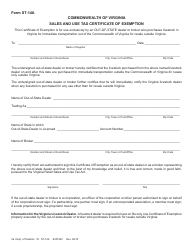

A: Form ST-16 requires you to provide your personal or business information, specify the type of exemption being claimed, and provide any supporting documentation if required.

Q: Can Form ST-16 be used for multiple transactions?

A: Yes, Form ST-16 can be used for multiple transactions, but a new form may be required for each fiscal year.

Q: What should I do with Form ST-16 after completing it?

A: After completing Form ST-16, you should keep a copy for your records and provide a copy to the seller to claim the exemption.

Q: Are there any penalties for misusing Form ST-16?

A: Misusing Form ST-16 or providing false information may result in penalties, including liability for the sales and use tax owed.

Q: Who can I contact for more information about Form ST-16?

A: For more information about Form ST-16, you can contact the Virginia Department of Taxation.

Form Details:

- Released on September 1, 2015;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-16 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.